Mass Notification Systems Market Size, Share, Trends and Forecast by Component, Solution, Deployment Type, Organization Size, Application, Vertical, and Region, 2025-2033

Mass Notification Systems Market Size and Share:

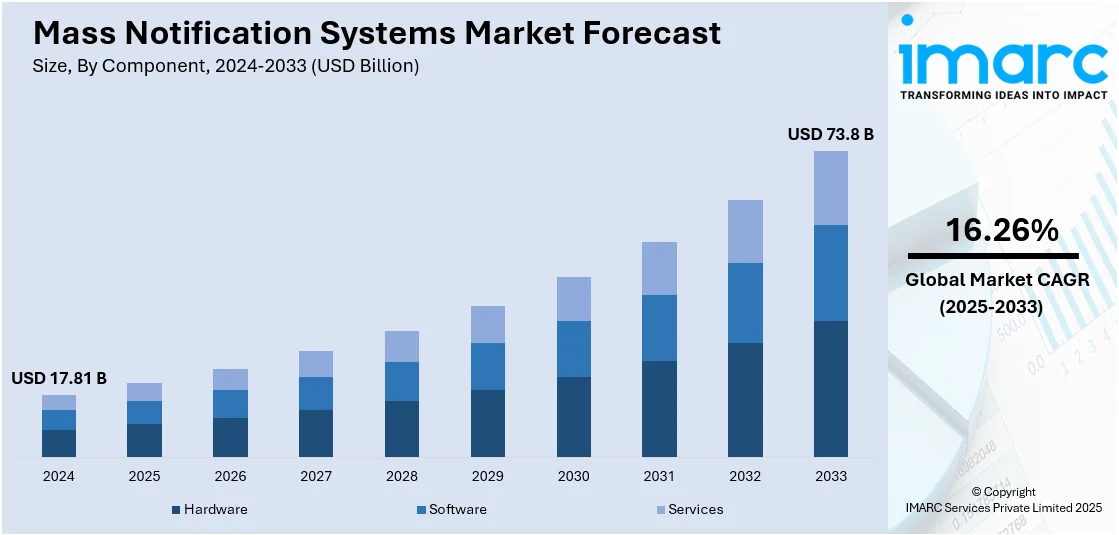

The global mass notification systems market size was valued at USD 17.81 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 73.8 Billion by 2033, exhibiting a CAGR of 16.26% during 2025-2033. North America dominated the market, holding a significant market share of 34% in 2024. The increasing incidents of natural disasters and terrorism, the growing need for public safety, and the rising demand for real-time communication systems represent some of the key factors contributing to the mass notification systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.81 Billion |

|

Market Forecast in 2033

|

USD 73.8 Billion |

| Market Growth Rate 2025-2033 | 16.26% |

The market is expanding due to rising concerns over public safety, especially in high-risk environments like schools, hospitals, industrial sites, and government institutions. The growing frequency of natural disasters, cyber threats, and active shooter incidents has increased the need for rapid, coordinated emergency communication. Governments and regulatory bodies are mandating robust alert systems, boosting adoption. Technological advancements, including cloud-based deployments, mobile apps, multi-modal communication (SMS, email, voice, social media), and integration with IoT devices, are enhancing system capabilities and reach. Organizations are also using these platforms for internal communication, improving operational efficiency. The COVID-19 pandemic further supported the mass notification systems market growth as businesses and institutions sought ways to communicate quickly with dispersed teams. These factors collectively drive the market, especially across North America, Europe, and rapidly urbanizing regions in Asia Pacific.

In the United States, local governments are increasingly deploying advanced alert systems to streamline communication with residents and employees. These platforms support real-time updates on civic matters, ensuring better coordination and public awareness. The focus is shifting toward multi-purpose systems that enhance responsiveness and engagement across municipal services and community events. For instance, in February 2025, Panama City in Florida, officially launched a new mass notification system, CivicReady. This tool is intended to enhance the interactions of the city authorities with both the general public and their workforce. With CivicReady, the Panama City authorities would be able to deliver timely and significant notifications on a variety of topics, such as city news, road closures, changes to waste collection, various events, and notices of public meetings.

Mass Notification Systems Market Trends:

Growing Focus on Security-Driven Communication Tools

Escalating global safety concerns, particularly those linked to violent threats, are pushing public and private institutions to strengthen their emergency response infrastructure. There is a noticeable shift toward advanced communication platforms that can quickly alert large populations in unpredictable situations. Governments and critical infrastructure operators are giving greater importance to real-time dissemination systems that ensure swift and coordinated action. Urban centers, transportation networks, and high-footfall areas are being equipped with more reliable and scalable solutions. This shift is also prompting innovation in multi-channel delivery formats, covering text, voice, and digital signage, to ensure message reach regardless of location or access. The increased emphasis on proactive public safety is shaping procurement and policy decisions across regions. According to the Global Terrorism Index, the lethality of terrorist attacks rose by 26% in 2023. In 2024, deaths due to terrorism rose by 22% to 8,352, recording the highest number of deaths since 2017.

Shift toward Cloud-Based Deployment Models

Organizations across Europe are steadily adopting cloud infrastructure to enhance the scalability and efficiency of their operations. This shift is reflected in the growing use of cloud-based mass communication systems, especially among businesses aiming for flexible and remote-capable alert mechanisms. Cloud platforms allow quicker system updates, simplified integration with existing IT frameworks, and reduced hardware dependencies, making them a preferred choice over traditional on-premise setups. Service providers are adapting by offering modular, subscription-based solutions that cater to varied operational needs, from critical incident alerts to routine organizational messaging. This evolving preference for cloud deployment is shaping the mass notification systems market outlook, signaling continued growth opportunities driven by digital transformation and operational agility. For instance, 45.2% of businesses in Europe utilized cloud services in 2023, recording a growth of 4.2% in comparison to 2021, as per Eurostat.

Rising Integration with Connected Devices

The growing presence of connected devices is reshaping how organizations approach emergency communication. With billions of IoT endpoints expected to be in use, mass notification systems are being designed to integrate seamlessly with a wide range of smart technologies. This integration enhances the ability to deliver alerts through diverse channels, ranging from wearable tech to connected appliances, ensuring timely communication across dynamic environments. Public safety systems, enterprise platforms, and smart infrastructure are increasingly incorporating IoT-based alert triggers to automate responses based on real-time data. As connectivity expands, the need for scalable, device-agnostic messaging systems is becoming more pronounced, especially in sectors like transportation, healthcare, and industrial operations where immediate response is critical. The mass notification systems market forecast suggests that this deepening integration with IoT infrastructure will be a major driver of adoption, supporting broader use across both public and private sectors. According to the National Cybersecurity Center of Excellence, approximately 75 Billion IoT devices are expected to be in use in 2025.

Real-time Information and User Advice During Emergencies

The Mass Notification Systems (MNS) industry is observing a robust trend toward delivering up-to-date information and situational advice in times of an emergency. It is being caused due to an immediate need for alertness in situations of natural disasters, industrial mishaps, or terror attacks. Organisations are now increasingly using multi-channel communications systems such as mobile applications, SMS, voice calls, emails, and digital signs to provide instant delivery of directives to impacted groups. Integration with Internet of Things (IoT) devices like sensors and security cameras increases system smarts, facilitating automated warnings based on identified risks. Additionally, artificial intelligence and machine learning software are being integrated to forecast threats and propose the right response, assisting individuals and responders in making prompt, informed decisions. This drive not only shortens response times but also increases public safety and organizational resilience during emergencies.

Broad Adoption in Healthcare

Healthcare centers globally are embracing Mass Notification Systems at a fast pace to enhance emergency response, staff synchronization, and patient safety. The COVID-19 pandemic highlighted the urgent necessity of real-time communication in hospitals, clinics, and care facilities. MNS solutions allow administrators to quickly notify medical teams, broadcast outbreak information, and organize evacuations or lockdowns during emergencies such as fires, active shooters, or system failures. Integration with hospital information systems and wearable medical devices enables automated, condition-related alerts that enhance clinical workflows. Moreover, these systems are increasingly being employed for non-emergency use like normal staff reminders, visitor alerts, and patient appointment scheduling. With increasing regulatory compliance and accreditation requirements necessitating strong communication abilities, healthcare organizations are giving high importance to MNS investments in order to facilitate business continuity, safeguard lives, and address changing expectations of safety.

Rising Demand for Security and Public Safety

Increased emphasis on public security and safety is propelling mass adoption of Mass Notification Systems in government, transportation, education, and enterprise segments. Increased urbanization, repeating cyber-physical attacks, and enhanced risk of terrorism or civil disturbances require real-time, fault-tolerant communication infrastructure. Geo-targeted messaging has become a feature of MNS platforms, allowing issuing of localized messages based on risk areas or event severity. Cloud-based systems provide scalability, redundancy, and resilience that guarantee message delivery even in instances of network interruptions. Moreover, integration with surveillance systems, access controls, and emergency response networks allows for improved threat detection and incident management. Public agencies and private organizations across the globe acknowledge the benefit of such systems in reducing risk, ensuring public order, and safeguarding critical assets. This increased demand is a sign of a global trend towards proactive, technology-enabled safety and risk management.

Mass Notification Systems Market Opportunities:

Integration with Smart City Infrastructure

A future opportunity for the Mass Notification Systems market is integration with smart city initiatives. As cities invest in IoT-enabled infrastructure—like intelligent traffic control, connected utilities, and environmental monitoring systems—MNS can be a centrepiece of urban safety and efficiency. By connecting with actual-time data sources such as weather sensors, traffic cameras, and public transportation systems, such sites can provide hyper-localized warnings regarding emergencies like flooding, chemical spills, or transport disturbances. Such a contextual communication makes public warnings and advisories quicker, more precise, lessens risks, and improves urban resilience. Municipal and government agencies are actively on the lookout for end-to-end solutions that facilitate smart city missions, putting MNS vendors providing scalable, IoT-ready platforms in a strong growth position. This presents a large market growth opportunity, particularly in fast-growing urban areas around the globe.

Mass Notification Systems Market Challenges:

Data Privacy and Security Concerns

One of the most important challenges for the Mass Notification Systems industry is data security and privacy. MNS systems harvest and process large quantities of sensitive information, which includes personal contact information, location data, and organizational security policies. Ineffectual security measures can leave systems vulnerable to cyberattacks, data breaches, or abuse of private data, causing public trust and compliance risks. Furthermore, cross-border deployments are subject to differing privacy regulations like GDPR in Europe or HIPAA in the United States, which makes data handling procedures more complex. With increasing integration of systems with IoT devices and analytics from AI, the attack surface for threats further increases. Vendors thus need to invest in strong encryption, access management, and compliance tools to protect user data. Not heeding these issues would have disastrous consequences, including reputational loss, legal sanctions, and resistance from institutions or governments to the use of such technologies at scale.

Mass Notification Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mass notification systems market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, solution, deployment type, organization size, application, and vertical.

Analysis by Component:

- Hardware

- Software

- Services

Hardware stood as the largest component in 2024, holding around 65.7% of the market. Key components such as command and control centers, outdoor warning sirens, digital display boards, and dedicated speaker systems are essential for effective emergency communication. Demand is rising for reliable, high-performance hardware that ensures consistent message delivery during critical events. Upgrades in public safety infrastructure, particularly in schools, airports, and industrial zones, are leading to increased procurement of these devices. The integration of hardware with IoT sensors and real-time monitoring systems is enhancing situational awareness and response times. Investments in hardware are also supported by compliance requirements and safety regulations, particularly in regions prioritizing disaster preparedness and institutional readiness.

Analysis by Solution:

- In-Building Solutions

- Wide-Area Solutions

- Distributed Recipient Solutions

In-building solutions led the market with around 60% of market share in 2024. These solutions are essential for delivering clear, timely messages within enclosed spaces like offices, schools, hospitals, malls, and government facilities. Increasing concerns about workplace safety and emergency preparedness have pushed organizations to invest in reliable internal communication tools. In-building solutions, including voice evacuation systems, public address systems, and digital signage, ensure quick message dissemination during fire alerts, lockdowns, or medical emergencies. Integration with building management systems and mobile applications adds to their effectiveness. With regulatory standards emphasizing occupant safety, especially in high-density structures, the demand for robust in-building alert systems continues to grow, making them a central component of institutional safety strategies.

Analysis by Deployment Type:

- On-Premise

- Cloud

On-premise led the market with around 54.3% of market share in 2024 due to its control, security, and customization advantages. Many organizations, particularly in sectors like defense, manufacturing, and government, prefer on-premise deployment to maintain direct oversight of their data and system operations. This setup ensures uninterrupted communication, even during network outages or external cyber threats. Institutions with strict compliance needs also favor on-premise solutions for better data governance. The ability to tailor configurations based on facility-specific protocols adds further appeal. Moreover, organizations with existing IT infrastructure often opt for on-premise systems to leverage their current assets. This segment remains important for entities requiring high levels of confidentiality, operational autonomy, and localized emergency communication capabilities.

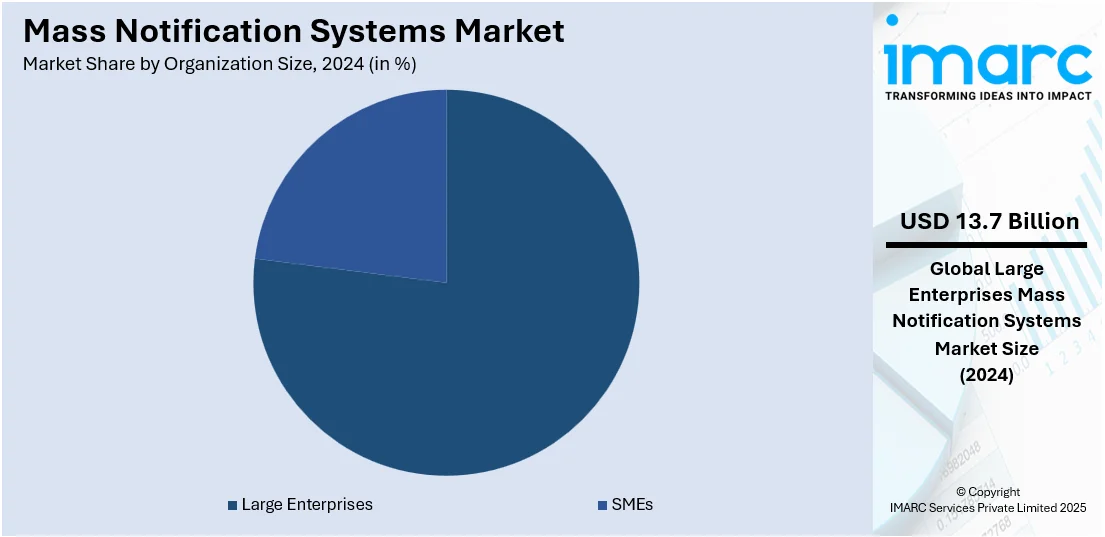

Analysis by Organization Size:

- Large Enterprises

- SMEs

Large enterprises led the market with around 76.7% of market share in 2024, owing to their complex operational needs and high emphasis on employee safety. These organizations typically have a widespread workforce, multiple facilities, and varied risk profiles that require seamless internal communication during emergencies. Mass notification systems help streamline alerts, maintain business continuity, and meet regulatory compliance. Enterprises are also investing in systems that integrate with HR platforms, building controls, and IT networks to enable centralized control and rapid response. The need for consistent communication across departments, locations, and time zones adds further relevance. As large enterprises adopt digital transformation strategies, mass notification solutions are being included as core components of their risk management and organizational resilience frameworks.

Analysis by Application:

- Integrated Public Alert and Warning

- Emergency Communication

- Disaster Recovery

- Others

The integrated public alert and warning segment supports nationwide emergency broadcasts by enabling authorities to send alerts through radio, television, mobile devices, and public systems, ensuring communities are informed during disasters, security threats, or health crises. These systems are often mandated and funded by government programs, making them a foundational component of national safety efforts. On the other hand, the emergency communication segment focuses on internal alerting within specific institutions such as hospitals, airports, factories, and office campuses. These solutions provide real-time notifications to staff and stakeholders through channels like voice calls, texts, digital boards, and mobile apps, helping coordinate evacuations, manage lockdowns, or communicate operational changes during critical events with speed and clarity.

Analysis by Vertical:

- Commercial and Industrial

- Energy and Utilities

- Education

- Healthcare and Life Sciences

- Transportation and Logistics

- Defense and Military

- Government

- Others

Education led the market in 2024, as schools, colleges, and universities prioritize student and staff safety. Rising concerns about campus security, including incidents such as intrusions, natural disasters, and medical emergencies, have led institutions to adopt reliable alert systems. These solutions enable real-time communication through multiple channels like text, email, loudspeakers, and digital signage, ensuring rapid dissemination of critical information. Compliance with government regulations on emergency preparedness further supports this trend. Educational institutions also seek to maintain operational continuity by managing closures, schedule changes, and important announcements efficiently. Integration with mobile apps and learning management systems enhances accessibility. This focus on secure, connected campuses continues to increase adoption across public and private education sectors.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of 34%, owing to a combination of regulatory mandates, high technology adoption, and strong infrastructure. The region has stringent public safety and emergency communication regulations, particularly in sectors such as education, healthcare, government, and transportation. These mandates have accelerated the deployment of mass notification systems in schools, hospitals, airports, and public institutions. Additionally, widespread use of smartphones and high internet penetration support multi-channel communication, including SMS, email, voice calls, and mobile apps. The presence of key players and advanced R&D capabilities further contributes to technological innovation and market maturity in the region. Moreover, organizations across the U.S. and Canada are increasingly integrating these systems with IoT devices and cloud platforms to enhance coverage and reliability. High awareness of security threats, such as active shooters and natural disasters, continues to drive investments. Overall, North America's proactive safety culture and readiness to adopt advanced solutions underpin its market leadership.

Key Regional Takeaways:

United States Mass Notification Systems Market Analysis

In 2024, the United States accounted for 82.8% of the market share in North America. The United States mass notification systems (MNS) market is primarily driven by increasing concerns over public safety, rising demand for emergency communication solutions, and the need for businesses and government agencies to comply with regulations. As natural disasters, public health emergencies, and security threats become more frequent, the demand for real-time, reliable communication tools has risen. For instance, the United States experienced around 27 documented weather/climate natural disaster incidents in 2024, with each event surpassing USD 1 Billion in damages, according to the National Centers for Environmental Information (NCEI). The need for efficient communication during emergencies, whether for evacuations, weather alerts, or active shooter situations, has made MNS essential across a variety of sectors, including education, healthcare, government, and large enterprises. Additionally, advancements in cloud-based technologies and mobile devices have made MNS more scalable, flexible, and accessible, driving adoption among organizations of all sizes. The integration of MNS with other systems, such as building management and surveillance, is further enhancing their capabilities and providing more comprehensive emergency management solutions. Furthermore, regulatory requirements, such as the FCC's Wireless Emergency Alerts (WEA) system, are prompting businesses and municipalities to implement mass notification systems to ensure compliance. The growing focus on employee and public safety, combined with the need for reliable communication during emergencies, is further propelling the widespread adoption of MNS.

Asia Pacific Mass Notification Systems Market Analysis

The Asia Pacific mass notification systems (MNS) market is expanding due to rapid urbanization, increasing infrastructure development, and a heightened focus on disaster preparedness. As cities across the region expand and smart city initiatives take shape, the need for advanced communication solutions that can quickly alert populations during emergencies is growing. Frequent natural disasters, including earthquakes, floods, and typhoons, are also driving demand for effective mass notification systems in countries such as Japan, India, and the Philippines. Additionally, the expansion of mobile phone usage and mobile app-based communication in the region has also made mass notifications more accessible, allowing governments and businesses to reach large, diverse populations quickly. For instance, in 2024, the smartphone penetration rate reached 46.5% in India, with over 660 million smartphone users in the country, as per industry reports. Regulatory requirements and increasing awareness about safety and security across sectors, including education, healthcare, and transportation, are also contributing to market growth in the Asia Pacific region.

Europe Mass Notification Systems Market Analysis

The Europe mass notification systems (MNS) market is experiencing robust growth, fueled by increased awareness about the need for proactive emergency response and enhanced communication during crises. The rise of complex, interconnected infrastructure in sectors such as transportation, utilities, and large-scale manufacturing has heightened the need for systems that can rapidly alert people to potential threats or disruptions. Moreover, the European Union's focus on disaster resilience and preparedness is encouraging investments in mass notification systems to ensure effective communication across various regions. As Europe faces increasing challenges from climate change, such as floods, wildfires, and extreme weather events, the demand for advanced systems capable of real-time warnings and coordination is rising. For instance, in 2022, the European Union witnessed the highest number of fires since 2006, with wildfires occurring in 26 of the EU27 nations (all except Luxembourg), according to the United Nations Framework Convention on Climate Change (UNFCCC). The total area burnt was 837,2123 hectares overall, with the fires causing damages of an estimated 2.5 billion euros. Other than this, the emphasis on workplace safety and employee well-being, particularly in large industrial facilities, is also prompting numerous businesses to implement comprehensive MNS solutions, supporting overall market growth.

Latin America Mass Notification Systems Market Analysis

The Latin America mass notification systems (MNS) market is significantly influenced by growing urbanization, increased investment in infrastructure, and a rising focus on public safety. As per estimates by Worldometers, 88.4% of the population of Latin America lives in urban areas, equating to 387,287,563 individuals. As cities expand, the need for effective communication systems to address emergencies such as natural disasters, security threats, and public health crises is becoming more pressing. The rollout of 5G networks is also enabling faster, more reliable communication, enhancing the speed and efficiency of emergency alerts across urban and rural areas. As per industry reports, the number of 5G network connections in Latin America reached 67 million in Q3 2024, recording a growth of 19%. Besides this, the adoption of cloud-based solutions and mobile applications is also facilitating the widespread deployment of MNS, allowing for quicker dissemination of alerts across diverse population groups.

Middle East and Africa Mass Notification Systems Market Analysis

The Middle East and Africa mass notification systems (MNS) market is being increasingly propelled by infrastructure development and a heightened focus on public safety due to the increasing frequency of natural and man-made disasters. As cities expand and smart city projects progress, there is a rising need for real-time communication systems to manage emergencies such as floods, fires, and terrorist threats. According to a report published by the IMARC Group, the smart cities market in the Middle East reached USD 62,965.8 Million in 2024 and is forecasted to grow at a CAGR of 21.89% during 2025-2033. Other than this, governments and businesses are also investing in MNS to comply with safety regulations and improve crisis management capabilities, further supporting market growth.

Competitive Landscape:

The current mass notification systems market is marked by active product innovation, strategic partnerships, technology agreements, and increased collaboration between vendors and public agencies. Organizations are also investing in research and development to enhance system capabilities, focusing on multi-channel integration and real-time alerting. Government initiatives continue to support nationwide emergency communication upgrades. Although funding announcements are less frequent, the focus remains on strengthening existing platforms and expanding use cases. Among all recent developments, partnerships and collaborations are the most common practice, enabling faster deployment, improved interoperability, and broader market access across sectors such as education, healthcare, and critical infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the mass notification systems market with detailed profiles of all major companies, including:

- Alertus Technologies

- Airbus DS Communications

- Blackboard Inc.

- DesktopAlert, Inc.

- Eaton Corporation

- Everbridge

- Honeywell International Inc.

- IBM Corporation

- Motorola Solutions, Inc.

- Omnilert LLC

- OnSolve LLC

- Rave Mobile Safety, Inc.

- Siemens Aktiengesellschaft

- Singlewire Software, LLC

- xMatters, Inc.

Latest News and Developments:

- May 2025: The City of Williamsburg, Virginia, U.S., introduced a new emergency mass notification system. Williamsburg will now utilize RAVE Mobile Safety, an established provider of vital communication and teamwork tools for mass emergency alerts, as its official emergency notification system for informing citizens during crises. The City said it will save around USD 30,000 annually by replacing its current notification system with RAVE Mobile Safety.

- March 2025: The City and County of Honolulu in Hawaii, U.S., launched HNL Alert, a new mass notification system, in the City’s Emergency Operations Center. Through this system, locals and guests can subscribe to receive text messages, push notifications, or emails about extreme weather conditions, emergencies, and other critical community news. The HNL Alert is a replacement for the current HNL.Info Alerts used by the city.

- March 2025: The City of El Centro in California, U.S., unveiled a new Mass Notification System to keep local citizens safe and informed. This free service provides real-time alerts for community-affecting emergencies and non-emergencies, including fire warnings, evacuation advisories, and other critical safety information. Citizens can sign up for this Mass Notification System through the City’s official website.

- March 2025: The City of Umatilla, Oregon, U.S., in collaboration with CivicPlus, implemented the CivicReady emergency response system, a new mass notification system for emergency alerts. Through the system, the government can send voicemails, text messages, and emails to community members who have registered to receive regular updates, emergency instructions, warnings, and urgent alerts. To keep updated and get real-time emergency warnings affecting Umatilla, residents can install the CivicReady application across their Google and Apple devices.

Mass Notification Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Solutions Covered | In-Building Solutions, Wide-Area Solutions, Distributed Recipient Solutions |

| Deployment Types Covered | On-Premise, Cloud |

| Organization Sizes Covered | Large Enterprises, SMEs |

| Applications Covered | Integrated Public Alert and Warning, Emergency Communication, Disaster Recovery, Others |

| Verticals Covered | Commercial and Industrial, Energy and Utilities, Education, Healthcare and Life Sciences, Transportation and Logistics, Defense and Military, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Alertus Technologies, Airbus DS Communications, Blackboard Inc., DesktopAlert, Inc., Eaton Corporation, Everbridge, Honeywell International Inc., IBM Corporation, Motorola Solutions, Inc., Omnilert LLC, OnSolve LLC, Rave Mobile Safety, Inc., Siemens Aktiengesellschaft, Singlewire Software, LLC, and xMatters, inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mass notification systems market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mass notification systems market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mass Notification Systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mass notification systems market was valued at USD 17.81 Billion in 2024.

The mass notification systems market is projected to exhibit a CAGR of 16.26% during 2025-2033, reaching a value of USD 73.8 Billion by 2033.

The mass notification systems market is driven by rising demand for public safety, increasing adoption in education and healthcare sectors, government regulations for emergency communication, growing threats of natural disasters and cyberattacks, and technological advancements such as cloud-based platforms, multi-channel alerts, and integration with IoT and AI-driven analytics.

North America dominated the mass notification systems market in 2024, accounting for a share of 34% due to strict safety regulations, high adoption across sectors like education and healthcare, and advanced infrastructure supporting rapid deployment of communication technologies.

Some of the major players in the mass notification systems market include Alertus Technologies, Airbus DS Communications, Blackboard Inc., DesktopAlert, Inc., Eaton Corporation, Everbridge, Honeywell International Inc., IBM Corporation, Motorola Solutions, Inc., Omnilert LLC, OnSolve LLC, Rave Mobile Safety, Inc., Siemens Aktiengesellschaft, Singlewire Software, LLC, xMatters, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)