Malaysia Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and States, 2025-2033

Malaysia Steel Tubes Market Overview:

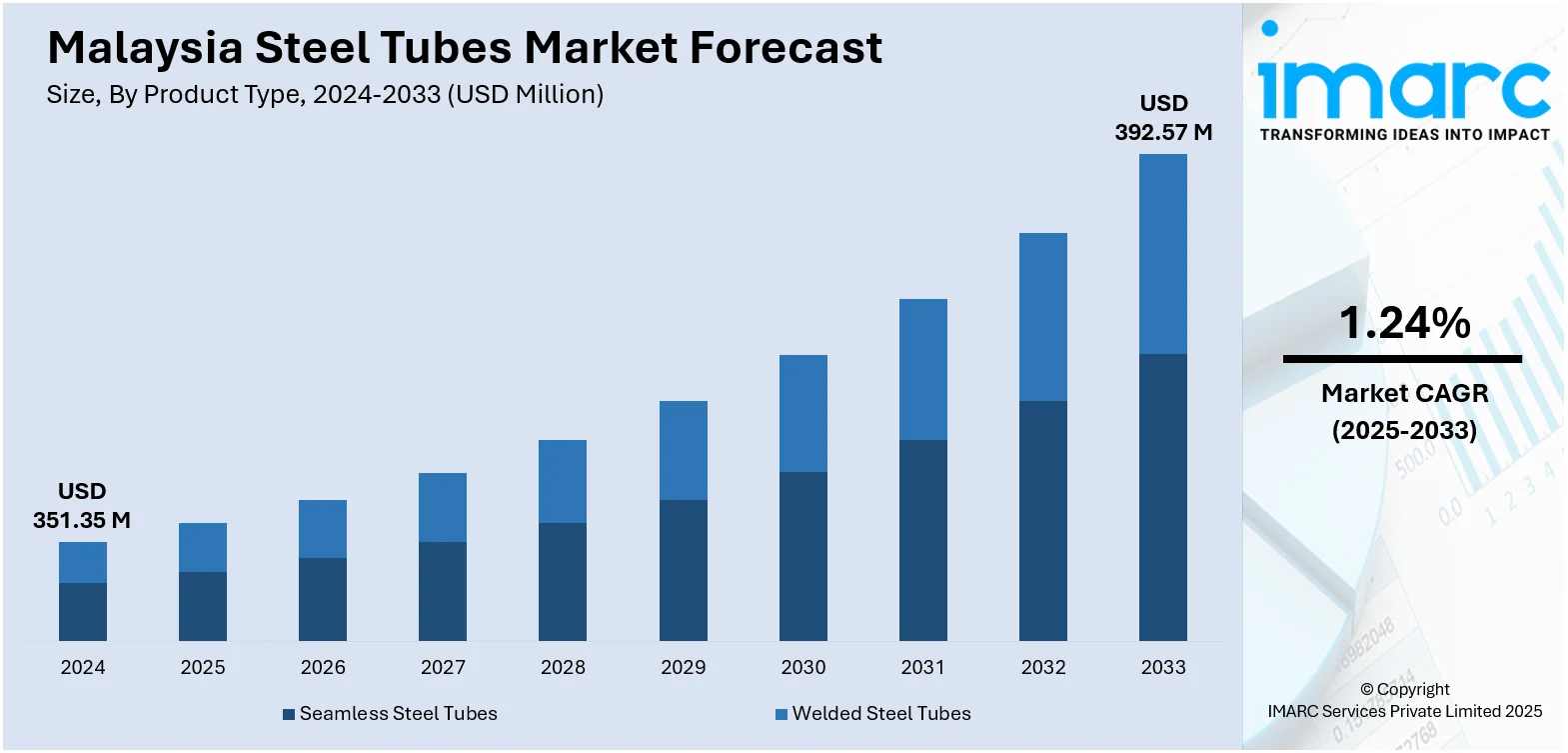

The Malaysia steel tubes market size reached USD 351.35 Million in 2024. The market is projected to reach USD 392.57 Million by 2033, exhibiting a growth rate (CAGR) of 1.24% during 2025-2033. The market is experiencing steady growth, driven by expanding infrastructure projects, industrial development, and rising demand in construction and automotive sectors. Developments in manufacturing and rising use of lightweight, long-lasting materials are shaping market trends. The market is also gaining from regional investment and government policies favoring industrial development. With end-use industries continuing to grow, demand for efficient and high-performance tubing solutions is likely to increase, further dominating the Malaysia steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 351.35 Million |

| Market Forecast in 2033 | USD 392.57 Million |

| Market Growth Rate 2025-2033 | 1.24% |

Malaysia Steel Tubes Market Trends:

Emerging Domestic Production Momentum

In August 2024, Malaysia implemented a government-led “production capacity suspension order” targeting the flat-steel segment to control oversupply and promote low-carbon initiatives. This shift has opened space for domestic producers to redirect efforts toward higher value segments like steel tubes. The move is more than just regulatory, it’s strategic. Local mills are starting to prioritise precision tube manufacturing, aligning production with emerging demands from infrastructure, utilities, and high-spec industrial applications. Instead of expanding output for volume’s sake, producers are refining quality and reliability, aiming to serve long-term national development goals. This redirection is also helping smaller regional mills stay competitive by focusing on niche specifications and performance-based products. Industry conversations now increasingly focus on material consistency, certification, and supply chain stability, indicating a broader shift toward capability-leading growth. These market dynamics reflect a maturing steel sector that’s no longer chasing scale alone. The domestic manufacturing base is evolving, not only to meet internal demand but also to raise the bar on what’s produced and how. This focus on high-value output is a key driver of Malaysia steel tubes market growth.

To get more information on this market, Request Sample

Selective Trade Policies Boost Local Steel Tube Production

In January 2025, Malaysia's Ministry of Investment, Trade and Industry (MITI) had imposed temporary anti-dumping duties on China, India, Japan, and South Korea's imports of certain flat-rolled iron and steel. The move came after investigation revealed that these imports were being dumped into the domestic market at below-cost prices, causing injury to domestic producers. While the duties are levied on flat steel products, the impact is registered throughout the steel tubes industry. The policy has also incentivized construction, infrastructure, and manufacturing purchasers to rely increasingly on local suppliers, appreciating reliable quality, certification, and supply chain consistency. Steel tube import volumes have thereby dropped as indigenous mills capture increasing market share by providing these improved standards. The trend also works in line with government intentions to stimulate local steel industry capability and decrease dependence on overseas products. With procurement strategies changing, the emphasis on compliance and quality fortifies the local supply chain. This changing regulatory environment is creating a more resilient market, pointing to one of the key Malaysia steel tubes market trends.

Infrastructure Investments Propel Steel Tube Demand

The largest utility in Malaysia, in July 2025 announced a five-year plan to modernize the power grid and fuel the nation's energy transition. Major investment will likely boost the demand for steel tubes, which are essential for constructing transmission lines, substations, and other infrastructure components. The growth of the power infrastructure and its upgrading is a part of a larger national movement toward sustainability and energy supply reliability. As infrastructure development moves forward, high-grade steel tubes meeting high requirements are ever more critical, leading local makers to enhance capacity and product quality. This environment enhances innovation, particularly in making tubes with decreased carbon footprints, as per government policies for green steel. The increasing pipeline of infrastructure projects signals sustained growth in demand for steel tubes, courtesy of both private and government sectors. Together, the two tend to bring a bullish outlook into the Malaysia steel tubes market.

Malaysia Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

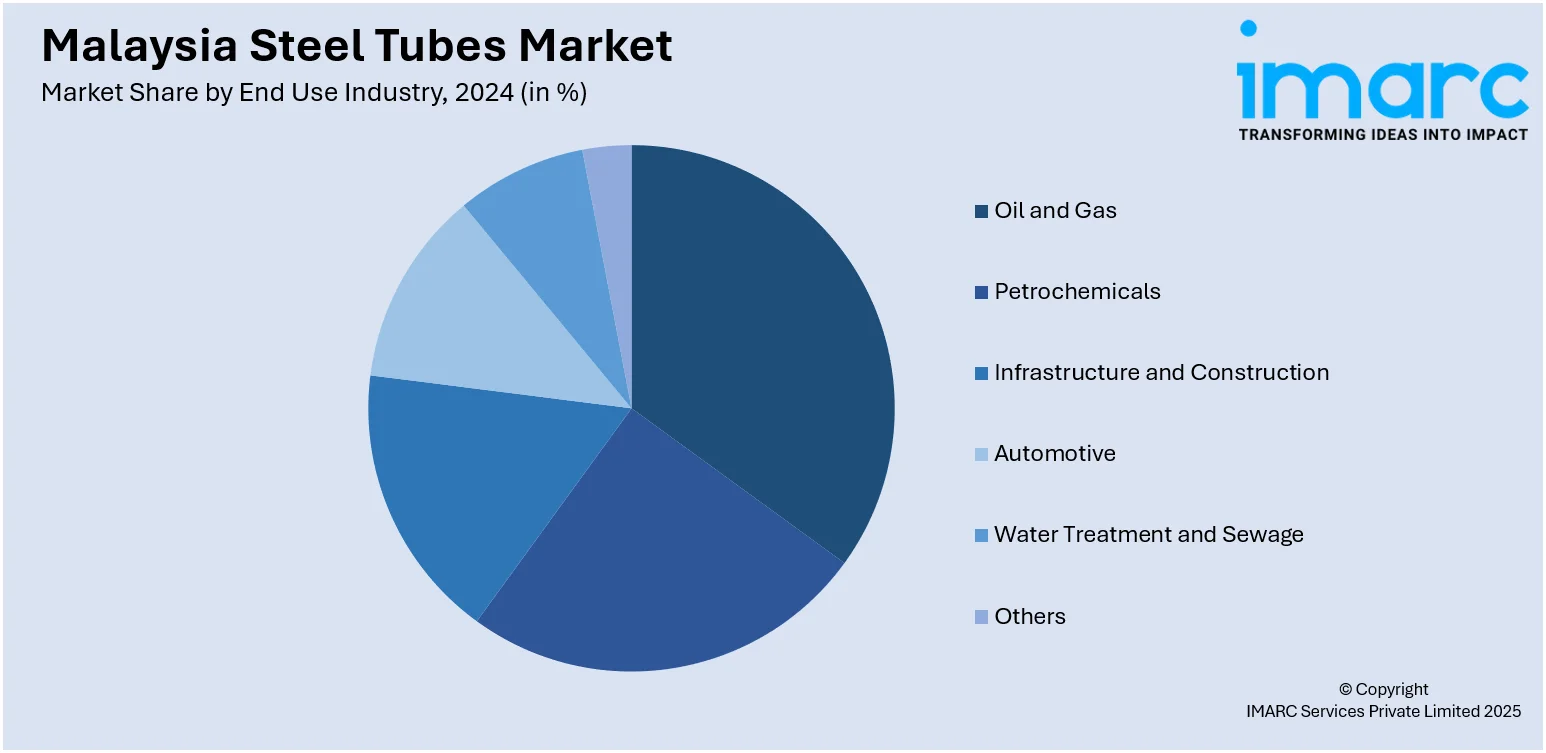

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

States Insights:

- Selangor

- W. P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major states markets, which include the Selangor, W. P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Steel Tubes Market News:

- September 2024: Mycron Steel Berhad, a leading steel producer in Malaysia, is advancing into sustainable manufacturing with plans to develop and launch its own patented green steel products. The company has forged a strategic memorandum of understanding with Japan’s JFE Steel to incorporate JGreeX™ into its production process, marking a pioneering effort in Malaysian green steel manufacturing. Mycron’s initiative aligns with national sustainability and decarbonization goals, reflecting its commitment to environmentally responsible industrial leadership.

Malaysia Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| States Covered | Selangor, W. P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia steel tubes market on the basis of product type?

- What is the breakup of the Malaysia steel tubes market on the basis of material type?

- What is the breakup of the Malaysia steel tubes market on the basis of end use industry?

- What is the breakup of the Malaysia steel tubes market on the basis of states?

- What are the various stages in the value chain of the Malaysia steel tubes market?

- What are the key driving factors and challenges in the Malaysia steel tubes market?

- What is the structure of the Malaysia steel tubes market and who are the key players?

- What is the degree of competition in the Malaysia steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)