Malaysia Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Malaysia Fintech Market Overview:

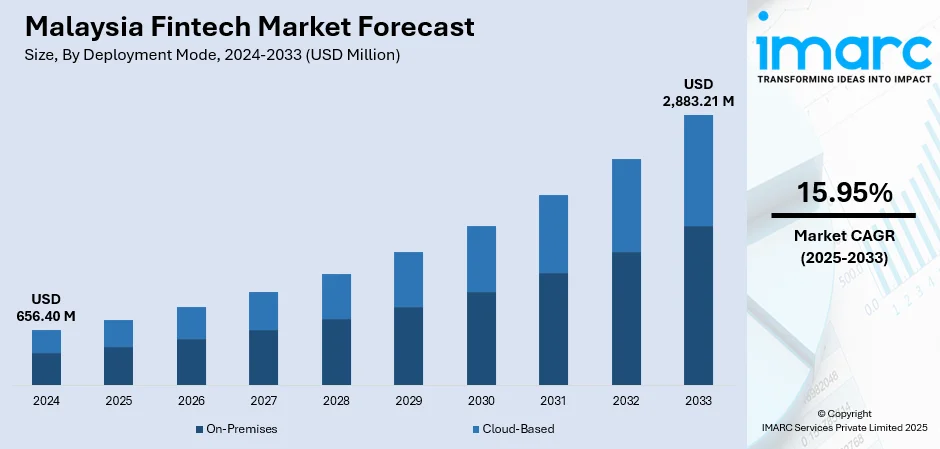

The Malaysia fintech market size reached USD 656.40 Million in 2024. The market is projected to reach USD 2,883.21 Million by 2033, exhibiting a growth rate (CAGR) of 15.95% during 2025-2033. The market is expanding steadily, driven by digital transformation, supportive regulatory frameworks, and increased consumer demand for innovative financial services. The sector spans various deployment modes including cloud-based solutions, and is shaped by technologies such as AI, blockchain, and data analytics. Key applications include payments, lending, wealth management, and insurtech, catering to a wide range of end users. Regional fintech hubs and public-private collaborations further support industry momentum. These developments collectively contribute to the evolving Malaysia fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 656.40 Million |

| Market Forecast in 2033 | USD 2,883.21 Million |

| Market Growth Rate 2025-2033 | 15.95% |

Malaysia Fintech Market Trends:

Increasing Adoption of Digital Payment Systems

Digital payments are rapidly becoming the norm across Malaysia, with both consumers and merchants embracing fast, contactless methods for everyday transactions. In March 2025, Bank Negara Malaysia announced a major milestone digital payment transaction exceeded billions for the first time in a single quarter. This signals widespread adoption and reflects how embedded digital finance has become in daily life. Much of this growth is driven by government-supported programs promoting cashless payments, alongside improvements in digital infrastructure that allow users to enjoy secure and seamless transactions. Mobile wallets and QR payments are now widely used, making financial services more accessible to both urban and rural populations. Small merchants are also increasingly benefiting, with faster settlement times and less dependence on cash. In response, financial institutions are rolling out more customer-centric, innovative products that prioritize speed, security, and simplicity. These developments reflect growing trust and familiarity with fintech solutions, and they are laying the groundwork for sustained Malaysia fintech market growth as digital transactions continue to expand across sectors.

To get more information on this market, Request Sample

Rapid Growth in Digital Lending

Digital lending is reshaping how Malaysians access financing, especially among groups traditionally underserved by conventional banks. Demand has been rising steadily, and in January 2025, the Securities Commission Malaysia revealed that digital lending platforms processed over 800,000 loan requests in the previous year. This marks a turning point in how consumers and small businesses view alternative credit options. Technology plays a major role—these platforms streamline approvals, reduce operational overhead, and use advanced data tools to assess creditworthiness with greater accuracy. As a result, borrowers benefit from quicker decisions, flexible repayment terms, and a more personalized lending experience. This has a ripple effect on financial inclusion, opening doors for entrepreneurs and individuals who might otherwise be left behind. Regulators are also adapting, working to strike a balance between innovation and consumer safeguards, which supports healthy, long-term growth in this space. These shifts signal a deeper integration of fintech into the nation’s financial fabric. Together, they represent a clear evolution in Malaysia fintech market trends, where digital finance is becoming central to everyday economic activity.

Emergence of Embedded Finance

Malaysia experienced a rapid ramp-up of embedded finance in June 2024, as financial services such as payments, lending, and insurance are created within regular digital platforms like e-commerce and ride-hailing apps. The trend is reshaping customer behavior by making financial products more conveniently and easily available without requiring users to switch apps or platforms. Embedded finance enables instant credit approvals, frictionless payments, and tailored insurance products that become a part of day-to-day living. Such ease is particularly desired by younger, technology-savvy users who expect convenience and ease of financial transactions. Integration also creates new revenue streams for businesses through the potential to offer tailored financial services alongside their core business. With embedded finance expanding in many sectors such as retail, education, and transport, it is becoming a driver of innovation and inclusion in Malaysia's finance. The growth is a testament to the central role that embedded finance has played in propelling the Malaysia fintech ecosystem towards a future digital environment where finance is inherently embedded.

Malaysia Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

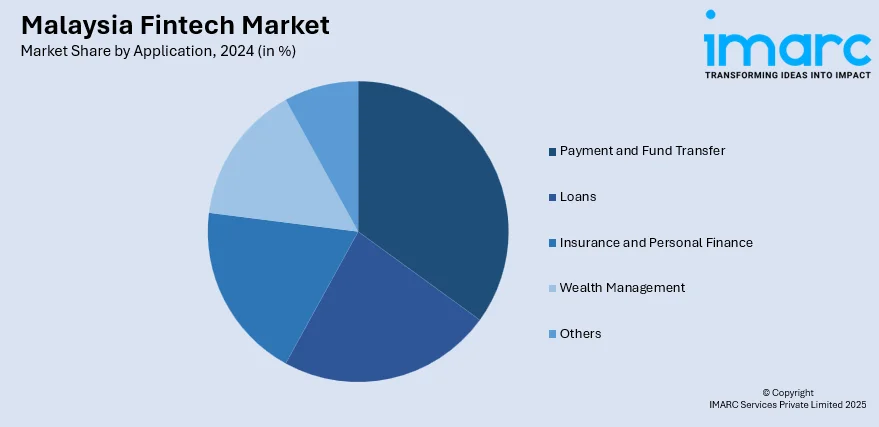

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Fintech Market News:

- August 2025: Malaysia has granted Sunrate, a Singapore-based payments and treasury management platform, in‑principle approval for a Money Services Business licence from Bank Negara Malaysia. This key development allows Sunrate to introduce its full suite of cross-border B2B payment solutions into the Malaysian market. The company also plans to establish Kuala Lumpur as the location for its global operations hub, reflecting its strategic commitment to the country. Sunrate’s move underscores Malaysia’s growing importance as a regional fintech centre.

- August 2025: Malaysia's KAF Digital Bank has been officially launched after being approved by Bank Negara Malaysia. The venture, spearheaded by KAF Investment Bank and backed by firms such as Carsome, MoneyMatch, Jirnexu, and StoreHub, provides Shariah-compliant digital banking solutions. Savings accounts, virtual debit cards, and payment solutions are available to consumers through the KAF Digital Bank mobile application. Launching is an important development in growing Malaysia's Islamic fintech landscape and adding more digital banking alternatives in the nation.

Malaysia Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia fintech market on the basis of deployment mode?

- What is the breakup of the Malaysia fintech market on the basis of technology?

- What is the breakup of the Malaysia fintech market on the basis of application?

- What is the breakup of the Malaysia fintech market on the basis of end user?

- What is the breakup of the Malaysia fintech market on the basis of region?

- What are the various stages in the value chain of the Malaysia fintech market?

- What are the key driving factors and challenges in the Malaysia fintech market?

- What is the structure of the Malaysia fintech market and who are the key players?

- What is the degree of competition in the Malaysia fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)