Mass Spectrometry Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Mass Spectrometry Market Size and Share:

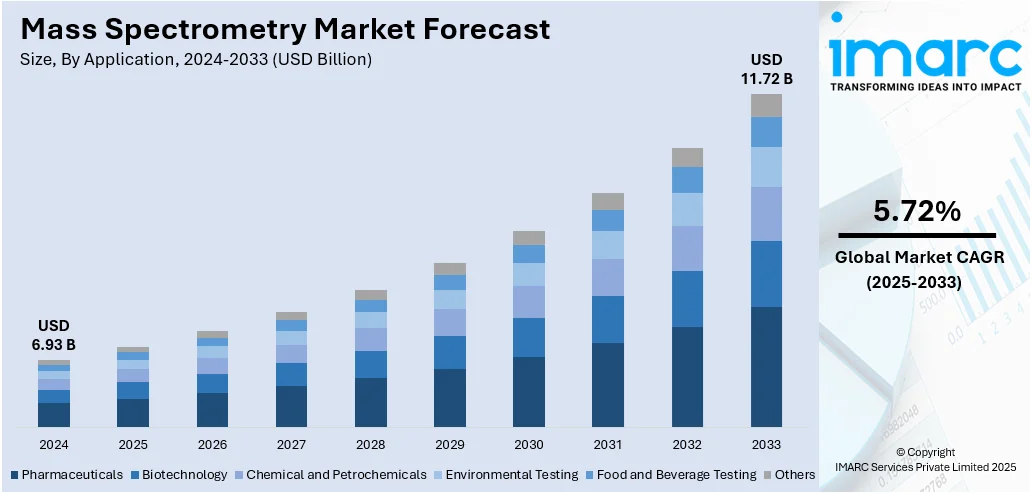

The global mass spectrometry market size was valued at USD 6.93 Billion in 2024. The market is projected to reach USD 11.72 Billion by 2033, exhibiting a CAGR of 5.72% during 2025-2033. North America currently dominates the market, holding a significant market share of around 41.7% in 2024. The market is fueled by the demand for precise and fast analytical methods in the pharmaceutical, biotechnology, and food safety industries. Moreover, increased investments in drug development and discovery, combined with the rising incidences of chronic diseases, are accelerating the adoption of mass spectrometry for proteomics, metabolomics, and clinical diagnostics. Furthermore, improvements in hybrid spectrometry technology and automation are improving instrument functionality, further augmenting the mass spectrometry market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.93 Billion |

| Market Forecast in 2033 | USD 11.72 Billion |

| Market Growth Rate (2025-2033) | 5.72% |

The market is majorly influenced by the continuous advancements in high-resolution instrumentation and enhanced ionization techniques, which are encouraging wider use across sectors. Moreover, concerns over environmental contamination and trace-level detection have intensified deployment in food testing and water quality monitoring. A research study published in January 2025 highlights the pivotal role of mass spectrometry, including GC‑MS, LC‑MS/MS, and high‑resolution hybrid systems, in monitoring trace levels of emerging environmental contaminants across water, soil, and air matrices. It reports detection limits as low as 1.13–5.45 ng L⁻¹ for pharmaceutical residues in water and emphasizes real‑time detection of volatile organic compounds and non‑targeted screening capabilities enabled by high‑resolution platforms. Also, expanding pharmaceutical pipelines and the surge in biopharmaceutical research require precise molecular characterization, further supporting demand.

To get more information on this market, Request Sample

In the United States, the market is driven by the growing emphasis on personalized medicine and genetic studies, which increases the requirement for detailed molecular profiling tools. Furthermore, one of the emerging mass spectrometry market trends is the substantial federal funding for biomedical and clinical research sustaining significant equipment upgrades. As per industry reports, the National Institutes of Health (NIH) invests over USD 47 Billion each year, making it the world’s biggest public source of funding for research in health, medicine, and behavior. Besides, strict regulations for food labeling and pesticide residue drive adoption among agricultural and food testing labs. In addition, the development of advanced forensic protocols and heightened homeland security measures pushes agencies to acquire precise detection equipment. Also, integration of mass spectrometry into metabolomics and lipidomics workflows enhances research depth. Additionally, the robust presence of leading manufacturers and accessible technical support boosts continuous laboratory investments nationwide.

Mass Spectrometry Market Trends:

Technological Advancements

Continuous technological advancements are significantly contributing to the growth of the market. Cutting-edge improvements, such as higher sensitivity, better accuracy, and rapid throughput, are making these instruments indispensable in modern laboratories. Furthermore, technological progress is expanding the capabilities of mass spectrometry instruments to include the analysis of increasingly complex samples. Additionally, recent innovations like high-resolution mass spectrometry and tandem mass spectrometry that are providing unprecedented levels of detail and analytical depth are supporting the market growth. Moreover, the incorporation of real-time monitoring capabilities, allowing immediate data collection and interpretation, is strengthening the mass spectrometry market growth. In addition, the miniaturization of these devices is leading to the creation of portable units that can be employed for on-site analysis, thereby favoring the market development. As such, in March 2025, 908 Devices received a USD 1.7 Million order from Ukraine’s Ministry of Health for MX908 handheld mass spectrometers to detect hazardous substances and explosives for post-war environmental testing, highlighting the growing demand for portable solutions.

Strict Regulatory Policies for Quality Control

Regulatory requirements for quality control in industries, such as pharmaceuticals and food safety, are propelling the market expansion. The introduction of stringent standards by regulatory agencies is prompting companies to rely on mass spectrometry for its high degree of accuracy and sensitivity in detecting impurities, ensuring product quality, and validating processes. In addition, mass spectrometry ensures that compounds meet purity standards and that contaminants are detected at extremely low concentrations. Accordingly, in April 2025, Bruker acquired a majority stake in RECIPE, a Munich-based clinical MS kit provider with 60 employees and USD 15 Million revenue, advancing high-throughput ‘chrom-free’ ClinDART TDM assays. Furthermore, the widespread technology utilization in the food industry to ensure the absence of pesticides, toxins, and other contaminants is favoring the market growth. Moreover, these regulatory compulsions make mass spectrometry not just an option but a necessity for quality assurance in product development and manufacturing processes.

Growing Focus on Personalized Medicine

The growing emphasis on personalized medicine is another pivotal factor positively impacting the mass spectrometry market outlook. An industry report noted that the FDA approved over 300 personalized medicines, with about 25% of new drugs linked to biomarker data, and personalized strategies now make up over 40% of major pharma pipelines. Healthcare is becoming increasingly tailored to individual patients, resulting in a higher demand for detailed molecular and genetic information. Mass spectrometry provides the capability to analyze biomarkers, metabolites, and proteins at a molecular level, thereby playing a significant role in proteomics and genomics research. These insights are crucial for understanding individual health profiles, predicting disease susceptibility, and tailoring treatments accordingly. Furthermore, the rise in personalized medicine is pushing healthcare providers and research institutions to invest in mass spectrometry technologies to keep up with the demand for precise, patient-specific data. As a result, the focus on personalized healthcare is not only boosting the application of mass spectrometry in existing markets but is also pioneering its entry into new avenues of medical science.

Mass Spectrometry Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mass spectrometry market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

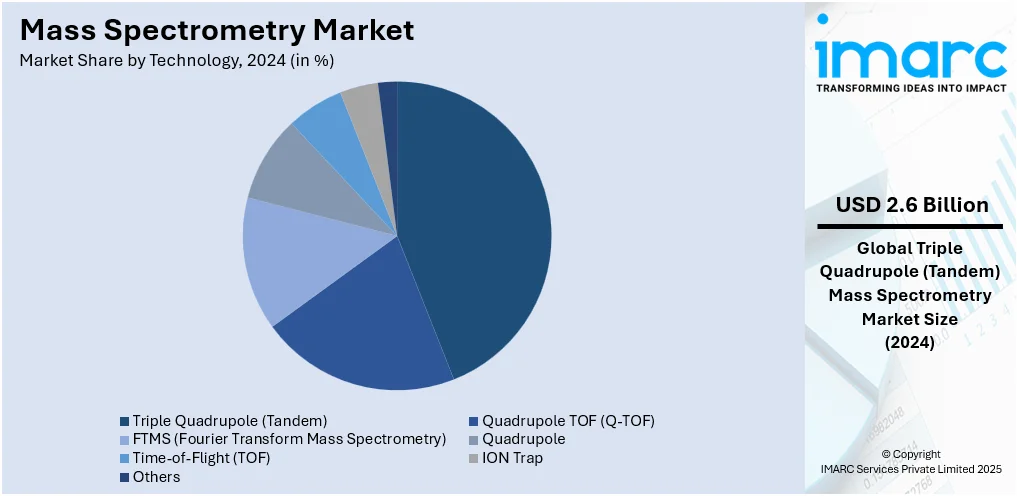

Analysis by Technology:

- Triple Quadrupole (Tandem)

- Quadrupole TOF (Q-TOF)

- FTMS (Fourier Transform Mass Spectrometry)

- Quadrupole

- Time-of-Flight (TOF)

- ION Trap

- Others

Triple quadrupole (tandem) leads the market with around 37.5% of market share in 2024.Triple quadrupole systems offer high sensitivity and selectivity, making them ideal for detecting low-abundance analytes in complex samples. Furthermore, they are versatile and can be applied to various fields, such as proteomics, metabolomics, pharmaceuticals, and environmental analysis. This multi-disciplinary application range contributes to their widespread adoption. Besides this, triple quadrupole mass spectrometers excel in quantitative measurements, as they provide excellent repeatability and accuracy, which are crucial in sectors like drug development and diagnostics. Additionally, these systems are often compatible with various ionization techniques and chromatography systems, allowing for broader applications and easier integration into existing workflows. Moreover, triple quadrupole meets or exceeds the stringent regulations and quality standards required in many industries, which makes them a safer investment for compliance-conscious organizations.

Analysis by Application:

- Pharmaceuticals

- Biotechnology

- Chemical and Petrochemicals

- Environmental Testing

- Food and Beverage Testing

- Others

Pharmaceuticals lead the market in 2024. Pharmaceuticals are governed by strict regulatory standards. In line with this, mass spectrometry is invaluable for quality control and compliance, ensuring that pharmaceutical products meet these rigorous benchmarks. Furthermore, mass spectrometry is critical in the various stages of drug discovery, including target identification, screening, and pharmacokinetics. It provides accurate and precise data that aid researchers in the identification and quantification of compounds, thereby accelerating the time-to-market for new drugs. Besides this, mass spectrometry offers the high sensitivity and specificity required for proteomic and genomic studies, thereby driving its adoption in the pharmaceutical sector. Additionally, it is extensively used in metabolomics to identify and quantify metabolites, thus offering valuable insights into drug metabolism. Moreover, mass spectrometry is routinely used for quality control and batch-to-batch verification of raw materials, intermediates, and finished products.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.7%. North America hosts some of the world's leading research institutions and laboratories, which contributes to a high demand for mass spectrometry equipment for advanced research. Additionally, various government agencies are offering substantial grants and funding options for research and development (R&D) activities, including those that require mass spectrometry, thus fostering a favorable environment for market growth. Besides this, North America is the headquarters for numerous companies that are market leaders in the mass spectrometry segment. Moreover, the region is at the forefront of technological innovation in advanced mass spectrometry techniques like time-of-flight (TOF) and orbitrap. In addition to this, the presence of a robust healthcare system, coupled with the focus on precision medicine and diagnostics in the region, is further boosting the market growth.

Key Regional Takeaways:

United States Mass Spectrometry Market Analysis

In 2024, the United States holds a substantial share of around 87.50% of the mass spectrometry market share in North America. The market in the United States is primarily driven by strong investments in biomedical research, which are expanding applications in precision medicine and personalized healthcare. According to the World Health Organization (WHO), approximately 88% of all biomedical research grants, amounting to nearly USD 33 Billion, were awarded to organizations based in the United States. In line with this, the rapid integration of high-resolution mass spectrometry in clinical diagnostics, which facilitates the early detection of diseases and therapeutic drug monitoring, is driving market growth. The rise in biopharmaceutical manufacturing is further propelling demand for advanced analytical systems to ensure quality control and regulatory compliance. Similarly, increasing government fundings for environmental monitoring, which encourages the widespread deployment of pollutant and toxin analysis, is fostering market expansion. The rising focus on food safety testing for contaminants and residues is driving additional market appeal. Additionally, the expansion of forensic and crime laboratories is stimulating the use of portable and high-throughput mass spectrometry solutions. Apart from this, continuous innovations in hybrid and tandem systems, which reinforces U.S. leadership in analytical research capabilities, is expanding the market scope.

Europe Mass Spectrometry Market Analysis

The European market is experiencing growth due to strong investments in life sciences infrastructure, supported by national and EU-level funding initiatives. In accordance with this, the growing demand for advanced analytical techniques to meet stringent EU environmental regulations is driving market expansion. Similarly, rising investment in precision medicine and oncology programs, transforming the clinical diagnostics landscape, is expanding market reach. As such, in 2024, Berlin-based AI company Aignostics raised €31.4 million in Series B funding to enhance precision medicine through AI-driven pathology insights. The round was led by ATHOS, with investments from Mayo Clinic, HTGF, and other existing investors. The heightened need for food authenticity testing and contaminant traceability driving the deployment of high-resolution systems is supporting market demand. Additionally, the emerging trend of cross-border research collaborations, which encourages the adoption of interoperable, standardized analytical platforms, is stimulating market accessibility. The rapid expansion of biopharmaceutical pipelines and biologics manufacturing hubs is driving a significant increase in the market appeal. Besides this, Europe’s expanding network of accredited testing facilities and the emphasis on laboratory automation are further providing an impetus to the regional market.

Asia Pacific Mass Spectrometry Market Analysis

The mass spectrometry market in the Asia Pacific is largely driven by rising government investments in precision medicine and genomic research. Furthermore, the growth of pharmaceutical manufacturing hubs in India and China, which drives demand for high-performance analytical instruments, is propelling market expansion. Similarly, increased collaborations between academic institutions and biotech companies, which foster innovation in biomarker discovery and proteomics, are strengthening market demand. The heightened adoption of stricter environmental monitoring standards is promoting the deployment of highly sensitive detection technologies. Additionally, the region’s intensified focus on food safety testing is accelerating the use of mass spectrometry in the agro-food sector. Moreover, increasing funding for research and development is promoting the adoption of advanced mass spectrometry solutions in Asia Pacific healthcare and public health laboratories. Accordingly, in 2024, the National Natural Science Foundation of China (NSFC) and the U.S. NSF funded joint projects on infectious disease ecology and evolution, offering up to RMB 4.5 Million (about USD 630,000) per research project and RMB 1 Million (about USD 140,000) per exchange project, encouraging new international networks.

Latin America Mass Spectrometry Market Analysis

In Latin America, the market is growing due to increasing government investments in public health surveillance and advanced disease diagnostics. Similarly, the expansion of precision medicine programs is driving demand for high-resolution analytical tools to support the discovery of biomarkers and the development of targeted therapies. As such, in April 2025, MGI expanded its partnership with Brazil’s Fiocruz to boost epidemiological surveillance and personalized medicine, equipping UNADIG’s labs with advanced sequencers to process 2,000 genetic samples weekly and 29,000 clinical samples daily. The increasing emphasis on environmental monitoring and food safety regulations is driving the deployment of advanced mass spectrometry instruments for the detection of pollutants and quality control. Furthermore, expanding collaborations between local institutions and global pharmaceutical companies are driving technology transfer, advancing innovation, and broadening the market scope.

Middle East and Africa Mass Spectrometry Market Analysis

The mass spectrometry market in the Middle East and Africa is expanding due to increasing investments in healthcare infrastructure and advanced diagnostic capabilities across leading GCC nations. Furthermore, a heightened regulatory focus on food safety and environmental monitoring is driving the adoption of high-performance mass spectrometry in laboratories and testing centers. Similarly, collaborative research partnerships between regional universities and global analytical technology providers are supporting knowledge transfer and developing local expertise. Moreover, the region’s growing pharmaceutical manufacturing sector is driving demand for precise analytical tools to ensure quality control, drug safety, and compliance with international standards, thereby providing an impetus to the market. Accordingly, in May 2025, Julphar announced a five-year investment plan of AED 300 Million (about USD 81 Million) to expand manufacturing, enhance technology, and encourage UAE pharmaceutical exports to over 40 global markets.

Competitive Landscape:

The competition in the market is intense, driven by continuous technological innovations and the growing requirement for accurate, dependable analytical solutions in a variety of industries. Firms in this market concentrate on creating hybrid platforms, miniaturized instruments, and user-friendly software interfaces to improve their competitive advantage. In addition, rigorous regulatory standards and increasing demand for sophisticated analytical capability across pharmaceutical development, food safety, and environmental testing drive ongoing investment in research and development (R&D). Besides, end users now place significant value on integrated systems that deliver accurate, complex analyses with minimal manual intervention, resulting in a greater emphasis on automation and ease of operation. Also, the demand for portable and high-throughput instruments is rising, driven by laboratories seeking to improve turnaround times and cost efficiency. According to the mass spectrometry market forecast, expanding applications in personalized medicine, proteomics, and metabolomics are expected to further accelerate the need for sophisticated mass spectrometry systems.

The report provides a comprehensive analysis of the competitive landscape in the mass spectrometry market with detailed profiles of all major companies, including:

- Agilent Technologies Inc.

- Bruker

- Danaher Corporation

- JEOL Ltd.

- Kore Technology Ltd.

- LECO Corporation

- PerkinElmer Inc.

- Rigaku Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Latest News and Developments:

- June 2025: Thermo Fisher Scientific launched the Orbitrap Astral Zoom and Orbitrap Excedion Pro mass spectrometers at ASMS 2025. These next-generation instruments deliver faster scan speeds, higher throughput, and advanced biomolecule analysis, aiming to accelerate precision medicine, proteomics research, and biopharma development for complex diseases.

- June 2025: SCIEX launched the ZenoTOF 8600 system at ASMS 2025, offering unmatched mass quantitation, 10x sensitivity gains, and advanced data analysis with ZT Scan DIA 2.0. New software collaborations enhance metabolomics, lipidomics, and proteomics workflows, expanding research capabilities across diverse omics applications.

- June 2025: Bruker acquired biocrates, a global leader in MS-based quantitative metabolomics, expanding its multiomics strategy. The deal enhances Bruker’s portfolio with biocrates’ metabolomics kits, assays, and software, supporting integrated proteomics and metabolomics solutions for life sciences, biopharma research and development (R&D), and clinical research worldwide.

- May 2025: Bruker launched the timsOmni mass spectrometer at ASMS, combining timsTOF speed with Omnitrap functionality. This next-gen system enables deep proteoform sequencing, precise PTM identification, and advanced structural insights, revolutionizing disease research, biologics development, and quality control through multimodal fragmentation and AI-powered OmniScape software.

- December 2024: Roche launched the cobas Mass Spec solution after receiving CE mark approval. This fully automated, integrated system brings advanced mass spectrometry to routine labs, offering over 60 analytes for hormone, drug, and disease monitoring, enhancing diagnostic precision and supporting faster, more accurate clinical decisions globally.

Mass Spectrometry Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Triple Quadrupole (Tandem), Quadrupole TOF (Q-TOF), FTMS (Fourier Transform Mass Spectrometry), Quadrupole, Time-of-Flight (TOF), ION Trap, Others |

| Applications Covered | Pharmaceuticals, Biotechnology, Chemical and Petrochemicals, Environmental Testing, Food and Beverage Testing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Bruker, Danaher Corporation, JEOL Ltd., Kore Technology Ltd., LECO Corporation, PerkinElmer Inc., Rigaku Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mass spectrometry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global mass spectrometry market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mass spectrometry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mass spectrometry market was valued at USD 6.93 Billion in 2024.

The mass spectrometry market is projected to exhibit a CAGR of 5.72% during 2025-2033, reaching a value of USD 11.72 Billion by 2033.

The market is driven by increasing applications in pharmaceutical research, growing demand for accurate analytical techniques, and advancements in mass spectrometry technologies. Rising focus on proteomics, metabolomics, and drug discovery, along with increased use in environmental and food testing, further contributes to market growth. Academic research and clinical diagnostics are also propelling market expansion.

North America currently dominates the mass spectrometry market with a market share of around 41.7%. The dominance is fueled by strong investment in life sciences research, presence of major pharmaceutical companies, and advanced healthcare infrastructure. Supportive regulatory frameworks and high adoption of analytical technologies also contribute to the region’s leadership.

Some of the major players in the mass spectrometry market include Agilent Technologies Inc., Bruker, Danaher Corporation, JEOL Ltd., Kore Technology Ltd., LECO Corporation, PerkinElmer Inc., Rigaku Corporation, Shimadzu Corporation, Thermo Fisher Scientific Inc., and Waters Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)