Malaysia Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2026-2034

Malaysia Seeds Market Summary:

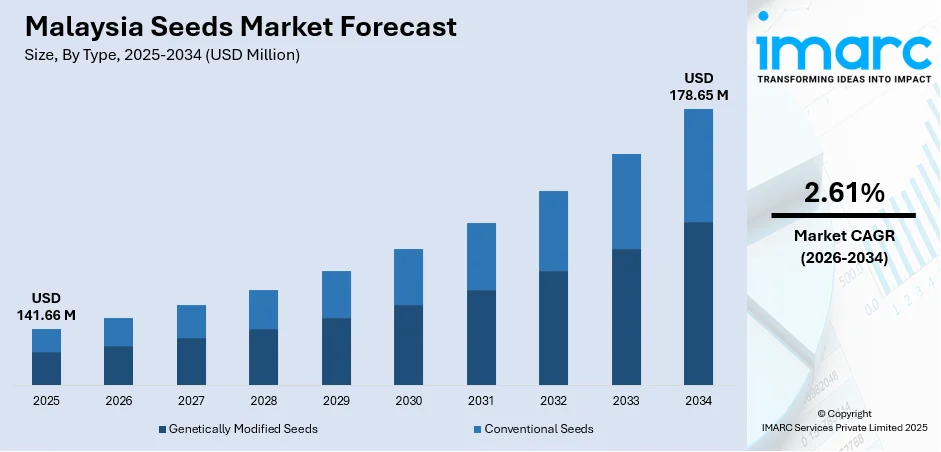

The Malaysia seeds market size reached USD 141.66 Million in 2025 and is projected to reach USD 178.65 Million by 2034, growing at a compound annual growth rate of 2.61% during 2026-2034.

The Malaysia seeds market is experiencing steady growth driven by government-led agricultural modernization programs, rising food security concerns, and increasing adoption of high-yielding seed varieties. National policies under the 12th Malaysia Plan and National Agrofood Policy 2.0 are strengthening investment in seed research, precision agriculture, and farmer support programs. Growing demand for certified seeds across rice, vegetable, and oilseed cultivation, combined with expanding international trade partnerships and technological integration in farming practices, is positioning the sector for sustained development. These dynamics are reshaping supply chains and enhancing access to improved planting materials, driving Malaysia seeds market share.

Key Takeaways and Insights:

- By Type: Conventional seeds hold the largest market share at 82% in 2025, reflecting farmer preference for non-genetically modified varieties developed through traditional plant-breeding techniques suited to local growing conditions.

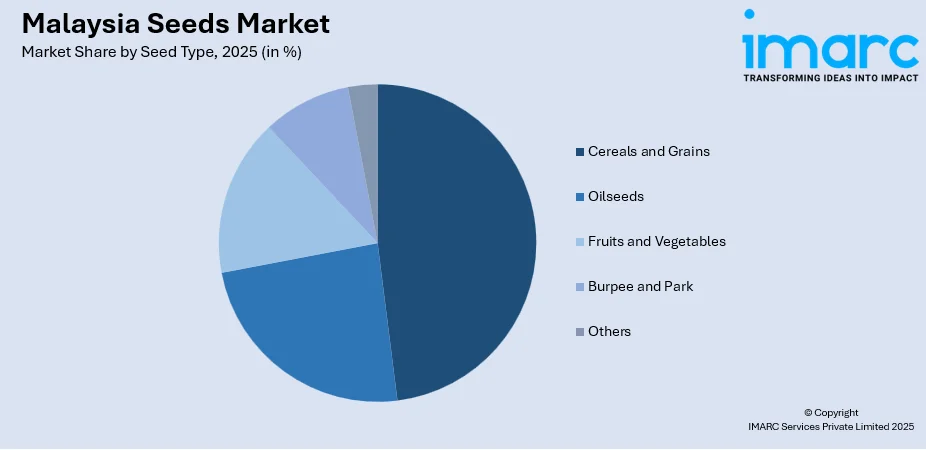

- By Seed Type: Cereals and grains dominate the market with 48% share in 2025, driven by rice cultivation supporting over 300,000 farmers and national food self-sufficiency initiatives.

- By Traits: Herbicide-tolerant seeds lead the traits segment with 55% share in 2025, addressing persistent weed management challenges in paddy fields across major rice-producing states.

- By Availability: Commercial seeds account for 80% market share in 2025, supported by government subsidy programs and growing farmer adoption of certified planting materials.

- By Seed Treatment: Treated seeds represent 70% of the market in 2025, as farmers increasingly recognize benefits of enhanced germination rates and early-stage crop protection.

- Key Players: The Malaysia seeds market features established research institutions and international seed companies investing in varietal development, strategic partnerships, technology transfer, and distribution network expansion to serve diverse agricultural segments across the country.

To get more information on this market Request Sample

The Malaysia seeds market is advancing as national food security priorities drive investment in improved seed varieties and modern agricultural infrastructure. Government initiatives such as the five-season planting program and smart farming integration are accelerating adoption of high-performance seeds. In July 2025, MARDI in partnership with BASF launched the Clearfield rice varieties MR CL3 and MR CL4, designed to yield over seven tons per hectare while maturing in 99 days. The sector continues to benefit from biodiversity conservation efforts, international seed trade expansion, and digitalization of farming practices, creating favorable conditions for sustainable growth across cereals, vegetables, and oilseed segments.

Malaysia Seeds Market Trends:

Rising Adoption of Climate-Resilient Seed Varieties

The Malaysia seeds market is witnessing growing adoption of climate-resilient and high-yield seed varieties designed to address environmental challenges and enhance agricultural productivity. Research institutions are developing seeds with improved drought tolerance, disease resistance, and shorter maturation cycles suited to tropical conditions. Collaborative partnerships between government agencies and international seed companies are accelerating the release of improved varieties that support national planting programs while addressing persistent weed management challenges affecting paddy cultivation across major rice-producing states.

Diversification through Biodiversity Conservation

Malaysia is actively strengthening its genetic resource preservation capabilities to secure long-term agricultural resilience and expand breeding options. National gene banks are collaborating with international institutions to safeguard traditional varieties and develop improved seeds. In May and December 2024, MARDI deposited 725 plant accessions including 207 traditional rice varieties, eggplants, and long beans to the Svalbard Global Seed Vault under the BOLD Project funded by CropTrust. This Malaysia seeds market growth trend reflects broader efforts to integrate genetic diversity into public breeding programs, creating region-specific varieties while reducing over-reliance on narrow commercial hybrids.

Technology-Driven Efficiency in Seed Systems

Digital infrastructure advancement is transforming seed system operations from production through distribution, enhancing quality control and farmer access to certified materials. Smart agriculture platforms are enabling precision monitoring, automated tracking, and data-driven advisory services throughout the seed value chain. In March 2025, Bentong district launched the Jelajah Digital: 5G Enabled Agritech program, achieving 72.3% 5G coverage of populated areas by January 2025. These technologies support precision irrigation, automated crop monitoring, and real-time agronomic guidance, creating a more responsive and transparent seed ecosystem serving rural and peri-urban farming communities.

Market Outlook 2026-2034:

The Malaysia seeds market is poised for sustained expansion, supported by continued government investment in agricultural modernization and food security programs. The market generated a revenue of USD 141.66 Million in 2025 and is projected to reach a revenue of USD 178.65 Million by 2034, growing at a compound annual growth rate of 2.61% from 2026-2034, driven by rising adoption of high-yielding certified seeds, expanded research partnerships, and technology integration across farming operations. National initiatives including the 12th Malaysia Plan allocations, smart farming programs, and international seed trade agreements will continue strengthening the sector. Growing emphasis on climate-adaptive varieties, enhanced seed treatment technologies, and improved distribution networks positions the Malaysia seeds market for progressive development across all major crop segments.

Malaysia Seeds Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Conventional Seeds | 82% |

| Seed Type | Cereals and Grains | 48% |

| Traits | Herbicide-Tolerant (HT) | 55% |

| Availability | Commercial Seeds | 80% |

| Seed Treatment | Treated | 70% |

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

Conventional seeds dominate the Malaysia seeds market with 82% share in 2025, driven by farmer preference for non-GM varieties and regulatory frameworks governing modified crop cultivation.

Conventional seeds remain the foundation of Malaysia's agricultural sector, with farmers favoring varieties developed through traditional breeding methods that are well-adapted to local soil conditions and climate patterns. Research institutions continue releasing improved conventional varieties combining higher yields with disease resistance. Strategic partnerships between government agencies and international seed companies are accelerating development of non-transgenic seeds through traditional plant-breeding techniques offering enhanced productivity and faster maturation cycles. These collaborative efforts demonstrate ongoing investment in conventional seed improvement programs supporting national food security objectives.

Seed Type Insights:

Access the comprehensive market breakdown Request Sample

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed)

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

Cereals and grains lead the Malaysia seeds market, accounting for 48% share in 2025 due to rice being a staple food supporting extensive paddy cultivation across major producing states.

The cereals and grains segment dominates the Malaysia seeds market, with rice cultivation providing livelihoods for farming communities across major producing states and serving substantial domestic consumption requirements. Government programs including subsidized seed distribution, planting incentives, and the five-season-in-two-years initiative continue driving certified seed adoption among paddy farmers. USDA projections indicate Malaysia's rice production will increase due to improved seed varieties, government incentives, and expanded planting areas. Investment in research facilities and varietal development supports ongoing improvement of cereals performance across diverse growing conditions throughout the country.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

Herbicide-tolerant seeds hold 55% of the Malaysia seeds market in 2025, addressing critical weed management challenges affecting rice productivity across Malaysia's major paddy-growing regions.

Herbicide-tolerant seed varieties are experiencing strong adoption as Malaysian farmers confront persistent weedy rice infestations that significantly reduce crop yields across paddy-growing regions. The development of seeds with built-in herbicide tolerance enables more effective weed control while protecting the primary crop from chemical damage. Research institutions are collaborating with international partners to advance integrated crop management approaches combining tolerant genetics with targeted herbicide application and stewardship practices. These systems support the Ministry of Agriculture's recommendations for commercialization through certified seed incentive programs nationwide.

Availability Insights:

- Commercial Seeds

- Saved Seeds

Commercial seeds account for 80% of the Malaysia seeds market in 2025, supported by government subsidy programs, quality certification frameworks, and expanding distribution networks.

The commercial seeds segment dominates as farmers increasingly recognize benefits of certified planting materials offering consistent quality, improved genetics, and documented performance characteristics. Government support programs including paddy crop subsidies for ploughing, fertilizer, and pesticide assistance encourage adoption of quality commercial seeds across cultivation areas. The Ministry of Agriculture's incentive programs further strengthen commercial seed utilization through expanded farmer support initiatives. As certified seed accessibility improves and farmers recognize yield advantages of professionally produced varieties, the transition toward commercial seed adoption continues accelerating across multiple crop categories.

Seed Treatment Insights:

- Treated

- Untreated

Treated seeds lead the segment with 70% share of the Malaysia seeds market in 2025, reflecting growing farmer awareness of benefits including enhanced germination rates, early-stage protection, and improved crop establishment.

The treated seeds segment has expanded significantly as farmers increasingly value the protection and performance advantages offered by seed treatment technologies in Malaysia's tropical growing environment. Modern treatments incorporate fungicides, insecticides, and biological agents that protect seeds from soil-borne diseases, pest damage, and environmental stresses during critical germination and early growth phases. Research institutions are developing comprehensive cultivation approaches integrating seed coating with plant growth promoters, demonstrating how treated seed technologies are being incorporated into production systems enhancing farmer outcomes and improving crop establishment rates.

Regional Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

Selangor serves as a strategic hub for Malaysia's seeds market, benefiting from proximity to major research institutions, urban consumer markets, and well-developed agricultural infrastructure. The state's diverse farming activities span vegetable cultivation, horticultural production, and specialty crops. Strong logistics networks facilitate efficient seed distribution, while government extension services support farmer adoption of improved varieties across intensive farming operations.

Kuala Lumpur functions as the administrative and commercial center for Malaysia's seeds industry, hosting headquarters of key market participants, regulatory authorities, and trade associations. The federal territory facilitates policy development, industry coordination, and market access initiatives. Urban agriculture programs are gaining traction, driving demand for vegetable and specialty crop seeds suited to controlled environment cultivation and community gardening projects.

Johor represents a significant agricultural state with diverse cropping patterns influencing seed market dynamics. The state's proximity to Singapore creates export opportunities for fresh produce, driving demand for quality vegetable seeds. Palm oil cultivation remains prominent alongside expanding fruit and vegetable farming activities. Agricultural development programs support farmer modernization efforts, encouraging adoption of certified seeds and improved cultivation practices.

Sarawak presents unique opportunities within Malaysia's seeds market, with government initiatives prioritizing agricultural development across the state's diverse landscapes. Paddy cultivation expansion programs are strengthening rice seed demand while tropical fruit and vegetable production activities create varied requirements. Traditional farming communities are transitioning toward certified seed adoption, supported by extension services and infrastructure improvements connecting rural growing areas to distribution networks.

Other Malaysian states including Kedah, Perlis, Kelantan, Pahang, and Sabah collectively form the backbone of national rice production and diverse agricultural activities. Northern peninsular states dominate paddy cultivation, driving substantial certified rice seed consumption. Eastern states are expanding tropical crop development while highland regions support temperate vegetable seed demand. Government recovery programs assist farmers affected by seasonal weather events.

Market Dynamics:

Growth Drivers:

Why is the Malaysia Seeds Market Growing?

Government Agricultural Development and Subsidy Programs

National policies and substantial budgetary allocations are driving sustained investment in Malaysia's seed sector development. The government has prioritized agricultural modernization through comprehensive programs addressing research, infrastructure, farmer support, and food self-sufficiency objectives. Additionally, The Ministry of Agriculture announced RM 86 million (USD 18.4 million) in 2025 funding under the 12th Malaysia Plan specifically for agricultural development in Sabah, contributing to total allocations exceeding RM 432.4 million (USD 92.5 million) since 2021. These investments are accelerating improved seed variety adoption and strengthening agricultural value chains nationwide.

Rising Food Security Concerns and Import Reduction Strategies

Growing recognition of food security vulnerabilities is intensifying focus on domestic agricultural capacity expansion and seed system strengthening. Malaysia's food imports reached approximately USD 18 billion in 2023, representing a considerable increase from the previous year and highlighting substantial dependence on external sources for essential commodities. The National Agrofood Policy 2.0 establishes frameworks addressing this challenge through five core policy thrusts including modernization through smart agriculture, research and development enhancement, and sustainable food system development. The Ministry's PINTAR initiative emphasizes innovation implementation across the agro-food value chain, driving demand for improved seed varieties that can enhance domestic productivity.

International Seed Trade Partnerships and Export Expansion

Malaysia is emerging as a significant participant in international seed trade, particularly for palm oil germplasm and tropical crop varieties suited to regional markets. Strategic partnerships with foreign entities are creating new revenue streams while strengthening bilateral agricultural relationships. State-owned agricultural enterprises are establishing long-term supply agreements with international buyers, marking important milestones in Malaysia's seed export capabilities. These partnerships extend beyond simple seed supply transactions to encompass comprehensive agricultural collaboration including advisory services, agronomist site visits, and planted seed mortality monitoring. Such arrangements position Malaysia as a premium supplier of tropical agricultural germplasm while supporting partner nations seeking to expand domestic cultivation of key crops. The growing international demand for quality planting materials creates sustained opportunities for Malaysian seed producers.

Market Restraints:

What Challenges the Malaysia Seeds Market is Facing?

Climate Change Impacts and Weather Vulnerabilities

Climate variability poses significant challenges to Malaysia's agricultural sector, with altered rainfall patterns, flooding events, and temperature changes affecting crop production and seed demand stability. Monsoon floods and extreme weather events periodically damage crops and disrupt planting schedules, creating uncertainty while highlighting needs for resilient varieties.

Aging Farmer Population and Labor Constraints

Malaysia's agricultural workforce demographics present structural challenges affecting technology adoption and sector modernization. Concerns exist about succession, knowledge transfer, and capacity for adopting modern farming practices as younger populations continue migrating toward urban centers, reducing agricultural labor availability.

Regulatory Uncertainties and Proposed Legislation Concerns

Pending regulatory changes are generating discussion among farming communities and agricultural stakeholders. Proposed legislation regarding seed quality requirements would mandate licenses for seed storage, sharing, and sales activities. Smallholder farmer groups argue the legislation would burden traditional seed-saving practices.

Competitive Landscape:

The Malaysia seeds market features a dynamic competitive environment with participation from government research institutions, international seed companies, and regional agricultural enterprises. Key players focus on varietal development partnerships, technology transfer agreements, and distribution network expansion to serve diverse farmer segments. Research collaborations between different organizations and international agricultural bodies are advancing seed improvement programs. Companies are investing in facilities, quality certification capabilities, and farmer education initiatives to strengthen market positions. The sector demonstrates moderate consolidation with opportunities for specialized participants addressing specific crop categories, regional requirements, and emerging trait technologies. Strategic alliances combining local agronomic expertise with global genetic resources characterize competitive strategies across multiple market segments.

Recent Developments:

- In June 2025, Sawit Kinabalu Group, a Malaysian state agency, supplied 1.5 Million palm oil seeds to India's Patanjali Group under a five-year contract ending in 2027 for total delivery of 4 Million seeds. This marks the first palm oil seed supply agreement by a Malaysian state agency, supporting India's National Mission on Edible Oils - Oil Palm initiative targeting 1 Million Hectares of cultivation by 2025-26.

Malaysia Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Malaysia seeds market size was valued at USD 141.66 Million in 2025.

The Malaysia seeds market is expected to grow at a compound annual growth rate of 2.61% during 2026-2034 to reach USD 178.65 Million by 2034.

Conventional seeds hold the largest share at 82%, driven by farmer preference for non-GM varieties developed through traditional plant-breeding techniques, regulatory frameworks, and ongoing research investment in improved conventional seed varieties.

Key factors driving the Malaysia seeds market include government agricultural development programs, rising food security concerns, technology integration in farming, international seed trade partnerships, and increasing adoption of high-yielding certified seed varieties across major crop categories.

Major challenges include climate change impacts causing weather vulnerabilities and crop losses, aging farmer demographics with labor shortages, regulatory uncertainties regarding proposed seed quality legislation, and persistent dependence on food imports requiring domestic production expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)