Medical Polymers Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Medical Polymers Market Size and Share:

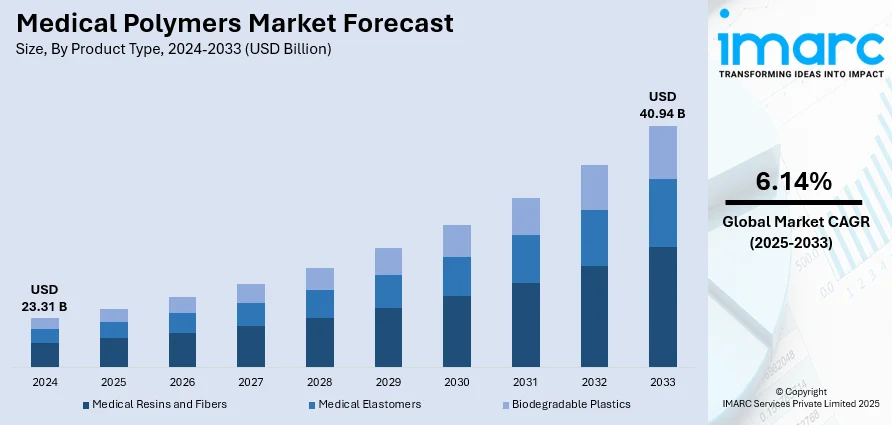

The global medical polymers market size was valued at USD 23.31 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40.94 Billion by 2033, exhibiting a CAGR of 6.14% from 2025-2033. North America currently dominates the market, holding a market share of 43.2% in 2024. At present, producers are seeking materials that can satisfy the stringent performance, safety, and biocompatibility demands of contemporary medical devices. Additionally, heightened occurrence of chronic conditions like diabetes, cardiovascular diseases, and cancer globally is supporting the market growth. Furthermore, innovations in polymer science and engineering are expanding the medical polymers market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.31 Billion |

|

Market Forecast in 2033

|

USD 40.94 Billion |

| Market Growth Rate 2025-2033 | 6.14% |

The market for medical polymers is experiencing growth owing to the rise in the demand for sophisticated medical devices, higher healthcare spending, and increasing rates of chronic disease. Thermoplastics, thermosets, and elastomers are the types of medical polymers that are being used extensively in the production of surgical equipment, implants, diagnosis devices, and drug delivery systems because they possess biocompatibility, stability, and lightness. Among the leading trends in the market is the growing use of bioresorbable polymers. These are increasingly used in products like sutures, stents, and orthopedic implants, where there is a need for temporary support leading to natural absorption. Moreover, advances in polymer chemistry are allowing the creation of high-performance polymers with superior mechanical strength and chemical resistance, further diversifying their functions across intricate medical applications.

To get more information on this market, Request Sample

The US medical polymers market is growing strongly, driven by innovation in healthcare technology, growing demand for high-performance medical devices, and increasing population aging. Medical polymers play a crucial role in the manufacture of various healthcare products, such as surgical devices, prosthetic devices, diagnostic devices, and drug delivery systems. The US is an important market because of its established medical infrastructure and high investment in research and development activities. An emerging trend in the US market is the increasing application of bioresorbable and biocompatible polymers, especially in orthopedics, cardiovascular implants, and tissue engineering. These products provide the benefit of biodegradability within the body, minimizing the need for secondary operations and enhancing patient recovery. Further, the growing incidence of long-term diseases like diabetes and cardiovascular disease is also driving demand for polymer-based devices such as catheters and insulin pumps. In 2024, Veterans of the plastics industry, Benjamin Harp and Tom Rybicki, established Polymer Medical Inc. to offer contract injection-molding and assembly services to clients in healthcare and biosciences. The new firm will concentrate on developing essential drug-delivery systems, medical disposables such as home healthcare medical devices, syringes, to orthopedics, specialized packaging, and various pharmaceutical disposables among other offerings.

Medical Polymers Market Trends:

Rising Demand for Advanced Medical Devices

The market for medical polymers is experiencing steady growth as producers always look for materials that can satisfy the stringent performance, safety, and biocompatibility demands of contemporary medical devices. Medical polymers are increasingly being used in creating minimally invasive surgical tools, diagnostic apparatus, prosthetics, and implantable devices. The polymers provide excellent features including flexibility, durability, resistance to chemicals, and sterilization ease, making them suitable for various applications in medicine, they are by supporting the medical polymers market growth. With medical technologies rapidly changing, manufacturers are switching increasingly to high-performance polymers to make devices with enhanced patient benefits and more design flexibility. The continuous Shift towards home care and wearable medical technologies is also boosting demand, as medical polymers allow for the development of light, compact, and easy-to-use devices. With ongoing innovation in polymer formulation and processing methods, the market is growing to accommodate intricate device designs that cannot be met by traditional materials. In 2024, Avient Corporation, a leading supplier of specialized and eco-friendly materials solutions and services, introduced Colorant Chromatics™ Transcend™ Biocompatible PEEK Pre-Colored Compounds and Colorants at MEDICA 2024, one of the largest B2B medical technology and healthcare trade fairs.

Increasing Incidence of Chronic Diseases

One of the major medical polymers market trends includes the heightened occurrence of chronic conditions like diabetes, cardiovascular diseases, and cancer globally. As per the American Cancer Society, in 2025, it is estimated that there will be 2,041,910 new cancer diagnoses and 618,120 cancer-related fatalities in the United States. Polymer-based medical devices are utilized by healthcare professionals for diagnosis, treatment, and long-term disease control. For example, polymers are being applied in catheter production, infusion pumps, insulin delivery systems, and implantable cardiovascular devices. Since patients need ongoing monitoring and consistent therapeutic interventions, the healthcare sector is resorting to solutions based on polymers, which provide stability, biocompatibility, and flexibility. The aging population in the developed and emerging markets is also leading to the increased demand for such devices, thereby driving the use of medical polymers further. Additionally, polymers are enabling innovation in drug delivery technologies, making possible more efficient and controlled release systems. As healthcare infrastructures are evolving to cope with chronic diseases more effectively, medical polymers are at the center of facilitating scalable and patient-specific care models.

Advances in Polymer Science

Ongoing innovations in polymer science and engineering are propelling the creation of next-generation medical polymers with improved functional properties. Scientists and producers are investing more in the development of polymers with better strength, flexibility, thermal stability, and biocompatibility. These advances are allowing for the production of more dependable and functional medical devices, especially in orthopedics, cardiology, and regenerative medicine. For instance, bioresorbable polymers are being developed to safely break down in the body, obviating the necessity for additional surgeries. Stimuli-responsive smart polymers that react to environmental cues like temperature or pH are also increasing their usage in targeted drug delivery and diagnostic devices. At the same time, processing technologies like 3D printing and injection molding are advancing to enable more accurate and cost-effective production of personalized devices. With ongoing advancement in the integration of material science and biomedical engineering, technology innovation is offering a favorable medical polymers market outlook. In 2024, Americhem Healthcare, a worldwide leader in the development and production of tailored color masterbatch, functional additives, engineered compounds, and performance technologies, increased its initiatives in Europe to enhance material selection and medical device development. Americhem launched ColorRx® compounds and masterbatch in a range of standard colors and base resins to the European market to assist OEMs and their molders in initiating their device development.

Medical Polymers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global medical polymers market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

Analysis by Product Type:

- Medical Resins and Fibers

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Polystyrene

- Others

- Medical Elastomers

- Styrene Block Copolymer

- Rubber Latex

- Others

- Biodegradable Plastics

Medical resins and fibers stand as the largest component in 2024, holding 73.9% of the market. They possess many advantages that make them critical materials in the medical field. They are commonly used in the production of diagnostic machines, surgical tools, implantable devices, and disposable medical devices because of their better physical, chemical, and biological properties. Medically rated resins, e.g., polyethylene, polypropylene, and polycarbonate, offer high strength-to-weight ratios, good biocompatibility, and chemical and sterilization-resistant properties that qualify them for single- and long-term medical uses. Fibers, especially those from synthetic polymers like polyester and nylon, are desirable due to their flexibility, tensile strength, and responsiveness. They are also widely utilized in sutures, wound dressings, and filtration systems. Their fine texture allows for improved performance in applications with a need for breathability, moisture management, and microbial resistance. Resins and fibers can also be designed to fulfill precise performance requirements, like drug-eluting properties or bioresorbability.

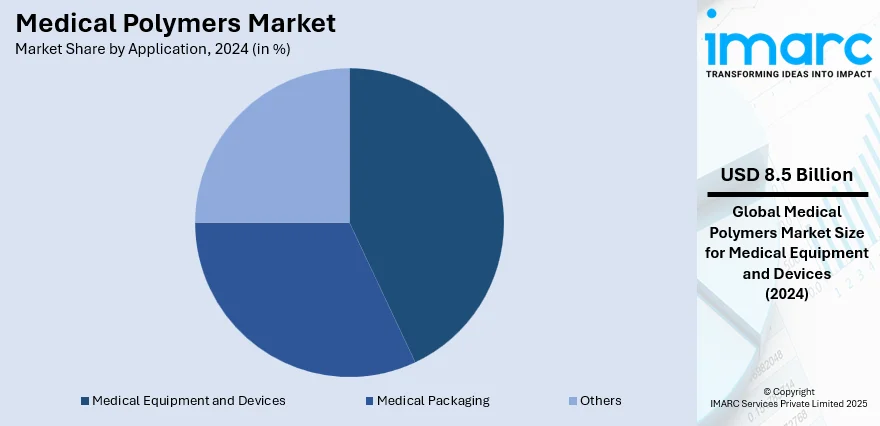

Analysis by Application:

- Medical Equipment and Devices

- Medical Packaging

- Others

Medical equipment and devices lead the market with 36.4% of market share in 2024. Medical polymers find extensive application in the production of a vast array of medical devices and equipment owing to their versatility, strength, and biocompatibility. These polymers form the backbone of products that are disposable as well as for long-term use, and they possess properties that surpass the conventional materials of metals and ceramics by far. The typical applications are surgical devices, diagnostic tools, catheters, tubing, and implantable parts, all of which gain from the lightness, non-reactive, and sterilizable properties of medical-grade polymers. In diagnostic devices, polymers are utilized for housings, cartridges, and fluid management parts, offering accuracy and resistance to contamination. In operating rooms, devices consisting of high-performance polymers including polyether ether ketone (PEEK) and polypropylene provide greater ergonomics and one-time use, minimizing the chances of cross-contamination. Polymers are also used extensively in implantable devices like pacemaker housing and orthopedic implants, where silicone and bioabsorbable polymers enable biocompatibility with body tissue and absorbable degradation within the body.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 43.2%. The market is growing steadily with the influence of technological innovation, increasing healthcare spending, and a well-established medical infrastructure. The region is backed by a good base of key medical device players, research facilities, and regulatory agencies that promote the implementation of advanced materials. Medical polymers are being used more frequently in a broad variety of applications, ranging from single-use medical devices to diagnostic devices, surgical devices, and implantable devices, based on their biocompatibility, light weight, and cost-effectiveness. One of the major trends governing the market is the increased need for bioresorbable and specialty polymers in orthopedic applications, cardiology, and drug delivery systems. Such materials are facilitating more patient-specific treatment modes, such as temporary implants and controlled-release medication platforms. Also, the growth of home healthcare and wearable medical devices is boosting the application of flexible and robust polymers in monitors, sensors, and handheld devices.

Key Regional Takeaways:

United States Medical Polymers Market Analysis

The United States holds 88.20% share in North America. The market is primarily driven by the growing demand for durable, lightweight, and biocompatible materials used in medical devices. In line with this, ongoing advancements in polymer technology, enabling the production of more efficient and cost-effective devices, are impelling the market. The aging population, contributing to a rise in chronic conditions, is further propelling market growth as the need for medical devices and implants increases. Similarly, regulatory advancements and the approval of innovative polymer-based materials are enhancing the market’s potential. The emerging trend of minimally invasive surgeries is driving demand for flexible medical polymers in devices like catheters and stents. Additionally, the ongoing shift towards single-use medical devices is expanding the market scope due to the cost-effectiveness of polymer solutions. Besides this, increasing investments in research and development (R&D) for polymer materials, fostering innovation in the sector are creating lucrative market opportunities. As such, in September 2024, Ohio launched the Greater Akron Polymer Innovation Hub with USD 31.25 Million in state funding. The hub aims to advance polymer research, create 2,400 jobs, and support industries like healthcare, mobility, and energy by 2031.

Europe Medical Polymers Market Analysis

The Europe market is experiencing growth due to the increasing demand for minimally invasive surgeries, which require advanced polymer materials for devices like stents and catheters. In accordance with this, the rise in the aging population is driving the need for more medical devices and polymers in healthcare. According to reports, at the start of 2024, the EU population was 449.3 million, with over 20% aged 65 or older, showing a 0.3% increase from 2023. Similarly, continual advancements in polymer technology, such as the development of bioabsorbable and antimicrobial polymers, are transforming the industry. The tightening of regulatory frameworks is promoting the use of certified medical polymers to ensure safety and quality. Furthermore, increased healthcare spending and investments in infrastructure are further propelling the market's expansion. It has been reported that in 2022, the average healthcare expenditure per inhabitant in the EU was EUR 3,685, marking a 38.6% increase compared to EUR 2,658 in 2014. Additionally, the ongoing shift toward single-use medical devices is strengthening the demand for cost-effective, high-performance polymers. Moreover, growing collaboration between polymer manufacturers and healthcare companies is fostering the development of specialized medical polymers.

Asia Pacific Medical Polymers Market Analysis

The Asia Pacific market for medical polymers is largely propelled by expanding healthcare infrastructure and rising demand for advanced medical devices. Furthermore, the increasing adoption of polymer-based drug delivery systems is propelling market growth. Similarly, rapid urbanization and rising disposable incomes are promoting the need for advanced medical solutions, which in turn is impelling the market. The ongoing development of high-performance, biocompatible polymers is providing more opportunities in the market. Moreover, the growing prevalence of chronic diseases and an aging population are driving the demand for polymer-based implants and prosthetics, further contributing to the market's expansion. The Department of Biotechnology stated that in India, non-communicable diseases account for 53% of all deaths and 44% of disability-adjusted life-years lost.

Latin America Medical Polymers Market Analysis

In Latin America, the market is growing due to the increasing adoption of advanced polymer materials in medical device manufacturing, particularly for implants and prosthetics. The Latin American implantable medical devices market was valued at USD 7.8 billion in 2024. According to IMARC Group, the market is projected to grow to USD 12.9 billion by 2033, with a compound annual growth rate (CAGR) of 5.7% from 2025 to 2033. In addition to this, the rising demand for biocompatible polymers in drug delivery systems is driving market expansion. The growing focus on healthcare infrastructure development and the medical device sector is further promoting the use of medical polymers. Moreover, increasing healthcare awareness and the need for affordable, high-quality medical solutions are accelerating the adoption of durable, cost-effective polymers across the region, bolstering market growth.

Middle East and Africa Medical Polymers Market Analysis

The market in the Middle East and Africa is significantly driven by advancements in healthcare infrastructure and increasing demand for high-performance medical devices. Furthermore, the growing prevalence of chronic diseases is propelling the need for polymer materials in diagnostics and treatment. According to NCBI, in 2019, 64% of non-communicable disease (NCD) deaths in the WHO African region occurred among people aged 70 years or younger, with premature deaths from NCDs ranging from 36.5% to 72.1%. The rising adoption of polymer-based solutions in wound care and surgical devices is also fostering market development. Apart from this, the region's increasing focus on sustainability and eco-friendly, recyclable polymers is encouraging manufacturers to innovate, driving the demand for environmentally conscious medical applications.

Competitive Landscape:

Market players in the medical polymers industry are actively engaging in strategic initiatives like mergers and acquisitions (M&A) and partnerships to strengthen their market position and improve product portfolios. Companies are investing heavily in R&D to create high-performance and bioresorbable polymers tailored for advanced medical applications, including implants, drug delivery systems, and diagnostic devices. Leading manufacturers are also focusing on sustainable material innovations in response to environmental and regulatory pressures. Additionally, collaborations with healthcare institutions and device makers are enabling the co-development of customized solutions that meet evolving clinical needs. As per medical polymers market forecasts, expansion into emerging markets and increased production capacity are further expected to help companies meet rising global demand while maintaining quality and compliance with stringent medical standards.

The report provides a comprehensive analysis of the competitive landscape in the medical polymers market with detailed profiles of all major companies, including:

- BASF SE

- Celanese Corporation

- Covestro AG

- DuPont

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Huizhou Foryou Medical Device Co. Ltd.

- Kraton Corporation and Solvay S.A.

Latest News and Developments:

- July 2025: Artience launched the Sciforiem PL 1000 Series, functional synthetic polymers designed to enhance in vitro diagnostic performance. These polymers improve sensitivity, stability, and efficiency in diagnostic assays by stabilizing proteins and preventing non-specific protein adsorption. The series will debut at ADLM 2025 in Chicago.

- July 2025: Stanford Advanced Materials (SAM) launched Polymer Tungsten, a flexible and environmentally friendly alternative to lead for radiation shielding. Combining tungsten powder with polymers, it offers superior shielding, design flexibility, and durability for medical, nuclear, and industrial applications while meeting safety standards and reducing environmental risks.

- June 2025: Covestro launched localized production of Desmopan Rx medical-grade TPU at its Changhua site in Taiwan. This material, used in medical devices like catheters and endoscopes, meets global standards for biocompatibility. Covestro also integrates polymers for advanced healthcare applications, supporting regional supply in the Asia Pacific.

- April 2025: Peijia Medical partnered with DSM-Firmenich to develop innovative polymer heart valve materials using ultra-high molecular weight polyethylene (UHMWPE) and thermoplastic polyurethane (TPU). The collaboration aims to improve valve longevity, biocompatibility, and cost-efficiency, advancing non-animal-derived materials for heart valve applications in structural heart disease.

- January 2025: SCHOTT Pharma launched the next-generation SCHOTT TOPPAC infuse polymer syringes, featuring a new cap, functional label, and RFID chip for drug traceability. Made from cyclic olefin copolymer (COC), these syringes improve drug stability, reduce waste, and enhance efficiency in medication inventory and packaging processes.

Medical Polymers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Medical Equipment and Devices, Medical Packaging, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Celanese Corporation, Covestro AG, DuPont, Eastman Chemical Company, Evonik Industries AG, Exxon Mobil Corporation, Huizhou Foryou Medical Device Co. Ltd., Kraton Corporation and Solvay S.A |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the medical polymers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global medical polymers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the medical polymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical polymers market was valued at USD 23.31 Billion in 2024.

The medical polymers market is projected to exhibit a CAGR of 6.14% during 2025-2033, reaching a value of USD 40.94 Billion by 2033.

The market is being driven by heightened need for advanced medical devices, increased healthcare spending, growing prevalence of chronic diseases, and continuous innovations in polymer science and materials engineering.

North America currently dominates the medical polymers market, accounting for a share of 43.2% in 2024, supported by strong healthcare infrastructure, technological innovation, and high R&D investments.

Some of the major players in the medical polymers market include BASF SE, Celanese Corporation, Covestro AG, DuPont, Eastman Chemical Company, Evonik Industries AG, Exxon Mobil Corporation, Huizhou Foryou Medical Device Co. Ltd., Kraton Corporation, Solvay S.A, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)