Medical Cyclotron Market Size, Share, Trends and Forecast by Type, Product Type, End User, and Region, 2026-2034

Medical Cyclotron Market Size and Share:

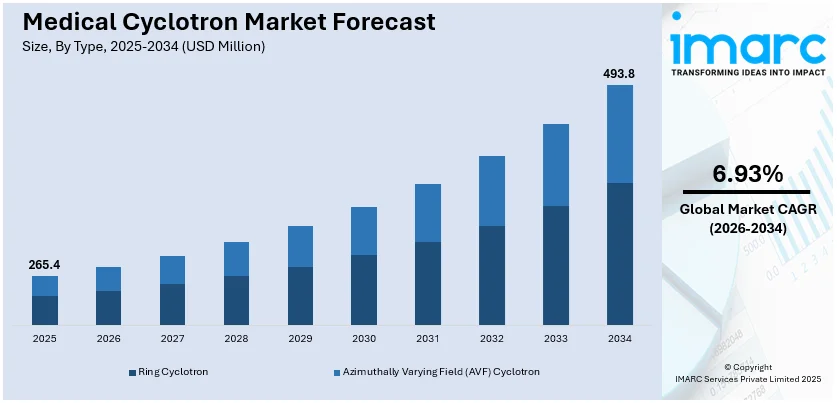

The global medical cyclotron market size was valued at USD 265.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 493.8 Million by 2034, exhibiting a CAGR of 6.93% during 2026-2034. Asia Pacific dominated the market in 2025. The increasing cancer prevalence, advancements in radiopharmaceuticals, rising demand for positron emission tomography (PET) scans, technological innovations, expanding healthcare infrastructure, growing research activities, and supportive government initiatives promoting nuclear medicine and diagnostic imaging are some of the key factors contributing to the medical cyclotron market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 265.4 Million |

|

Market Forecast in 2034

|

USD 493.8 Million |

| Market Growth Rate 2026-2034 | 6.93% |

The market is growing steadily due to several key factors. One major driver is the increasing demand for diagnostic imaging procedures, particularly Positron Emission Tomography (PET) scans, which require radioisotopes produced by cyclotrons. The rising global incidence of cancer and cardiovascular diseases has further amplified the need for early and accurate diagnostic tools. Technological advancements in radiopharmaceuticals and imaging techniques have improved the efficiency and precision of diagnosis, encouraging greater adoption of cyclotron systems. Additionally, expanding healthcare infrastructure in emerging economies and rising investments in nuclear medicine support medical cyclotron market growth. Supportive government policies, including funding for cancer diagnostics and public-private partnerships in healthcare innovation, are also playing a role. Moreover, the shift toward decentralized isotope production and the increasing number of diagnostic centers have strengthened the demand for compact, hospital-based cyclotrons.

To get more information on this market Request Sample

FDA certification for in-house gallium-68 production using compact cyclotron systems is enabling hospitals and radiopharmacies to locally manufacture diagnostic isotopes in high activity. This development supports wider access to PET imaging agents, reduces dependence on centralized supply, and underscores a growing move toward decentralized radiopharmaceutical manufacturing in the US market. For instance, in April 2025, Telix ARTMS, Inc. announced that Gozellix became the first product certified by the US Food and Drug Administration (FDA) to reference the drug master file (DMF) for gallium-68 production using Telix ARTMS, Inc.'s QUANTM Irradiation System cyclotron technology. With this approval, radiopharmacies and hospitals would be able to generate multi-Curies of 68Ga for use with Gozellix by utilizing ARTMS’ QIS cyclotron technology and related targets.

Medical Cyclotron Market Trends:

Rising Prevalence of Cancer and Chronic Diseases

One of the primary trends driving the market is the increasing incidence of cancer and other chronic diseases worldwide. Cancer remains one of the leading causes of death globally, necessitating advanced diagnostic tools for early detection and treatment. In 2022, there were 9.7 million deaths due to cancer, and 53.5 million people living with a cancer diagnosis. Medical cyclotrons play a crucial role in producing radioisotopes used in PET scans, which are highly effective in detecting various types of cancers at an early stage. Additionally, the escalating prevalence of chronic diseases such as cardiovascular disorders (CVD) and neurological conditions has increased the demand for precise diagnostic imaging techniques. As healthcare systems emphasize early diagnosis and effective treatment plans, the need for reliable and high-quality radioisotopes is bolstering the medical cyclotron market growth.

Advancements in Radiopharmaceuticals

Based on the medical cyclotron market outlook, Radiopharmaceuticals play a crucial role in nuclear medicine for both diagnostic and therapeutic purposes. Recent advancements have led to the development of more precise and targeted radiopharmaceuticals, enhancing the accuracy and effectiveness of diagnostic imaging and treatments. This innovation in radiopharmaceuticals has expanded their application scope, enabling the diagnosis and treatment of a broader range of diseases beyond oncology, including cardiology and neurology. As a result, in 2024, the global radiopharmaceuticals market reached USD 5.8 Billion, as per a report by the IMARC Group. The market is further projected to reach USD 8.9 Billion by 2033, growing at a CAGR of 4.9% during 2025-2033. Moreover, the integration of AI and machine learning (ML) in radiopharmaceutical research has spurred the development of new compounds, improving patient outcomes. These advancements necessitate the production of novel radioisotopes, thereby providing an impetus to the medical cyclotron market size.

Expanding Healthcare Infrastructure and Investments in Diagnostic Imaging

The medical cyclotron market forecast indicates that the expansion of healthcare infrastructure significantly contributes to the market growth. For instance, in India, there are a total of 1,69,615 Sub-Centres (SCs), 31,882 Primary Health Centres (PHCs), 6,359 Community Health Centres (CHCs), 1,340 Sub-Divisional/District Hospitals (SDHs), 714 District Hospitals (DHs), and 362 Medical Colleges (MCs) serving both rural and urban areas as of March 2023, according to the Ministry of Health and Family Welfare. Both public and private sector organizations are making huge investments in the development of cutting-edge medical facilities equipped with innovative diagnostic imaging technologies. The rising development of PET and PET-CT centers in hospitals and diagnostic clinics is helping in market growth. Additionally, positive government initiatives and funding to support nuclear medicine and diagnostic imaging are further enhancing the market growth. For example, many nations are putting in place policies that enhance access to advanced diagnostic equipment and the availability of critical radiopharmaceuticals. This is having a favorable influence on the outlook of the medical cyclotron market since they are critical in the production of radioisotopes necessary for use in such advanced imaging procedures.

Medical Cyclotron Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical cyclotron market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, product type, and end user.

Analysis by Type:

- Ring Cyclotron

- Azimuthally Varying Field (AVF) Cyclotron

As per the medical cyclotron market research report, the ring cyclotron stood as the largest component in 2025. As per the medical cyclotron industry statistics, ring cyclotrons dominate the market due to their superior capabilities in producing high-energy radioisotopes essential for advanced diagnostic imaging techniques like PET. Their design allows for continuous and efficient acceleration of particles, resulting in higher yields of radioisotopes with greater purity and consistency. Ring cyclotrons are well-suited for large-scale production in medical facilities owing to their efficiency, which guarantees a consistent supply of essential radiopharmaceuticals. Additionally, their advanced technology supports a wider range of isotopes, catering to diverse medical applications beyond oncology, such as cardiology and neurology. The combination of high production capacity, reliability, and versatility positions ring cyclotrons as the preferred choice in the medical cyclotron market.

Analysis by Product Type:

- Cyclotron 10-12 MeV

- Cyclotron 16-18 MeV

- Cyclotron 19-24 MeV

- Cyclotron 24 MeV and Above

Cyclotron 16-18 MeV led the market in 2025. The demand for cyclotrons with 16-18 MeV energy levels is mainly driven by their optimal balance between production capacity and operational efficiency. Fluorine-18, which is essential for PET imaging, is among the many radioisotopes that can be produced by these cyclotrons. The 16-18 MeV energy range allows for efficient production of high-purity isotopes with sufficient yield to meet the demands of both large hospitals and commercial radio pharmacies. Additionally, these cyclotrons are cost-effective, offering a favorable return on investment for medical facilities. Their versatility, combined with the ability to support diverse diagnostic and therapeutic applications, makes 16-18 MeV cyclotrons the preferred choice in the industry.

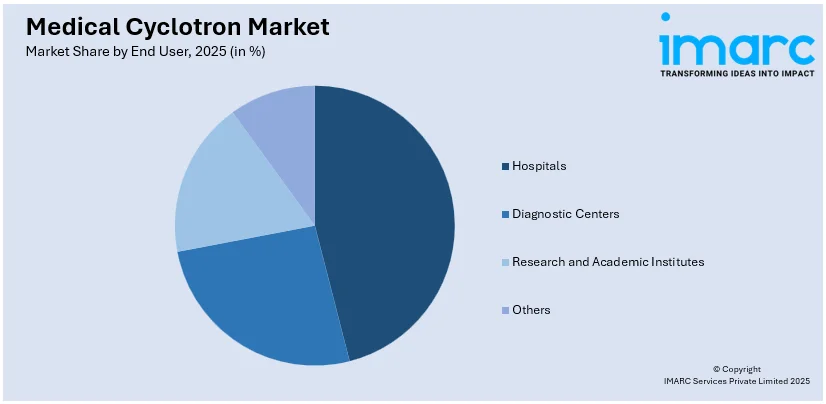

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Diagnostic Centers

- Research and Academic Institutes

- Others

Hospitals led the market in 2025. Medical cyclotron market insights exhibit hospitals as the biggest end users, with their critical role in providing advanced diagnostic and therapeutic services. Medical cyclotrons in hospitals produce essential radioisotopes used in PET and SPECT imaging, which are pivotal for diagnosing and monitoring various diseases, including cancer, CVDs, and neurological disorders. The integration of cyclotrons within hospital settings ensures a timely and reliable supply of these radiopharmaceuticals, enhancing patient care and treatment outcomes. Furthermore, the growing trend of in-house production of radioisotopes allows hospitals to reduce dependence on external suppliers, lower operational costs, and improve the efficiency of their nuclear medicine departments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share. Medical cyclotron market analysis revealed Asia Pacific as the leading region due to robust healthcare infrastructure expansion, particularly in countries like China, Japan, and India, which boosts the demand for advanced diagnostic and therapeutic technologies. Increasing government investments and favorable policies support the adoption of medical cyclotrons in healthcare facilities. Additionally, the rising prevalence of cancer and other chronic diseases in the region amplifies the need for advanced imaging and treatment solutions, further driving market growth. The presence of leading cyclotron manufacturers and growing research and development (R&D) activities in nuclear medicine also contribute to the region's dominance.

Key Regional Takeaways:

United States Medical Cyclotron Market Analysis

The United States medical cyclotron market is primarily driven by the growing demand for advanced diagnostic imaging, particularly positron emission tomography (PET) scans used in oncology, cardiology, and neurology. The increasing incidence of cancer and chronic diseases has heightened the need for reliable radioisotope production, notably Fluorine-18, which is widely used in PET imaging. For instance, the National Cancer Institute estimates that there will be 2,041,910 new cases of cancer in 2025 and approximately 618,120 deaths due to cancer. With many traditional nuclear reactors being phased out or operating under strict regulations, medical cyclotrons provide a safer, decentralized alternative for isotope generation. Moreover, advancements in compact and automated cyclotron technologies have improved operational efficiency and reduced the infrastructure burden, enabling adoption even in mid-sized hospitals and diagnostic centers. The increasing demand for personalized medicine has further strengthened the role of on-site cyclotron production. Government investments, favorable reimbursement policies for PET procedures, and growing partnerships between public institutions and private firms are also propelling industry expansion. Additionally, FDA approvals for new radiopharmaceuticals and a focus on increasing domestic isotope production to reduce import reliance are expanding installations. The trend of integrating cyclotrons with radiochemistry labs for streamlined operations is also attracting attention from healthcare providers seeking to enhance service offerings and reduce lead times in isotope availability, particularly for time-sensitive radiotracers.

Asia Pacific Medical Cyclotron Market Analysis

The Asia Pacific medical cyclotron market is expanding due to increasing government support for indigenizing isotope production and strengthening national nuclear medicine programs. Several countries in the region are enhancing regulatory frameworks and offering funding incentives to encourage hospitals and academic centers to establish cyclotron facilities. Government initiatives to strengthen diagnostic capabilities, along with rising public and private healthcare expenditure, are facilitating cyclotron installations in both urban and tier-2 cities. For instance, from 2017-18 to 2023-24, expenditure on healthcare in India increased from 1.4% to 1.9%, as per the Press Information Bureau (PIB). Additionally, efforts to integrate cyclotron technology with automated radiopharmacy units are improving workflow efficiency and compliance with international safety standards. Local manufacturing of cyclotron components and turnkey radiopharmacy solutions is also gaining traction, lowering installation and maintenance costs. Academic research on novel radiotracers for diseases prevalent in Asia is further boosting demand for dedicated cyclotron facilities tailored to regional diagnostic priorities, facilitating industry expansion.

Europe Medical Cyclotron Market Analysis

The Europe medical cyclotron market is experiencing robust growth, fueled by the rising demand for radioisotopes in PET and SPECT imaging, driven by the increasing geriatric population and the growing prevalence of cancer, cardiovascular, and neurological diseases in the region. According to reports, cancer was the second leading cause of death in the European Union in 2021, with 1.1 Million deaths, which equated to 21.6% of the total number of deaths in the region. Additionally, male mortality rates from cancer were higher at 23.8% than female mortality rates at 19.4%. A strong emphasis on early and precise diagnosis is also prompting hospitals and diagnostic centers across Europe to invest in medical cyclotrons for in-house radiotracer production. Stringent regulatory frameworks around nuclear reactors and radioactive material are further leading to a shift toward decentralized, hospital-based cyclotron installations to ensure a stable and timely isotope supply. Moreover, the European Commission’s initiatives to reduce dependency on imported medical isotopes and enhance domestic production capabilities are creating significant funding opportunities and research incentives. Technological advancements in compact and energy-efficient cyclotrons have made installations more feasible in smaller clinical settings, expanding the market beyond large academic centers. Other than this, collaborations between public health bodies, research institutions, and private sector players are fostering innovation and infrastructure development.

Latin America Medical Cyclotron Market Analysis

The Latin America medical cyclotron market is significantly influenced by the growing demand for advanced diagnostic imaging in oncology, neurology, and cardiology, along with increasing awareness about nuclear medicine applications. Countries such as Brazil, Mexico, and Argentina are expanding public and private healthcare investments to enhance diagnostic infrastructure, including PET-CT capabilities. According to the International Trade Administration (ITA), Brazil spends 9.47% of its GDP on healthcare, equating to USD 161 Billion and making the country the largest healthcare market in Latin America. Regional efforts to modernize healthcare systems and improve early disease detection are also supporting market growth. Besides this, strategic collaborations with international cyclotron manufacturers are helping reduce costs and improve access to training and operational support in the region, supporting industry expansion.

Middle East and Africa Medical Cyclotron Market Analysis

The Middle East and Africa medical cyclotron market is being increasingly propelled by rising investments in nuclear medicine infrastructure and growing demand for PET imaging in cancer diagnosis and management. Countries such as the UAE, Saudi Arabia, and South Africa are expanding advanced diagnostic services as part of broader healthcare modernization efforts. Moreover, medical tourism growth in Gulf countries and the establishment of specialized cancer treatment centers are further supporting cyclotron adoption. For instance, according to a report by the IMARC Group, the medical tourism market in Saudi Arabia reached USD 1,341.1 Million in 2024 and is expected to grow at a CAGR of 21.80% during 2025-2033. The limited availability of imported isotopes, combined with the need for timely and efficient radiotracer supply, is further driving interest in localized cyclotron facilities and propelling market growth.

Competitive Landscape:

The medical cyclotron market is experiencing growth driven by several key developments. Technological advancements have led to the creation of compact, energy-efficient cyclotrons, enhancing accessibility for healthcare facilities. Public-private partnerships and government funding are increasingly common, aiming to mitigate financial barriers and expand access to cyclotron technologies. Research and development efforts are focused on producing novel radioisotopes for diagnostic and therapeutic applications. Among these trends, government initiatives and funding stand out as prevalent practices, facilitating the establishment of cyclotron facilities and promoting nuclear medicine advancements.

The report provides a comprehensive analysis of the competitive landscape in the medical cyclotron market with detailed profiles of all major companies, including:

- Advanced Cyclotron Systems Inc.

- Alcen

- Best Medical International Inc.

- General Electric Company

- IBA RadioPharma Solutions

- Ionetix Corporation

- Isosolution Inc.

- Siemens AG

- Sumitomo Heavy Industries Ltd.

- Varian Medical Systems Inc.

Latest News and Developments:

- February 2025: The State Government of Nagpur solidified plans to establish a cyclotron center in the city, paving the way for early cancer detection and cutting-edge treatment by creating radio isotopes. The cyclotron technology will facilitate nuclear research in Nagpur in addition to applications in a wide range of industries, including semiconductor production and metallurgy.

- February 2025: Framatome established a partnership with IBA (Ion Beam Applications S.A., EURONEXT) through a memorandum of understanding (MoU) to promote the industrial manufacturing of the alpha-emitting radioisotope Astatine-211 in the United States and Europe. The partnership seeks to develop a dependable and sustainable network of state-of-the-art specialized alpha-emitting cyclotrons, guaranteeing the prompt and uninterrupted manufacturing of the Astatine-211 alpha-emitting radioisotope.

- November 2024: The National Institute of Science Education and Research (NISER) in Bhubaneswar announced plans to start building a medical cyclotron facility in March 2025. The facility would manufacture the radioactive isotopes needed for vital imaging tests, such as hospital PET CT and SPECT-CT scans, which are used to identify cancer.

- October 2024: The African Medical Centre of Excellence (AMCE) announced plans to establish a cyclotron facility at its center in Abuja. This cutting-edge technology will be essential for the diagnosis and treatment of complicated illnesses, including cancer, heart conditions, and neurological conditions, which are areas that AMCE will specialize in.

Medical Cyclotron Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ring Cyclotron, Azimuthally Varying Field (AVF) Cyclotron |

| Product Types Covered | Cyclotron 10-12 MeV, Cyclotron 16-18 MeV, Cyclotron 19-24 MeV, Cyclotron 24 MeV and Above |

| End Users Covered | Hospitals, Diagnostic Centers, Research and Academic Institutes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Cyclotron Systems Inc., Alcen, Best Medical International Inc., General Electric Company, IBA RadioPharma Solutions, Ionetix Corporation, Isosolution Inc., Siemens AG, Sumitomo Heavy Industries Ltd., Varian Medical Systems Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical cyclotron market from 2020-2034.

- The medical cyclotron market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical cyclotron industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical cyclotron market was valued at USD 265.4 Million in 2025.

The medical cyclotron market is projected to exhibit a CAGR of 6.93% during 2026-2034, reaching a value of USD 493.8 Million by 2034.

The medical cyclotron market is driven by rising demand for diagnostic imaging, growing prevalence of cancer, increased use of PET scans, advancements in radiopharmaceuticals, expanding healthcare infrastructure, and supportive government initiatives. These factors boost cyclotron adoption in hospitals and research centers for producing isotopes used in nuclear medicine procedures.

Asia Pacific dominated the medical cyclotron market in 2024 due to rising healthcare investments, growing cancer prevalence, expanding diagnostic infrastructure, and increased adoption of PET imaging across countries like China, India, and Japan.

Some of the major players in the medical cyclotron market include Advanced Cyclotron Systems Inc., Alcen, Best Medical International Inc., General Electric Company, IBA RadioPharma Solutions, Ionetix Corporation, Isosolution Inc., Siemens AG, Sumitomo Heavy Industries Ltd., Varian Medical Systems Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)