Global Medical Gases Market Expected to Reach USD 26.18 Billion by 2033 - IMARC Group

Global Medical Gases Market Statistics, Outlook and Regional Analysis 2025-2033

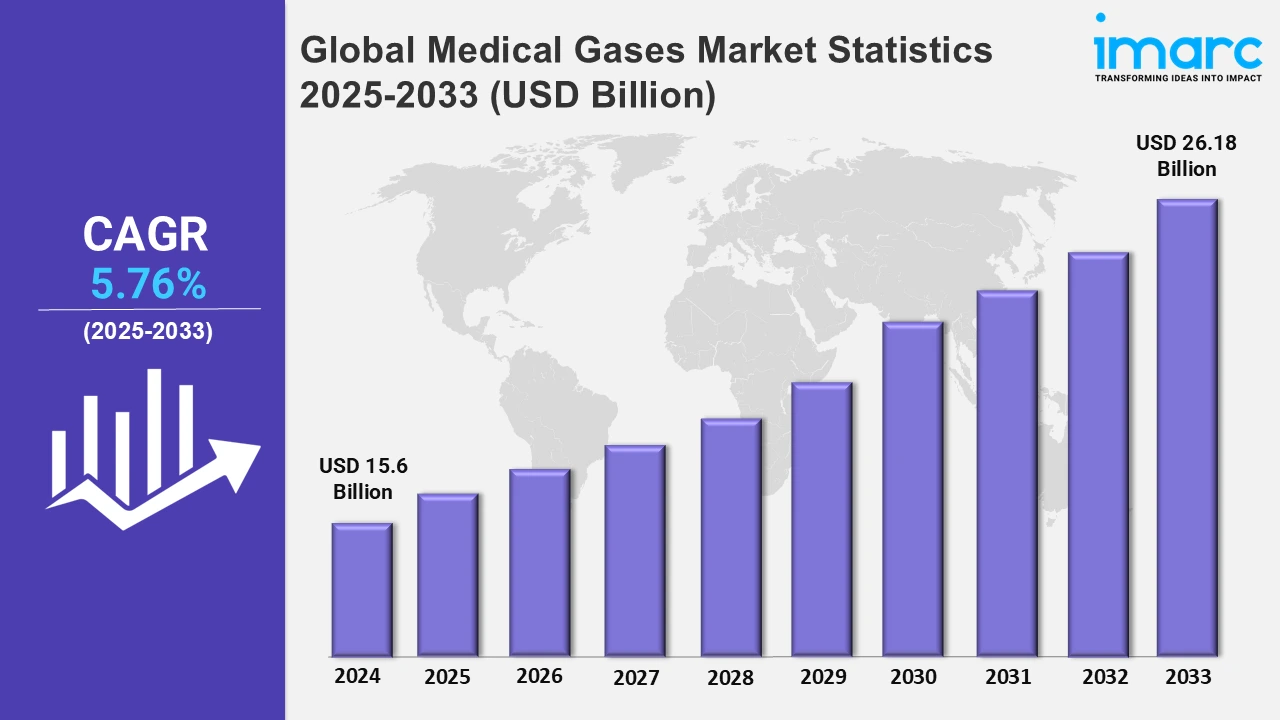

The global medical gases market size was valued at USD 15.6 Billion in 2024, and it is expected to reach USD 26.18 Billion by 2033, exhibiting a growth rate (CAGR) of 5.76% from 2025 to 2033.

To get more information on this market, Request Sample

The medical gases market is witnessing increasing adoption of low-carbon solutions as healthcare systems prioritize sustainability. Growing emissions regulations and environmental goals drive demand for eco-friendly medical gas supply across various regions. For instance, in January 2025, Air Liquide launched its low-carbon medical gas supply in Europe and Brazil, extending its ECO ORIGIN solution to cut emissions. The company secured its first Brazilian contract at a São Paulo hospital, supporting healthcare’s sustainability efforts.

Additionally, local production of medical oxygen is increasing in developing regions to improve accessibility and affordability. Regional manufacturing facilities are scaling up production, cutting costs, and making oxygen more available to healthcare systems. For instance, in October 2024, Unitaid invested USD 22 Million to support three Kenyan and Tanzanian manufacturers in establishing the East African Program on Oxygen Access. This marked Africa’s first regional liquid oxygen production initiative, aimed at increasing oxygen production by 300% and reducing prices by up to 27%. The program focused on East and Southern Africa, improving medical oxygen access, lowering costs for healthcare systems, and enabling the treatment of thousands more patients each month. Besides this, new technologies like portable oxygen concentrators, digital flow meters, and automated monitoring systems are making gas delivery more efficient, safer, and precise. These innovations not only improve patient care but also increase the reliability of the gas supply. The addition of remote monitoring and smart systems helps streamline management, reduce errors, and enhance healthcare results. As these technologies continue to evolve, they’re improving access to quality care in various healthcare settings.

Global Medical Gases Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America exhibited a clear dominance in the market owing to the rising healthcare spending.

North America Medical Gases Market Trends:

North America dominates the overall market, accounting for approximately 37.8% share in 2024 due to an increase in home healthcare. As more patients opt for home care, the demand for portable oxygen concentrators and oxygen therapy equipment grows. Companies such as Linde Healthcare are delivering these solutions, which improve patient comfort while lowering dependency on healthcare facilities.

Europe Medical Gases Market Trends:

In Europe, regulatory changes and standards for medical gases are supporting the market. The implementation of the European Pharmacopeia (EP) ensures higher safety standards in medical gas production and usage. Moreover, various companies like Air Liquide have adopted these standards to ensure compliance, fostering trust in medical gas products and contributing to the region’s robust market growth.

Asia Pacific Medical Gases Market Trends:

In the Asia Pacific region, there is an extensive increase in healthcare infrastructure development. Countries like China and India are expanding their healthcare facilities, boosting demand for medical gases like oxygen. Also, Praxair has been expanding its operations in these regions to support the growing healthcare sector.

Latin America Medical Gases Market Trends:

In Latin America, the medical gases market growth is fueled by improving healthcare access and rising surgical procedures. For instance, Brazil has seen increased utilization of oxygen and nitrous oxide in public healthcare initiatives. Efforts to combat respiratory diseases, including tuberculosis, also drive demand for medical-grade oxygen.

Middle East and Africa Medical Gases Market Trends:

In the Middle East and Africa, the growing elderly population is acting as one of the major growth-inducing factors. The need for medical gases such as nitrous oxide and oxygen, essential for treatments related to chronic conditions, is booming among senior adults. Also, the UAE, with a rapidly aging population, has witnessed an increase in hospitalizations requiring oxygen therapy for respiratory conditions, further supporting the market growth.

Top Companies Leading in the Medical Gases Industry

Some of the medical gases market companies include Air Liquide Healthcare, Air Products and Chemicals, Inc., Airgas, Inc, Ellenbarrie Industrial Gases Limited, INOX-Air Products Inc, Linde PLC, MATHESON Tri-Gas, Inc, Messer SE & Co. KGaA, Sharjah Oxygen Company, SOL Spa, and Taiyo Nippon Sanso Corporation, among many others. For instance, in December 2024, SOL Group expanded its footprint in Spain by acquiring SISEMED, which is one of the clinical engineering firms, in cooperation with Costaisa Group. This company generally specializes in the management of electromedical equipment. This acquisition aligns with SOL's worldwide expansion strategy for the Iberian Peninsula. Furthermore, Air Products, in September 2024, completed the sale of its LNG process equipment worth about USD 1.81 Billion.

Global Medical Gases Market Segmentation Coverage

- On the basis of the gas type, the market has been bifurcated into pure gases (medical air, medical oxygen, nitrous oxide, nitrogen, carbon dioxide, and helium) and gas mixtures (aerobic gas mixtures, anaerobic gas mixtures, blood gas mixtures, lung diffusion mixtures, medical laser mixtures, medical drug gas mixtures, and others), wherein pure gases accounted the most prominent share for about 57.8% of market dominance in 2024. Pure gases can be used in a wide range of medical treatments. Moreover, the escalating demand for these gases in hospitals is driving its dominance.

- Based on the application, the market is categorized into therapeutic, diagnostic, biotechnology and pharmaceutical industry, and others, amongst which therapeutic held the largest market share with approximately 42.4% of market share in 2024. Therapeutic oxygen aids patients with breathing difficulties, enhancing their overall well-being and quality of life, which in turn drives the growth of this market segment.

- On the basis of the end user, the market has been divided into hospitals, home healthcare, academic and research institutions. Among these, hospitals acquired the largest share with a market share of around 29.8% in 2024, as they rely on oxygen and other gases for patient care and surgeries.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 15.6 Billion |

| Market Forecast in 2033 | USD 26.18 Billion |

| Market Growth Rate 2025-2033 | 5.76% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gas Types Covered |

|

| Applications Covered | Therapeutic, Diagnostic, Biotechnology and Pharmaceutical Industry, Others |

| End Users Covered | Hospitals, Home Healthcare, Academic and Research Institutions |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Air Liquide Healthcare, Air Products and Chemicals, Inc., Airgas, Inc, Ellenbarrie Industrial Gases Limited, INOX-Air Products Inc, Linde PLC, MATHESON Tri-Gas, Inc, Messer SE & Co. KGaA, Sharjah Oxygen Company, SOL Spa, Taiyo Nippon Sanso Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Medical Gases Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)