Malaysia Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Malaysia Pallet Market Overview:

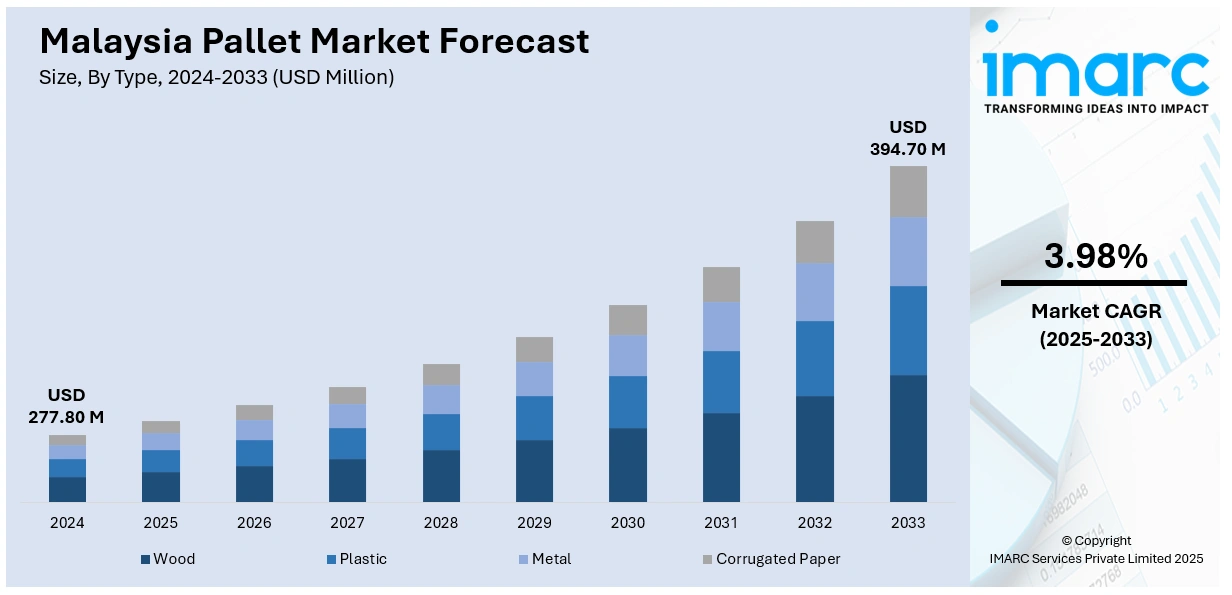

The Malaysia pallet market size reached USD 277.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 394.70 Million by 2033, exhibiting a growth rate (CAGR) of 3.98% during 2025-2033. The market is driven by stringent regulatory frameworks, coupled with corporate ESG commitments from major players, compelling adoption of sustainable pallet solutions and circular practices. Furthermore, substantial investments in logistics automation necessitate dimensionally precise, robust pallets compatible with modern material handling systems. Concurrently, the pursuit of supply chain visibility and efficiency fuels demand for smart pallets embedded with RFID or IoT sensors, further augmenting the Malaysia pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 277.80 Million |

| Market Forecast in 2033 | USD 394.70 Million |

| Market Growth Rate 2025-2033 | 3.98% |

Malaysia Pallet Market Trends:

Accelerated Shift Towards Sustainable and Eco-Conscious Pallet Solutions

The market is experiencing a pronounced shift towards sustainable materials and circular economy principles, driven by a confluence of regulatory pressures, corporate ESG commitments, and growing environmental awareness. Government initiatives like the Green Technology Master Plan and the Plastics Sustainability Roadmap, alongside potential carbon pricing mechanisms like the proposed Plastic Tax, are incentivizing businesses to re-evaluate their logistics footprint. Malaysia's Master Plan on Green Technology and Roadmap on Plastics Sustainability are nudging companies to revisit their logistics networks for greater environmental efficiency. The launch of the proposed Plastic Tax and the Bursa Carbon Exchange signal the coming of age of carbon pricing as a key regulatory tool. These moves, as part of the SDG Roadmap Phase II, signal a shift towards low-carbon business and practices under a circular economy. This translates directly into growing demand for pallets made from recycled plastic, responsibly sourced FSC/PEFC-certified timber, or rapidly renewable alternatives like bamboo and molded pulp. Major multinationals operating in Malaysia, such as Nestlé and Sime Darby, are publicly committing to sustainable supply chains, pushing pallet suppliers and pooling providers to offer verifiable eco-credentials. Furthermore, pallet refurbishment, repair, and end-of-life recycling programs are gaining traction as companies seek to minimize waste and extend pallet lifespans, moving beyond the traditional linear "take-make-dispose" model. While cost premiums remain a hurdle, the long-term benefits of compliance, brand reputation enhancement, and alignment with global sustainability trends are solidifying this shift as a dominant force.

To get more information on this market, Request Sample

Rising Demand for Automation-Compatible and Smart Pallets

Driven by the relentless pursuit of efficiency and the rapid modernization of Malaysia's logistics and manufacturing sectors, there is an accelerating demand for pallets specifically engineered for seamless integration with automated material handling systems (AMHS). Therefore, this is further propelling the Malaysia pallet market growth. As warehouses and distribution centers invest heavily in Automated Guided Vehicles (AGVs), robotic arms, and automated storage and retrieval systems (AS/RS), pallet dimensional consistency, structural rigidity, and precise bottom configurations become non-negotiable requirements. This favors standardized, high-quality plastic pallets and consistently manufactured wooden pallets that meet stringent tolerances. Concurrently, the integration of smart technologies onto pallets is gaining momentum. Embedding RFID tags, QR codes, or IoT sensors allows for real-time tracking of location, temperature, humidity, shock events, and even load weight throughout the supply chain. This provides unprecedented visibility, enhances security, enables predictive maintenance for pooled pallets, optimizes inventory management, and streamlines processes like automated check-in/check-out. Investments in national logistics infrastructure and the push towards Industry 4.0 are accelerating this trend, making "smart" and automation-ready pallets a critical component of future-proof logistics operations for major players like DHL Supply Chain and PKT Logistics Group operating within Malaysia. In June 2025, Malaysia's industrial production showed a year-on-year growth of 3%, higher than expectations, as manufacturing output grew 3.6%. Growth was led mainly by a significant 6.4% expansion in the electrical and electronics industry, in addition to a rebound in transport-associated manufacturing, which grew 3.2%. This increasing trend, driven by the embrace of Industry 4.0, reflects growth in automation and the use of digital technologies, and this consequently has positive impacts on the demand for pallets and logistics optimization in smart factories and electronics supply chains.

Malaysia Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

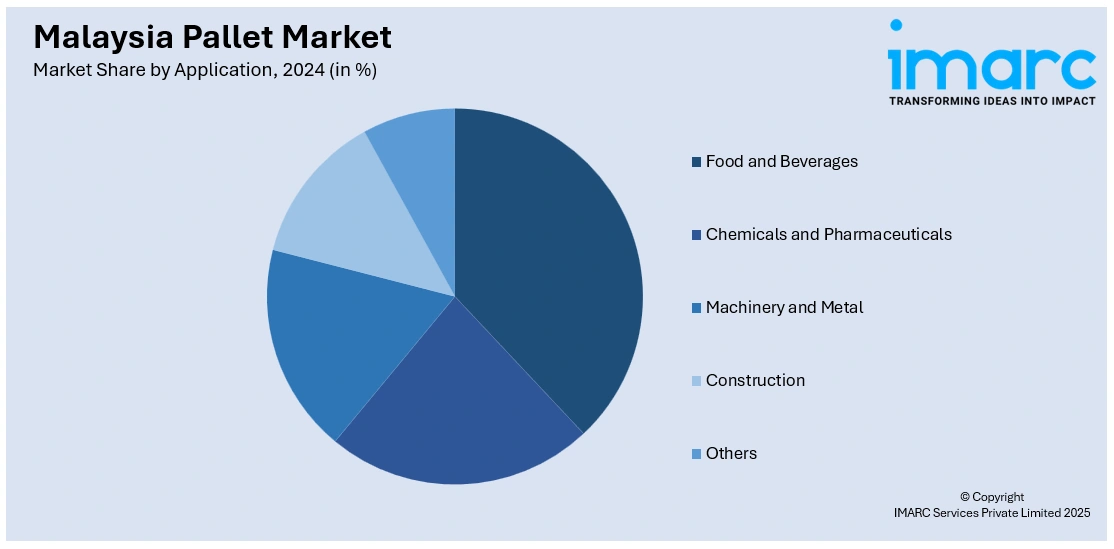

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia pallet market on the basis of type?

- What is the breakup of the Malaysia pallet market on the basis of application?

- What is the breakup of the Malaysia pallet market on the basis of structural design?

- What is the breakup of the Malaysia pallet market on the basis of region?

- What are the various stages in the value chain of the Malaysia pallet market?

- What are the key driving factors and challenges in the Malaysia pallet market?

- What is the structure of the Malaysia pallet market and who are the key players?

- What is the degree of competition in the Malaysia pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)