Metal Cans Market Size, Share, Trends and Forecast by Material Type, Fabrication, Can Type, and Region, 2025-2033

Metal Cans Market Size and Share:

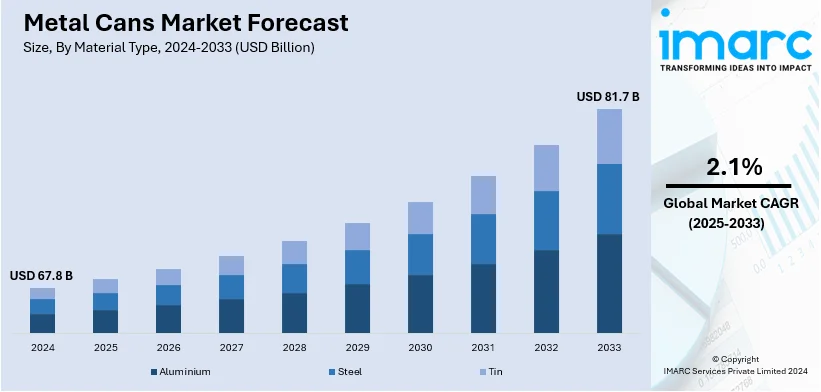

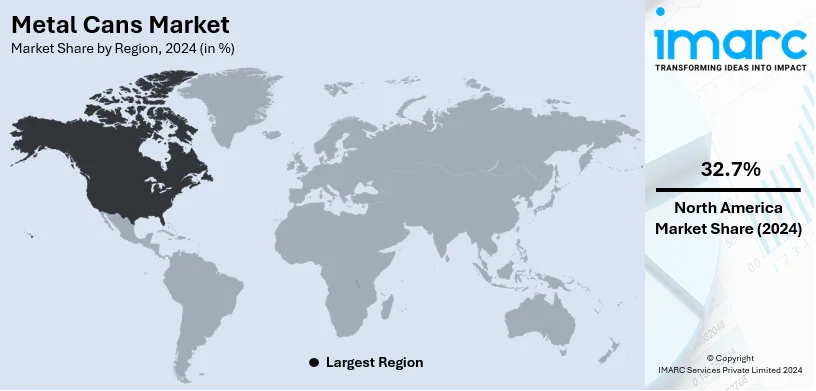

The global metal cans market size was valued at USD 67.8 Billion in 2024. Looking forward, the market is forecasted to reach USD 81.7 Billion by 2033, exhibiting a CAGR of 2.1% during 2025-2033. North America currently dominates the market, holding a significant market share of over 32.7% in 2024. The market growth is driven by the rising demand for packaged food and beverages, sustainability trends, recyclability, convenience, and innovations in packaging technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 67.8 Billion |

|

Market Forecast in 2033

|

USD 81.7 Billion |

| Market Growth Rate (2025-2033) | 2.1% |

The market is driven by several key factors, including the increasing demand for packaged beverages and food products, particularly in the soft drink, beer, and energy drink segments. Consumers’ preference for convenient, portable packaging that offers extended shelf life fuels this demand. Sustainability trends are also pivotal, as metal cans, especially aluminum, are 100% recyclable and have a lower environmental impact as compared to other materials. Advancements in packaging technology, such as lighter cans and enhanced printing, improve cost-efficiency and product appeal. The growing focus on eco-friendly and sustainable practices by both manufacturers and consumers supports the shift towards recyclable and durable materials. Additionally, the rise of online food and beverage delivery services further boosts the demand for metal cans.

To get more information on this market, Request Sample

In the United States, the market is propelled by the growing demand for packaged beverages, especially soft drinks, beer, and energy drinks. The trend toward on-the-go convenience and the need for durable, recyclable packaging are significant factors. Sustainability concerns are pushing manufacturers to adopt more eco-friendly materials, with aluminum being a popular choice due to its recyclability. For instance, in October 2024, PPG announced to join a U.S. recycling movement to collect millions of aluminum beverage cans as part of the “2 Million Cans Recycling Contest.” The contest is a partnership with the Can Manufacturers Institute (CMI), a recycling education group Recycling is like Magic, elementary schools, scrapyards, and aluminum can makers and suppliers to encourage students to learn about the importance of recycling. Additionally, the rise of e-commerce and direct-to-consumer services for food and beverages has further increased the demand for metal cans as reliable, protective packaging.

Metal Cans Market Trends:

Growing Demand for Packaged and Processed Food

The escalating usage of packaged and processed food products, as they offer convenience to consumers, especially in today's fast-paced lifestyles, is one of the key factors stimulating the metal cans market growth. For instance, according to a recent report published by the United States Department of Agriculture (USDA), the food processing industry in India contributes to 13% of the country’s total GDP. Moreover, the Prime Minister of India, along with the Union Cabinet, approved the Production-Linked Incentive (PLI) scheme in food products to enhance the manufacturing capabilities and elevate the exports. Metal cans are an ideal packaging solution for a wide range of processed foods, including fruits, vegetables, soups, sauces, and ready-to-eat meals. They provide shelf-stable storage, easy opening, and portion control, making them a convenient choice for consumers. Moreover, metal cans offer a secure and hygienic packaging option for processed food products, protecting them from contamination and tampering during storage and transportation. Besides this, the growing demand for beverages is stimulating the metal cans market share. For example, the revenue of Coca-Cola, one of the major key players in the beverage industry, grew 7% in the fourth quarter of 2023.

Increasing Focus on Recycling

Metals can be easily recycled without compromising on the quality. Apart from this, the elevating environmental concerns, along with surging awareness among consumers to mitigate disposal in landfills, are driving the metal cans market demand. As per the Environmental Protection Agency (EPA), in the U.S., the aluminum beverage cans recycling rate in 2018 was 50.4%, with 670,000 tons recycled, highlighting the significant potential of aluminum cans in waste reduction. One of the key metal cans market recent developments include extensive investment in recycling infrastructures and technologies. Furthermore, government and regulatory bodies are also taking significant initiatives and imposing stricter regulations and targets for recycling and waste reduction. For instance, in October 2023, Budweiser Brewing Co APAC Ltd, the largest beer company in the Asia Pacific, launched "Can-to-Can" recycling initiative in China. The program aimed to boost the percentage of recycled aluminum cans. Many metal cans manufacturers are also setting sustainability goals, including targets for using recycled materials in their packaging. This has led to an increased demand for recycled metal. Moreover, the concept of the circular economy, which aims to minimize waste and maximize resource efficiency, is propelling the demand for recycling. For example, an analysis of the most popular beverage packaging substrates conducted recently by the Energy and Resources Institute (TERI), the first of its type in India, revealed that aluminum cans support a fully circular economy and that most of them have the lowest Global Warming Potential (GWP).

Rising Usage of Alcoholic and Non-Alcoholic Beverages

The elevating adoption of metal cans in the food and beverage (F&B) industry as a packaging solution for storing various products, including iced teas, energy drinks, alcoholic beverages, sodas, carbonated soft drinks, etc., represents one of the key factors propelling the metal cans market revenue. Moreover, as per the metal cans market statistics the rising consumption of both alcoholic and non-alcoholic beverages like beer and fizzy drinks in regions, including Europe, is also acting as a significant growth-inducing factor. For instance, according to the Barth-Haas Group, Germany was the top beer producer in the Europe metal cans market in 2021. More than 85 million hl of beer were produced in Germany, more than twice as much as in the UK. Moreover, the rising environmental concern is augmenting the demand for eco-friendly cans.

Metal Cans Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on material type, fabrication, and can type.

Analysis by Material Type:

- Aluminium

- Steel

- Tin

Aluminium leads the market with around 74.5% of market share in 2024. The demand for aluminium cans is increasing owing to the rising investment by various market players in setting up new manufacturing infrastructures to meet growing orders and solve the shortage of aluminum cans. For example, in September 2021, the Ball Corporation started the construction of a new aluminum beverage packaging plant in Nevada, United States. The production of this multi-line factory was started in late 2022. Apart from this, the rising awareness among consumers towards the advantages associated with aluminum packaging in terms of sustainability and ease of recycling without affecting quality or energy efficiency will continue to offer metal cans market opportunities to the industry players.

Analysis by Fabrication:

- Two Piece Metal Can

- Three Piece Metal Can

Two piece metal can leads the market with around 69.5% of the market share in 2024. The demand for the two-piece cans is increasing in the market as many companies, like Kian Joo Can Factory and Berhad, choose to manufacture and sell the DWI steel cans, which are usually used to package processed and evaporated milk products, coupled with sweetened condensed milk. These cans are highly versatile and can be used for various applications, which in turn is contributing to the growth of this segment in the market.

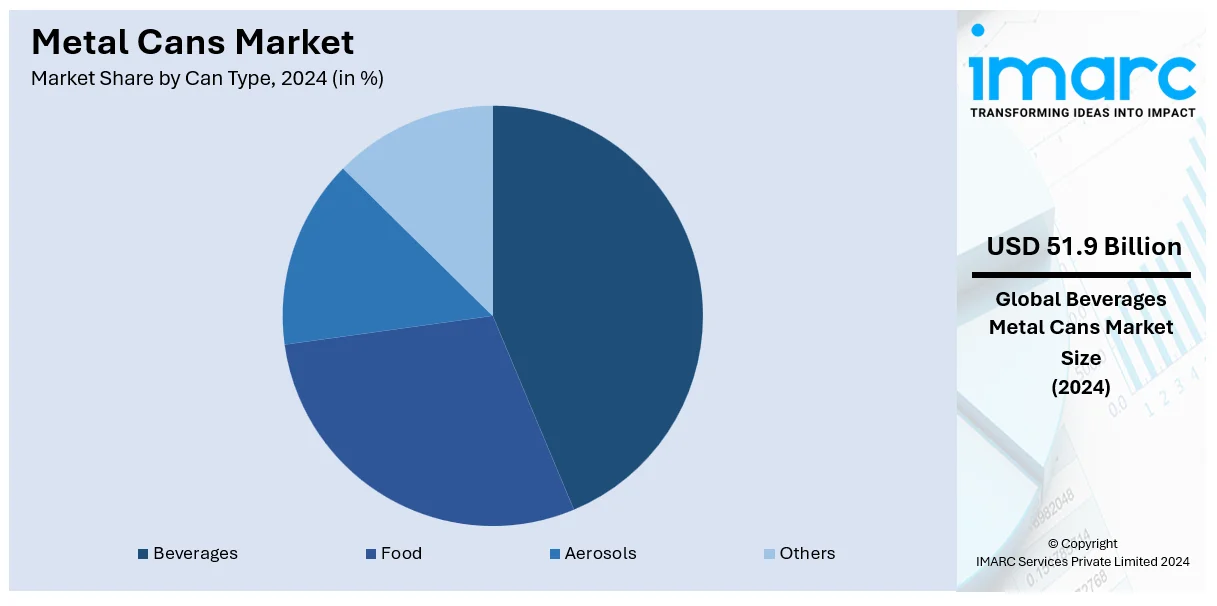

Analysis by Can Type:

- Food

- Vegetable

- Fruits

- Pet Food

- Others

- Beverages

- Alcoholic Beverage

- Non-Alcoholic Beverage

- Aerosols

- Paints and Varnishes

- Cosmetic and Personal Care

- Pharmaceuticals

- Others

- Others

Beverages leads the market with around 76.5% of the market share in 2024. Metal cans are extensively used to contain beverages without spoiling, leaking, or contaminating them which is primarily driving the segment growth in the market. As per the metal cans market overview, another factor contributing significantly to this segment's growth is the increasing demand for carbonated beverages, especially among younger consumers. The beverage market has been further segmented into alcoholic and non-alcoholic beverages. The rising preference for alcoholic beverages among the millennial population, along with the increasing disposable income are expected to fuel the segment growth in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 32.7%. The North America metal cans market is primarily driven by the highly developed infrastructure, and subsequent recycling industry. The region's growth is also catalysed, owing to the presence of significant market players. Along with their increased profitability, the ongoing strategic efforts of these manufacturers to produce sustainable packaging solutions are also positively influencing the regional market. Additionally, the escalating demand for canned food in countries, including Canada, will continue to drive the metal cans market in North America over the forecasted period.

Key Regional Takeaways:

United States Metal Cans Market Analysis

In 2024, the United States accounted for the market share of over 65.40%. The U.S. metal cans market is of great importance in the worldwide industry, mainly dominated by beverages and food. The metal can demand has been strong lately, particularly that of aluminium cans, mainly because of the material's recyclability feature, which is beneficial for the environmentally conscious buyer. According to an industrial data, in 2023, U.S. aluminum cans shipments, especially for alcoholic beverages such as beer, and soft drinks, shipped around 150.5 billion cans. Consumer trends toward sustainability and lightweight packaging are another significant market driver for this type of can. Ball Corporation and Crown Holdings, key producers in the market, actively invest in improving aluminum can production through innovation in eco-friendly solutions and lightweight designs. Lastly, the U.S. has strong domestic manufacturing capabilities and robust infrastructure in the country, thus supplying steady supplies of metal cans for beverage industry. The continued increase in the consumption of ready-to-drink beverages and environmental awareness has upped the game, making the U.S. continue to occupy the top rank among all countries in the metal can industry.

Europe Metal Cans Market Analysis

European metal cans market is growing with constant speed owing to increasing demand of environmentally friendly packaging solutions. In line with this, as per an industrial report, in Europe, 73% of aluminum beverage cans and 85.5% of steel packaging are recycled, which makes metal the most recycled packaging material. Still, there are obstacles with competition from polymer-based packaging alternatives like PET. Carbonated soft drinks and beer are large components of this demand within the beverage industry. The European market is also shifting towards increased adoption of aluminum cans due to their recyclability. In fact, the European Aluminium Foil Association reported that 75% of aluminum cans were recycled in 2023. Moreover, government regulations for sustainability and circular economies are pushing manufacturers to be more environmentally friendly, making Europe a leader in the global market for sustainable metal packaging.

Asia Pacific Metal Cans Market Analysis

Rapid growth in the metal cans market in the Asia Pacific region is experienced because of increased urbanization, change in consumer preferences, and rise in disposable incomes. According to an industrial report, the largest producer and consumer, China, accounted for almost 45% of the region's total metal can output in 2023. A primary driver of demand is in the beverage sector, especially soft drinks, beer, and energy drinks, through aluminum cans. India has also experienced growth, with a significant surge in aluminium can imports, supported by its rising beverage industry. Moreover, sustainable trends and government policies supporting recycling further accelerated demand for aluminum cans. Manufacturers are investing more in production facilities in this region to meet the growing demand and to leverage cost advantages, making Asia Pacific a major hub for the global metal can industry.

Latin America Metal Cans Market Analysis

Latin America metal cans market is doing well with rising beverage consumption and the middle class. It is driven by Brazil as the largest economy in the region. As per an industrial report, in 2023, Brazil's aluminum can market had an increase in sales by 1.65%, with a yearly production total of 32.3 billion cans. Per capita consumption in Brazil amounts to 165 12-can packages, which indicates a strong domestic demand for aluminum cans, especially in the beer segment. The metal can industry in Brazil is expected to increase in 2024, underpinned by positive economic conditions and the trend of individual consumption, including new offerings in non-alcoholic and flavoured beverages. The country is also a global leader in recycling, with more than 95% of cans recycled, which is a key driver of sustainability and cost-efficiency in the market. With enough production capacity to expand up to 40 billion cans yearly, Brazil remains a significant force in the Latin American metal cans sector.

Middle East and Africa Metal Cans Market Analysis

The Middle East and Africa region is slowly adopting the use of metal cans. The growth of the market is supported by improving healthcare systems and increased investments in medical research. Countries like Saudi Arabia, the UAE, and South Africa are driving this progress by modernizing healthcare infrastructure and enhancing access to advanced treatments. According to an industrial report, UAE citizens and residents each on average consume more than 60 aluminium drink cans every year - some 660 million aluminium beverage cans in total annually. The development of the market in the region is also influenced by growing awareness of chronic diseases and the necessity of effective therapeutic options.

Competitive Landscape:

The market is highly competitive, with key players such as Ball Corporation and Ardagh Group leading the industry. These companies focus on product innovation, sustainability, and technological advancements to meet growing consumer demand for eco-friendly packaging. Key strategies include mergers and acquisitions, partnerships with beverage and food companies, and investment in research and development for improved can designs. The shift toward recyclable and lightweight materials further intensifies competition. Additionally, emerging companies are capitalizing on regional growth opportunities, particularly in developing markets. Regulatory pressures and evolving consumer preferences for sustainable packaging are shaping the competitive landscape. For instance, in November 2024, The Brazilian Aluminum Can Manufacturers Association (Abralatas) and the digital content platform World of Cans established a cooperation agreement. This partnership intends to provide the technical content created by the World of Cans with a new channel for dissemination through Abralatas, while offering its users access to the aluminum can industry in Brazil.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Allied Cans Limited

- Ardagh Group

- Ball Corporation

- Berlin Packaging

- Envases Group

- Hindustan Tin Works Ltd.

- Independent Can Company

- Kaira Can Company Limited

- Kian Joo Can Factory Berhad

- Mauser Packaging Solutions

- SKS Bottle & Packaging, Inc.

- The Cary Company

Recent Developments:

- November 2024: Ball Corporation acquired Alucan, extending its sustainable aluminum packaging offerings in Europe. The transaction adds the company's Spanish and Belgian manufacturing plants for large-diameter aerosol cans and extruded bottles to its portfolio.

- July 2024: Silgan Holdings Inc. agreed to acquire Weener Plastics Holdings B.V. for Euro 838 million (USD 881.77 Million). This acquisition expands Silgan's global dispensing and specialty closures franchise, further optimizing its capabilities in consumer markets.

- June 2024: Sonoco announced its acquisition of Eviosys for about USD 3.9 Billion, combining to create the world's leading metal food can and aerosol packaging platform. This deal accelerates Sonoco's growth strategy with over USD 100 million in synergies.

- February 2024: Crown and CANPACK, two producers of beverage cans, have joined forces with Emirates Global Aluminium (EGA) to introduce "Every Can Counts," a creative campaign that encourages the recycling of used aluminium drink cans. This program, unveiled at COP28, is an important step in the United Arab Emirates' direction of developing a circular economy.

- December 2023: Vinca launched organic Sicilian wine in Ardagh Metal Packaging’s wine cans.

Metal Cans Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Aluminium, Steel, Tin |

| Fabrications Covered | Two Piece Metal Can, Three Piece Metal Can |

| Can Types Covered | Food (Vegetable, Fruits, Pet Food, Others), Beverages (Alcoholic Beverage, Non-Alcoholic Beverage), Aerosols (Paints and Varnishes, Cosmetic and Personal Care, Pharmaceuticals, Others), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allied Cans Limited, Ardagh Group, Ball Corporation, Berlin Packaging, Envases Group, Hindustan Tin Works Ltd., Independent Can Company, Kaira Can Company Limited, Kian Joo Can Factory Berhad, Mauser Packaging Solutions, SKS Bottle & Packaging, Inc., The Cary Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal cans market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global metal cans market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the metal cans industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Metal cans are containers made primarily from aluminum or steel, designed to store and preserve various products, including beverages, food, and chemicals. They are durable, lightweight, and recyclable, offering excellent protection against contamination and spoilage. Commonly used in packaging industries, metal cans ensure long shelf life and convenient transportability of the products.

The metal cans market was valued at USD 67.8 Billion in 2024.

IMARC estimates the global metal cans market to exhibit a CAGR of 2.1% during 2025-2033.

The beverages segment accounted for the largest metal cans market share of 76.5% by can type.

The metal cans market is driven by factors such as the increasing demand for packaged food and beverages, particularly in the convenience and ready-to-drink segments. Additionally, metal cans offer excellent preservation, durability, and recyclability, aligning with consumer preferences for sustainable packaging. Advancements in design and functionality also contribute to market growth.

According to the report, aluminium represented the largest segment by material type, due to its lightweight, recyclability, corrosion resistance, and cost-effectiveness, making it ideal for packaging

Two-piece metal cans leads the market by fabrication due to their cost-efficiency, ease of manufacturing, strength, and suitability for beverages and food packaging.

Beverages is the leading segment by can type, due to high demand for canned soft drinks, beer, and energy drinks, offering convenience and preservation.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global metal cans market include Allied Cans Limited, Ardagh Group, Ball Corporation, Berlin Packaging, Envases Group, Hindustan Tin Works Ltd., Independent Can Company, Kaira Can Company Limited, Kian Joo Can Factory Berhad, Mauser Packaging Solutions, SKS Bottle & Packaging, Inc., and The Cary Company.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)