Malaysia Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Malaysia Foreign Exchange Market Overview:

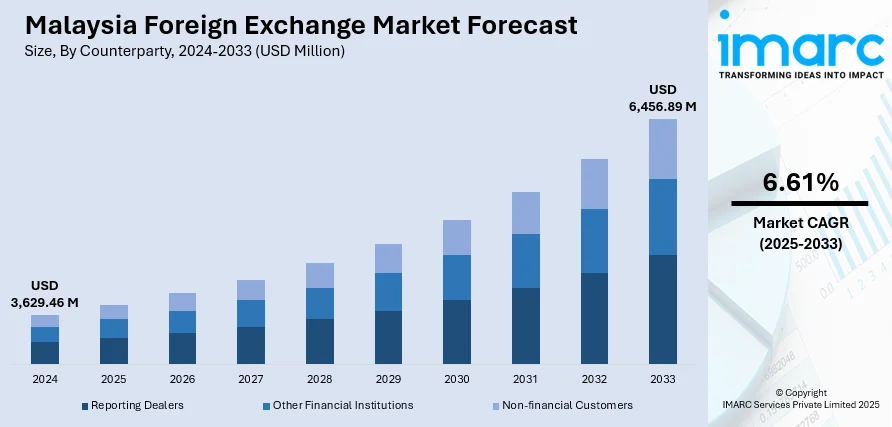

The Malaysia foreign exchange market size reached USD 3,629.46 Million in 2024. The market is projected to reach USD 6,456.89 Million by 2033, exhibiting a growth rate (CAGR) of 6.61% during 2025-2033. The market is fueled by the country's trade flows, capital movements, and monetary policy stance. Moreover, high export volumes and foreign direct investments increase demand for the ringgit, while global commodity prices, particularly oil and palm oil, influence forex inflows. In addition to this, exchange rate expectations, macroeconomic indicators, and regulatory measures are some of the significant factors augmenting the Malaysia foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,629.46 Million |

| Market Forecast in 2033 | USD 6,456.89 Million |

| Market Growth Rate 2025-2033 | 6.61% |

Malaysia Foreign Exchange Market Trends:

Shifting Interest Rate Dynamics and Portfolio Realignments

The market is experiencing a moderate recovery of the ringgit following prior periods of depreciation. This trend is largely supported by narrowing interest rate differentials between Malaysia and major economies such as the United States. As global monetary tightening slows and expectations shift toward eventual rate normalization, investors' need for emerging-market assets, including Malaysian debt and equities, has improved. This has encouraged capital inflows and strengthened demand for the ringgit. Additionally, a relatively stable domestic interest rate environment maintained by Bank Negara Malaysia has helped enhance investor confidence and currency stability. The renewed inflow of foreign portfolio investments, especially into government securities and equities, has bolstered forex reserves and supported ringgit appreciation. Exporters are also increasingly converting proceeds, particularly in sectors like electronics, palm oil, and petrochemicals, contributing to natural demand for the local currency. This momentum is further backed by the central bank's ongoing efforts to manage volatility and maintain orderly conditions in the currency markets without adopting a fixed exchange rate policy.

To get more information on this market, Request Sample

Regional Integration and Local Currency Settlement Mechanisms

The structural shift toward greater use of local currencies in trade and cross-border transactions is positively impacting the Malaysia foreign exchange market growth. With Malaysia being a central player in ASEAN regional economic initiatives, there is a strategic emphasis on reducing dependency on traditional settlement currencies such as the U.S. dollar. Local businesses and financial institutions are increasingly adopting ringgit-denominated settlements in intra-regional trade, especially with neighboring economies where bilateral trade volumes are substantial. This move enhances monetary sovereignty and limits exposure to external exchange rate fluctuations. In addition to this, corporate agreements and financial linkages among regional banks are facilitating smoother and faster ringgit transactions, thereby increasing its utility in commercial operations. Furthermore, the development of domestic financial infrastructure and payment systems, aimed at supporting multi-currency trade invoicing, encourages Malaysian exporters and importers to price goods in ringgit. These developments reinforce structural demand for the currency and gradually deepen the domestic foreign exchange market through more consistent and organic currency flows.

Rising Foreign Exchange Risk Awareness

One of the defining trends in the market is the increased participation of both corporations and individuals in currency management, driven by heightened exchange rate volatility and enhanced financial literacy. Malaysian exporters and importers, particularly in sectors with high exposure to currency fluctuations such as manufacturing, energy, and agriculture, are expanding their use of hedging instruments to manage forex risks. This includes greater use of forward contracts, currency swaps, and options to lock in favorable exchange rates and protect profit margins. As businesses scale regionally and globally, managing currency exposure has become a strategic priority. Simultaneously, improvements in digital finance platforms have lowered the barrier to entry for retail investors, enabling more individuals to engage in foreign exchange trading. These platforms offer real-time access to currency markets, analytical tools, and risk management features, allowing retail participants to respond swiftly to market movements. This dual increase in corporate and retail engagement has added depth to the market and encouraged a more dynamic and diversified foreign exchange ecosystem in Malaysia.

Malaysia Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

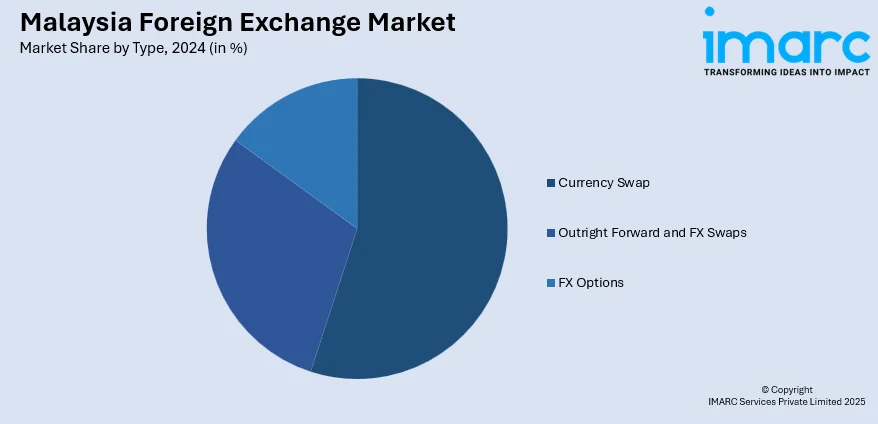

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Foreign Exchange Market News:

- June 2025: Bank Negara Malaysia announced the full implementation of the Qualified Resident Investor (QRI) Programme, effective from July 2025, with the objective of enhancing flexibility and resilience in Malaysia’s foreign exchange market. The program enables eligible resident institutional investors to repatriate and convert foreign-currency inflows into ringgit and subsequently reconvert ringgit into foreign currency for overseas investments without requiring prior approval from the central bank. This initiative is designed to facilitate two-way capital flows, promote greater onshore FX liquidity, and reduce operational barriers for corporates engaging in international financial activities.

Malaysia Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia foreign exchange market on the basis of counterparty?

- What is the breakup of the Malaysia foreign exchange market on the basis of type?

- What is the breakup of the Malaysia foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Malaysia foreign exchange market?

- What are the key driving factors and challenges in the Malaysia foreign exchange market?

- What is the structure of the Malaysia foreign exchange market and who are the key players?

- What is the degree of competition in the Malaysia foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)