Malaysia Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2025-2033

Malaysia Office Furniture Market Overview:

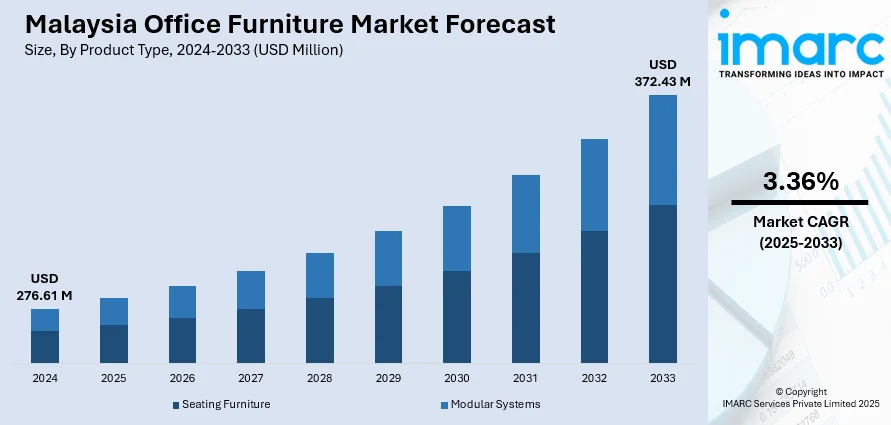

The Malaysia office furniture market size reached USD 276.61 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 372.43 Million by 2033, exhibiting a growth rate (CAGR) of 3.36% during 2025-2033. The office furniture market in Malaysia is driven by the growing hybrid work model, demand for modern and functional designs, and the shift toward adaptable, ergonomic, and modular furniture. Businesses are investing in flexible, space-saving solutions that accommodate diverse work environments, prioritizing employee well-being and operational efficiency, thereby contributing to the expansion of the Malaysia office furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 276.61 Million |

| Market Forecast in 2033 | USD 372.43 Million |

| Market Growth Rate 2025-2033 | 3.36% |

Malaysia Office Furniture Market Trends:

Shift Toward Modern and Functional Designs

As companies strive to create office environments that are both aesthetically pleasing and functional, the demand for adaptable, modular, and compact furniture is increasing. Businesses are shifting away from traditional, fixed furniture arrangements, opting for items that offer flexibility and enhanced support for various work styles. This trend is also shaped by employee health, with a growing focus on ergonomic and health-oriented designs. With the rise of hybrid and remote work models, furniture requirements are evolving to accommodate these changing settings, emphasizing the integration of technology and multifunctional designs. The need for furniture that combines design with practicality is increasing, as businesses invest in styles that balance both visual appeal and usability. A distinct illustration of this transition appears in 2024, as WORQ launched its eighth coworking location at Sunway Putra Mall, conveniently situated along the PWTC LRT line. This marked WORQ’s seventh transit-oriented development (TOD) location in the Klang Valley, aimed at enhancing connectivity and promoting sustainable remote work options. The launch of these contemporary, adaptable coworking spaces underscores the growing demand for furniture that facilitates teamwork and enables companies to quickly adapt to evolving work trends. This trend highlights the growing emphasis on modern office layouts that prioritize both practicality and employee well-being. Thus, the rising demand for modern, practical, and adaptable designs is a crucial factor propelling the Malaysia office furniture market growth.

To get more information on this market, Request Sample

Growing Popularity of Hybrid Work Model

The rising trend of hybrid work models is driving the need for office furniture in Malaysia. With the transition towards flexible work arrangements, employees divide their time between home and the workplace, resulting in a change in the use of office spaces. This change is encouraging businesses to invest in furniture options that accommodate both traditional office environments and remote work arrangements. Modular furniture is highly sought after because it can be effortlessly rearranged for team discussions, personal workspaces, or virtual meetings. Moreover, companies are seeking furniture that facilitates a seamless transition between home and office work settings, such as adaptable desks and ergonomic chairs that are suitable for both environments. This trend indicates a wider movement towards flexibility and adaptability in office environments, with businesses emphasizing multifunctional and portable furniture elements. In line with this trend, in 2025, International Workplace Group (IWG) announced a new Signature center at Merdeka 118 in Kuala Lumpur, offering 637 workstations and flexible office solutions. This marks IWG’s fourth center within PNB properties, supporting the growing demand for hybrid workspaces in Malaysia. This move underscores the growing demand for office furniture that promotes a dynamic and flexible work environment, enabling companies to adapt to the evolving work landscape while equipping employees with the necessary adaptability.

Malaysia Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture and modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

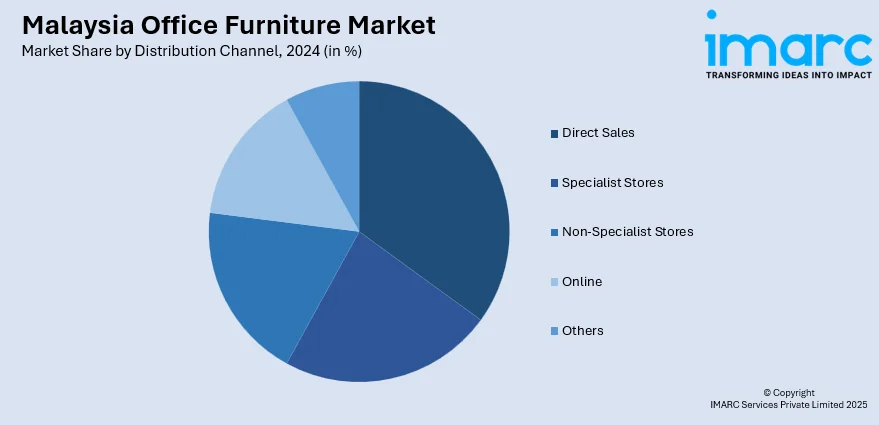

Distribution Channel Insights:

- Direct Sales

- Specialist Stores

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist stores, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Office Furniture Market News:

- In October 2024, organizers announced that the Malaysia International Furniture Fair (MIFF) 2025 will be held from March 1–4 in Kuala Lumpur at MITEC and WTCKL. As Southeast Asia’s largest B2B furniture trade show, MIFF will showcase a wide range of products, with a strong focus on office furniture and smart workspace solutions.

Malaysia Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Stores, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia office furniture market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia office furniture market on the basis of product type?

- What is the breakup of the Malaysia office furniture market on the basis of material type?

- What is the breakup of the Malaysia office furniture market on the basis of distribution channel?

- What is the breakup of the Malaysia office furniture market on the basis of price range?

- What is the breakup of the Malaysia office furniture market on the basis of region?

- What are the various stages in the value chain of the Malaysia office furniture market?

- What are the key driving factors and challenges in the Malaysia office furniture market?

- What is the structure of the Malaysia office furniture market and who are the key players?

- What is the degree of competition in the Malaysia office furniture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia office furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)