Medical Disposables Market Size, Share, Trends and Forecast by Product, Raw Material, End Use, and Region, 2025-2033

Medical Disposables Market Size and Share:

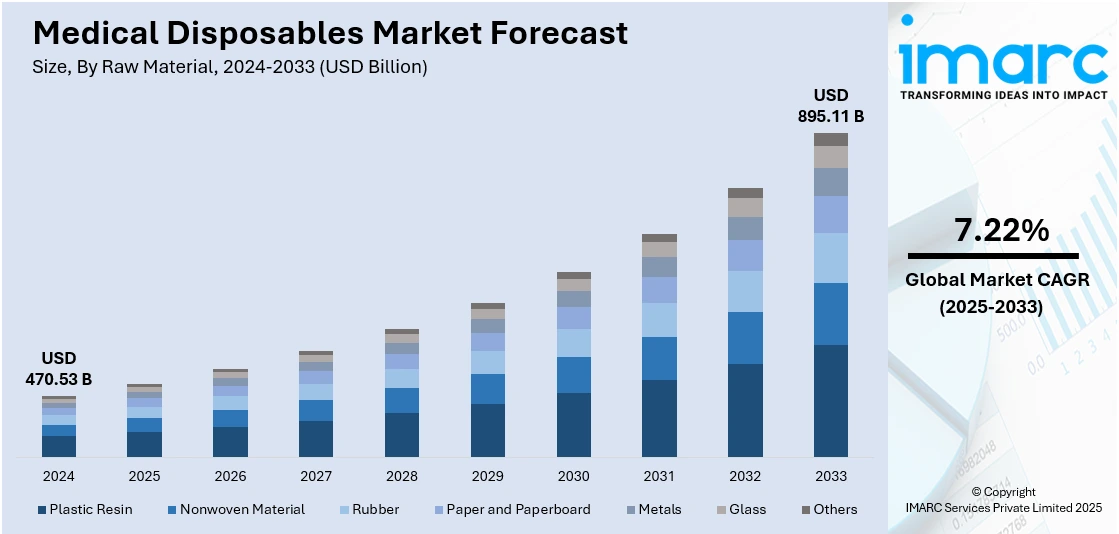

The global medical disposables market size was valued at USD 470.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 895.11 Billion by 2033, exhibiting a CAGR of 7.22% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.5% in 2024. The rising prevalence of dental disorders, increasing dental tourism in the emerging markets, and rapid advancements in medical technologies are some of the major factors fueling the medical disposables market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 470.53 Billion |

| Market Forecast in 2033 | USD 895.11 Billion |

| Market Growth Rate 2025-2033 | 7.22% |

The market for medical disposables is driven by rising healthcare demand, increasing surgical procedures, and heightened awareness of infection control. The growing prevalence of chronic diseases and hospital-acquired infections has led to greater reliance on single-use items like gloves, masks, syringes, and gowns to ensure hygiene and patient safety. The COVID-19 pandemic further accelerated this shift, making disposables essential in preventing cross-contamination. Technological advancements have improved the quality, safety, and comfort of disposable products. Additionally, the expansion of outpatient services, home healthcare, and ambulatory surgical centers supports market growth due to the convenience and cost-effectiveness of disposables. Supportive government regulations and strict hygiene protocols continue to encourage their widespread use, sustaining demand in both developed and emerging healthcare markets.

The United States medical disposables market growth is driven by the heightened emphasis on infection control, especially in the wake of the COVID-19 pandemic, which underscored the necessity of single-use items to prevent cross-contamination in healthcare settings. The prevailing aging population and growing incidence of chronic diseases have led to more hospital admissions and longer stays, thereby elevating the demand for disposable medical products. Technological advancements have resulted in the development of more efficient and environmentally friendly disposable items, aligning with the healthcare sector's sustainability goals. Additionally, stringent regulatory standards imposed by agencies like the FDA ensure the consistent quality and safety of disposable medical supplies. The expansion of outpatient services and home healthcare also shape the medical disposables market outlook, as these settings often prefer the convenience and cost-effectiveness of disposable products. For instance, in January 2024, as a leader in life support technology to replace conventional mechanical ventilators, Inspira Technologies OXY B.H.N Ltd. declared to introduce a single-use disposable blood oxygenation kit for its INSPIRA ART medical device series. In order to capitalize on the market for disposable perfusion systems, the Kit is also designed to be interoperable with a number of additional life support devices.

Medical Disposables Market Trends:

Increasing Emphasis on Infection Control

HAIs pose significant risks to patients and can lead to extended hospital stays, increased healthcare costs, and even mortality. To combat this, medical disposables have gained prominence as critical tools for infection prevention. Single-use products, such as gloves, masks, and sterile drapes, create a barrier between patients, healthcare workers, and potentially harmful pathogens. In a study of open glove boxes, human pathogenic bacteria were detected on around 13% of single-use medical gloves. These disposables significantly reduce the likelihood of cross-contamination, thus safeguarding both patients and medical personnel. With healthcare institutions focusing on reducing HAIs to improve patient outcomes, the demand for medical disposables remains robust.

Rising Chronic Diseases

Conditions like diabetes, requiring regular blood glucose monitoring and insulin administration, necessitate the use of disposable syringes, lancets, and test strips. Similarly, cardiovascular diseases demand frequent interventions such as catheterizations, stent placements, and angioplasties, all of which require sterile single-use tools. According to the WHO, every year an estimated 16 billion injections are administered worldwide. The convenience, safety, and accuracy offered by medical disposables play a pivotal role in managing chronic diseases effectively. As population age and chronic disease rates continue to climb, the reliance on these disposable products is expected to grow, driving innovation and expansion within the medical disposables market.

Advancements in Medical Technology

Rapid advancements in medical technology have transformed the landscape of healthcare, leading to the emergence of innovative medical procedures and devices. According to the medical disposables market forecast, for many of these innovative procedures, a sterile environment is necessary to reduce the risk of infection. Specialized catheters, surgical drapes, and diagnostic instruments are examples of medical disposables that guarantee the safe and efficient execution of these cutting-edge operations. Furthermore, in order to maintain the highest standards of hygiene, the trend toward minimally invasive surgeries, made possible by advanced devices and tools, heavily depends on disposable equipment. The need for specialized medical disposables will continue to be a major factor in determining the market's growth trajectory as medical technology advances.

Medical Disposables Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical disposables market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, raw material, and end use.

Analysis by Product:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Hand Sanitizers

- Others

Drug delivery products stand as the largest product in 2024, holding 17.24% of the market due to their widespread use across various healthcare settings and treatment types. Items such as disposable syringes, IV sets, and infusion pumps are essential for accurate, sterile, and efficient medication administration. These products are used extensively in hospitals, outpatient care, and home healthcare, supporting chronic disease management and emergency interventions. Their single-use nature ensures infection control and patient safety. Additionally, advancements in self-administered drug delivery devices and biologics have increased demand for user-friendly, disposable options. The combination of necessity, convenience, and safety drives their dominant position in the market.

Analysis by Raw Material:

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

Plastic resin leads the market with 57.0% share in 2024. Plastics are renowned for their versatility, enabling them to be molded into a wide variety of medical disposable products, ranging from syringes and catheters to gloves and tubing. This adaptability allows manufacturers to address the diverse needs of healthcare facilities efficiently. Additionally, plastic resins can be engineered to exhibit properties crucial for medical applications, such as biocompatibility, chemical resistance, and sterility maintenance. They can be formulated to prevent interactions with medications and bodily fluids while ensuring a safe and effective environment for patient care. Other than this, plastic disposables are often lightweight and cost-effective, aligning well with the demands of both healthcare providers and patients. The ease of mass production and customization further enhances their attractiveness for medical applications. Moreover, plastics' ability to be produced with minimal risk of contamination and to withstand sterilization processes like autoclaving or ethylene oxide treatment contributes to their prevalence in medical disposables.

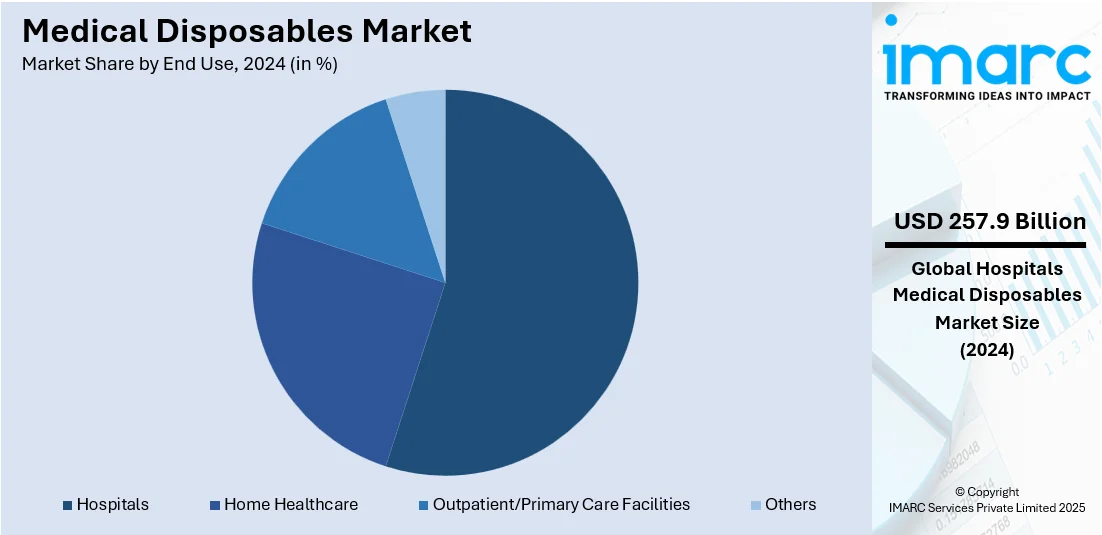

Analysis by End Use:

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

Hospitals leads the market with 54.8% of market share in 2024. Hospitals serve as vital centers for medical diagnosis, treatment, surgery, and patient care, thereby requiring a substantial volume of medical disposables to ensure optimal infection control and patient safety. Within hospitals, a wide range of medical procedures, surgeries, and interventions take place, each demanding specific disposable items. Sterile gloves, masks, drapes, syringes, and catheters are a few medical disposables needed to maintain a safe and hygienic environment. The criticality of infection prevention, particularly in a high-risk environment like a hospital, drives the demand for these single-use products. Additionally, hospitals cater to a diverse patient population with varying medical needs. This diversity necessitates an extensive array of medical disposables to address different conditions and procedures, contributing to the significant consumption of these products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.5%. North America possesses a well-established and sophisticated healthcare ecosystem, characterized by world-class hospitals, research institutions, and medical facilities. The region's emphasis on delivering high-quality patient care and advanced medical procedures necessitates a substantial demand for medical disposables. Additionally, the region's high healthcare expenditure allows for the consistent procurement of medical disposables to maintain rigorous infection control standards. The priority placed on patient safety and infection prevention drives the utilization of single-use products, contributing to the robust demand for medical disposables. Other than this, stringent regulatory frameworks and quality standards in North America ensure that medical disposables adhere to the highest levels of safety and efficacy. This focus on regulatory compliance enhances trust in these products, further bolstering their consumption. Furthermore, North America's responsiveness to technological advancements and innovations in healthcare fosters the adoption of novel medical procedures and devices, many of which rely on disposable tools to maintain sterility and prevent infections.

Key Regional Takeaways:

United States Medical Disposables Market Analysis

In 2024, the United States accounted for 90.30% of the medical disposables market in North America. The United States is witnessing a significant surge in demand for medical disposables driven by the rising chronic diseases that require frequent medical interventions, diagnostic procedures, and long-term patient care. The main causes of death and disability in the US are chronic illnesses like diabetes, cancer, and heart disease. They are also the main causes of the USD 4.5 Trillion in healthcare spending that the country incurs each year. With an aging population and rising occurrence of diabetes, cardiovascular conditions and cancer, the consumption of items such as gloves, syringes, and catheters is expanding rapidly. Hospitals and outpatient settings are prioritizing single-use products to minimize cross-contamination risks. Moreover, regulatory emphasis on infection control measures further supports the uptake of disposable supplies. The rising chronic disease trend contributes to the regular need for hygienic and safe treatment environments. As a result, the healthcare sector in the United States remains a major contributor to the steady growth in demand for medical disposables, creating opportunities for manufacturers and suppliers.

Asia Pacific Medical Disposables Market Analysis

Asia-Pacific continues to experience a rise in medical disposables demand due to the growing risk of infections across healthcare environments. Risk factors such as HIV, diabetes, and undernourishment are highlighted in the India TB Report 2024. Additionally, the data shows that in India, 95% of people were diagnosed with the virus received treatment. With densely populated urban centers and rapidly expanding hospital networks, concerns about hospital-acquired infections have prompted the healthcare industry to shift toward single-use products. Increased awareness of hygiene practices among medical professionals and patients has further fueled this trend. Moreover, government health programs are supporting infection prevention strategies, which in turn drive the adoption of sterile disposables in clinical settings. The growing risk of infections has made it essential for both public and private healthcare providers to invest in safe and effective solutions.

Europe Medical Disposables Market Analysis

Europe is advancing the adoption of medical disposables in response to growing environmental conservation efforts that influence healthcare procurement policies. Estimates from Eurostat indicate that the European Union's (EU) investments in environmental protection grew by 1.5% per year between 2006 and 2023, from €52 Billion to €67 Billion. Regulatory frameworks increasingly emphasize eco-friendly materials and the reduction of medical waste using biodegradable and recyclable disposable products. Healthcare institutions are aligning with sustainability goals by shifting away from reusable supplies that require intensive energy and water for sterilization. The push for environmental conservation has encouraged innovation in the production of low-impact, single-use devices that support both hygiene and environmental responsibility. As awareness around the carbon footprint of healthcare services grows, medical disposables designed for minimal environmental impact are gaining favor.

Latin America Medical Disposables Market Analysis

Latin America is boosting demand for medical disposables, supported by growing investments in healthcare infrastructure. For instance, in Brazil, 25% of the population utilizes the private healthcare system. New hospitals, clinics, and diagnostic centers are being built with an emphasis on modern equipment and infection control standards. As healthcare services expand, the need for disposable gloves, gowns, and syringes increases steadily. This infrastructure growth enhances access to safer care and drives long-term consumption of medical disposables.

Middle East and Africa Medical Disposables Market Analysis

The Middle East and Africa show increased usage of medical disposables due to growing healthcare facilities in the region. As of 2023, the region of Riyadh had 109 hospitals in Saudi Arabia, which was the most in the Kingdom. Of these 109 hospitals, 44 belonged to the private sector. The expansion of hospitals, outpatient clinics, and specialized centers is accompanied by a rising preference for single-use medical items. This shift reduces contamination risks and aligns with quality standards in emerging healthcare systems.

Competitive Landscape:

Prominent companies invest significantly in research and development to create cutting-edge medical disposable products that align with emerging medical trends. This includes developing materials with enhanced biocompatibility, sustainability, and infection resistance, as well as designing disposables tailored to specific medical procedures. Additionally, leading companies continually expand their portfolios to encompass a wide array of medical disposables, catering to various medical disciplines and procedures. This diversification ensures they can offer comprehensive solutions that meet the needs of different healthcare settings. Other than this, key players are actively entering new markets and regions to tap into unmet healthcare demands. By leveraging their expertise and distribution networks, they aim to provide medical disposables to underserved areas, thus contributing to global healthcare access. Besides this, collaboration with healthcare institutions, research centers, and regulatory bodies enables key players to stay updated on industry trends and regulatory changes. These partnerships foster knowledge exchange, aid in compliance, and drive mutual growth. In line with this, numerous major players are focusing on sustainability by exploring eco-friendly materials and manufacturing processes for their disposables. These efforts align with growing environmental awareness and consumer demands for greener healthcare solutions.

The report provides a comprehensive analysis of the competitive landscape in the medical disposables market with detailed profiles of all major companies, including:

- 3M Company

- Abbott Laboratories

- AMMEX Corporation

- Ansell Ltd.

- B Braun Melsungen AG

- Becton Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health Inc.

- Medline Industries LP

- Medtronic plc

- Narang Medical Limited

- Smith & Nephew plc

- Terumo Cardiovascular Systems Corporation (Terumo Medical Corporation)

Latest News and Developments:

- May 2025: U.S. Medical Glove Company launched a fully operational face mask production unit in Harvard, Illinois, to enhance domestic output of medical disposables. The facility is equipped to produce over 75 million 3-ply disposable face masks annually, with scalability for emergencies.

- April 2025: INTCO Medical launched its patented Syntex Synthetic Disposable Latex Gloves, surpassing traditional medical disposables in elasticity, puncture resistance, and comfort while eliminating natural latex allergy risks. The gloves meet EN455, EN374, FDA, and EU CE standards and support EUDR compliance by avoiding deforestation-linked materials.

- March 2025: Edinburgh-based start-up Mask Logic secured funding to advance its development of sustainable medical disposables, particularly focusing on PPE. The company aims to reduce environmental impact by creating biodegradable and recyclable alternatives to traditional single-use medical products. This initiative addresses the growing demand for eco-friendly solutions in healthcare, especially in the wake of increased PPE usage during the COVID-19 pandemic.

- February 2025: Chulalongkorn University's Faculty of Medicine, in collaboration with CP Group, developed the "POR-DEE" mask, a medical disposable designed to filter up to 99% of PM2.5 particles. Featuring a four-layer structure and available in four sizes tailored for Asian facial structures, the mask ensures comfort and effective protection.

- February 2025: AIIMS Delhi launched an automated system named "Srjanam" to convert hazardous biomedical waste, including medical disposables, into safer byproducts. Developed by CSIR-NIIST, the system offered an economical, eco-friendly alternative to incineration and neutralized waste with added fragrance for easier handling.

Medical Disposables Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Wound Management Products, Drug Delivery Products, Diagnostic and Laboratory Disposables, Dialysis Disposables, Incontinence Products, Respiratory Supplies, Sterilization Supplies, Non-woven Disposables, Disposable Masks, Disposable Eye Gear, Disposable Gloves, Hand Sanitizers, Others |

| Raw Materials Covered | Plastic Resin, Nonwoven Material, Rubber, Paper and Paperbound, Metals, Glass, Others |

| End Uses Covered | Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Abbott Laboratories, AMMEX Corporation, Ansell Ltd., B Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cardinal Health Inc., Medline Industries LP, Medtronic plc, Narang Medical Limited, Smith & Nephew plc, Terumo Cardiovascular Systems Corporation (Terumo Medical Corporation) etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical disposables market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical disposables market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical disposables market was valued at USD 470.53 Billion in 2024.

The medical disposables market is projected to exhibit a CAGR of 7.22% during 2025-2033, reaching a value of USD 895.11 Billion by 2033.

Key factors driving the medical disposables market include rising healthcare demand, increased surgical procedures, and heightened focus on infection control. Technological advancements, growing chronic disease prevalence, and expanding outpatient and home healthcare services also contribute. Regulatory support further encourages the adoption of safe, single-use medical products across various care settings.

North America currently dominates the medical disposables market due to advanced healthcare infrastructure, high surgical volume, infection control focus, chronic disease prevalence, and strong regulatory standards.

Some of the major players in the medical disposables market include 3M Company, Abbott Laboratories, AMMEX Corporation, Ansell Ltd., B Braun Melsungen AG, Becton Dickinson and Company, Boston Scientific Corporation, Cardinal Health Inc., Medline Industries LP, Medtronic plc, Narang Medical Limited, Smith & Nephew plc, Terumo Cardiovascular Systems Corporation (Terumo Medical Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)