MENA Generic Drug Market Report by Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), Distribution Channel (Retail Pharmacies, Hospital Pharmacies), and Country 2026-2034

MENA Generic Drug Market Size:

The MENA generic drug market size reached USD 20,513.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 36,092.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.48% during 2026-2034. The growing healthcare access, rising cost-effectiveness of generics, increasing prevalence of chronic diseases, supportive government policies, significant demand for affordable, high-quality pharmaceuticals, and growing awareness about generic medications are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 20,513.3 Million |

| Market Forecast in 2034 | USD 36,092.1 Million |

| Market Growth Rate 2026-2034 | 6.48% |

Access the full market insights report Request Sample

MENA Generic Drug Market Analysis:

- Major Market Drivers: The increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer represents the major driver in the market. This rise in chronic conditions necessitates affordable and effective treatment options, making generic drugs highly sought after. Economic factors also play a significant role in driving the market in MENA.

- Key Market Trends: The widespread adoption of biosimilars, which are generic versions of biological drugs represents the key trend of the MENA generic drug market growth. Biosimilars offer similar therapeutic benefits at a lower cost, addressing the rising demand for advanced treatments in the region. Another significant trend is the growing focus on regulatory harmonization and quality standards across the MENA region.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces various challenges including regulatory inconsistencies across different countries which can hinder market access and compliance. However, the market also faces several challenges such as the growing demand for affordable healthcare solutions and the increasing prevalence of chronic diseases.

MENA Generic Drug Market Trends:

Growing Government Support and Policies

Governments of various countries in the MENA region are actively promoting the use of generic drugs to manage healthcare costs. Regulatory reforms, incentives for local manufacturing, and streamlined approval processes are some of the measures taken to encourage the adoption of generics. For instance, the Saudi Food and Drug Authority (SFDA) is the regulatory body responsible for the oversight and registration of pharmaceutical products within Saudi Arabia. Responsible for both innovator and generic products, SFDA has recently amended its rules when it comes to generic pharmaceutical registration and has provided guidelines on best practices for obtaining Marketing Authorisation of a generic product. These changes to the rules have also placed certain obligations on innovator companies. The SFDA, through these updates, looks to create a closer working relationship with the Saudi Authority for Intellectual Property (SAIP), in particular the Patent Office, in creating a “Patent Linkage” system in Saudi Arabia.

Rising Prevalence of Chronic Diseases

The increasing rates of chronic diseases such as diabetes, cardiovascular disorders, and cancer in the MENA region drive the demand for long-term medication. Generic drugs offer an affordable and effective solution for managing these conditions, contributing to their growing popularity. According to the International Diabetes Federation, more than 73 million people in the MENA region live with the disease; by 2045, this figure is expected to rise to 135.7 million. According to the World Heart Federation, cardiovascular disease is the number one cause of death in the Middle East and North Africa region, responsible for more than one-third of all deaths, or 1.4 million people every year. Deaths attributed to cardiovascular diseases range from 40% of total deaths in Oman to 10% in Somalia. This is further increasing the MENA generic drug market share significantly.

Increasing Healthcare Access

The rising efforts to improve healthcare infrastructure and access to medical services in the MENA region are expanding the market for generic drugs. Enhanced healthcare facilities and services facilitate the demand for affordable medication options, boosting the growth of the generic drug market. For instance, in April 2024, ACCESS Health International MENA Region recently entered into strategic partnerships by signing five Memorandums of Understanding (MoUs). These collaborations aim to fortify dedication to the MENA region and amplify collective endeavors in enhancing healthcare accessibility and quality. This includes a strategic partnership with Africa Health Business, a partnership with CTEQ to advance hospital planning and design, a partnership with FVE Lifecare for modular healthcare infrastructure, collaboration with Blockthree to drive healthcare innovation using Blockchain, collaboration with the Research Institute of Virology to eliminate hepatitis in Uzbekistan, and collaboration with Penta Pharma Egypt. This is expected to influence the MENA generic drug market forecast positively over the coming years.

MENA Generic Drug Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Breakup by Therapy Area:

To get detailed segment analysis of this market Request Sample

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

The demand for generic drugs targeting the central nervous system is driven by the rising prevalence of neurological disorders such as depression, anxiety, and epilepsy. Cost-effective treatment options, increasing mental health awareness, and expanding healthcare access contribute to the growth of this segment in the MENA region.

The high incidence of cardiovascular diseases, such as hypertension and heart disease, drives demand for generic cardiovascular drugs. Government health initiatives, aging populations, and the need for affordable, long-term medications support the growth of this market segment across the MENA region.

The increasing cases of skin conditions, such as acne, eczema, and psoriasis, coupled with rising cosmetic dermatology treatments, drive the demand for generic dermatology drugs. Cost-effectiveness and growing awareness of skin health contribute to the market growth in the MENA region.

The demand for genitourinary and hormonal generic drugs is driven by the prevalence of conditions such as hormonal imbalances, menopause, and prostate disorders. Government healthcare initiatives and the need for affordable treatments boost this market segment in the MENA region.

High rates of respiratory conditions, including asthma and chronic obstructive pulmonary disease (COPD), drive the demand for generic respiratory drugs. Government health programs, awareness campaigns, and the cost-effectiveness of generics support market growth in the MENA region.

The rising incidence of rheumatoid arthritis and other inflammatory joint diseases drives the demand for generic rheumatology drugs. Affordable treatment options, government support, and an aging population contribute to the market expansion in the MENA region.

The growing prevalence of diabetes in the MENA region drives demand for generic antidiabetic drugs. Cost-effective management options, government health initiatives, and increasing awareness of diabetes care support market growth.

The rising incidence of cancer and the high cost of branded oncology drugs drive the demand for generic oncology medications. Government efforts to improve cancer treatment accessibility and the need for affordable therapies contribute to the growth of this segment in the MENA region.

Breakup by Drug Delivery:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

The demand for oral generic drugs in the MENA region is driven by their ease of administration, widespread acceptance, and effectiveness in treating chronic diseases. Government initiatives promoting cost-effective treatments and an aging population with increasing medication needs further boost the demand for oral generics.

The demand for injectable generic drugs is fueled by the rising prevalence of chronic and acute conditions requiring rapid treatment, such as diabetes and infections. Hospital settings and emergency care necessitate cost-effective injectables, supported by government policies and investments in healthcare infrastructure.

Dermal and topical generic drugs are in demand due to increasing cases of skin conditions, such as acne, eczema, and psoriasis, and their ease of use. The growing awareness of affordable treatment options, combined with the rising focus on skincare and cosmetic applications, supports market growth.

The demand for generic inhalers is driven by the high prevalence of respiratory conditions like asthma and COPD in the MENA region. Cost-effective treatment options, coupled with government healthcare initiatives and increasing awareness about respiratory health, contribute to the growing market for generic inhalers.

Breakup by Distribution Channel:

- Retail Pharmacies

- Hospital Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies and hospital pharmacies.

The demand for retail pharmacies in the market is driven by increasing consumer access to affordable medications, growing awareness of generics, and expanding urbanization. Convenience and ease of purchasing medications, coupled with government initiatives to promote generics, support the growth of retail pharmacies.

The demand for hospital pharmacies in the market is driven by the rising prevalence of chronic diseases, expanding healthcare infrastructure, and government policies favoring cost-effective treatments. Hospital pharmacies ensure a steady supply of affordable generic drugs for inpatient and outpatient care, addressing the need for comprehensive healthcare services.

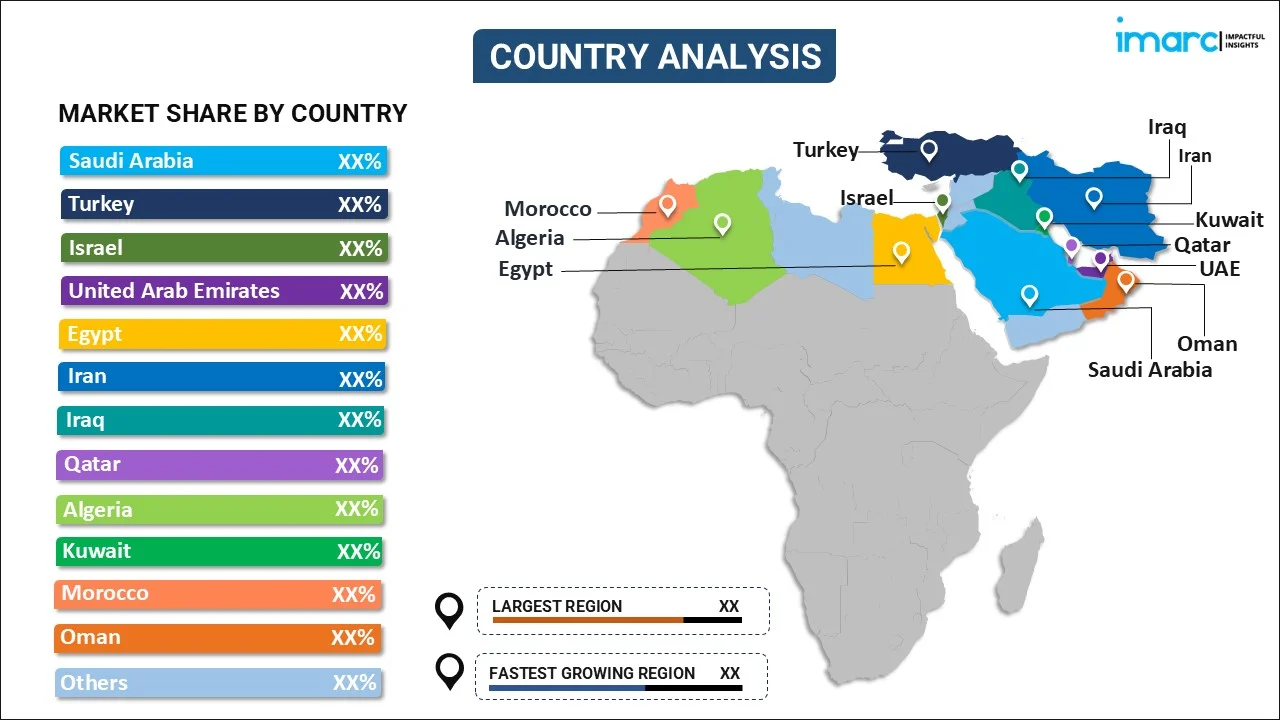

Breakup by Country:

To get detailed regional analysis of this market Request Sample

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Egypt

- Iran

- Iraq

- Qatar

- Algeria

- Kuwait

- Morocco

- Oman

- Others

The report has also provided a comprehensive analysis of all the major markets in the country, which include Saudi Arabia, Turkey, Israel, United Arab Emirates, Egypt, Iran, Iraq, Qatar, Algeria, Kuwait, Morocco, Oman, and Others.

In Saudi Arabia, the market is driven by government initiatives to reduce healthcare costs, an increasing prevalence of chronic diseases, and a growing population. The country's Vision 2030 plan encourages local pharmaceutical production, boosting the market for generics. Additionally, high healthcare spending and an expanding healthcare infrastructure support market growth.

In Turkey, the market is propelled by a robust healthcare system, government policies favoring generics to reduce healthcare expenditures, and a large domestic pharmaceutical industry. The increasing burden of chronic diseases and a young population also drive the demand for affordable medications. Regulatory reforms and incentives for local manufacturing further enhance the market.

In Israel, the market benefits from a strong pharmaceutical industry, high healthcare standards, and a focus on innovation. The presence of major generic drug manufacturers, such as Teva Pharmaceuticals, and supportive government policies drive market growth. Additionally, the aging population and rising incidence of chronic diseases boost demand for generics.

In the UAE, the market is driven by government initiatives to improve healthcare access, a growing expatriate population, and a high prevalence of chronic diseases. Investments in healthcare infrastructure and policies promoting local pharmaceutical production further support the market. Additionally, the emphasis on cost-effective healthcare solutions boosts generic drug adoption.

In Egypt, the generic drug market is fueled by a large population, increasing healthcare needs, and government efforts to expand healthcare coverage. Economic constraints make affordable generic drugs more attractive. Local pharmaceutical production and regulatory support for generics also drive market growth, addressing the high burden of chronic diseases.

In Iran, the market is driven by economic sanctions that limit access to branded drugs, promoting the use of cost-effective generics. A well-established local pharmaceutical industry and government policies supporting self-sufficiency in drug production boost the market. The high prevalence of chronic diseases and a large population further enhance demand.

In Iraq, the market is influenced by the need to rebuild healthcare infrastructure, a growing population, and limited access to expensive branded medications. Government initiatives to improve healthcare services and encourage local pharmaceutical production support market growth. Additionally, the high burden of chronic diseases drives demand for affordable generic drugs.

In Qatar, the market benefits from a strong healthcare infrastructure, government policies promoting generics to reduce healthcare costs, and a high prevalence of chronic diseases. Investments in healthcare facilities and a growing expatriate population further drive demand. Efforts to diversify the economy and promote local pharmaceutical production also support market growth.

In Algeria, the market is driven by government efforts to reduce healthcare costs, a large and growing population, and an increasing burden of chronic diseases. Regulatory support for local pharmaceutical production and economic constraints that make generics more attractive contribute to market growth.

In Kuwait, the market is propelled by government initiatives to enhance healthcare access, a high prevalence of chronic diseases, and an affluent population seeking cost-effective medications. Investments in healthcare infrastructure and policies promoting local pharmaceutical manufacturing support market growth. The emphasis on reducing healthcare expenditures also boosts the demand for generics.

In Morocco, the market is influenced by government policies promoting affordable healthcare, a large population, and a growing middle class. The increasing burden of chronic diseases and efforts to improve healthcare infrastructure drive demand for generics. Local pharmaceutical production and regulatory support further enhance market growth.

In Oman, the market is driven by government initiatives to improve healthcare access, a growing population, and a high prevalence of chronic diseases. Investments in healthcare infrastructure and policies promoting cost-effective medications support market growth. Efforts to diversify the economy and encourage local pharmaceutical production also contribute to the demand for generics.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape of the MENA generic drug market is highly competitive, with a mix of local and international players striving for market share. Key local manufacturers leverage regional knowledge and cost-effective production, while global pharmaceutical giants bring advanced technologies and extensive portfolios. Strategic partnerships, mergers, and acquisitions are common, enhancing market reach and capabilities. For instance, in January 2024, Guardant Health, Inc. a leading precision oncology company, and Hikma Pharmaceuticals PLC, a multinational pharmaceutical company, announced an agreement to promote Guardant Health’s portfolio of liquid and tissue biopsy tests for cancer screening, recurrence monitoring, and tumor mutation profiling across all solid cancers in countries across the Middle East and North Africa (MENA).

MENA Generic Drug Market News:

- In June 2024, TVM Capital Healthcare, an international healthcare expansion and growth capital firm, announced a USD 35 million investment in Boston Oncology Arabia, a bio-generic drugs manufacturing company based in the Kingdom of Saudi Arabia. From its headquarters in Riyadh and production facility in Sudair Industrial City, Boston Oncology Arabia provides vital medicines for critical conditions through the local development and manufacturing of internationally licensed, best-in-class therapeutics.

- In May 2024, Klinge Biopharma GmbH, licensee and exclusive holder of the worldwide commercialization rights for FYB203, Formycon’s biosimilar candidate to Eylea®1 (Aflibercept), entered into an exclusive licensing and supply agreement with MS Pharma for the commercialization of FYB203 in the Middle East and North Africa (“MENA region”). MS Pharma is a leading regional pharmaceutical company in the MENA region and specializes in the distribution of biotechnological as well as generic drugs.

MENA Generic Drug Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Countries Covered | Saudi Arabia, Turkey, Israel, United Arab Emirates, Egypt, Iran, Iraq, Qatar, Algeria, Kuwait, Morocco, Oman, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the MENA generic drug market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the MENA generic drug market?

- What is the breakup of the MENA generic drug market on the basis of therapy area?

- What is the breakup of the MENA generic drug market on the basis of drug delivery?

- What is the breakup of the MENA generic drug market on the basis of distribution channel?

- What are the various stages in the value chain of the MENA generic drug market?

- What are the key driving factors and challenges in the MENA generic drug market?

- What is the structure of the MENA generic drug market, and who are the key players?

- What is the degree of competition in the MENA generic drug market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the MENA generic drug market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the MENA generic drug market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the MENA generic drug industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)