Medical Membrane Market Size, Share, Trends and Forecast by Technology, Material, Application, and Region, 2025-2033

Medical Membrane Market Size and Share:

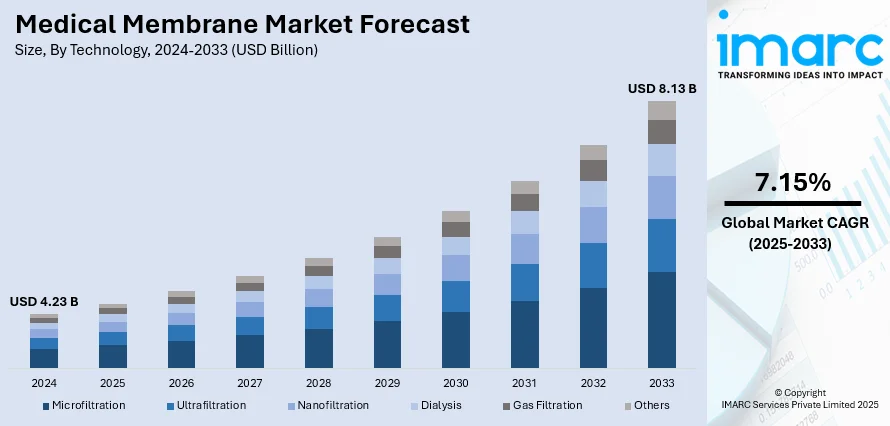

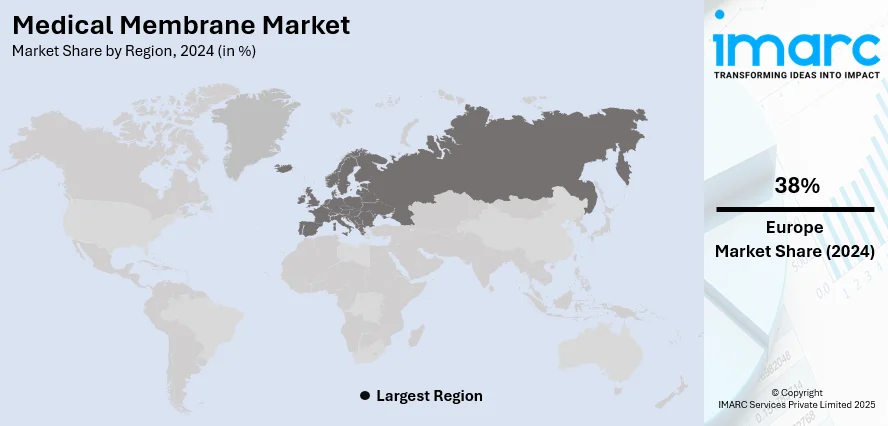

The global medical membrane market size was valued at USD 4.23 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.13 Billion by 2033, exhibiting a CAGR of 7.15% from 2025-2033. Europe currently dominates the market, holding a market share of 38% in 2024. The dominance of the market is attributed to the strong investments in healthcare infrastructure, presence of advanced manufacturing capabilities, supportive regulatory frameworks, and high adoption of innovative medical technologies. Continuous research initiatives and favorable government policies further reinforce the region’s leadership, thereby influencing the medical membrane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.23 Billion |

|

Market Forecast in 2033

|

USD 8.13 Billion |

| Market Growth Rate 2025-2033 | 7.15% |

The growing prevalence of chronic conditions, such as kidney diseases and diabetes, is driving the need for medical membranes in areas like hemodialysis and wound treatment. With patients needing consistent and enduring treatment options, membranes are increasingly becoming vital for enhancing clinical results and facilitating contemporary therapeutic methods. Moreover, advancements in polymer technology and membrane design are creating solutions that are more efficient, long-lasting, and biocompatible. These enhancements boost efficiency in filtration, separation, and sterilization methods, encouraging broader use in medical devices and healthcare systems, as well as aiding the creation of innovative, next-generation therapeutic solutions. Besides this, rigorous regulations for sterilization and product safety are strengthening the dependence on high-quality membranes. Manufacturers and healthcare practitioners must adhere to stringent regulations, leading to a heightened need for membranes that ensure uniformity, dependability, and safety in both clinical procedures and pharmaceutical manufacturing settings.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the continuous introduction of advanced wound care solutions that combine innovation, durability, and clinical effectiveness. New product developments with improved structural properties and regulatory approvals support broader adoption, while reimbursement pathways enhance accessibility, strengthen the market growth and reinforcing the role of membranes in modern healthcare. In 2024, BioLab Holdings, Inc., a US-based medical manufacturer, launched its Tri-Membrane Wrap, a triple-layered amniotic skin substitute designed for deep and hard-to-cover wounds. The product featured enhanced thickness and strength, allowing for suturing and use with wound VAC systems. It was registered with the FDA in the United States and became available under Medicare with HCPCS code Q4334.

Medical Membrane Market Trends:

Rising Geriatric Population

A consistent rise in the worldwide elderly population is a major factor catalyzing the demand for medical membranes. According to the WHO, by 2030, one out of every six individuals worldwide will be 60 years old or older. The population of individuals aged 80 and above is projected to increase threefold from 2020 to 2050, reaching 426 million. Elderly people are more prone to intricate and long-lasting health problems, frequently requiring extended treatments like dialysis, oxygen therapy, and intravenous feeding. Medical membranes are crucial to these therapies, offering vital roles, such as blood cleansing, regulated fluid transfer, and sterile medication administration. There is a higher demand for technologies that guarantee safety, consistency, and lower infection risks is especially critical, due to the increased susceptibility of elderly patients to complications. Healthcare systems are progressively concentrating on creating devices that not only prolong life but also enhance the quality of care for older adults, positioning membranes at the core of this initiative.

Increasing Chronic Disease Burden

The growing occurrence of chronic illnesses is heightening dependence on medical membranes in various healthcare sectors. Conditions like diabetes, heart disease, kidney problems, and lung infections frequently necessitate continuous medical treatments, with many relying on membrane-based technologies. According to the latest International Diabetes Federation (IDF) Diabetes Atlas (2025), 11.1% – or 1 in 9 – of adults (ages 20-79) are diagnosed with diabetes, with more than 40% unaware of their condition. As these diseases account for an increasing proportion of global morbidity, healthcare providers must ensure access to technologies that enhance patient outcomes while meeting rigorous quality standards. Membranes aid in allowing accurate separation, purification, and sterilization methods in clinical and pharmaceutical environments. Moreover, managing chronic conditions highlights the significance of consistent reliability and patient safety, qualities directly associated with superior membrane performance. This ongoing demand highlights the essential function of membranes in maintaining treatment strategies for an increasing worldwide challenge of chronic illness.

Advancements in High-Performance Membrane Development

Advancements in membrane technology is contributing to market growth, as producers are placing greater emphasis on creating high-quality materials that comply with global standards. Improved traits like elevated protein binding ability, consistent microporous designs, and prolonged stability greatly enhance diagnostic precision and dependability. These developments improve the function of membranes in vital applications, especially in medical diagnostics where reliability and sensitivity are crucial. Firms that invest in research and independent development acquire a competitive edge, broadening their product ranges while meeting increasing global healthcare needs. For instance, in 2025, Kingfa Medical announced it had independently developed a high-quality Nitrocellulose (NC) membrane for immunodiagnostics, now in production. This NC membrane offers high protein binding, uniform microporous structure, and long-term stability, reaching international standards. The capacity to meet globally recognized quality standards not only enhances acceptance in local markets but also aids in entering international supply chains, thereby bolstering the market growth.

Medical Membrane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical membrane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, material, and application.

Analysis by Technology:

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Dialysis

- Gas Filtration

- Others

Nanofiltration leads the market because of its exceptional capacity for accurate separation, all while ensuring high efficiency and affordability. It provides excellent selectivity for eliminating impurities, bacteria, and dissolved organic matter, making it very effective in adhering to stringent medical and pharmaceutical standards. Nanofiltration membrane offers an ideal balance between filtration precision and energy efficiency, making it highly suitable for large-scale healthcare and pharmaceutical applications. Its superior permeability, along with durability and resistance to fouling, guarantees reliable long-term performance in challenging situations. Technological progress is increasing the adaptability of nanofiltration, enabling its use in diverse medical applications, ranging from water filtration for healthcare institutions to sophisticated drug manufacturing. The growing demand for dependable, high-quality filtration techniques that guarantee patient safety and product purity further enhances the role of nanofiltration, reinforcing its status as the top technology in the medical membrane sector.

Analysis by Material:

- Acrylics

- Polypropylene (PP)

- Polyvinylidene Fluoride (PVDF)

- Polysulfone (PSU) and Polyether Sulfone (PESU)

- Polytetrafluoroethylene (PTFE)

- Others

Polysulfone (PSU) and polyether sulfone (PESU) represent the largest segment, accounting for 32.2% market share, owing to their excellent mechanical strength, thermal stability, and chemical resistance, making them ideal for rigorous medical applications. These materials demonstrate excellent biocompatibility and resilience, guaranteeing reliable functionality in essential healthcare procedures. Their capacity to uphold structural integrity during demanding sterilization conditions, such as autoclaving and contact with potent cleaning agents, increases their dependability. Ongoing improvements in processing technologies are enhancing the porosity and selectivity of PSU and PESU membranes, allowing for greater efficiency in filtration and separation processes. Their ability to adjust across various medical devices and procedures highlights their flexibility and enduring worth. The growing need for high-performance membranes in healthcare, pharmaceuticals, and diagnostics is solidifying the superiority of these materials and establishing PSU and PESU as the favored options in the market.

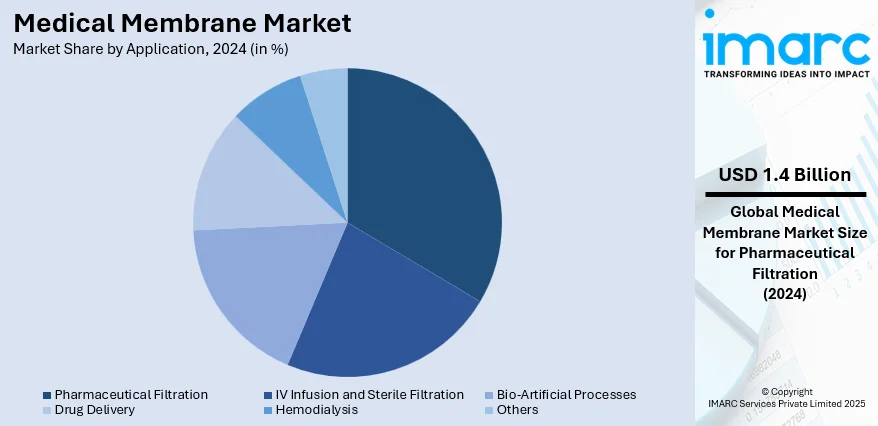

Analysis by Application:

- Pharmaceutical Filtration

- IV Infusion and Sterile Filtration

- Bio-Artificial Processes

- Drug Delivery

- Hemodialysis

- Others

Pharmaceutical filtration holds the biggest market share of 33.8%, accredited to its essential role in guaranteeing the purity, safety, and efficacy of drug formulations. The procedure is crucial for eliminating impurities, microbes, and particulate substances, thus fulfilling stringent quality and regulatory requirements. Ongoing progress in membrane technology is improving the effectiveness, dependability, and scalability of pharmaceutical filtration, facilitating its increasing use in various drug manufacturing processes. The growing intricacy of contemporary pharmaceuticals, such as biologics and specialty drugs, is catalyzing the demand for accurate and high-performance filtration systems. Increasing funding in research operations, along with the rising pharmaceutical manufacturing sector, further enhances its market leadership. Moreover, the need for uniform product quality and sterile manufacturing conditions strengthens dependence on sophisticated filtration technologies. Collectively, these elements establish pharmaceutical filtration as the primary application segment, fostering innovation and sustained expansion in the medical membrane market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe dominates the market with a share of 38%, because of its robust healthcare infrastructure, superior research and development (R&D) capabilities, and a significant presence of top manufacturers dedicated to innovation. The area benefits from a well-trained labor force and considerable funding in medical technology, promoting the advancement and implementation of next-generation membrane solutions. Supportive regulatory structures guarantee quality, safety, and dependability, which enhances market trust and accelerate wider adoption in healthcare and pharmaceutical industries. Additionally, there is a high prevalence of long-term illnesses and chronic health conditions, which requires advanced medical treatments and technologies. According to Eurostat, over one-third of individuals in the EU reported experiencing a long-term illness or health issue in 2024. This trend underscores the growing reliance on efficient membrane solutions to support healthcare delivery and improve patient outcomes across the region. Furthermore, ongoing government backing for healthcare innovations and extended funding initiatives fosters stability and expansion in the industry.

Key Regional Takeaways:

United States Medical Membrane Market Analysis

In North America, the market portion held by the United States was 92.00%, driven by increasing demand for cutting-edge filtration technologies in therapeutic uses. The rising incidence of chronic illnesses is resulting in greater reliance on dialysis, drug distribution systems, and sterile filtration methods. Significantly, the National Institute of Diabetes and Digestive and Kidney Diseases emphasizes that approximately 1 in 3 individuals with diabetes and 1 in 5 individuals with hypertension suffer from kidney disease. Additionally, the nation's robust healthcare system and increasing funding in medical research are fostering the utilization of advanced membrane materials. The emphasis on biopharmaceutical production and precision medicine is also encouraging the adoption of specialized membrane technologies. Furthermore, the enforcement of strict regulatory standards concerning product quality and patient safety is driving advancements in membrane design and functionality. Government incentives that encourage local production of essential healthcare components is also offering a favorable medical membrane market outlook.

North America Medical Membrane Market Analysis

The North America medical membrane market is propelled by an increasing need for innovative filtration technologies in healthcare, biotechnology, and pharmaceutical production. Rising instances of chronic diseases and the growth of diagnostic testing are encouraging the use of membranes in drug delivery, hemodialysis, and sterile filtration procedures. In 2025, BioLab Holdings, Inc. launched its largest clinical trial to date, BIOCAMP, evaluating four human placental membrane (HPM) products plus standard of care (SOC) versus SOC alone for treating chronic wounds. The study will enroll 650 patients with diabetic foot and venous leg ulcers across up to 30 US sites. BioLab aims to generate robust real-world evidence supporting its amnion-based regenerative therapies. Moreover, strict regulations for product safety and sterilization are encouraging healthcare providers and manufacturers to depend on high-performance membrane solutions. The increase in hospital admissions, rising investments in healthcare facilities, and a shift towards less invasive procedures are further contributing to the medical membrane market growth in the region.

Europe Medical Membrane Market Analysis

The medical membrane market in Europe is growing due to a rising focus on sustainable healthcare practices and progress in biotechnology. The area is experiencing increased use of membrane technologies in tissue engineering, cell culture, and plasma separation, supported by increasing investments in regenerative medicine. According to reports, the UK biotech industry saw significant growth in 2024, securing USD 4.5 Billion, a 94% rise from the prior year, emphasizing the growing investor confidence in innovative health technologies, such as membranes. Additionally, the increasing senior population that often require home medical care is driving the need for small and effective membrane-based devices. The incorporation of artificial organs and wearable health systems is also influencing the market, as these advancements need highly selective and resilient membranes. Besides this, the emphasis on reducing infections acquired in hospitals is increasing the application of membranes in sterilization and contamination management procedures. Research institutions and healthcare providers are joining forces to create innovative membrane designs, propelled by automation in diagnostics and the growth of bioprocessing in medical labs.

Asia Pacific Medical Membrane Market Analysis

The medical membrane market in the Asia Pacific region is seeing notable expansion, propelled by improvements in healthcare systems, a rising elderly demographic, and the growing incidence of chronic illnesses. This growth is further supported by advancements like the incorporation of nanotechnology, which improves the performance and biocompatibility of medical membranes. Major uses in the area, such as hemodialysis, drug delivery systems, and sterile filtration, are contributing to the market demand, with ultrafiltration technologies being especially desired for their effectiveness in isolating macromolecules and pathogens. With the ongoing increase in healthcare demands, the market is poised for ongoing expansion, especially in nations such as China, India, and Japan. According to the India Brand Equity Foundation (IBEF), the Indian healthcare sector is expected to attain USD 638 Billion by FY25, showcasing robust regional growth in healthcare that supports membrane adoption.

Latin America Medical Membrane Market Analysis

The medical membrane industry in Latin America is witnessing growth owing to the rising adoption of cost-effective healthcare solutions and improved diagnostic capabilities. Increasing public health awareness and efforts to improve access to medical services in underprivileged areas are encouraging the use of membrane-based devices in primary care settings. Recent financial reports show that Brazil's budget for the Unified Health System (SUS) increased by 6.2% compared to 2024, reflecting enhanced public investment in healthcare infrastructure and medical technology. The growth of local pharmaceutical production is catalyzing the demand for membranes in sterile filtration and drug formulation processes. Furthermore, a growing focus on laboratory testing and clinical diagnostics is improving membrane utilization in sample preparation and fluid separation technologies. These modifications suggest the region's gradual transition towards enhanced medical standards and autonomous healthcare systems.

Middle East and Africa Medical Membrane Market Analysis

The medical membrane market in the Middle East and Africa is growing due to a heightened emphasis on infection control and the rising need for specialized treatment methods. The growth of both private and public healthcare services is resulting in the integration of membrane systems in various clinical uses, especially in surgical environments and intensive care units. A regional health report indicates that currently, one in ten individuals in Saudi Arabia has diabetes, with the prevalence of the disease projected to nearly double by 2045, underscoring the immediate requirement for kidney and filtration-related medical treatments. Furthermore, the implementation of contemporary sterilization methods and the utilization of disposables in medicine are enhancing the adoption of advanced membranes. The demand for healthcare modernization and increased access to quality treatment choices is propelling the market growth.

Competitive Landscape:

Major participants in the medical membrane industry are committed to enhancing their standings via ongoing innovation, production capacity expansion, and strategic partnerships. They are funding research activities to create membranes that exhibit improved selectivity, durability, and biocompatibility, in response to the growing need for sophisticated medical applications. For example, in 2024, Xtant Medical launched SimpliGraft™ and SimpliMax™, two amniotic membrane allografts designed to treat chronic and acute wounds by providing a protective barrier. These dehydrated, irradiated membranes came in single and dual-layer forms and marked Xtant's entry into the wound care market. Numerous companies are optimizing their supply chains and implementing eco-friendly manufacturing methods to comply with regulations and lower expenses. Furthermore, they aim to expand in emerging healthcare industries and increase their presence via acquisitions and collaborations. Their focus is on improving efficiency, guaranteeing reliability, and meeting the growing demand for superior medical membranes.

The report provides a comprehensive analysis of the competitive landscape in the medical membrane market with detailed profiles of all major companies, including:

- 3M Company

- Asahi Kasei Corporation

- Cobetter Filtration Equipment Co., Ltd

- Cytiva (Danaher Corporation)

- MANN+HUMMEL

- Merck KGaA

- Sartorius AG

- W. L. Gore & Associates, Inc.

Latest News and Developments:

- June 2025: New Horizon Medical Solutions expanded its bioscience wound care line with AdvoGraft One and AdvoGraft Membrane Dual, using human amniotic membranes. Backed by CMS-approved Q codes, the products offered room-temperature, sterile storage and improved reimbursement processes, supporting acute and chronic wound protection through biologically sourced, regulatory-compliant healing barriers.

- October 2024: Asahi Kasei Medical has introduced its next-generation Planova™ FG1 virus removal filter, designed to enhance the production of biotherapeutics. This advanced filter, featuring a high-performance membrane, offers a significant increase in flux, approximately seven times greater than the Planova™ BioEX, allowing for faster virus filtration and improved productivity in biopharmaceutical manufacturing. The Planova™ FG1 filter is equipped with a membrane that maximizes virus removal capability while reducing the time required for the filtration process, thus meeting the growing demand for monoclonal antibodies and other biopharmaceuticals.

Medical Membrane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Microfiltration, Ultrafiltration, Nanofiltration, Dialysis, Gas Filtration, Others |

| Materials Covered | Acrylics, Polypropylene (PP), Polyvinylidene Fluoride (PVDF), Polysulfone (PSU) and Polyether Sulfone (PESU), Polytetrafluoroethylene (PTFE), Others |

| Applications Covered | Pharmaceutical Filtration, IV Infusion and Sterile Filtration, Bio-Artificial Processes, Drug Delivery, Hemodialysis, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Asahi Kasei Corporation, Cobetter Filtration Equipment Co., Ltd, Cytiva (Danaher Corporation), MANN+HUMMEL, Merck KGaA, Sartorius AG, W. L. Gore & Associates, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical membrane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical membrane market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical membrane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical membrane market was valued at USD 4.23 Billion in 2024.

The medical membrane market is projected to exhibit a CAGR of 7.15% during 2025-2033, reaching a value of USD 8.13 Billion by 2033.

The medical membrane market is driven by rising demand for advanced filtration in healthcare, increasing prevalence of chronic diseases, growth in biopharmaceutical production, and stricter regulatory requirements for safety and sterilization. Technological advancements in membrane materials, expanding healthcare infrastructure, and the growing adoption of minimally invasive treatments are further influencing the market.

Europe currently dominates the medical membrane market, accounting for a share of 38%. The dominance of the segment is attributed to its strong investment in healthcare infrastructure, presence of advanced manufacturing capabilities, supportive regulatory frameworks, and high adoption of innovative medical technologies. Continuous research initiatives and favorable government policies further reinforce the region’s leadership.

Some of the major players in the medical membrane market include 3M Company, Asahi Kasei Corporation, Cobetter Filtration Equipment Co., Ltd, Cytiva (Danaher Corporation), MANN+HUMMEL, Merck KGaA, Sartorius AG, W. L. Gore & Associates, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)