Malaysia Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Malaysia Private Equity Market Overview:

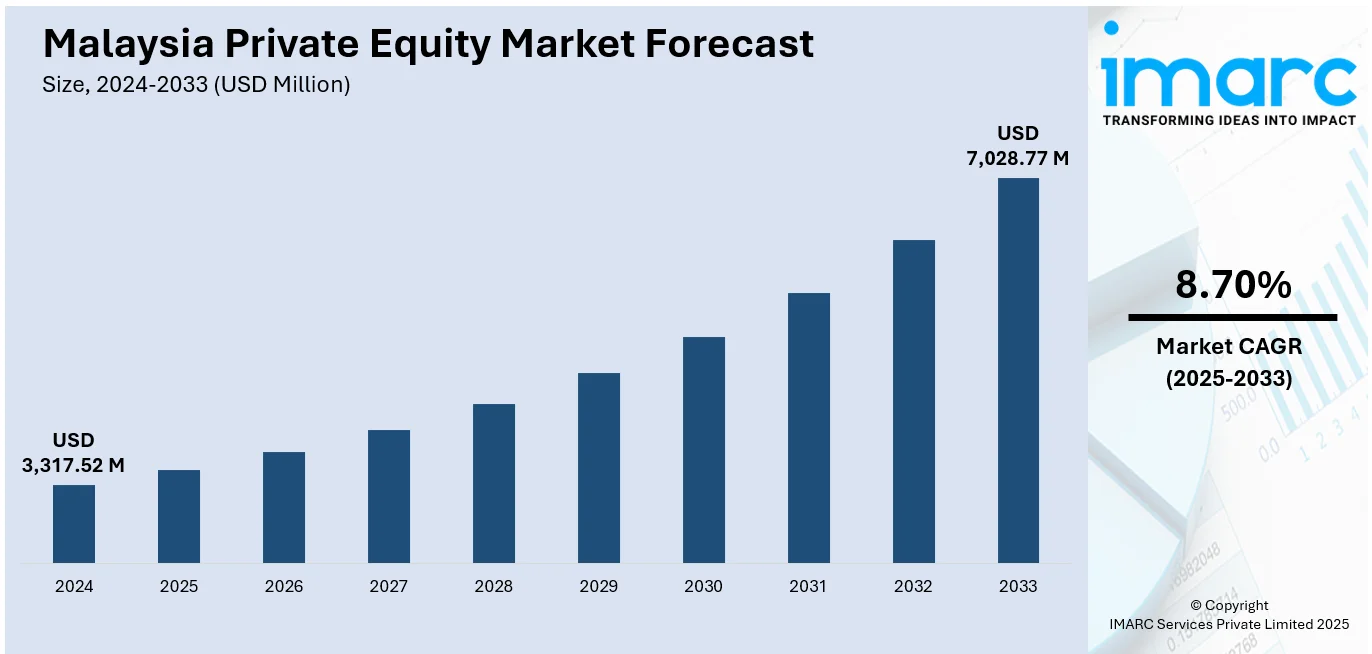

The Malaysia private equity market size reached USD 3,317.52 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,028.77 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is driven by regulatory reforms, increased institutional investor participation, and digitalization across industries. Accelerating startup ecosystems, cross-border investments, and government-led funding schemes also contribute. Growing interest in ESG-aligned ventures further supports the Malaysia private equity market share expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,317.52 Million |

| Market Forecast in 2033 | USD 7,028.77 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Malaysia Private Equity Market Trends:

Emphasis on ESG Integration

Environmental, Social, and Governance (ESG) considerations are increasingly influencing investment decisions in Malaysia’s private equity landscape. Fund managers are incorporating ESG metrics to align portfolios with international sustainability standards. This shift reflects pressure from both institutional investors and regulators. The integration not only enhances brand reputation but also mitigates risk exposure, especially in volatile sectors. ESG-focused strategies are proving advantageous in attracting foreign capital, as transparency and impact measurement become central to valuation. Furthermore, ESG-aligned companies are showing improved long-term performance metrics, encouraging more firms to adopt sustainable practices. As a result, ESG integration is becoming a competitive differentiator, driving Malaysia private equity market growth by enhancing investor confidence and expanding the range of viable investment opportunities. For instance, in July 2025, KWAP selected 12 global general partners to manage a RM6 billion allocation under its Dana Pemacu initiative, targeting domestic private equity, infrastructure, and real estate investments. The private equity mandates were awarded to Investcorp, Navis Capital, Nexus Point, and The Vistria Group. The programme, launched in May 2024 under Malaysia’s Ekonomi MADANI and GEAR‑uP reforms, pairs international GPs with local partners and focuses on Shariah‑compliant opportunities across key national sectors.

To get more information on this market, Request Sample

Favorable Tax Incentives Driving Startup-Focused Capital Deployment

Targeted tax incentives are reshaping Malaysia’s private equity landscape by encouraging increased investment in the local startup ecosystem. Concessionary tax rates for funds investing a significant portion of capital in Malaysian startups reduce barriers to capital deployment and enhance fund attractiveness. For instance, in June 2025, Malaysia introduced a concessionary 5% tax rate for up to 10 years on funds that invest at least 20% of their capital in Malaysian startups, as part of new venture capital tax incentives. Additionally, registered VC and private equity management firms benefit from a 10% tax rate under specified conditions. The measures aim to broaden investment access via onshore LLPs, simplify cross-border fundraising, and position Malaysia as a regional hub for startup capital. These measures facilitate greater early-stage and growth capital flow, especially in technology-driven sectors, by lowering tax burdens on both investment funds and management firms. Additionally, simplifying cross-border fundraising and promoting onshore limited liability partnerships (LLPs) supports more efficient capital mobilization. This regulatory environment fosters a more vibrant venture capital market and positions Malaysia as a growing regional hub for startup investments, contributing significantly to Malaysia private equity market growth.

Malaysia Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional level for 2025-2033. Our report has categorized the market based on fund type.

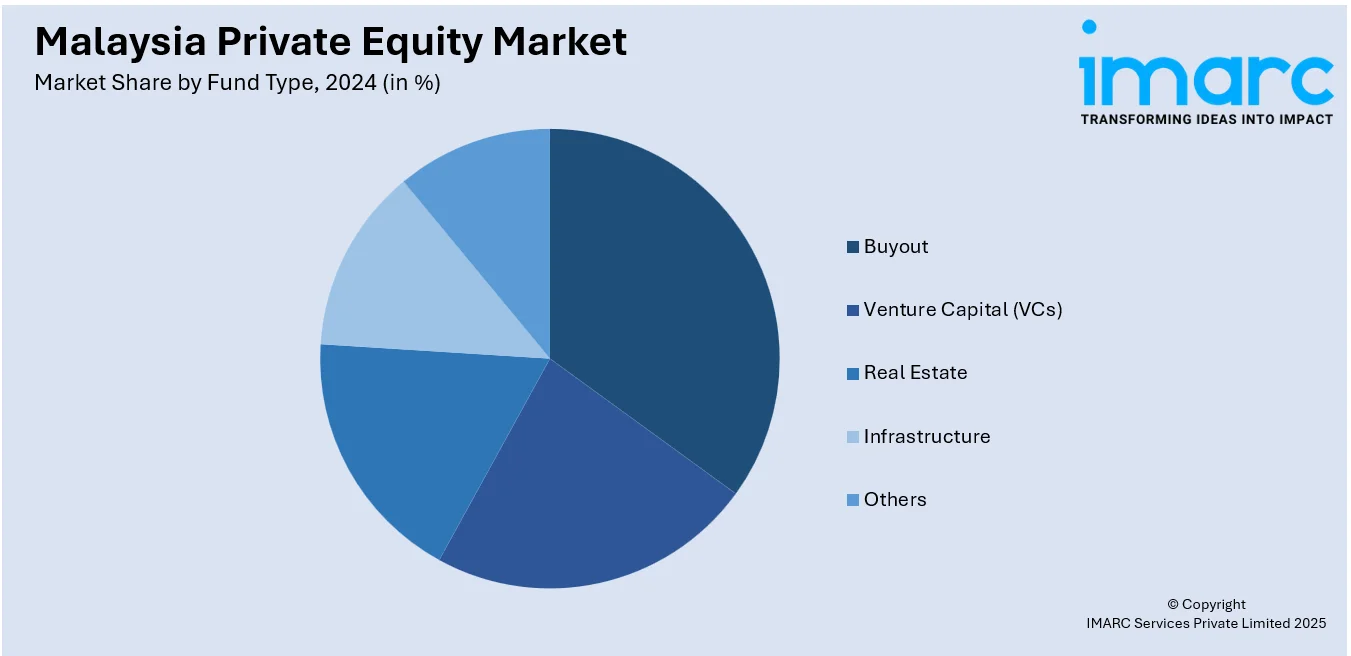

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Private Equity Market News:

- In June 2025, Khazanah Nasional and Jelawang Capital selected five venture capital firms under the Emerging Fund Managers’ Programme (EMP) and Regional Fund Managers’ Initiative (RMI) to strengthen Malaysia’s VC ecosystem. The EMP supported local fund managers in raising competitive regional funds, while the RMI attracted global firms to help Malaysian startups scale regionally and globally. This initiative aligned with the Malaysian Venture Capital Roadmap 2024-2030 and Ekonomi MADANI framework, aiming to position Malaysia as a leading regional VC hub by 2030 and drive private equity market growth through enhanced fund manager capabilities and capital inflows.

- In January 2025, Investcorp was selected by Malaysia’s KWAP to manage a $110 million private equity special managed account, primarily targeting Southeast Asia with a 15-20% allocation to Europe. This mandate reflects Investcorp’s expanding presence in Asia, where it has raised $2.2 billion from institutional investors in the last 18 months. The partnership reinforces Investcorp’s global growth strategy and commitment to serving Asian investors, marking a significant milestone in its private equity operations.

Malaysia Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia private equity market on the basis of fund type?

- What is the breakup of the Malaysia private equity market on the basis of region?

- What are the various stages in the value chain of the Malaysia private equity market?

- What are the key driving factors and challenges in the Malaysia private equity market?

- What is the structure of the Malaysia private equity market and who are the key players?

- What is the degree of competition in the Malaysia private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)