Malaysia Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Malaysia Paper Packaging Market Overview:

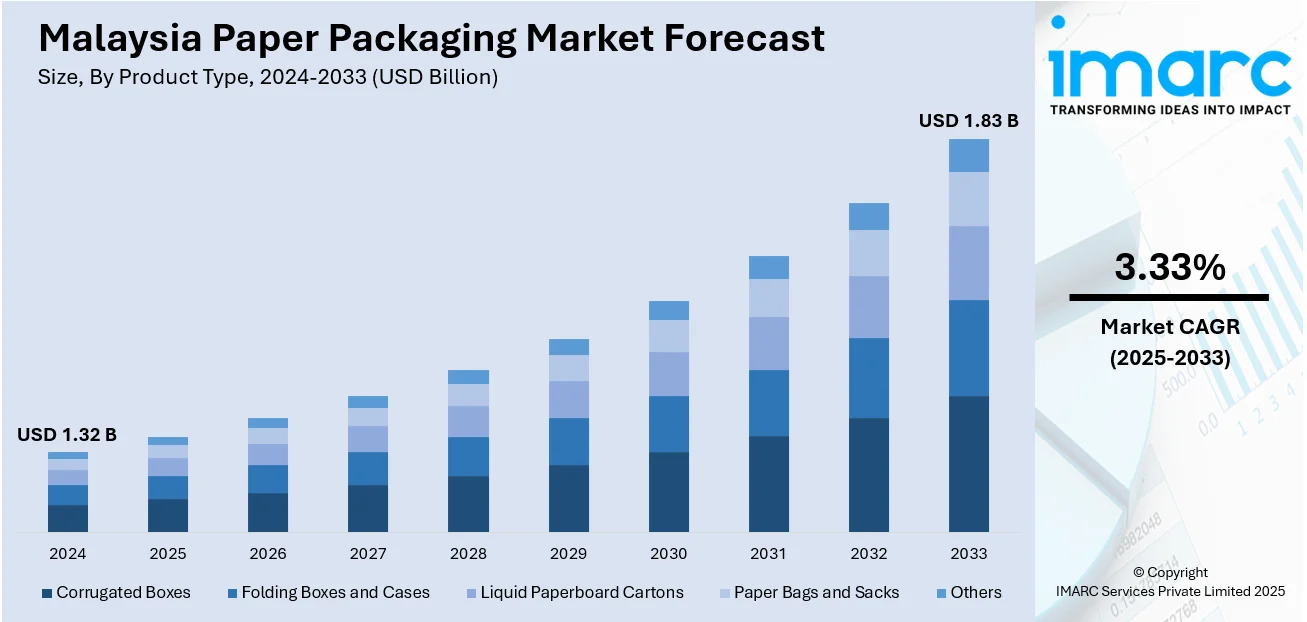

The Malaysia paper packaging market size reached USD 1.32 Billion in 2024. The market is projected to reach USD 1.83 Billion by 2033, exhibiting a growth rate (CAGR) of 3.33% during 2025-2033. The market is driven by growing sustainability efforts, rapid e‑commerce and manufacturing expansion, and modernization of operations. Increasing environmental awareness and supportive policies are pushing businesses to adopt recyclable, biodegradable paper solutions to meet consumer and regulatory expectations. At the same time, the surge in online shopping, urban consumption, and industrial production fuels demand for durable, cost-effective packaging across sectors like food, retail, and electronics. Additionally, automation and digital technologies are streamlining production, improving efficiency, and enabling innovation, solidifying Malaysia paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.32 Billion |

| Market Forecast in 2033 | USD 1.83 Billion |

| Market Growth Rate 2025-2033 | 3.33% |

Malaysia Paper Packaging Market Trends:

Growth in E‑commerce, Urbanization & Manufacturing

Malaysia’s paper packaging market is being driven by rapid e‑commerce growth, urbanization, and industrial expansion. A 24% surge in e‑commerce sales in 2023 has significantly boosted the need for paper-based shipping boxes, mailers, and protective materials, as businesses adapt to the demands of online retail. At the same time, urban consumers are purchasing more packaged food, beverages, electronics, and personal care products, further increasing demand for versatile, eco-friendly packaging. The country’s expanding manufacturing sector, especially in fast-moving consumer goods, retail, and electronics, is also fueling the need for scalable and reliable packaging solutions. This convergence of online retail growth, evolving urban lifestyles, and modernized supply chains underscores the critical role of paper packaging in ensuring efficiency, safety, and brand visibility. Together, these trends position paper packaging as an essential pillar of Malaysia’s rapidly transforming economic and consumer landscape.

To get more information on this market, Request Sample

Sustainability and Environmental Policies

One of the most prominent Malaysia paper packaging market trends is the increasing focus on sustainability. Government and business efforts alike are shifting towards minimizing the eco-effect of packaging. State policies promote the use of recyclable and biodegradable materials, and numerous companies are embracing paper-based solutions to support environmental objectives and international ESG expectations. Concurrently, shoppers are increasingly aware of the decisions they make at checkout, opting for sustainable packaging and products that reflect responsible sourcing. This change in regulation and consumer perspective compelled packaging producers to innovate, substituting plastic with sustainable paper-based options in many industries. Consequently, paper packaging has transformed from a secondary choice to a necessary part of business for companies looking to comply with environmental regulations and enhance their brand image in a more environmentally conscious marketplace.

Digitization, Automation & Modernization of Operations

The modernization of packaging operations has become a crucial driver of Malaysia paper packaging market growth, with companies increasingly adopting automation, digital technologies, and advanced production methods to enhance efficiency and remain competitive. By 2023, around 60% of Malaysian packaging companies had integrated digital solutions, a sharp rise from just 20% in 2020, reflecting the industry’s rapid transformation. These upgrades include smart machinery for high-speed production, data-driven systems for supply chain optimization, and innovative design capabilities to meet evolving customer needs. Digitization also supports better quality control, flexibility, and customization, enabling manufacturers to deliver high-quality products at scale. Automation further reduces labor dependency, improves cost efficiency, and minimizes downtime. Together, these technological advancements empower businesses to manage rising demand from e-commerce, retail, and manufacturing sectors while positioning Malaysia’s paper packaging producers as agile, forward-thinking players in a competitive, modernized market.

Malaysia Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

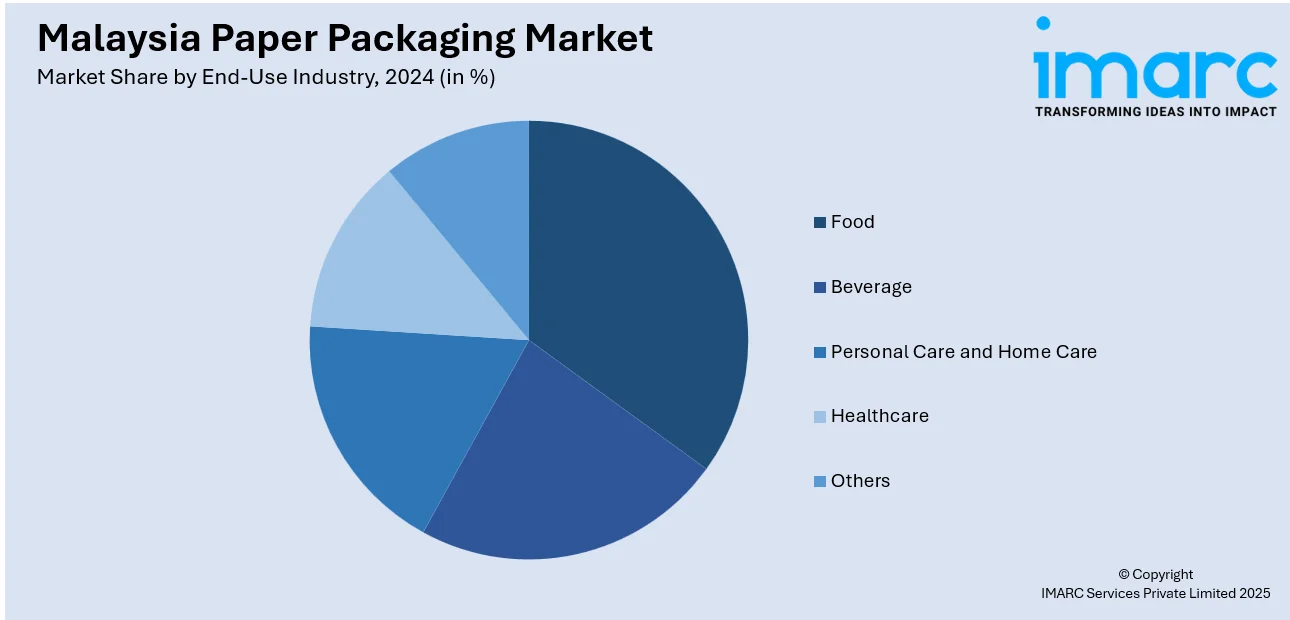

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Paper Packaging Market News:

- In April 2025, Amcor launched a state-of-the-art medical device packaging coating facility in Selangor, Malaysia, the first in Asia to produce both top and bottom substrates for medical device packaging. Equipped with advanced air knife coating and water-based systems, the facility enhances precision, reduces waste, and strengthens supply chain resilience. This expansion underscores Amcor’s commitment to healthcare packaging growth in Asia, complementing recent investments in China, India, and Singapore.

- In April 2025, Lecta introduced Creaset HGP, a one-sided coated, grease-resistant paper designed for flexible packaging applications. Free from PFAS, it offers a safer and more sustainable solution for modern packaging needs. With a recyclability rating of 95 out of 100 from Cepi, Creaset HGP is ideal for uses such as butter wrapping and as a laminate for pet food packaging, aligning with growing demand for eco-friendly, high-performance packaging materials.

Malaysia Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia paper packaging market on the basis of product type?

- What is the breakup of the Malaysia paper packaging market on the basis of grade?

- What is the breakup of the Malaysia paper packaging market on the basis of packaging level?

- What is the breakup of the Malaysia paper packaging market on the basis of end-use industry?

- What is the breakup of the Malaysia paper packaging market on the basis of region?

- What are the various stages in the value chain of the Malaysia paper packaging market?

- What are the key driving factors and challenges in the Malaysia paper packaging market?

- What is the structure of the Malaysia paper packaging market and who are the key players?

- What is the degree of competition in the Malaysia paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)