Medical Ceramics Market Report by Type (Bioinert, Bioactive, Bioresorbable, and Others), Application (Orthopedic, Implantable Devices, Dental, Surgical and Diagnostic Instruments, and Others), End User (Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, and Others), and Region 2025-2033

Market Overview:

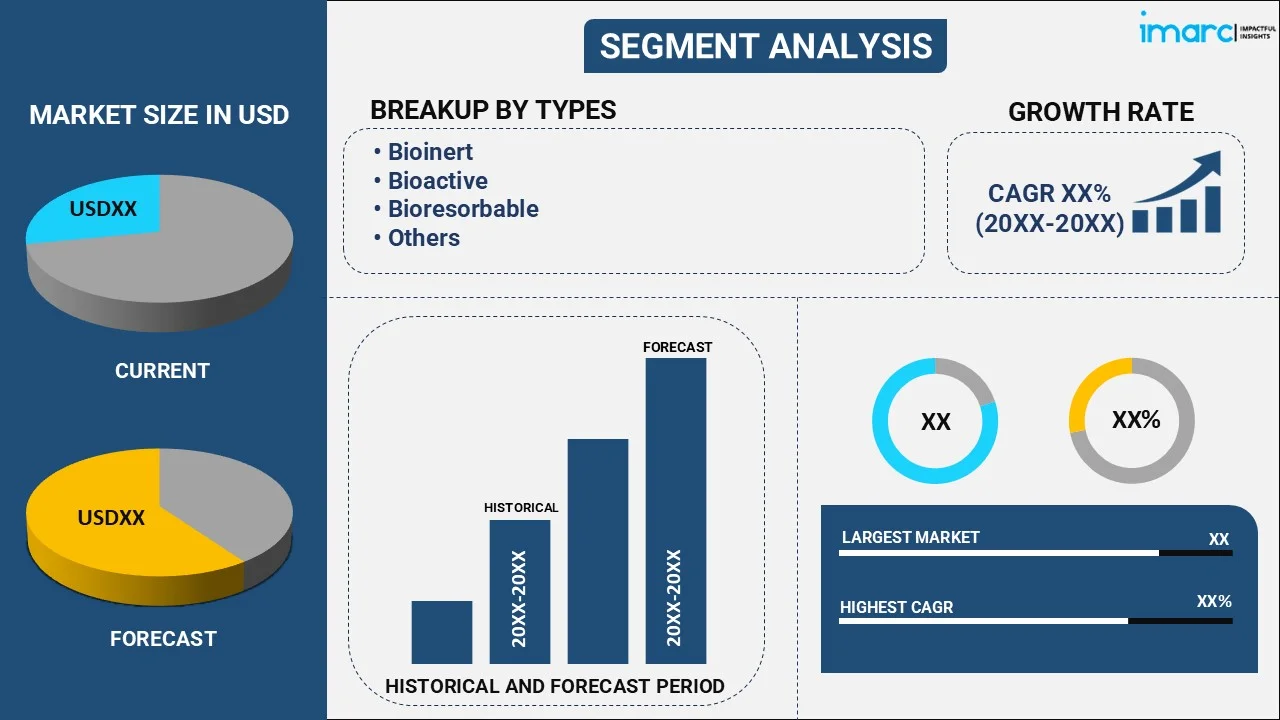

The global medical ceramics market size reached USD 11.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.34% during 2025-2033. The increasing prevalence of chronic diseases, a growing aging population, the rising adoption of minimally invasive surgical techniques, advancements in ceramic manufacturing technologies, stringent regulatory standards, and expanding dental and tissue engineering applications are accelerating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.8 Billion |

| Market Forecast in 2033 | USD 17.4 Billion |

| Market Growth Rate (2025-2033) | 4.34% |

Medical ceramics are specialized materials with an extensive range of applications in the field of healthcare and medicine. These ceramics are designed to interact with biological systems without causing harm or adverse reactions. Advantages of medical ceramics include their biocompatibility, which means they are well-tolerated by the human body. They do not corrode or degrade easily, ensuring long-lasting performance. They also exhibit high mechanical strength, making them suitable for load-bearing applications such as orthopedic implants and dental prosthetics. Moreover, their excellent electrical insulation properties are vital in devices like pacemakers. There are several types of medical ceramics, including alumina ceramics, zirconia ceramics, and hydroxyapatite ceramics.

The global medical ceramics market is influenced by the burgeoning prevalence of chronic diseases and the growing aging population. This is further supported by the rising focus on minimally invasive surgeries, which has led to a surge in the adoption of ceramic-based tools and components due to their biocompatibility and durability. Moreover, ongoing advancements in ceramic manufacturing technologies have resulted in the development of innovative and customized medical ceramics, further boosting the market growth. Additionally, the stringent regulatory standards and safety requirements in the healthcare industry have encouraged the use of medical ceramics, as they offer exceptional bio-inertness and non-reactivity, which, in turn, is augmenting the market growth. In line with this, the expanding dental industry, with a growing emphasis on cosmetic dentistry, has created a significant demand for ceramics in dental prosthetics, which is further fueling the market growth.

Medical Ceramics Market Trends/Drivers:

Escalating prevalence of chronic diseases and aging population

The global medical ceramics market is significantly influenced by the burgeoning prevalence of chronic diseases and the growing aging population. With a rise in chronic health conditions such as osteoarthritis, cardiovascular diseases, and orthopedic disorders, the demand for advanced medical devices and implants has surged. Ceramic materials have gained prominence in this context due to their biocompatibility and durability. As older individuals often require medical interventions like joint replacements, the need for reliable and long-lasting ceramic implants has grown substantially. This trend is expected to continue as the aging population expands worldwide. The medical ceramics market benefits from this demographic shift as it caters to the demand for high-quality, biocompatible materials used in a wide range of medical applications.

Focus on minimally invasive surgeries

The rising emphasis on minimally invasive surgeries has become another major driver of the medical ceramics market. Ceramic-based tools and components are preferred in these procedures for several reasons. Their biocompatibility ensures minimal tissue reaction, and their excellent mechanical properties make them suitable for delicate and precise surgeries. Ceramic materials are also known for their resistance to wear and corrosion, making them ideal for repeated sterilization, a crucial aspect of maintaining surgical instruments. As the medical community continues to prioritize minimally invasive techniques, the demand for medical ceramics in surgical applications is expected to grow steadily.

Advancements in ceramic manufacturing technologies

Advancements in ceramic manufacturing technologies have played a pivotal role in driving the growth of the medical ceramics market. These innovations have resulted in the development of innovative and customized medical ceramics tailored to specific medical applications. Modern manufacturing techniques enable the production of complex ceramic components with high precision and consistency. This has expanded the possibilities for using ceramics in medical devices, implants, and tools, as manufacturers can create intricate designs and shapes that were previously challenging to achieve. Furthermore, improved quality control and reproducibility in ceramic production ensure the reliability and safety of these materials in healthcare settings. As a result, ongoing developments in ceramic manufacturing technology continue to fuel the expansion of the medical ceramics market.

Medical Ceramics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical ceramics market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Breakup by Type:

- Bioinert

- Bioactive

- Bioresorbable

- Others

Bioinert dominates the market

The report has provided a detailed breakup and analysis of the market based on the type. This includes bioinert, bioactive, bioresorbable, and others. According to the report, bioinert represented the largest segment.

The bioinert segment within the medical ceramics market is experiencing notable growth due to the surging awareness regarding the advantages of bioinert ceramics. They are highly biocompatible materials, making them ideal for various medical applications, including dental implants and joint replacements. Patients and healthcare professionals alike value their minimal tissue reaction and excellent compatibility with the human body. In line with this, the increasing prevalence of chronic diseases and the aging population have amplified the demand for long-lasting and reliable medical implants. Bioinert ceramics' durability and resistance to wear and corrosion contribute to their popularity in these critical applications, where the longevity of the implant is crucial. Furthermore, the emphasis on minimally invasive surgeries has led to a growing preference for bioinert ceramics in surgical tools and components. Their ability to withstand repeated sterilization processes, coupled with their precision and biocompatibility, makes them indispensable in modern surgical procedures.

Breakup by Application:

- Orthopedic

- Implantable Devices

- Dental

- Surgical and Diagnostic Instruments

- Others

Implantable devices dominate the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes orthopedic, implantable devices, dental, surgical and diagnostic instruments, and others. According to the report, implantable devices represented the largest segment.

The growth of the implantable devices segment within the medical ceramics market is primarily propelled by the increasing prevalence of chronic diseases and age-related conditions. Ceramic materials, known for their biocompatibility and durability, are favored for applications such as hip and knee replacements, dental implants, and cochlear implants. Apart from this, the trend towards minimally invasive surgeries has driven the demand for ceramic-based implants, as they offer precision and reduced tissue reactivity. Moreover, advancements in ceramic manufacturing technologies have enabled the development of sophisticated and patient-specific implantable devices. These innovations enhance the performance and longevity of implants, bolstering their adoption. Additionally, the stringent regulatory standards in the healthcare industry promote the use of biocompatible materials like ceramics in implants.

Breakup by End User:

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Others

Hospitals and clinics dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, pharmaceutical and biotechnology companies, and others. According to the report, hospitals and clinics represented the largest segment.

The growth of the hospitals and clinics segment can be attributed to the increasing global population, particularly the aging demographic, which has led to a higher demand for healthcare services. As individuals age, they typically require more medical attention, which drives the need for hospitals and clinics. In line with this, advancements in medical technology and treatment modalities have expanded the range of services that hospitals and clinics can offer, attracting more patients seeking advanced care. Additionally, healthcare policies and insurance coverage play a pivotal role in driving growth. Improved access to healthcare services through insurance schemes and government initiatives has made it easier for individuals to seek medical care, further boosting the utilization of hospitals and clinics. Furthermore, the COVID-19 pandemic highlighted the critical importance of hospitals and clinics in providing essential healthcare services and responding to public health emergencies, reinforcing their significance. Moreover, the trend towards specialized medical centers within hospitals, such as cancer treatment centers or cardiac care units, has increased patient volumes in these facilities.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest medical ceramics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region is experiencing robust growth in the medical ceramics market, driven by the region's expanding population, coupled with rising healthcare expenditures. The increasing prevalence of chronic diseases in countries like China and India has further accelerated this trend, as ceramic materials are favored for their biocompatibility and durability. Moreover, the growing awareness of minimally invasive surgical techniques in the Asia Pacific is propelling the adoption of ceramic-based tools and components. These materials offer exceptional biocompatibility, making them ideal for precise and minimally disruptive procedures, which are increasingly preferred by patients and healthcare professionals alike. Furthermore, the Asia Pacific region is witnessing a surge in research and development activities related to medical ceramics. Government initiatives and collaborations between academia and industry are driving innovation in ceramic manufacturing technologies, resulting in the introduction of novel materials and products catering to the specific needs of the healthcare sector.

Competitive Landscape:

The competitive landscape of the global medical ceramics market is marked by intense rivalry among several key players, each vying for a prominent position in this rapidly evolving sector. These companies are engaged in a variety of strategies aimed at maintaining and expanding their market share. One notable aspect of the competitive landscape is the emphasis on research and development. Leading firms are consistently investing in cutting-edge technologies to develop innovative ceramic materials with enhanced properties. This focus on innovation is essential for meeting the evolving demands of the healthcare industry, such as the need for biocompatible, durable, and versatile ceramics. Additionally, strategic collaborations and partnerships are common within the industry. Companies often join forces with research institutions, universities, and other stakeholders to leverage their combined expertise and resources for product development and market penetration.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- 3M Co.

- CeramTec GmbH

- CoorsTek, Inc.

- Medical Device Business Services, Inc.

- H.C. Starck Tungsten GmbH

- KYOCERA Corporation

- Morgan Advanced Materials Plc

- NGK Spark Plug Co., Ltd.

- Institut Straumann AG

- Zimmer Biomet Holdings, Inc.

Recent Developments:

- In April 2023, NGK Spark Plugs (U.S.A.) Inc announced to change the company name to Niterra North America INC. The name change follows the strategy to unify the global brand NGK Spark Plug Co. LTD, which will begin operating under the English tradename Niterra Co.

- In November 2022, CeramTec GmbH, Plochingen invested in a Carmel 1400C ceramic Additive Manufacturing machine. The company plans to utilize the Carmel 1400C to support customers, as well as work with XJet to deliver complex ceramic parts to a variety of manufacturers and industries.

Medical Ceramics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Bioinert, Bioactive, Bioresorbable, Others |

| Applications Covered | Orthopedic, Implantable Devices, Dental, Surgical and Diagnostic Instruments, Others |

| End Users Covered | Hospitals and Clinics, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Co., CeramTec GmbH, CoorsTek, Inc., Medical Device Business Services, Inc., H.C. Starck Tungsten GmbH, KYOCERA Corporation, Morgan Advanced Materials Plc, NGK Spark Plug Co., Ltd., Institut Straumann AG, Zimmer Biomet Holdings, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global medical ceramics market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the global medical ceramics market?

- What are the key regional markets?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the global medical ceramics market and who are the key players?

- What is the degree of competition in the industry?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical ceramics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical ceramics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical ceramics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)