Malaysia Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and States, 2025-2033

Malaysia Used Cooking Oil Market Overview:

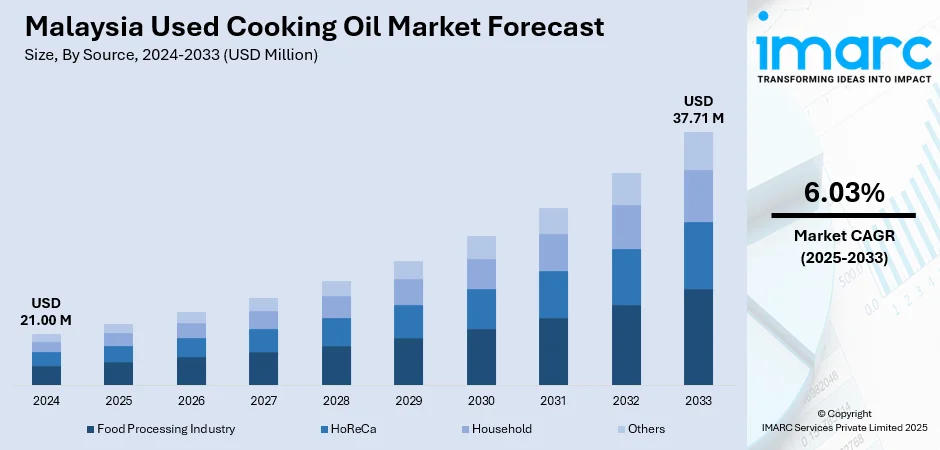

The Malaysia used cooking oil market size reached USD 21.00 Million in 2024. The market is projected to reach USD 37.71 Million by 2033, exhibiting a growth rate (CAGR) of 6.03% during 2025-2033. At present, rising regulatory support for renewable energy adoption and export opportunities are encouraging the development of a reliable and efficient used cooking oil supply chain. Besides this, the broadening of cafes and restaurants due to changing lifestyles is contributing to the expansion of the Malaysia used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.00 Million |

| Market Forecast in 2033 | USD 37.71 Million |

| Market Growth Rate 2025-2033 | 6.03% |

Malaysia Used Cooking Oil Market Trends:

Increasing demand for biofuels

Rising demand for biofuels is positively influencing the market in Malaysia. As the country is shifting towards cleaner energy alternatives, biofuels are gaining strong traction. Used cooking oil, being readily available and cost-effective, is emerging as a preferred feedstock for biodiesel production. This trend is supported by both government sustainability goals and industry initiatives aimed at reducing reliance on fossil fuels. With Malaysia’s robust palm oil industry, the volume of used cooking oil generated is substantial, providing a consistent and scalable input for biofuel manufacturers. Moreover, several companies are launching biofuel production facilities to capitalize on the increasing international and domestic demand, thereby boosting the collection and value of used cooking oil. In January 2025, Ecoceres revealed plans to initiate operations at its biofuels production facility located in Malaysia in the latter half of 2025. The plant was expected to possess an overall capacity of 350,000 Metric Tons annually of biofuels, comprising 220,000 tpy of sustainable aviation fuel (SAF) and 130,000 tpy of hydrotreated vegetable oil. Palm oil mill wastewater and used cooking oil would be the primary feedstocks for this facility. Apart from this, regulatory support for renewable energy adoption and export opportunities are also encouraging the development of a reliable used cooking oil supply chain. As industries and individuals are becoming more environmentally conscious, converting used cooking oil into biofuels not only supports emission reduction targets but also promotes a circular economy.

To get more information on this market, Request Sample

Expansion of cafes and restaurants

The broadening of cafes and restaurants is impelling the Malaysia used cooking oil market growth. As changing lifestyles are driving the demand for convenient dining options, the number of food establishments continues to rise across cities and towns. These outlets, particularly those that prepare deep-fried and grilled food items, generate large quantities of used cooking oil regularly. An increase in the number of foodservice outlets is leading to a more consistent and scalable supply of used cooking oil, which is becoming a valuable raw material for biodiesel production and other industrial applications. With greater awareness around sustainability and waste management, many restaurants and cafes are also partnering with oil collection companies to responsibly dispose of or recycle their used cooking oil. This not only helps them comply with environmental regulations but also contributes to the circular economy. The hospitality sector’s growth thus plays a pivotal role in reinforcing the infrastructure for used cooking oil collection and processing, making it easier for refiners and biodiesel producers to access high volumes of feedstock. The continual rise in tourist arrivals is further fueling the expansion of food outlets, generating more demand and supply for used cooking oil in the country. For instance, in 2024, Malaysia received around 25.02 Million international visitors who typically spent a considerable amount on food and drinks, which was 16.2%.

Malaysia Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

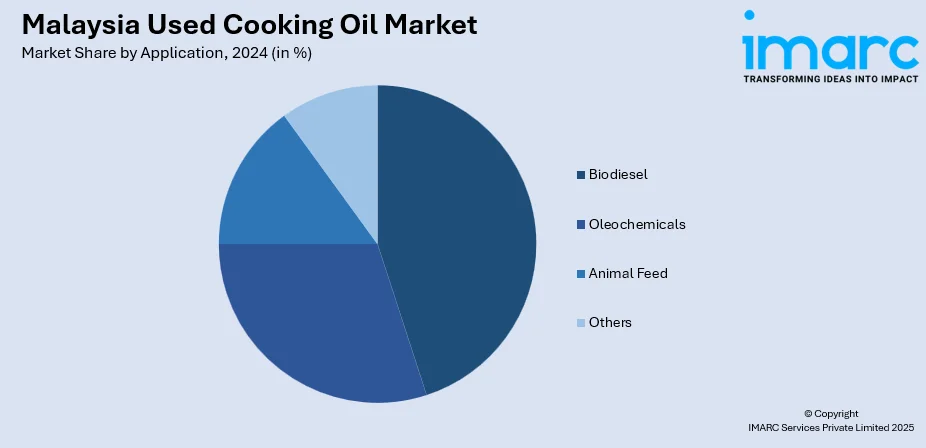

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

States Insights:

- Selangor

- W.P. Kuala Lumpur

- Johor

- Sarawak

- Others

The report has also provided a comprehensive analysis of all the major states markets, which include Selangor, W.P. Kuala Lumpur, Johor, Sarawak, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Malaysia Used Cooking Oil Market News:

- In February 2025, Malaysia Aviation Group (MAG) entered into a memorandum of understanding (MoU) with FatHopes Energy (FHE) to investigate the feasibility of utilizing used cooking oil as feedstock for the production of SAF in Malaysia. Through this collaboration, FHE would offer advisory expertise to MAG, guaranteeing that the used cooking oil collection aligned with sustainability standards and regulatory obligations. FHE would provide technical assistance to support the gathering, processing, and transformation of used cooking oil into refined SAF.

- In October 2024, Bursa Malaysia Derivatives Berhad, a futures and options exchange, planned to introduce a used cooking oil futures contract to satisfy the growing demand for this product as a biofuel feedstock. The firm sought to establish itself as a center for edible oil.

Malaysia Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| States Covered | Selangor, W.P. Kuala Lumpur, Johor, Sarawak, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Malaysia used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Malaysia used cooking oil market on the basis of source?

- What is the breakup of the Malaysia used cooking oil market on the basis of application?

- What is the breakup of the Malaysia used cooking oil market on the basis of states?

- What are the various stages in the value chain of the Malaysia used cooking oil market?

- What are the key driving factors and challenges in the Malaysia used cooking oil market?

- What is the structure of the Malaysia used cooking oil market and who are the key players?

- What is the degree of competition in the Malaysia used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Malaysia used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Malaysia used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Malaysia used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)