Medical Gases Market Size, Share, Trends and Forecast by Gas Type, Application, End User, and Region, 2025-2033

Medical Gases Market Size and Share:

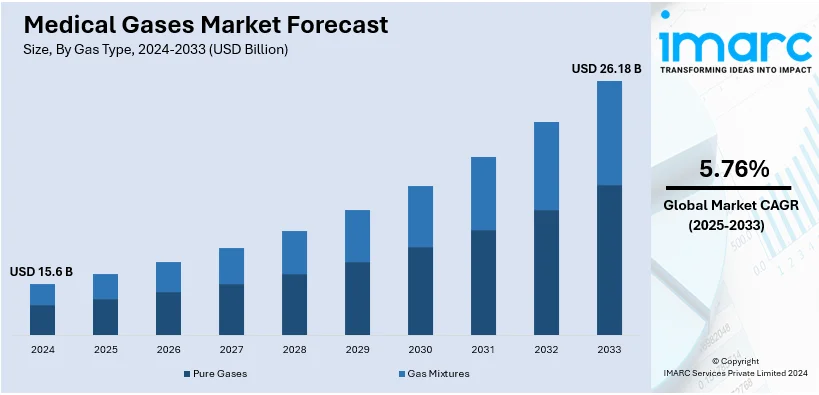

The global medical gases market size was valued at USD 15.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.18 Billion by 2033, exhibiting a CAGR of 5.76% during 2025-2033. North America currently dominates the market, holding a market share of over 37.8% in 2024. The rising prevalence of chronic diseases such as respiratory and cardiovascular diseases (CVDs), various advancements in medical technology, and the increasing trend toward home healthcare and telemedicine are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.6 Billion |

| Market Forecast in 2033 | USD 26.18 Billion |

| Market Growth Rate 2025-2033 | 5.76% |

Surgical procedures, both elective and emergency, often require the use of medical gases like oxygen, nitrous oxide, and carbon dioxide for anesthesia and patient care. It is estimated that around 2.5 to 4 million patients are admitted every year in the United States with emergency general surgery (EGS) conditions. As surgical techniques advance, the number of surgeries being performed worldwide continues to rise. This includes not only traditional surgeries but also minimally invasive surgeries (MIS) that require specific gas mixtures for anesthesia and to maintain a clear surgical field. Hospitals and surgical centers, therefore, rely heavily on medical gases to ensure that these procedures are carried out safely and effectively.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor with a market share of 85.40% in North America. It is driven by the growing geriatric population that is contributing significantly to the demand for surgeries, especially those related to aging issues like joint replacements, cataract removals, and heart surgeries. It has been reported that more than four million cataract surgeries are performed in the United States annually. This number is growing 3-4% each year and is expected to reach six million by the year 2030. Additionally, an increase in elective procedures, such as cosmetic surgeries, is pushing the need for medical gases even further. Nearly 25.4 million cosmetic minimally invasive procedures were performed in the country during the same period. As the complexity of surgeries continues to increase with the development of advanced technologies and techniques, the need for specialized gases, such as anesthetic gases and gases for ventilators, is also on the rise.

Medical Gases Market Trends:

Increasing Incidences of Chronic Diseases Such as Respiratory and Cardiovascular Diseases

The growing prevelance of respiratory diseases, such as chronic obstructive pulmonary disease (COPD), asthma, and interstitial lung diseases, demands medical gases like oxygen for respiratory support. The World Health Organization (WHO) indicates that chronic respiratory diseases (CRDs), which include chronic obstructive pulmonary disease (COPD), asthma, and interstitial lung diseases, are increasing. COPD alone caused approximately 3.2 million deaths worldwide in 2019, and the Global Asthma Report indicates that asthma impacts an estimated 262 million people worldwide. Patients experiencing breathing difficulties require oxygen therapy, which is essential for maintaining adequate oxygen levels in their bloodstream and alleviating symptoms. Besides, cardiovascular disorders, including heart failure, coronary artery disease, and hypertension, often require medical gases for diagnostic purposes and during medical interventions. Nitrous oxide is utilized as an anesthetic agent during cardiovascular surgeries, ensuring patient comfort and stability. Moreover, medical gases are indispensable in providing palliative care to patients with advanced stages of chronic diseases.

Various Advancements in Medical Technology

Technological advancements have led to the development of minimally invasive (MI) surgical procedures, such as laparoscopy and endoscopy. Medical gases like carbon dioxide are used to create a clear operating field, enabling surgeons to perform procedures with smaller incisions, faster patient recovery and reduced tissue trauma. Moreover, advancements in respiratory therapy equipment have enabled more targeted and personalized treatment for respiratory disorders. According to the World Health Organization, chronic respiratory diseases (CRDs), including COPD and asthma, are increasing globally, with approximately 262 million people affected by asthma and 3.2 million deaths attributed to COPD in 2019. Medical gases like oxygen are administered through advanced oxygen therapy devices, including oxygen concentrators and portable oxygen delivery systems. Besides, various advances in cryosurgery and dermatology have expanded the use of medical gases like liquid nitrogen for freezing and destroying abnormal or diseased tissue. Cryotherapy devices offer controlled and targeted treatment, minimizing damage to surrounding healthy tissue, thus propelling the market.

Increasing Trend Toward Home Healthcare and Telemedicine

Home healthcare often involves the provision of medical gases like oxygen to patients in their own residences. Patients with chronic respiratory conditions such as COPD require oxygen therapy to manage their symptoms and improve their quality of life. The trend toward home healthcare allows patients to receive oxygen therapy without the need for prolonged hospital stays, leading to increased demand for medical oxygen gases. Moreover, medical gases have various applications beyond oxygen therapy, such as nebulization, pain management, and respiratory treatments. This trend reduces the need for prolonged hospital stays, increasing the demand for medical oxygen. Furthermore, with an estimated 17.9 million global deaths from cardiovascular diseases annually, medical gases, including oxygen, are also vital for managing related conditions, enhancing the demand for home treatments. The expansion of home healthcare and telemedicine allows patients to receive a wider range of medical gas treatments in the comfort of their homes, further driving the demand for medical gases.

Medical Gases Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical gases market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on gas type, application, and end user.

Analysis by Gas Type:

- Pure Gases

- Medical Air

- Medical Oxygen

- Nitrous Oxide

- Nitrogen

- Carbon Dioxide

- Helium

- Gas Mixtures

- Aerobic Gas Mixtures

- Anaerobic Gas Mixtures

- Blood Gas Mixtures

- Lung Diffusion Mixtures

- Medical Laser Mixtures

- Medical Drug Gas Mixtures

- Others

Pure gases (medical oxygen) lead the market with around 57.8% of market share in 2024. Pure gases are essential for medical applications that require precise concentrations and accurate dosages. Medical procedures such as diagnostic testing, anesthesia, amnd respiratory therapy, necessitate gases with consistent and known compositions to achieve reliable results. Moreover, many medical procedures require a controlled environment to achieve desired outcomes. Pure gases provide the necessary control over variables like gas composition and pressure, ensuring optimal conditions for treatments, surgeries, and therapies. Besides, medical equipment and devices are calibrated and designed to work with specific gas compositions. Pure gases maintain the integrity of medical equipment and help prevent malfunctions that could impact patient care.

Analysis by Application:

- Therapeutic

- Diagnostic

- Biotechnology and Pharmaceutical Industry

- Others

Therapeutic leads the market with around 42.4% of market share in 2024. Medical gases, especially oxygen, are extensively used to manage respiratory conditions such as chronic obstructive pulmonary disease (COPD), asthma, and respiratory distress syndrome. Therapeutic oxygen delivery supports patients with compromised breathing and improves their quality of life. Besides, medical gases are indispensable in critical care units and emergency settings. They are administered to stabilize patients with acute respiratory distress, trauma, cardiac arrest, and other life-threatening conditions, playing a pivotal role in preventing further complications. Moreover, these gases are integrated into various rehabilitation and physiotherapy programs. They assist patients recovering from injuries, surgeries, or neurological disorders, aiding in improved breathing and overall well-being.

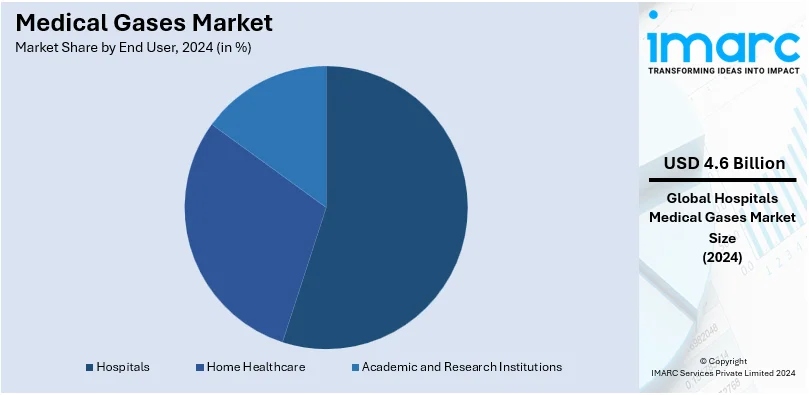

Analysis by End User:

- Hospitals

- Home Healthcare

- Academic and Research Institutions

Hospitals leads the market with around 29.8% of market share in 2024. Hospitals provide a wide range of medical services, including surgeries, emergency care, critical care, diagnostics, and treatments. Medical gases are utilized extensively in these diverse medical applications, such as anesthesia during surgeries, oxygen therapy for patients with respiratory conditions, and medical gas mixtures for diagnostic procedures. Moreover, hospitals perform a multitude of surgical procedures, ranging from routine surgeries to complex operations. Medical gases like oxygen and anesthetic gases are crucial for ensuring patient safety, comfort, and successful outcomes during surgical interventions. Besides, diagnostic imaging procedures, such as magnetic resonance imaging (MRI) and computed tomography (CT) scans, often involve the use of medical gases. These gases can be used to create contrast agents for enhanced imaging accuracy.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.8%. North America boasts advanced healthcare infrastructure, including well-established hospitals, clinics, research centers, and medical facilities. This robust infrastructure creates a high demand for medical gases for various medical procedures, surgeries, diagnostics, and patient care. Moreover, the region is a hub for medical research and technological innovation. Technological advancements in medical treatments, procedures, and diagnostic tools often require specialized medical gases for accurate diagnostics and efficient interventions, further driving the demand for these gases. Besides, the high prevalence of chronic diseases in North America, such as respiratory disorders, cardiovascular diseases, and diabetes, drives the demand for medical gases for treatments, therapies, and life support systems.

Key Regional Takeaways:

United States Medical Gas Market Analysis

The U.S. is leading the market in North America with over 85.40% market share. The U.S. medical gases market is booming with the advancement in health care and increased demand both in hospitals and home care settings. According to American Hospital Association, more than 33 million inpatient admissions took place in 2022, which has escalated the demand for oxygen and anesthetic gases. Other key drivers include the home healthcare market, furthered by the widespread adoption of portable oxygen concentrators. As indicated by the National Institute on Aging, around 15 million Americans have a need for respiratory treatments. Major companies such as Air Products and Praxair focus on innovation and sustainability to gain market power. An improved healthcare infrastructure with emergency preparedness from the U.S. government increases market demand. Strong partnerships between the manufacturers and health providers expand access to important medical gases. Enhanced regulation ensures safe and quality productions, further stabilizing the market to grow. Export of U.S.-produced gases to international markets also adds to its dominance.

Europe Medical Gas Market Analysis

European medical gases are growing by technology advancement and an age of people needing respiratory care. As many as over 100 million Europeans suffer from chronic respiratory diseases, thereby creating more demand for oxygen therapy; and market consumption in Germany, France, and the UK is dominating as the countries have advanced health systems with a higher prevalence rate of the diseases. According to the German Federal Statistical Office, health-care spending in Germany stood at EUR 489 billion (USD 491.8) in 2022, thereby continuously investing into resources like medical gases, and green initiatives are developed and adopted by adopting eco-friendly cylinders made of gas and sustainable modes of production. Air Liquide and Linde are leading-edge innovation providers with substantial research investments into enhancing product performance and efficiency. The collaboration between governments and private entities ensures wide accessibility and high quality.

Asia Pacific Medical Gas Market Analysis

Asia Pacific's medical gases market is highly growing with rising healthcare investment and the burden of disease. According to the World Bank, healthcare spending in China has increased to USD 1.2 Trillion by 2022, thus supporting the modernization of infrastructures and the use of advanced gas delivery systems. In India, the National Health Mission spends considerable sums on oxygen supply, especially to rural regions, hence increasing wider accessibility. According to Financial Express news article, India has allocated a 12% increase in healthcare budget for 2023, a proof of commitment towards health reform from the government side. Taiyo Nippon Sanso, one of the leading companies, with the support of local entities, develops cheaper solutions. Demand for specialty gases also rises as with the growth in demand for nitric oxide in neonatal care. Regulations toward quality assurance and safety add value to this growth.

Latin America Medical Gas Market Analysis

The Latin American medical gases market is gradually growing with the rise in healthcare access and improvement in medical technologies. As reported by an industrial report, the healthcare expenditure of Brazil constituted 13% of GDP in 2022, which further enhances the demand for essential gases like oxygen and nitrous oxide. Demand from medical tourism in countries like Costa Rica and Mexico is also boosting demand, as hospitals seek to acquire advanced equipment and gases to attract international patients. According to an article, more than 20% of Latin Americans are afflicted with respiratory diseases, which further fuels demand for therapeutic gases. Local players such as Indura S.A. collaborate with global companies to enhance production capacity and facilitate technology transfer. Government-supported schemes, such as subsidies for the rural health centers, promote wider use of medical gases.

Middle East and Africa Medical Gas Market Analysis

The Middle East and Africa medical gases market is growing by increasing healthcare infrastructure development and further rising disease burden. In 2022, as reported by the International Trade Administration, Saudi Arabia allocated more than USD 50 Billion to healthcare, directed toward advanced hospital infrastructure and acute care units. Oxygen therapy demand increased in Africa because respiratory diseases such as pneumonia remain at the top of the mortalities list. Regional companies, like African Oxygen Limited (Afrox) engage with international companies to increase their production scale and fulfil regional demands. By building hospitals and healthcare facilities, governments like that of Saudi Vision 2030 enhance modernization, and medical gases consumption increases.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of multiple players that include emerging startups, established brands, and specialty manufacturers. Presently, leading companies are focusing on innovating their medical gas offerings by introducing advanced gas mixtures, specialized formulations, and new delivery methods to cater to evolving medical needs and treatment modalities. They are also forming strategic partnerships with healthcare providers, hospitals, clinics, and research institutions to establish a strong network and secure long-term contracts. Besides, companies are expanding their market presence through geographical expansion, entering emerging markets with growing healthcare infrastructure, and establishing new distribution channels to reach a wider customer base.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Air Liquide Healthcare

- Air Products and Chemicals, Inc.

- Airgas, Inc

- Ellenbarrie Industrial Gases Limited

- INOX-Air Products Inc

- Linde PLC

- MATHESON Tri-Gas, Inc

- Messer SE & Co. KGaA

- Sharjah Oxygen Company

- SOL Spa

- Taiyo Nippon Sanso Corporation

Latest News and Developments:

- December 2024: SOL Group expanded its Spain presence by acquiring 51% of SISEMED, a clinical engineering firm, in partnership with Costaisa Group. This company specializes in electromedical equipment management and recorded a turnover of Euro 8 Million (USD 8.46 Million) in the year 2023. This acquisition is in line with the international expansion strategy of the Iberian Peninsula by SOL.

- October 2024: Air Liquide said that they will be investing USD 150 million in upgrading its pipeline network and production capacity in Tennessee, U.S. under a long-term agreement with LG Chem. Such an expansion supports LG Chem's cathode active material plant for electric vehicle batteries and enhances Air Liquide's Industrial Merchant market and is scheduled to be commissioned by 2027.

- October 2024: Linde agreed to de-capture two air separation units and increase industrial gas supply to Tata Steel Limited in the Indian state of Odisha under an existing agreement.

- September 2024: Air Products completed the USD 1.81 billion sale of its LNG process equipment and technology business to Honeywell. This strategic investment supports the company's increased focus on its industrial gases and clean hydrogen growth strategy. This transaction involves intellectual property, assets, and a total of around 475 employees.

- June 2024: Messer has commissioned a new production site in Estella, Spain. This production center will be utilized to expand the filling of industrial, food, medical, and specialty gases. The renewable energy-powered plant is expected to produce 250,000 gas cylinders each year and create 25 jobs. It will also be certified for pharmaceutical gas production and green hydrogen filling.

Medical Gases Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gas Types Covered |

|

| Applications Covered | Therapeutic, Diagnostic, Biotechnology and Pharmaceutical Industry, Others |

| End Users Covered | Hospitals, Home Healthcare, Academic and Research Institutions |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide Healthcare, Air Products and Chemicals, Inc., Airgas, Inc, Ellenbarrie Industrial Gases Limited, INOX-Air Products Inc, Linde PLC, MATHESON Tri-Gas, Inc, Messer SE & Co. KGaA, Sharjah Oxygen Company, SOL Spa, Taiyo Nippon Sanso Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical gases market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global medical gases market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical gases are used in healthcare settings for diagnostic, therapeutic, and anesthetic purposes. Common examples include oxygen, nitrous oxide, medical air, carbon dioxide, and helium. These gases are essential for patient care, assisting with breathing support, anesthesia, pain relief, and medical procedures.

The medical gases market was valued at USD 15.6 Billion in 2024.

IMARC estimates the global medical gases market to exhibit a CAGR of 5.76% during 2025-2033.

The key factors driving the global medical gases market include the rising demand for advanced healthcare services, growing geriatric population, increased prevalence of chronic diseases, heightened surgical procedures, and expanding healthcare infrastructure. Additionally, technological advancements in medical gas delivery systems contribute to the market growth.

According to the report, pure gases (medical oxygen) represented the largest segment by gas type, due to its essential role in treating various medical conditions, particularly respiratory diseases, where oxygen is crucial for patient care.

Therapeutic leads the market by application as medical gases like oxygen and nitrous oxide are vital for treating a wide array of health conditions, including chronic respiratory diseases.

Hospitals are the leading segment by end user, due to their high demand for various gases necessary for patient treatment, especially during critical care scenarios.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global medical gases market include Air Liquide Healthcare, Air Products and Chemicals, Inc., Airgas, Inc, Ellenbarrie Industrial Gases Limited, INOX-Air Products Inc, Linde PLC, MATHESON Tri-Gas, Inc, Messer SE & Co. KGaA, Sharjah Oxygen Company, SOL Spa, Taiyo Nippon Sanso Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)