Mercury Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition

Mercury Price Trend, Index and Forecast

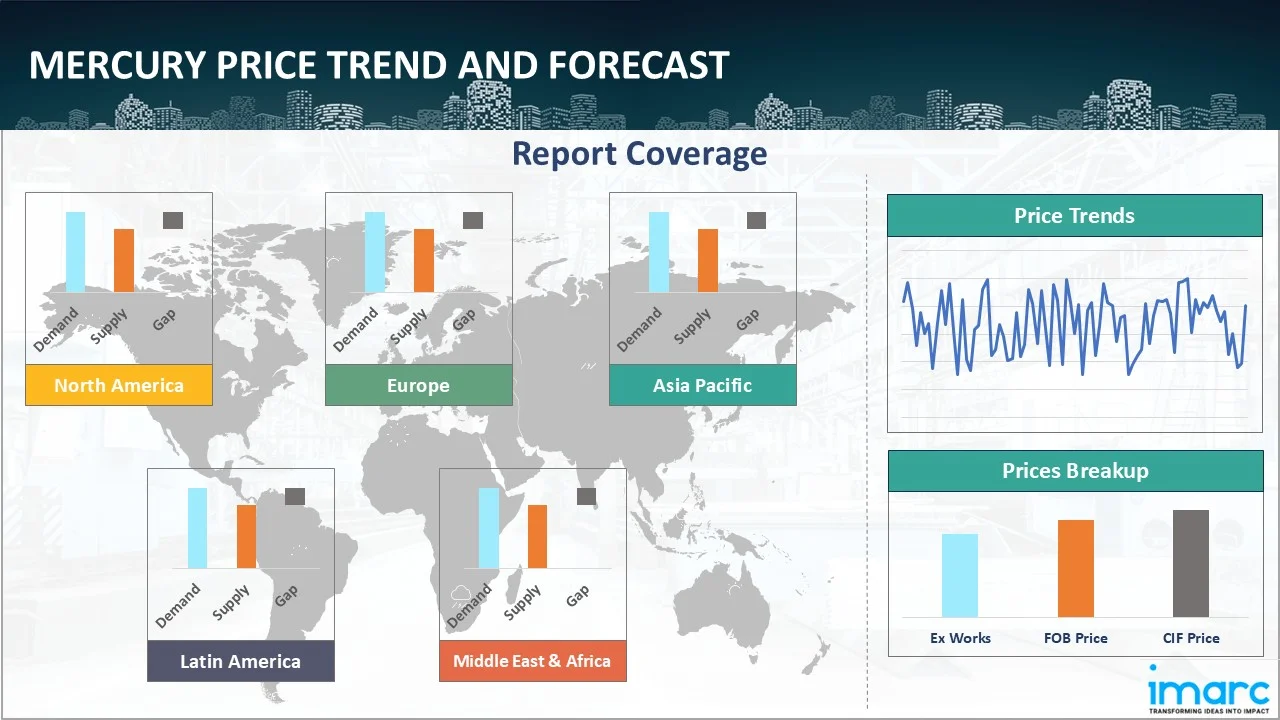

Track the latest insights on mercury price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Mercury Prices Outlook Q2 2025

- India: US$ 56,899/MT

- France: US$ 65,762/MT

- Russia: US$ 46,872/MT

- Japan: US$ 51,782/MT

- Italy: US$ 49,011/MT

Mercury Price Chart

Get real-time access to monthly/quaterly/yearly prices, Request Sample

During the second quarter of 2025, the mercury prices in India reached 56,899 USD/MT in June. As per the mercury price chart, general economic conditions in India, including inflation and import/export trends, played a role in the overall price of mercury. Besides, a complex interplay of industrial needs, supply limitations, and regulatory pressures contributed to the changing prices.

During the second quarter of 2025, mercury prices in France reached 65,762 USD/MT in June. Mercury prices in France fluctuated due to a combination of factors, including potential changes in import volumes, energy costs, and overall market demand.

During the second quarter of 2025, the mercury prices in Russia reached 46,872 USD/MT in June. Increased usage of mercury in various applications, including chemical engineering and medicine, influenced price trends. Besides, geopolitical events, and changes in regulations also affected the prices in Russia.

During the second quarter of 2025, the mercury prices in Japan reached 51,782 USD/MT in June. Mercury prices in Japan were influenced by a combination of factors related to the yen's value, interest rate adjustments, and overall market sentiment.

During the second quarter of 2025, the mercury prices in Italy reached 49,011 USD/MT in June. Short-term fluctuations occurred due to various factors like changes in global supply, industrial demand, especially from chemical engineering and medicine, and geopolitical events.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the mercury prices.

Global Mercury Price Trend

The report offers a holistic view of the global mercury pricing trends in the form of mercury price charts, reflecting the worldwide interplay of supply-demand balances, international trade policies, and overarching economic factors that shape the market on a macro level. This comprehensive analysis not only highlights current price levels but also provides insights into historical price of mercury, enabling stakeholders to understand past fluctuations and their underlying causes. The report also delves into price forecast models, projecting future price movements based on a variety of indicators such as expected changes in supply chain dynamics, anticipated policy shifts, and emerging market trends. By examining these factors, the report equips industry participants with the necessary tools to make informed strategic decisions, manage risks, and capitalize on market opportunities. Furthermore, it includes a detailed mercury demand analysis, breaking down regional variations and identifying key drivers specific to each geographic market, thus offering a nuanced understanding of the global pricing landscape.

Europe Mercury Price Trend

Q2 2025:

As per the mercury price index, prices in Europe were influenced by ongoing demand and regulatory changes. The EU implemented restrictions on mercury-containing products, such as certain types of lamps, which impacted demand and prices. Besides, demand from artisanal and small-scale gold mining (ASGM) also played a role.

This analysis can be extended to include detailed mercury price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Mercury Price Trend

Q2 2025:

The demand for mercury in various industrial processes, such as chlor-alkali production and other chemical applications, affected the prices. Besides, environmental regulations and policies regarding mercury use and disposal further influenced pricing. Moreover, regional demand, supply chain issues, and the adoption of mercury-free alternatives were some other factors playing a significant role in shaping pricing trends.

Specific mercury prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Mercury Price Trend

Q2 2025:

The report explores the mercury trends and mercury price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on mercury prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Mercury Price Trend

Q2 2025:

The development and adoption of mercury-free technologies and products, especially in industries like chlor-alkali production and dental amalgams, influenced the prices. Besides, the growing awareness of mercury's harmful effects and the implementation of stricter environmental regulations in the Asia Pacific region also impacted mercury demand and pricing.

This mercury price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Mercury Price Trend

Q2 2025:

Latin America's mercury market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in mercury prices. Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting the region's ability to meet international demand consistently. Moreover, the mercury price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing mercury pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Mercury Price Trend, Market Analysis, and News

IMARC's latest publication, “Mercury Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2025 Edition,” presents a detailed examination of the mercury market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of mercury at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed mercury price trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting mercury pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Mercury Industry Analysis

The global mercury market size reached USD 4.56 Billion in 2024. By 2033, IMARC Group expects the market to reach USD 5.46 Billion, at a projected CAGR of 1.98% during 2025-2033.

- Artisanal and small-scale gold mining continues to be the most significant driver of global mercury demand. In many developing countries across Africa, Asia, and South America, mercury is extensively used to extract gold from ore due to its cost-effectiveness and accessibility. Miners use mercury to amalgamate gold, a process that is easy to implement without sophisticated equipment. Despite global efforts to restrict mercury use, especially under the Minamata Convention, enforcement remains inconsistent in several regions, allowing mercury use in ASGM to persist. As gold prices rise and informal mining activities expand, demand for mercury in this sector is expected to remain strong. Furthermore, limited awareness, poverty, and lack of alternatives contribute to the sustained reliance on mercury.

- Mercury continues to find niche but critical applications in various industrial sectors despite increasing regulatory restrictions. It is utilized in the production of caustic soda and chlorine through the mercury cell process, particularly in regions where older technologies have not yet been phased out. Mercury also plays a role in the manufacturing of fluorescent lamps, high-intensity discharge lamps, thermometers, barometers, and electrical switches. Although many of these uses are declining due to safer alternatives, developing nations and legacy industries continue to maintain demand. Additionally, mercury compounds are used in certain specialized chemical synthesis processes, including catalysts and laboratory reagents. Its unique physical and chemical properties, such as high density and conductivity, make it difficult to substitute in some cases.

- Mercury's unique properties, such as its high density, thermal expansion, and electrical conductivity, make it indispensable in devices like barometers, thermometers, manometers, and certain electrical relays and sensors, especially for research and calibration applications. Laboratories and scientific institutions continue to use mercury-based instruments where extremely accurate and reliable measurements are required, and alternatives may not offer comparable precision or response times. Additionally, mercury vapor lamps are still used in spectroscopy and UV light generation for testing, curing, and disinfection applications.

Mercury News

The report covers the latest developments, updates, and trends impacting the global mercury industry, providing stakeholders with timely and relevant information. This segment covers a wide array of news items, including the inauguration of new production facilities, advancements in mercury production technologies, strategic market expansions by key industry players, and significant mergers and acquisitions that impact the mercury price trend.

Latest developments in the Mercury industry:

- November 2023: Leading high-purity mercury manufacturer ESPI Metals partnered with a research center to create a closed-loop mercury recycling technology for use in electronics manufacturing.

- March 2022: Waybridge, a digital supply‑chain platform for raw materials, partnered with The Mercury Group, a bulk‑materials logistics firm, to optimize the transport of over 2 million metric tons of raw materials annually, encompassing metals like mercury, aluminum, copper, and zinc.

Product Description

Mercury is a naturally occurring chemical element with the symbol Hg and atomic number 80. It is unique among metals as it exists in a liquid state at room temperature. Commonly referred to as quicksilver, mercury is known for its silvery sheen and high density. It is extracted primarily from the mineral cinnabar (mercury sulfide) through heating and condensation. Mercury has been historically used in a wide range of applications including thermometers, barometers, batteries, fluorescent lamps, and dental amalgams, owing to its conductivity and ability to form amalgams with other metals.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Mercury |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Mercury Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of mercury pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting mercury price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The mercury price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)