Malaysia Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Malaysia Luxury Fashion Market Overview:

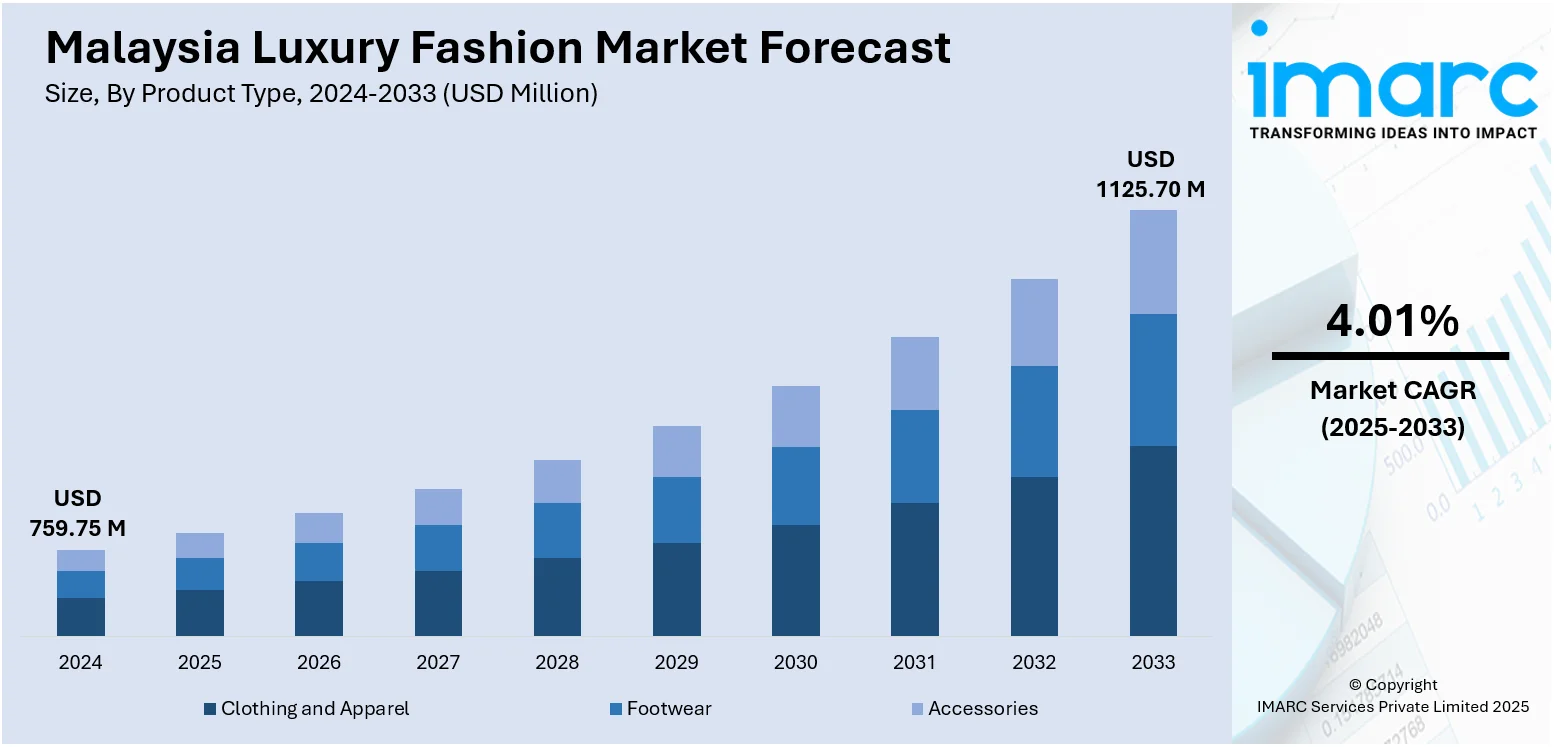

The Malaysia luxury fashion market size reached USD 759.75 Million in 2024. The market is projected to reach USD 1125.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.01% during 2025-2033. The market is fueled by increasing disposable income among Malaysia's high-income group, as well as increased demand for upscale international brands. Apart from this, increasing urban cities and an influx of high-end retail complexes have also made luxury fashion more accessible and visible. Further, social media platforms and aspirational consumer behavior are fueling demand for limited-edition collections and special designs, thereby further augmenting the Malaysia luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 759.75 Million |

| Market Forecast in 2033 | USD 1125.70 Million |

| Market Growth Rate 2025-2033 | 4.01% |

Malaysia Luxury Fashion Market Trends:

Surge in Affluent Millennial and Gen Z Consumers

The market is seeing a significant shift in consumer demographics, with successful millennials and Gen Z rapidly becoming more influential. Such younger consumers prefer brand authenticity, sustainability, and rare experiences to conventional demonstrations of status. Their buying habits are driven by digital interaction, and social media websites such as Instagram and TikTok play a pivotal role in brand discovery and the adoption of trends. They are very sensitive to influencer marketing, limited release drops, and collaborations that create the feeling of being unique and belonging to a community. In contrast to other generations, Gen Z consumers prefer personalization in terms of custom designs, in-store only services, or digital engagement that creates personalized recommendations. As a response, luxury houses globally are evolving by introducing specially dedicated collections and campaigns that are specifically marketed to Southeast Asian youth, including Malaysians. Moreover, as this consumer base becomes more aspirational and financially independent, their need to be associated with brands that represent personal values and contemporary styles will continue to propel consumption, specifically for fashion brands of the modern luxury category versus heritage styles.

To get more information on this market, Request Sample

Digital Retail and Omni-Channel Integration

Malaysia's luxury fashion chains are investing more in digital transformation, in sync with evolving customer expectations of seamless, multi-platform interactions. This trend is providing a boost to Malaysia luxury fashion market growth. Additionally, increasing numbers of high-net-worth individuals are embracing e-commerce, transforming how luxury fashion is positioned and sold. Apart from this, Malaysian luxury consumers demand seamless experiences across channels, from online consultations and personalized advice to in-store pickup and private appointments scheduled on mobile. In addition to this, retailers are adding virtual try-on tech, AI-powered styling suggestions, and inventory checks in real time to address these needs. Besides, WhatsApp and WeChat are being utilized as the primary communication platforms for luxury sales associates to be able to connect directly with clients, providing special previews and early access to new merchandise. These online touchpoints are not designed to substitute the luxury boutique visit but to add convenience and brand interaction. The use of data analytics also allows brands to optimize their targeting techniques and provide personalized experiences through digital and physical touchpoints.

Increased Demand for Ethical and Sustainable Luxury

There is growing consumer awareness in Malaysia around the ethical and environmental impact of fashion purchases, prompting luxury brands to respond with transparent and sustainable practices. Affluent Malaysian consumers, especially younger consumers, are scrutinizing supply chains, favoring brands that prioritize ethical labor practices, low-waste production, and responsible sourcing of raw materials. This has led to a rise in popularity of brands that emphasize eco-consciousness, artisanal craftsmanship, and slow fashion principles. Some consumers are also turning to high-quality vintage or pre-owned luxury fashion to support sustainability without compromising on brand prestige. Besides this, Malaysian boutiques and department stores have begun incorporating sustainability-focused designers and product lines, reflecting demand for accountability alongside exclusivity. Sustainability was once considered a secondary factor; it is now part of the primary decision-making process for many luxury fashion buyers in Malaysia, influencing both first-time purchases and brand loyalty.

Malaysia Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

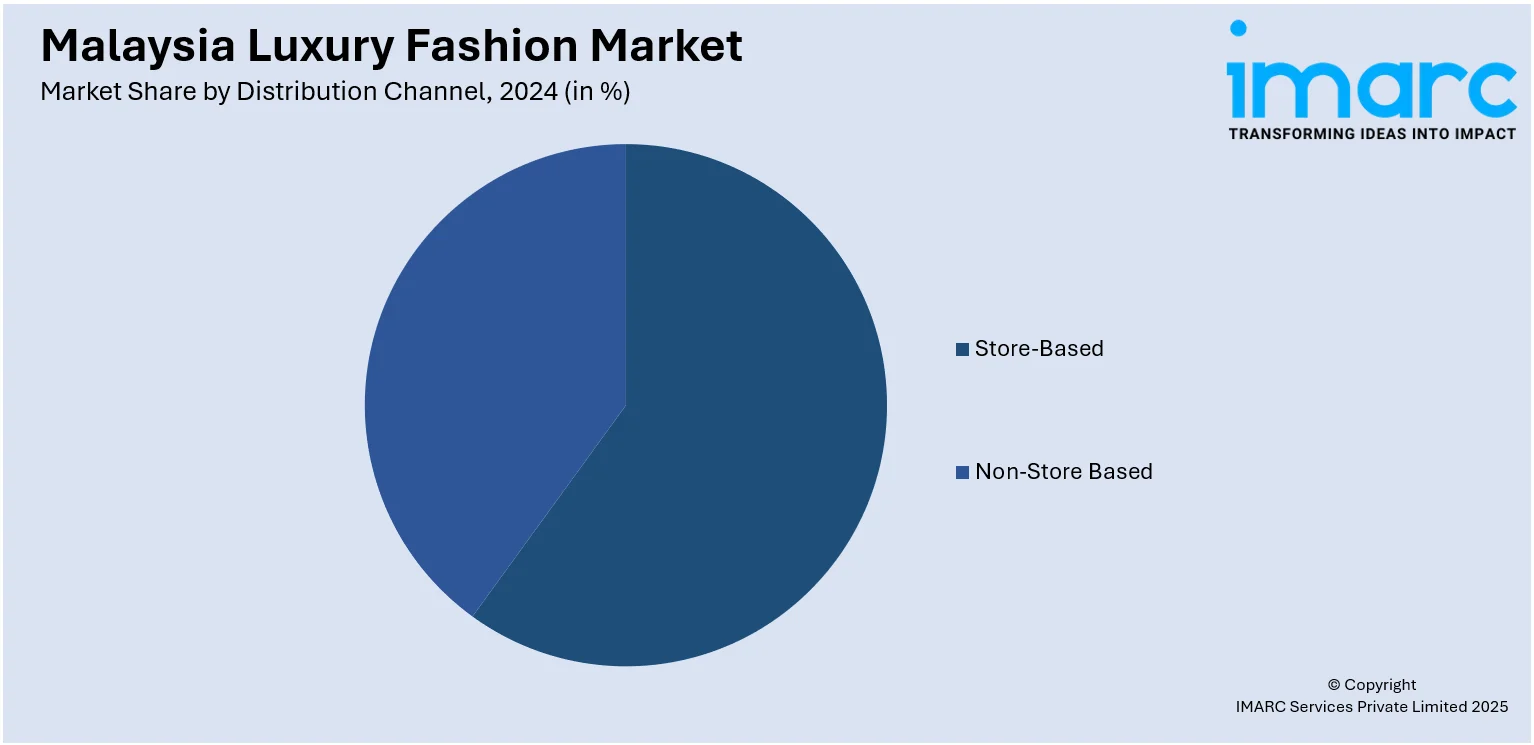

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Luxury Fashion Market News:

- July 2024: Chinese fast‑luxury fashion brand Urban Revivo inaugurated its inaugural Malaysian flagship at Pavilion KL in Kuala Lumpur, unveiling a 27,000 sq ft store featuring an escalator runway show, LED façade, and immersive art installations. The store's interior showcases warm ochre tones, curved designs, women's and men's collections, accessories, and a prominent visual projection area.

Malaysia Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia luxury fashion market on the basis of product type?

- What is the breakup of the Malaysia luxury fashion market on the basis of distribution channel?

- What is the breakup of the Malaysia luxury fashion market on the basis of end user?

- What is the breakup of the Malaysia luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Malaysia luxury fashion market?

- What are the key driving factors and challenges in the Malaysia luxury fashion market?

- What is the structure of the Malaysia luxury fashion market and who are the key players?

- What is the degree of competition in the Malaysia luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)