Manual Wheelchair Market Size, Share, Trends, and Forecast by Design & Function, Category, End User, and Region, 2025-2033

Manual Wheelchair Market Size and Share:

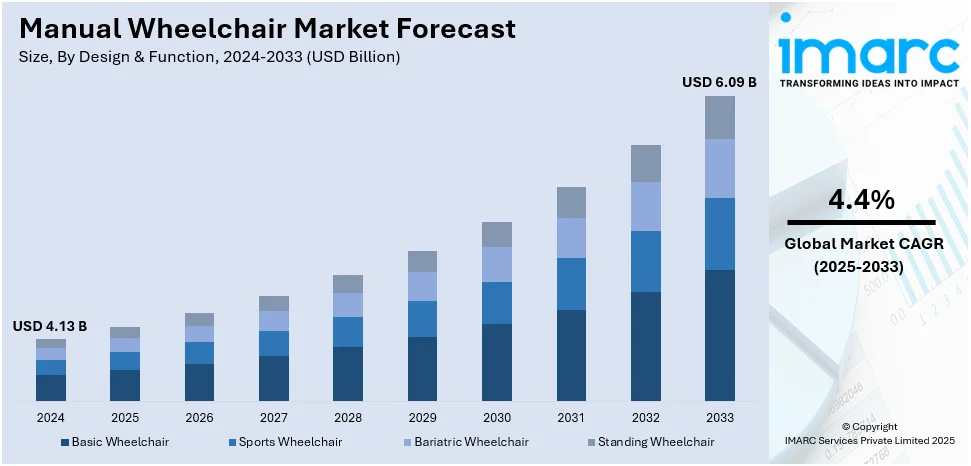

The global manual wheelchair market size was valued at USD 4.13 Billion in 2024. Looking forward, the market is expected to reach USD 6.09 Billion by 2033, exhibiting a CAGR of 4.4% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.8% in 2024. The market is expanding due to rising demand for mobility solutions that support independence and accessibility. Growing awareness about rehabilitation needs, advancements in lightweight designs, and increasing healthcare support are enhancing adoption worldwide. These factors collectively strengthen the manual wheelchair market share across diverse regions and user segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.13 Billion |

|

Market Forecast in 2033

|

USD 6.09 Billion |

| Market Growth Rate 2025-2033 | 4.4% |

A key driver is the rapidly growing geriatric population, as older adults face mobility challenges requiring reliable aids. Rising incidences of disabilities, including spinal cord injuries, multiple sclerosis, and cerebral palsy, further fuel demand. Technological advancements have introduced lightweight and ultra-lightweight manual wheelchairs, offering improved maneuverability and convenience for users and caregivers. Favorable government initiatives, particularly in low-resource regions, are improving availability and affordability. Additionally, rising disposable incomes, expanding healthcare spending, and strengthening infrastructure in emerging economies create a positive market outlook. Increasing awareness regarding mobility solutions and manufacturers’ focus on customized products also contribute significantly to the market’s sustained growth.

To get more information on this market, Request Sample

The manual wheelchair market growth in the United States is being propelled by several significant factors. One of the key drivers is the increasing prevalence of disabilities, such as spinal cord injuries, multiple sclerosis, and cerebral palsy, which heightens the demand for mobility aids. The expanding geriatric population also contributes, as aging individuals often require wheelchairs to maintain independence and mobility. In addition, continuous product innovations, including lightweight and ultra-lightweight models, enhance maneuverability and usability for both users and caregivers. Rising disposable incomes and robust healthcare spending further strengthen adoption by making mobility solutions more accessible. Favorable insurance coverage, advanced healthcare infrastructure, and growing awareness about assistive devices collectively reinforce the demand for manual wheelchairs across the United States. For instance, in July 2025, Etac North American Mobility introduced the Twist by Klaxon, a power-assist add-on that enhances manual wheelchair use. Designed for flexibility, it works in both rear-push and front-pull modes, with seamless switching that requires no lifting. Twist enables smooth navigation at home, work, or outdoors, delivering greater independence and convenience.

Manual Wheelchair Market Trends:

Growing Geriatric Population and Rising Disability Incidences

The market is strongly driven by the expanding global geriatric population, which faces higher risks of mobility challenges with age. By the late 2070s, the global population aged 65 and older is projected to reach 2.2 billion, surpassing the number of children under age 18. This demographic shift creates significant demand for mobility aids like manual wheelchairs. Additionally, the rising prevalence of disabilities, including spinal cord injuries, multiple sclerosis, and cerebral palsy, further escalates the need. For example, about 764,000 people in the U.S. (including both adults and children) exhibit at least one symptom of cerebral palsy. These factors collectively reinforce the necessity for manual wheelchairs across healthcare systems and households worldwide.

Product Innovations and Accessibility Initiatives

The introduction of advanced wheelchair designs, particularly lightweight and ultra-lightweight models, is boosting adoption by offering improved manoeuvrability and ease of transport. According to the manual wheelchair market trends, such innovations make wheelchairs more user-friendly for both patients and caregivers, expanding their appeal. Alongside this, favorable government initiatives are improving accessibility by ensuring wheelchairs reach low-resource regions where demand is high. Programs that enhance availability, especially in underserved markets, significantly contribute to industry growth. At the same time, rising awareness among the public about mobility aids is helping more individuals explore suitable solutions. Together, these developments not only improve the quality of life for users but also broaden the market reach of manufacturers, creating a stronger outlook for manual wheelchairs. For instance, in May 2024, Küschall, recognized for its innovative designs and advanced material use, announced the launch of its newest model, the Küschall Champion SL. This latest wheelchair incorporates cutting-edge features aimed at enhancing user comfort and performance. Presenting the design, Küschall emphasized that the Champion SL is “engineered for travel and designed for high performance.”

Economic Growth and Market Competitiveness

Economic factors are also shaping the market, as rising disposable incomes, higher healthcare spending, and stronger infrastructure development in emerging economies drive accessibility. In the United States, for instance, the disposable income in 2021–22 averaged USD 42,800 per year, reflecting growing consumer ability to invest in healthcare products. Leading market players are also focusing on providing customized wheelchair solutions tailored to individual needs, helping them gain a competitive edge. This push for personalization enhances user satisfaction while broadening adoption. Combined with expanding healthcare investments worldwide, these efforts create a favorable environment for long-term growth, ensuring that manual wheelchairs remain integral to mobility support solutions in both advanced and developing regions.

Manual Wheelchair Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global manual wheelchair market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on design & function, category, and end user.

Analysis by Design & Function:

- Basic Wheelchair

- Sports Wheelchair

- Bariatric Wheelchair

- Standing Wheelchair

Basic wheelchair leads the market with 62.7% of market share in 2024 due to their affordability, wide availability, and practicality. These models are designed to meet essential mobility needs, making them the most accessible option for a broad consumer base, including hospitals, rehabilitation centers, and individual users. Their simple design ensures ease of use, minimal maintenance, and durability, which are highly valued in both developed and developing regions. Additionally, government programs and healthcare providers often supply basic wheelchairs as part of mobility aid initiatives, further boosting their adoption. As they effectively serve the needs of patients with temporary or permanent mobility challenges at a lower cost, basic wheelchairs continue to dominate market demand and maintain the largest share.

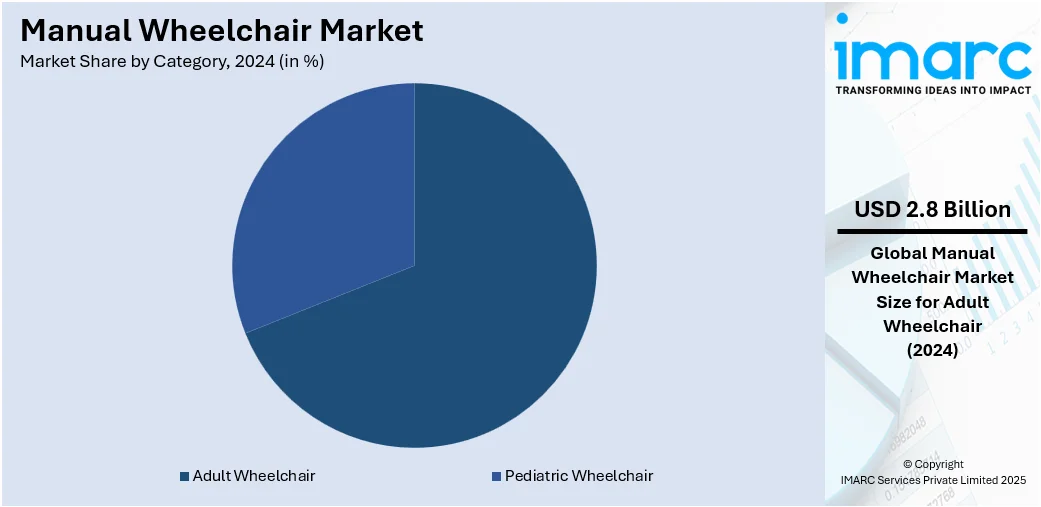

Analysis by Category:

- Adult Wheelchair

- Pediatric Wheelchair

Adult wheelchair leads the market with 68.8% of market share in 2024 as mobility challenges are more prevalent among the adult and elderly population compared to children. With the rising incidence of age-related conditions, chronic illnesses, and physical disabilities, the demand for adult wheelchairs continues to grow steadily. According to the manual wheelchair market forecast, these wheelchairs are widely used in hospitals, rehabilitation centers, and home care settings, making them a crucial mobility solution. Additionally, manufacturers prioritize adult models by offering a wide variety of designs, from basic to ultra-lightweight options, tailored to different needs and budgets. Government initiatives and healthcare support programs also primarily focus on adult users, further driving adoption. As a result, adult wheelchairs dominate usage, ensuring their leading share in the global market.

Analysis by End User:

- Homecare

- Institution

- Others

Institution holds the largest share in the market due to its extensive and consistent demand for mobility aids across healthcare and rehabilitation facilities. Hospitals, clinics, and long-term care centers require many wheelchairs to accommodate patients with temporary or permanent mobility limitations, which is creating a positive manual wheelchair market outlook. These organizations often prioritize basic and durable models that can be used by multiple individuals, ensuring cost efficiency and practicality. Additionally, rehabilitation centers and elderly care facilities maintain a steady need for manual wheelchairs to support daily patient mobility and recovery processes. Bulk procurement by institutions, supported by government healthcare programs and insurance coverage, further strengthens their purchasing power. This sustained, large-scale demand makes institutions the dominant end-user segment in the manual wheelchair market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.8%. The manual wheelchair market demand in North America is driven by several key factors that support strong and sustained growth. The region’s aging population, combined with a rising prevalence of mobility-related conditions such as spinal cord injuries, multiple sclerosis, and cerebral palsy, significantly fuels demand. Advanced healthcare infrastructure and comprehensive insurance coverage make mobility aids more accessible to patients, further boosting adoption. In addition, continuous product innovation, including lightweight and ultra-lightweight manual wheelchairs, enhances usability and independence for users, attracting wider acceptance. Favorable government programs aimed at improving accessibility and mobility solutions also contribute to market expansion. Moreover, growing consumer awareness, coupled with the presence of leading manufacturers and strong distribution networks, solidifies North America’s position as a leading market.

Key Regional Takeaways:

United States Manual Wheelchair Market Analysis

In 2024, the United States accounted for 89.60% of the manual wheelchair market in North America. United States is experiencing a surge in manual wheelchair adoption, driven by increasing chronic disease prevalence and rising healthcare expenditure. For instance, six out of 10 Americans have one chronic disease and four out of 10 have two or more chronic diseases that account for ninety percent of the USD 4.5 Trillion annual health care costs in the nation. With a growing number of individuals affected by conditions such as arthritis, cardiovascular disorders, and obesity-related mobility issues, there is a heightened need for assistive mobility solutions. Simultaneously, increased healthcare expenditure is allowing for broader insurance coverage and better access to rehabilitation and mobility aids. This financial capacity supports not only the procurement of manual wheelchairs but also ongoing maintenance and services. Moreover, awareness campaigns and policy support enhance accessibility and drive sustained demand. Healthcare providers are also integrating advanced wheelchair solutions into treatment plans.

Asia Pacific Manual Wheelchair Market Analysis

Asia-Pacific is witnessing significant growth in manual wheelchair adoption due to rising incidences of disabilities. According to the World Bank Group, growing evidence that people with disabilities comprise between 4 and 8 percent of the Indian population (around 40-90 Million individuals). Increased occurrences of injuries, age-related disorders, and congenital conditions are contributing to the region’s growing need for mobility assistance. As disability awareness spreads and social inclusivity improves, demand for manual wheelchairs is accelerating. Societal shifts toward improved quality of life and expanding access to basic healthcare services further strengthen this trend. Governments and private entities are investing more in accessible infrastructure and community mobility support programs. Rapid urbanization and increasing pressure on healthcare facilities are also prompting early adoption of cost-effective mobility aids.

Europe Manual Wheelchair Market Analysis

Europe is experiencing growing manual wheelchair adoption, primarily fueled by a rising geriatric population. According to the WHO, the population aged 60 and older is rapidly growing in the WHO European Region. In 2021, there were 215 Million; by 2030, it is projected to be 247 Million, and by 2050, over 300 Million. As the region faces increasing life expectancy and a shifting age demographic, age-related mobility impairments are becoming more prevalent. Older adults commonly suffer from musculoskeletal conditions, joint degeneration, and reduced physical endurance, making manual wheelchairs essential for daily movement and independence. Public health initiatives, social welfare programs, and strong healthcare systems support access to assistive mobility devices. The expanding elderly population places greater emphasis on long-term care and rehabilitation services, both of which drive demand for reliable and ergonomic wheelchair solutions.

Latin America Manual Wheelchair Market Analysis

Latin America is experiencing a rise in manual wheelchair adoption due to the growing disposable incomes of consumers. For instance, as of 2025, the average annual salary in Brazil is approximately BRL 40,200, which translates to around USD 7,025.63 per year. As personal financial capacity improves across various socioeconomic segments, there is an increased ability to afford mobility aids, including wheelchairs. Improved access to consumer financing and private health services also supports this growth. Rising disposable incomes allow individuals to prioritize mobility solutions that enhance comfort, independence, and participation in social activities.

Middle East and Africa Manual Wheelchair Market Analysis

Middle East and Africa are seeing rising manual wheelchair adoption driven by developing healthcare infrastructure. For instance, in 2025, the UAE is currently home to over 150 hospitals and has more than 5,000 healthcare facilities. As healthcare systems expand in scope and quality, more patients gain access to essential rehabilitation and mobility support services. Growth in public and private sector investment in hospitals, clinics, and community health programs also facilitates better wheelchair distribution.

Competitive Landscape:

The competitive landscape of the manual wheelchair market is characterized by strong global and regional players focusing on innovation, customization, and affordability. Leading companies emphasize developing lightweight, foldable, and ergonomic designs to enhance user comfort and mobility. Partnerships with healthcare providers and rehabilitation centers expand distribution networks and strengthen market reach. Many players also prioritize sustainability by incorporating advanced materials and user-friendly designs. Competitive strategies include mergers, acquisitions, and collaborations to enhance product portfolios and gain a global presence. Additionally, firms are investing in research and development to create advanced variants catering to diverse user needs. With rising demand worldwide, competition remains intense, driven by technological advancements, pricing strategies, and efforts to strengthen manual wheelchair market share.

The report provides a comprehensive analysis of the competitive landscape in the manual wheelchair market with detailed profiles of all major companies, including:

- Aspen Healthcare

- Etac AB

- GF Health Products Inc.

- Invacare Corporation

- Karma Medical Products Co. Ltd.

- Medline Industries LP

- Merits Health Products Co. Ltd.

- Meyra Group GmbH

- Nissin Medical Industries Co. Ltd.

- Ottobock SE & Co. KGaA

- Sunrise Medical Inc.

Latest News and Developments:

- July 2025: All Star Wheelchairs unveiled its Ultra Lightweight Carbon Fiber Electric Wheelchair, weighing just 29 lbs—lighter than many manual wheelchairs—and redefined mobility by offering unmatched portability and strength for thousands with mobility challenges. Designed for easy travel and daily use, the launch marked a significant shift in personal mobility solutions.

- July 2025: IIT Madras, in collaboration with Thryv Mobility, launched India’s lightest 9-kg rigid-frame manual wheelchair, YD One, in Chennai, offering a customized, affordable alternative at one-third the cost of imports. The manual wheelchair was hailed as a breakthrough in accessibility and dignity, with CSR support pledged for initial distribution.

- June 2025: Invacare unveiled the new limited edition Küschall Element manual wheelchair at Autonomic Paris 2025, showcasing innovative materials and sleek design that reflected its commitment to sustainability, performance, and user-focused mobility solutions.

- June 2025: Sunrise Medical launched seven new mobility products at its Elite Dealer event on June 3, 2025, including the Empulse R90, a push assist designed to integrate with a manual wheelchair, offering improved control and safety through an actuator-controlled drive and seamless attachment.

- May 2025: Sunrise Medical launched a new color palette for its manual wheelchair lines, including adult, pediatric, and JAY back products, across North America, EU, and APAC, reinforcing its legacy in design innovation and personalization. This move reflected its continued commitment to style and self-expression, echoing the revolutionary vision of QUICKIE founder Marilyn Hamilton.

Manual Wheelchair Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Design & Functions Covered | Basic Wheelchair, Sports Wheelchair, Bariatric Wheelchair, Standing Wheelchair |

| Categories Covered | Adult Wheelchair, Pediatric Wheelchair |

| End Users Covered | Homecare, Institution, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspen Healthcare, Etac AB, GF Health Products Inc., Invacare Corporation, Karma Medical Products Co. Ltd., Medline Industries LP, Merits Health Products Co. Ltd., Meyra Group GmbH, Nissin Medical Industries Co. Ltd., Ottobock SE & Co. KGaA, Sunrise Medical Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the manual wheelchair market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global manual wheelchair market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the manual wheelchair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The manual wheelchair market was valued at USD 4.13 Billion in 2024.

The manual wheelchair market is projected to exhibit a CAGR of 4.4% during 2025-2033, reaching a value of USD 6.09 Billion by 2033.

The manual wheelchair market is driven by the growing geriatric population, rising incidences of mobility-related disabilities, and increasing demand for affordable mobility solutions. Technological advancements, such as lightweight and ultra-lightweight designs, along with supportive government initiatives and improving healthcare infrastructure, further accelerate adoption.

North America currently dominates the manual wheelchair market driven by an aging population, rising mobility impairments, advanced healthcare infrastructure, product innovations, favorable government initiatives, and strong insurance coverage supporting accessibility and adoption.

Some of the major players in the manual wheelchair market Aspen Healthcare, Etac AB, GF Health Products Inc., Invacare Corporation, Karma Medical Products Co. Ltd., Medline Industries LP, Merits Health Products Co. Ltd., Meyra Group GmbH, Nissin Medical Industries Co. Ltd., Ottobock SE & Co. KGaA, Sunrise Medical Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)