Medical Foods Market Size, Share, Trends and Forecast by Product, Route of Administration, Application, Distribution Channel, and Region, 2025-2033

Medical Foods Market Size and Share:

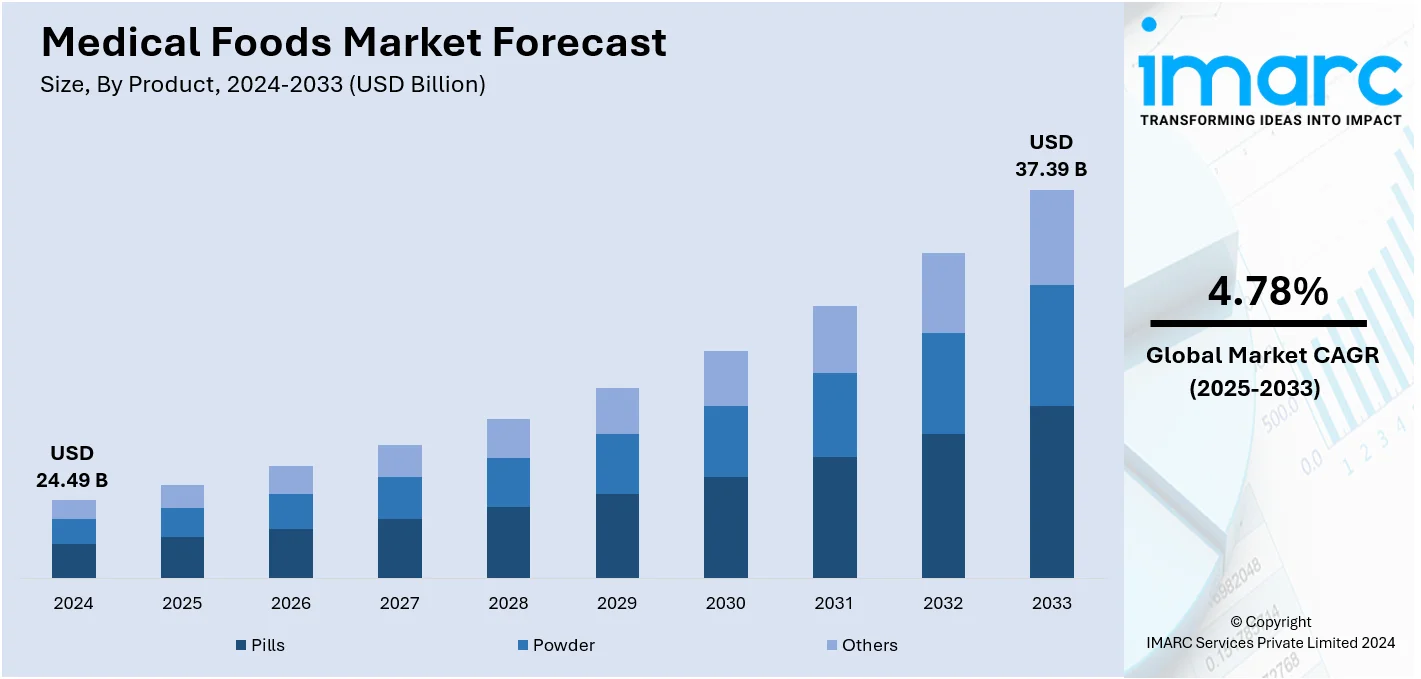

The global medical foods market size was valued at USD 24.49 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.39 Billion by 2033, exhibiting a CAGR of 4.78% from 2025-2033. North America currently dominates the market in 2024. The growing incidences of chronic illnesses like diabetes, cancer, and metabolic disorders among the masses, rising geriatric population, and the increasing progress in the field of nutrigenomics, focusing on the relationship between nutrition and genes, are several of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.49 Billion |

| Market Forecast in 2033 | USD 37.39 Billion |

| Market Growth Rate 2025-2033 | 4.78% |

The increased rate of chronic diseases, such as diabetes, cancer, or cardiovascular diseases, requiring focused nutritional interventions in these disease management is a major driver for the global market of medical foods. For instance, according to an industry report on April 17, 2024, a resurgence in the "food as medicine" approach within modern clinical trials, emphasizing dietary interventions' effectiveness in treating or delaying certain diseases. Recent studies, such as the PREDIMED trial, demonstrate that dietary interventions like the Mediterranean diet can effectively prevent or delay cardiovascular diseases. These findings suggest that incorporating specific dietary strategies into standard medical practice could enhance disease management and prevention. Furthermore, growing demands for products to prevent malnutrition and conditions related to old age are also contributing to the expansion of the market. Similarly, continual advances in clinical nutrition research and technology have made possible the development of new and customized medical food formulations, which are attractive to healthcare providers and patients. The increasing awareness regarding the role of personalized nutrition in health management significantly supports the market demand.

To get more information on this market, Request Sample

The United States is a key regional market and is experiencing growth due to rising the incidence of rare metabolic disorders which increased the demand for specific medical nutrition products catering to individual needs. Similarly, the growing focus on preventive care prompted the use of medical foods, preventing disease progression in vulnerable populations. In addition to this, favorable healthcare policies and strategic partnerships between healthcare services have also made them more accessible and adopted in the market. For example, the U.S. Department of Health and Human Services (HHS) and The Rockefeller Foundation announced a partnership on January 31, 2024, to accelerate the integration of Food is Medicine initiatives into health systems. The collaboration will improve health outcomes and equity by increasing public awareness of nutrition's role in health and exploring strategies to expand successful health programs to Americans. Also, The Rockefeller Foundation committed to increasing its investment in Food is Medicine programs by over USD 100 million, which also includes up to USD 51 million to the American Heart Association to study the health and economic impacts of these interventions across diverse U.S. populations. Improvements in pediatric and neonatal care have created a requirement for specialized nutritional solutions for infants and children with specific health conditions. Moreover, the developed pharmaceutical and healthcare infrastructure in the United States enables the speedy development, regulation, and distribution of medical foods, further strengthening its position in the global market.

Medical Foods Market Trends:

Integration Of Digital Health and Telehealth Services

The convergence of digital health technologies with medical nutrition represents a transformative trend reshaping patient care delivery and product accessibility. Healthcare providers are increasingly leveraging telehealth platforms to deliver personalized nutrition counseling, conduct remote assessments, and monitor patient compliance with therapeutic dietary regimens. This digital transformation enables practitioners to reach underserved populations, reduce geographical barriers, and provide continuous support between in-person visits. The adoption of video consultations, mobile health applications, and remote patient monitoring tools has created an ecosystem where medical nutrition therapy becomes more accessible and patient-centered. Healthcare institutions are implementing integrated telehealth solutions that connect registered dietitians, physicians, and patients in real-time, facilitating multidisciplinary care coordination. In January 2024, Aramark launched a groundbreaking telehealth program in partnership with Teladoc Health, providing hospitals with both technology and clinical nutrition talent to digitally connect inpatients with nutrition services. This represents the first program of its kind, addressing registered dietitian shortages while improving patient access to expert nutritional guidance. Additionally, in April 2025, ATA Action launched the Virtual Foodcare Coalition, which brought together healthcare, nutrition, and telehealth leaders to advocate for policies integrating virtual care with food and nutritional support to promote health and manage chronic conditions. The coalition identified priority areas including expanded Medicare coverage for nutrition therapy through telehealth and reduced referral burdens that create unnecessary barriers to care.

Expansion Of Food As Medicine Initiatives

Food as Medicine (FIM) programs are gaining substantial momentum as healthcare systems recognize nutrition's fundamental role in disease prevention, management, and recovery. These initiatives encompass produce prescription programs, medically tailored meals, and nutritional counseling services that are directly integrated into healthcare delivery models. Health insurers, government agencies, and healthcare providers are investing in FIM interventions to address the root causes of chronic diseases while reducing long-term healthcare costs. The evidence base supporting these programs continues to strengthen, with randomized controlled trials demonstrating improved clinical outcomes, reduced hospitalizations, and enhanced patient quality of life. Policy frameworks at federal and state levels are evolving to support FIM implementation, with expanded reimbursement mechanisms and dedicated funding streams. At the end of 2024, Elevance Health Foundation assessed its prior commitments to Food as Medicine programs and launched a new five-year commitment beginning in January 2025, broadening its focus to include new grant opportunities promoting greater collaboration among nonprofit organizations and healthcare institutions. Furthermore, at the end of September 2024, U.S. Representative Barbara Lee introduced the National Food as Medicine Program Act of 2024, marking the first comprehensive federal step to integrate Food as Medicine programs into healthcare delivery. The legislation reflects growing bipartisan recognition that nutritional interventions represent cost-effective solutions for managing diet-related chronic diseases. Healthcare providers are establishing clinical workflows that screen patients for food insecurity during medical visits and provide referrals to community-based food resources, creating seamless connections between clinical care and nutritional support services.

Advancement In Personalized Nutrition And Nutrigenomics

The personalized nutrition revolution is fundamentally transforming how medical foods are developed, prescribed, and consumed, driven by breakthroughs in nutrigenomics, microbiome research, and artificial intelligence. Healthcare providers and manufacturers are moving beyond one-size-fits-all approaches toward precision nutrition strategies that account for individual genetic variations, metabolic profiles, gut microbiome composition, and lifestyle factors. Genomic testing services enable clinicians to identify genetic polymorphisms that influence nutrient metabolism, absorption, and disease risk, allowing for highly targeted dietary interventions. Artificial intelligence platforms analyze complex datasets including biomarkers, continuous glucose monitoring data, and dietary logs to generate dynamic, personalized nutrition recommendations that adapt in real-time to changing health status. According to the U.S. Food and Drug Administration, the first over-the-counter continuous glucose monitor was approved in March 2024, intended for non-insulin users for general wellness, expanding access to metabolic monitoring beyond diabetic patients. This regulatory milestone enables metabolically healthy individuals to optimize their nutrition based on real-time glucose response data.

Rise Of Direct-To-Consumer Distribution Models

The medical foods distribution landscape is undergoing radical transformation as manufacturers increasingly embrace direct-to-consumer (DTC) channels, fundamentally altering traditional distribution paradigms. E-commerce platforms, subscription services, and telehealth-integrated marketplaces are empowering patients to access specialized nutrition products with unprecedented convenience, bypassing traditional retail intermediaries. This shift enables manufacturers to establish direct relationships with consumers, gather valuable behavioral data, and deliver personalized experiences including customized product recommendations, educational content, and ongoing support. DTC models reduce distribution costs, expand market reach to underserved geographical areas, and provide patients with discreet access to medical nutrition products they may be hesitant to purchase in person. Subscription-based models foster long-term patient adherence by automating product delivery, offering personalized guidance, and creating community connections through digital platforms. Digital platforms integrate artificial intelligence-driven recommendation engines, virtual nutrition coaching, and seamless integration with wearable biosensors to create comprehensive wellness ecosystems. This distribution evolution is democratizing access to medical nutrition, particularly benefiting patients in rural areas, those with mobility limitations, and individuals seeking privacy in managing sensitive health conditions.

Medical Foods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical foods market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, route of administration, application, and distribution channel.

Analysis by Product:

- Pills

- Powder

- Others

Powder leads the market in 2024. Powder is versatile, easy to use, and can be utilized in multiple of food products and drinks.It provides a convenient choice for patients needing personalized nutrition, enabling accurate dosing and customized nutrient profiles for addressing specific medical conditions. The dominance of this segment is further strengthened by rising improvements in formulation technologies, which enhance the flavor and texture of powdered products to increase patient adherence. Medical foods market trends indicate a growing preference for these versatile powdered products.

Analysis by Route of Administration:

- Oral

- Enteral

Oral administration leads the market in 2024. Oral is convenient, easy to use, and non-invasive, making it suitable for a wide range of patients including those with chronic conditions and need long-term nutritional support. The popularity of this segment is influenced by the creation of palatable and easily consumable formulations like tablets, capsules, powders, and ready-to-drink (RTD) beverages. Additionally, the growing presence of oral nutritional supplements in online and offline stores is making it more convenient for patients to adhere to their treatment. The extensive usage and reliability of oral nutritional items notably contribute to the overall medical foods market size.

Analysis by Application:

- ADHD

- Depression

- Diabetes

- Cancer

- Alzheimer's Disease

- Metabolic Disorders

- Others

Diabetes leads the market in 2024. This dominance is attributed to the high incidences of diabetes among the masses, which often require specialized nutritional products created to regulate blood sugar levels and overall metabolic well-being. Specially designed medical foods for individuals with diabetes are created to offer well-balanced nutrition, manage carbohydrate consumption, and avoid high blood sugar levels. The rise in Type 1 and Type 2 diabetes cases, coupled with the growing understanding about the importance of dietary control in managing the condition, is contributing to the market growth. Additionally, the rising focus on research operations, along with supportive regulatory frameworks, is further driving the medical foods demand as these products become essential for effective diabetes management and patient compliance. In 2023, Nestlé launched its Lean Cuisine Balance Bowls, a new line of frozen meals designed to support individuals managing blood sugar levels. These meals, developed with input from the American Diabetes Association, adhered to their nutrition guidelines and contained 400 calories or less, with zero added sugars.

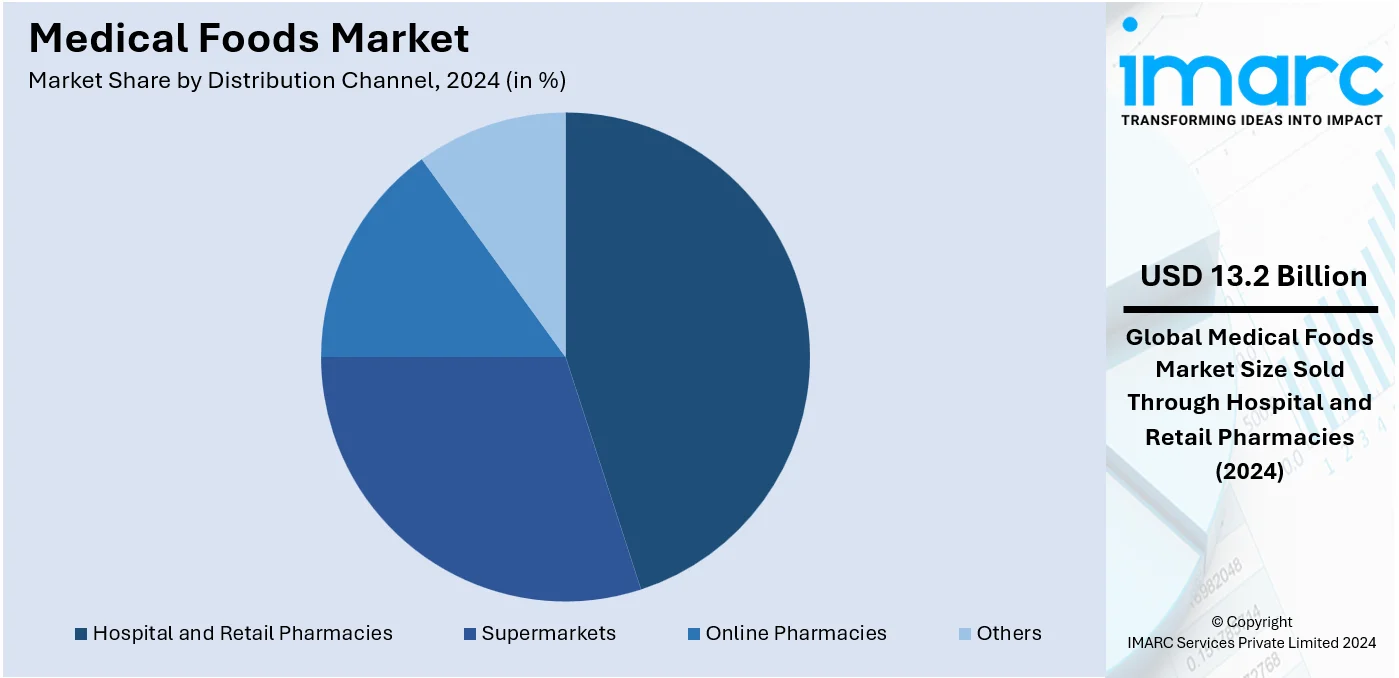

Analysis by Distribution Channel:

- Supermarkets

- Hospital and Retail Pharmacies

- Online Pharmacies

- Others

Hospitals and retail pharmacies lead the market in 2024. The leadership of the segment can be attributed to the trust and convenience these pharmacies offer, as they are often the primary point of contact for patients receiving prescriptions and guidance from healthcare professionals. Hospital and retail pharmacies provide a reliable source of medical foods, ensuring the availability of specialized nutritional products tailored to specific medical conditions, thereby offering a favourable medical foods market outlook. The professional advice and counselling available at these pharmacies enhance patient compliance and proper usage. Additionally, strategic collaborations between medical food manufacturers and pharmacies contribute to an efficient supply chain, ensuring that patients have consistent access to essential products.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share, driven by the advanced healthcare infrastructure, rising prevalence of chronic diseases, and increasing healthcare expenditure. The strong presence of major market players and ongoing innovations in medical food products are bolstering growth in the North American market. Additionally, the region benefits from robust regulatory frameworks that support the development and commercialization of medical foods. The growing awareness and proactive management about health conditions through specialized nutrition are positively influencing the market. Additionally, the robust insurance coverage in North America is making it easier for people to access and use medical foods. Moreover, the presence of various key market players in the region is making it easier for people to access medical nutrition products. In 2024, Danone announced its acquisition of Functional Formularies, a US-based whole foods tube-feeding business, from Swander Pace Capital. This acquisition expanded Danone’s medical nutrition portfolio, adding to its enteral tube-feeding ranges. Danone aimed to better support the nutritional needs of tube-fed patients and families through this deal.

Key Regional Takeaways:

United States Medical Foods Market Analysis

The United States medical foods market demonstrates robust growth trajectories driven by sophisticated e-commerce infrastructure, progressive healthcare policies, and substantial federal investment in nutrition-based interventions. Digital commerce platforms have fundamentally transformed product accessibility, enabling patients and caregivers to access specialized medical nutrition with unprecedented convenience while benefiting from detailed product information, peer reviews, and telehealth integration. According to the International Trade Administration, global B2C e-commerce revenue is anticipated to reach USD 5.5 Trillion by 2027, expanding at a 14.4% CAGR, with the United States representing a substantial portion of this growth. Expanding online distribution channels are driving medical food accessibility, enhancing convenience for patients managing chronic illnesses, malnutrition, and metabolic disorders. Advanced logistics networks ensure rapid product availability, addressing the growing demand for nutritionally precise formulations. The integration of telehealth services complements digital shopping experiences by enabling medical professionals to recommend specific formulations during virtual consultations, strengthening adoption rates and patient compliance. The U.S. government is demonstrating unprecedented commitment to nutrition-based healthcare interventions through substantial funding initiatives. The American Heart Association announced funding of USD 7.8 million in January 2024 for 19 research projects focused on heart and brain health as part of its Health Care by Food initiative. Furthermore, the U.S. FDA plans to invest USD 7.2 billion as part of the fiscal year 2025 proposed budget to enhance medical food safety and nutrition, advance medical product safety, and support supply chain resiliency. Partnership initiatives between federal agencies and philanthropic organizations are accelerating Food as Medicine program implementation across healthcare systems nationwide, creating sustainable infrastructure for integrating nutrition into standard medical practice.

Asia Pacific Medical Foods Market Analysis

The Asia Pacific medical foods market is experiencing unprecedented expansion driven by rapid healthcare infrastructure development, substantial government and private sector investment, and growing recognition of nutrition's pivotal role in disease management and recovery. The region's healthcare systems are undergoing transformative modernization, with governments allocating increasing proportions of GDP to healthcare infrastructure, innovation, and public health programs that incorporate medical nutrition therapy into standard treatment protocols. Healthcare practitioners throughout the region are increasingly integrating dietary management into comprehensive treatment plans, recognizing therapeutic formulations as essential components of effective disease management strategies. Hospitals and specialty clinics emphasize incorporating nutrition-based interventions for conditions including diabetes, gastrointestinal disorders, and neurological ailments, with parallel investments in specialized training programs empowering nutritionists and dietitians to advocate for evidence-based dietary solutions.

Europe Medical Foods Market Analysis

The European medical foods market is experiencing significant expansion propelled by the escalating burden of chronic diseases requiring specialized nutritional interventions as integral components of comprehensive treatment protocols. Healthcare systems throughout the region increasingly prioritize dietary strategies to complement conventional medical treatments, positioning medical foods as indispensable tools in managing disease-related malnutrition and metabolic imbalances. According to a 2022 publication by the European Parliament, Chronic Kidney Disease affects around 100 million people in Europe, with projections indicating it will become the fifth leading cause of global mortality by 2040 in the region. This substantial disease burden underscores the critical need for targeted nutritional support products designed to address specific metabolic requirements of patients with renal impairment. The cancer burden represents another major driver for medical foods adoption across Europe. This growing burden highlights the urgent need for supportive nutritional interventions, positioning medical foods as critical aids for cancer patients experiencing treatment-related malnutrition, metabolic alterations, and cachexia. Home-based care models are proliferating throughout Europe, driven by the imperative for cost-effective, patient-centered healthcare solutions, which substantially boosts consumption of tailored medical nutrition products. Manufacturers are responding with innovation in flavor enhancement technologies and easy-to-consume formats specifically designed to meet the complex dietary needs of individuals with compromised nutritional status.

Latin America Medical Foods Market Analysis

The Latin American medical foods market is experiencing transformative growth catalyzed by rapidly rising disposable incomes that fundamentally enhance consumer purchasing power and accessibility to premium nutrition products supporting specific health requirements. Economic development throughout the region is creating expanding middle-class populations with increased financial resources to allocate toward health optimization, preventive care, and management of chronic conditions through specialized nutritional interventions. Inflating disposable incomes in Latin America are projected to grow by nearly 60% in real terms from 2021 to 2040, driving substantial demand for medical foods. This economic growth is fueled by narrowing regional income disparities, technological advancement adoption, and structural shifts toward value-added economic sectors that generate higher wages and improve living standards. Enhanced purchasing power directly benefits the healthcare sector by increasing accessibility to specialized nutrition solutions previously available only to affluent consumers. Personalized dietary solutions are gaining significant popularity among health-conscious consumers seeking proactive wellness strategies and evidence-based approaches to disease prevention and management. Pharmacies and wellness centers throughout the region are prominently highlighting medical nutrition offerings as integral components of tailored healthcare routines, ensuring easier access for consumers across diverse income brackets through expanded product availability, payment flexibility, and professional guidance. The ability to invest in high-quality medical formulations reflects a growing societal shift toward preventive health measures, recognizing that nutritional interventions represent cost-effective strategies for reducing long-term healthcare expenditures associated with poorly managed chronic diseases. Medical nutrition products designed specifically for malnutrition management, post-surgical recovery, and chronic illness support are experiencing expanding adoption rates, paving pathways for robust market growth throughout the forecast period as healthcare infrastructure continues modernizing and consumer health literacy improves.

Middle East and Africa Medical Foods Market Analysis

The expansion of healthcare facilities is directly influencing the rising use of medical foods in this region. New clinics and hospitals integrate nutrition-focused approaches into patient care, emphasizing tailored dietary regimens for managing malnutrition, post-surgical recovery, and metabolic disorders. These facilities frequently collaborate with nutrition experts to develop personalized therapeutic plans, ensuring accessibility for patients in both urban and rural areas. The increased availability of specialized medical infrastructure aligns with efforts to provide comprehensive care, highlighting the critical role of targeted nutrition. As healthcare networks continue to grow, medical foods are becoming integral components of the patient treatment experience, promoting wider adoption across diverse demographics.

Competitive Landscape:

The global medical foods market is characterized by intense competition due to the increasing demand for specialty nutritional solutions designed for the management of chronic diseases. Formulation innovations, driven by the rising incidence and prevalence of diabetes, cancer, and neurological disorders, permeate medical food offerings from manufacturers. Divergence in regional regulation and changing dietary requirements propel product innovation and market access. Key players in the market are actively involved in huge research operations to innovate and improvise product formulations to ensure better efficacy and compliance by patients. Strategic mergers, acquisitions, and collaborations are very common to enhance market presence and distribution capabilities. Pricing, quality, and targeted efficacy always remain central to competitive strategies.

The report provides a comprehensive analysis of the competitive landscape in the medical foods market with detailed profiles of all major companies, including:

- Abbott Healthcare Private Limited

- Alfasigma S.p.A.

- Danone S.A.

- Fresenius Kabi AG

- Mead Johnson & Company LLC (Reckitt Benckiser)

- Medtrition Inc.

- Meiji Holdings Co. Ltd.

- Metagenics Inc. (Alticor)

- Nestlé S.A.

- Primus Pharmaceuticals Inc.

- Targeted Medical Pharma Inc.

- Victus Inc.

Latest News and Developments:

- May 2025: Otsuka Pharmaceutical Factory Inc. introduced HINEX Jelly Aqua, an updated liquid diet product designed to support hydration. This innovative product addresses the specific needs of patients requiring enhanced hydration support alongside nutritional supplementation.

- April 2025: Arla Foods Ingredients launched a new micellar casein isolate (MCI) to address the rising demand for high-quality ingredients for medical nutrition. This product innovation reflects the industry's commitment to developing advanced nutritional components that support patient health outcomes and meet evolving market demands.

- December 2024: Nestlé unveiled new products targeting the GLP-1 market, aiming to outpace competitors in the booming weight management segment. Capitalizing on society's growing focus on quick and efficient weight loss, the company leverages the rising demand for medical foods and supplements. These innovations address shifting consumer preferences for alternatives to traditional diet and exercise. Nestlé's aggressive approach highlights the lucrative opportunities in the GLP-1 and wellness market.

- December 2024: Lilavati Hospital, in collaboration with Sodexo, launched “Aarogyum,” a millet-based diet program to boost patient recovery and well-being. This initiative introduces nutrient-rich, immunity-boosting meals packed with protein, fiber, and essential vitamins. Millets are recognized for their benefits in digestion and gut health, vital for recovering patients. The program reflects the hospital's commitment to nutrition as a cornerstone of patient care. “Aarogyum” aims to promote quicker recovery and healthier dietary choices for improved overall health.

- September 2024: Dutch Medical Food B.V., a global leader in medical nutrition, partnered with India’s Pristine Pearl Pharma Pvt. Ltd. to launch innovative nutrition solutions. The collaboration introduces a range of medical foods targeting disease-related malnutrition in adults and children. With this calculated move, Dutch Medical Food enters the Indian market. The initiative aims to address the growing demand for tailored nutrition in managing chronic diseases. It highlights the importance of medical foods in improving patient health outcomes.

- May 2024: Solarea Bio announced the beta launch of Bondia, a novel daily medical food designed to manage postmenopausal bone loss using synbiotic capsules. The product, developed from fruit and vegetable-derived microbes, underwent clinical validation and a private beta program to evaluate its effectiveness.

Medical Foods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Pills, Powder, Others |

| Route of Administrations Covered | Oral, Enteral |

| Applications Covered | ADHD, Depression, Diabetes, Cancer, Alzheimer's Disease, Metabolic Disorders, Others |

| Distribution Channels Covered | Supermarkets, Hospital and Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Abbott Healthcare Private Limited, Alfasigma S.p.A., Danone S.A., Fresenius Kabi AG, Mead Johnson & Company LLC (Reckitt Benckiser), Medtrition Inc., Meiji Holdings Co. Ltd., Metagenics Inc. (Alticor), Nestlé S.A., Primus Pharmaceuticals Inc., Targeted Medical Pharma Inc., Victus Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical foods market from 2019-2033.

- The medical foods market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical foods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical foods are specially formulated products intended for the dietary management of specific diseases or conditions with distinct nutritional requirements. They are used under medical supervision and differ from conventional foods or supplements. The common applications of these foods include managing metabolic disorders, Alzheimer's, or gastrointestinal diseases and providing essential nutrients patients cannot obtain through regular diets.

The global Medical Foods market was valued at USD 24.49 Billion in 2024.

IMARC estimates the global medical foods market to exhibit a CAGR of 4.78% during 2025-2033.

The key factors driving the global medical foods market are rising prevalence of chronic diseases, increasing geriatric population, growing awareness of clinical nutrition, and advancements in medical food formulations that target disease-specific dietary needs.

According to the report, powder represented the largest segment by product, driven by its longer shelf life, ease of storage and transport, and suitability for a wide range of nutritional formulations tailored to specific health needs.

According to the report, oral represented the largest segment by route of administration, driven by patient preference, ease of consumption and the availability of diverse oral formulations designed for effective disease management and improved patient outcomes.

According to the report, diabetes represented the largest segment by applications, driven by the growing diabetic population, and increasing reliance on nutritional interventions to manage blood glucose and related complications effectively.

According to the report, hospital and retail pharmacies represented the largest segment by distribution channel, driven by widespread accessibility, healthcare provider recommendations, and patient trust in established pharmaceutical channels.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global medical foods market include Abbott Healthcare Private Limited, Alfasigma S.p.A., Danone S.A., Fresenius Kabi AG, Mead Johnson & Company LLC (Reckitt Benckiser), Medtrition Inc., Meiji Holdings Co. Ltd., Metagenics Inc. (Alticor), Nestlé S.A., Primus Pharmaceuticals Inc., Targeted Medical Pharma Inc., and Victus Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)