Malaysia Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Malaysia Insurtech Market Overview:

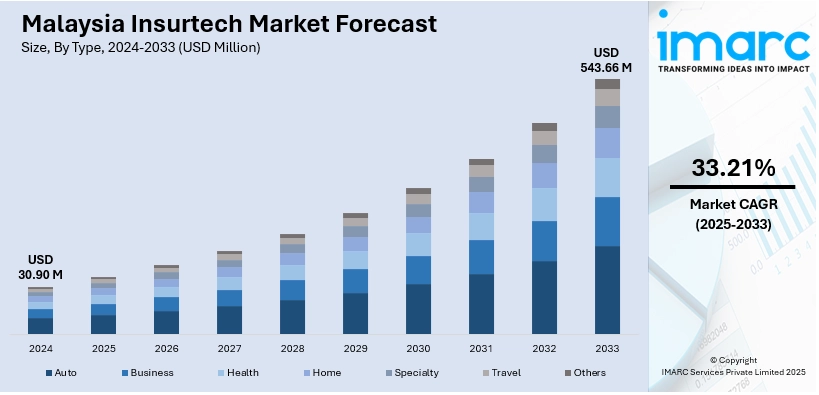

The Malaysia Insurtech market size reached USD 30.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 543.66 Million by 2033, exhibiting a growth rate (CAGR) of 33.21% during 2025-2033. The market is driven by the rise of the digital payment ecosystem, which enables seamless transactions for insurance services, enhancing user experience and promoting wider adoption of Insurtech solutions across the country. Furthermore, the increasing financial inclusion, with companies offering affordable, accessible digital solutions for underserved populations, is contributing to the expansion of the Malaysia Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.90 Million |

| Market Forecast in 2033 | USD 543.66 Million |

| Market Growth Rate 2025-2033 | 33.21% |

Malaysia Insurtech Market Trends:

Support for Financial Inclusion

Financial inclusion plays a crucial role in the Insurtech industry, particularly as a large segment of the population, especially in rural regions, encounters difficulties in obtaining conventional insurance products due to reasons, such as high costs, lack of awareness, and geographical obstacles. Insurtech firms are tackling these challenges by providing cost-effective, reachable, and digitally enhanced solutions aimed at underrepresented communities. An instance of this is the partnership between GXBank and Zurich Malaysia, revealed in May 2024. The two firms established a decade-long bancassurance alliance to introduce digital micro-insurance offerings designed to enhance the accessibility and affordability of insurance for low-income households. Utilizing digital platforms like mobile applications and online resources, these micro-insurance products offer adaptable coverage for groups that are often overlooked by traditional insurance markets because of financial limitations or geographical barriers. This partnership exemplifies a wider movement in the Insurtech industry aimed at improving accessibility and affordability, allowing a greater number of individuals, regardless of their financial situation or location, to access financial protection. By implementing these initiatives, Insurtech firms in Malaysia are effectively enhancing financial inclusion, making sure that insurance offerings reach a broader audience and aiding in closing the gap between conventional insurers and marginalized communities.

To get more information on this market, Request Sample

Growing Digital Payment Ecosystem

As the use of e-wallets, mobile banking applications, and online payment services rises, individuals are becoming more familiar with performing financial transactions online. This change in behavior is enabling Insurtech platforms to provide smooth and convenient payment options for premiums, claims, and various insurance-related services. A significant instance of this trend is the introduction of ShopeePay’s new app in 2025, offering an all-in-one financial hub that encompasses features, such as Buy Now Pay Later (BNPL) with SPayLater, bill payments, insurance, and takaful coverage. ShopeePay is simplifying access and management of insurance and other financial products for users by consolidating financial services into one app. The app's improved security features, DuitNow QR transfers, and in-store payment choices guarantee seamless and safe transactions, enhancing user trust. With the ongoing integration of digital payment systems into insurance platforms, the procedures for insurers and individuals are increasingly optimized, resulting in a more effective and user-friendly experience. This comfort with digital transactions is facilitating the widespread acceptance of Insurtech solutions in Malaysia, making digital insurance products more reachable and appealing to a broader audience. These efforts are contributing to the Malaysia Insurtech market growth, as digital solutions continue to expand and attract more users.

Malaysia Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

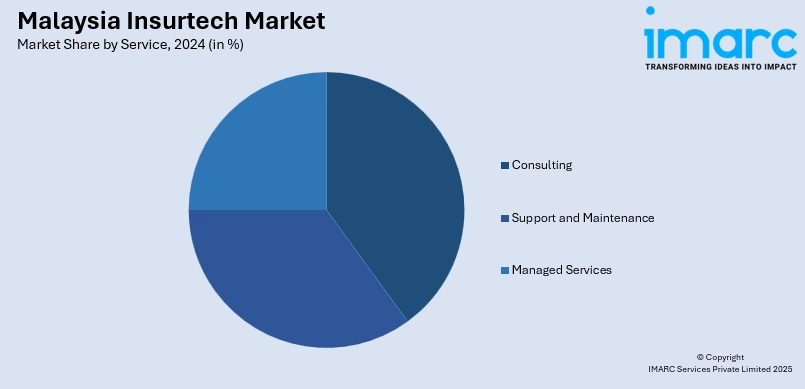

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Insurtech Market News:

- In April 2025, Censof Holdings launched insureKU, Malaysia's first fully digital insurance and takaful aggregator. The platform allows users to compare, review, and purchase various insurance products, including life and travel insurance, in under three minutes. Future plans include expanding product offerings and adding personalized tools for better financial planning.

- In February 2025, Malaysian insurtech PolicyStreet launched the Drive+ Membership loyalty program. It offers benefits like up to 80% off road tax, 0% interest payment options, and exclusive rewards. Starting February 12, 2025, the program replaces PolicyStreet's previous "Cheapest Road Tax in Town" offer.

Malaysia Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia Insurtech market on the basis of type?

- What is the breakup of the Malaysia Insurtech market on the basis of service?

- What is the breakup of the Malaysia Insurtech market on the basis of technology?

- What is the breakup of the Malaysia Insurtech market on the basis of region?

- What are the various stages in the value chain of the Malaysia Insurtech market?

- What are the key driving factors and challenges in the Malaysia Insurtech market?

- What is the structure of the Malaysia Insurtech market and who are the key players?

- What is the degree of competition in the Malaysia Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)