Metal Stamping Market Size, Share, Trends and Forecast Report by Material, Press Type, Process, Application, and Region, 2025-2033

Metal Stamping Market 2024, Size and Trends:

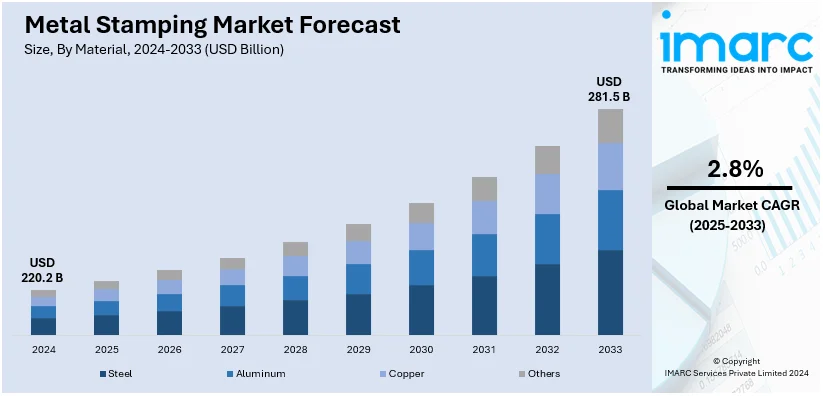

The global metal stamping market size was valued at USD 220.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 281.5 Billion by 2033, exhibiting a CAGR of 2.8% during 2025-2033. Asia Pacific currently dominates the market. The increasing emphasis on sustainable manufacturing practices, along with the rising adoption of metal-stamped parts in the oil and gas sector for equipment and machinery, is propelling the metal stamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 220.2 Billion |

| Market Forecast in 2033 | USD 281.5 Billion |

| Market Growth Rate (2025-2033) | 2.8% |

The automotive industry is a major force propelling the metal stamping market demand. Metal stamping plays a vital role in manufacturing vehicle components, including body panels, engine parts, and transmission systems. With the rise in vehicle production globally, driven by increasing urbanization and disposable incomes, the need for stamped metal parts is growing. Moreover, the growing preference for electric vehicles (EVs) is also boosting this demand. As per the data by the International Energy Agency, worldwide, over 14 million new electric vehicles were registered in 2023, bringing their total number on the roads to 40 million. EVs require lighter materials to improve energy efficiency, making aluminum and other lightweight metals crucial. Stamping processes cater perfectly to this need by providing precision and cost-effective production. Carmakers are also pushing for innovations in design, which further bolsters the requirement for advanced stamping technologies, like progressive die stamping and deep drawing.

The United States is a major market disruptor as its new electric car registrations totalled 1.4 million in the year 2023. EV adoption rates increased by more than 40% compared to 2022. Also, the electronics industry’s expansion is another driver boosting the metal stamping market share in the country. Modern electronic devices require small, intricately designed metal components for internal assemblies such as connectors, shields, and housing units. As demand for consumer electronics like smartphones, laptops, and wearable devices continues to grow, metal stamping becomes indispensable in ensuring precision and scalability for these intricate parts. For instance, the country’s smartphone market is expected to showcase a growth rate of 2.07% during 2024-2032. Thus, leading to the increased use of metal stamping.

Metal Stamping Market Trends:

Increasing Integration of Automation and Robotics

Automation and robotics offer numerous benefits, such as higher production speed, enhanced precision, and improved efficiency in metal stamping operations. Manufacturers can significantly reduce production or waiting time and costs by automating repetitive and labor-intensive tasks, increasing profitability and competitiveness. For instance, in April 2024, Scantech launched the AM-CELL C, a revolutionary optical automated 3D measurement system. It consists of a robot, a positioner, and a tracking station and was designed for efficient and automated inspection of small-to-medium-sized parts, such as stamping. Its revolutionary modular units allow for a variety of layouts, flexible deployment, and multiple-positioning operations. This innovative automated measurement technology allows for continuous measurements without waiting or interruptions, giving a measurement rate five times faster than a traditional system. Besides this, the integration of automation and robotics in metal stamping also enhances worker safety by reducing human involvement in hazardous operations. This leads to improved workplace conditions and higher workforce satisfaction. For instance, according to an article published by Keneng, robotic systems execute jobs that could risk the safety of human workers, such as lifting heavy goods or executing repetitive motions. This minimizes the chance of workplace accidents and helps create a safer workplace. These factors are further contributing to the metal stamping market share. According to data from the International Federation of Robotics, the 2023 annual robot installation total of 541,302 units is the second largest ever recorded. It is merely 2% below the high of 552,946 units installed in 2022.

Rising Utilization in the Medical Industry

The growing process utilization in the medical industry is driving the metal stamping market growth. Metal stamping allows for precise and complex components required in medical devices, such as surgical instruments, implantable devices, and diagnostic equipment. For instance, according to an article published by Clamason, precision is crucial in the manufacturing of medical devices. Metal stamping is a highly automated process that produces exceedingly accurate pieces with astounding accuracy. This permits exact standards to be met in large quantities. Besides this, metal stamping offers cost-effective solutions for producing high-volume components, essential for medical device manufacturers aiming to achieve economies of scale. For example, as per an article published by Worthy Hardware, metal stamping has transformed the medical business by providing precise, dependable, and cost-effective methods for manufacturing a variety of medical components. Furthermore, medical-grade metals, such as stainless steel, titanium, and various alloys, are commonly used in metal stamping for their biocompatibility, corrosion resistance, and strength. Various manufacturers are adopting metal stamping using stainless steel to produce medical lifesaving devices. For instance, in February 2022, Facet Medical Technologies installed a Bruderer high-performance, high-speed, 30-ton mechanical press line to stamp needles. It includes a decoiler (left), which unrolls a coil of chemically etched stainless steel. These factors are further bolstering the metal stamping market revenue.

Growing Automotive Sector

Rising vehicle production and an increase in demand for passenger vehicles across the globe are propelling the demand for metal stamping. For instance, according to an industrial report, the sales of passenger cars are expected to reach approximately 91 million in 2028. Moreover, metal stamping is used to manufacture body panels, such as doors, hoods, fenders, and roofs. These components are crucial for vehicle aesthetics, aerodynamics, and overall structural integrity. Automotive manufacturers are taking various initiatives to boost metal stamping. For example, in September 2022, General Motors Co. announced an investment of USD 491 Million to increase the manufacturing of steel and aluminum stamped parts for future products, including electric vehicles, at its Marion metal stamping facility in Indiana. This is further positively influencing the metal stamping market price trends. Besides this, various automotive manufacturers rely on blanking to produce a wide range of components essential for vehicle construction, including body panels, structural reinforcements, brackets, and various internal and external parts. Several players are forming strategic business partnerships with original equipment manufacturers (OEMs), which is witnessing major growth in the metal stamping market. For instance, in February 2023, Fischer Group collaborated with TRUMPF to introduce the cutting-edge TruLaser 8000 coil edition blanking at its Achern headquarters. This unique technology can process up to 25 tons of coiled sheet metal on its own, revolutionizing sheet metal production by increasing material use and resource efficiency.

Metal Stamping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global metal stamping market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, press type, process, and application.

Analysis by Material:

- Steel

- Aluminum

- Copper

- Others

As per the latest metal stamping market outlook, steel accounted for the largest market in 2024. The market is witnessing significant growth, largely driven by the demand for stamped components made from steel materials. Steel has become crucial in various industries due to its exceptional strength, versatility, and cost-effectiveness. As a result, multiple manufacturing sectors, including automotive, aerospace, electronics, and construction, heavily rely on steel-based stamped parts for their products. In the automotive industry, steel stampings are widely used in manufacturing body panels, chassis components, and other critical parts due to their high strength and ability to withstand harsh conditions. Moreover, rising mergers and acquisition activities among key players in the automotive industry are also driving the demand for steel stamping. For instance, in July 2023, the ArcelorMittal Europe collaborated with Germany-based Gestamp Metal Forming GmbH involving the handling of Gestamp's ferrous scrap. Furthermore, the construction industry utilizes steel stampings for fabricating structural parts, brackets, and fittings, benefiting from their durability and corrosion resistance. In the electronics sector, steel-based stamped components find application in electrical contacts and connectors due to their excellent electrical conductivity. Manufacturers are continuously investing in advanced technologies and processes to enhance their steel stamping capabilities, which is expanding the metal stamping market size.

Analysis by Press Type:

- Mechanical Press

- Hydraulic Press

- Servo Press

According to the recent metal stamping market forecast, mechanical press led the market in 2024. The mechanical press plays a significant role in catalyzing the market. Mechanical presses are widely used in various industries for their versatility, cost-effectiveness, and ability to handle a wide range of materials, including steel. Their simple and robust design makes them suitable for high-volume production, aligning perfectly with multiple sectors' demands. In the automotive industry, these presses are extensively employed to manufacture complex and precision components such as car body parts, engine components, and transmission parts. The ability to produce these parts efficiently and in large quantities has fueled the adoption of mechanical presses in automotive manufacturing.

Similarly, mechanical presses are utilized for producing stamped parts like panels, enclosures, and connectors in the appliance and electronics industries due to their consistent and reliable performance. Moreover, the construction and aerospace sectors also benefit from these presses for fabricating structural components and aerospace parts. The growth of the mechanical press segment is attributed to continuous advancements in press technology, leading to enhanced speed, accuracy, and automation capabilities. As industries seek increased productivity and cost efficiency, the widespread use of these presses in metal stamping fuels the overall market growth significantly.

Analysis by Process:

- Blanking

- Embossing

- Bending

- Coining

- Deep Drawing

- Flanging

- Others

Blanking led the market in 2024. According to the metal stamping market overview, blanking is a key metal stamping process to cut flat shapes from a metal sheet, creating precise components used in various industries. It enables mass production of components with consistent dimensions, meeting the demands of industries like automotive, electronics, and appliances. Its efficiency in producing high-quality parts at a rapid rate contributes to increased productivity and cost-effectiveness, driving market growth. Moreover, blanking's ability to work with different materials, including steel, aluminum, and copper, allows manufacturers to cater to diverse industry requirements. This versatility expands the market reach of metal stamping, attracting clients from various sectors seeking reliable and customized metal solutions. As industries continue to seek efficient and precise metal components, the demand for blanking in metal stamping will likely rise, further propelling the market. For instance, in February 2022, Toyota Tsusho America, Inc. and Southern Mobility Products formed a joint venture, Madison Metal Processing (MMP), in Huntsville, Alabama, to focus on blanking and storing steel goods, such as hot-rolled steel, cold-rolled steel, and exposed and coated steel.

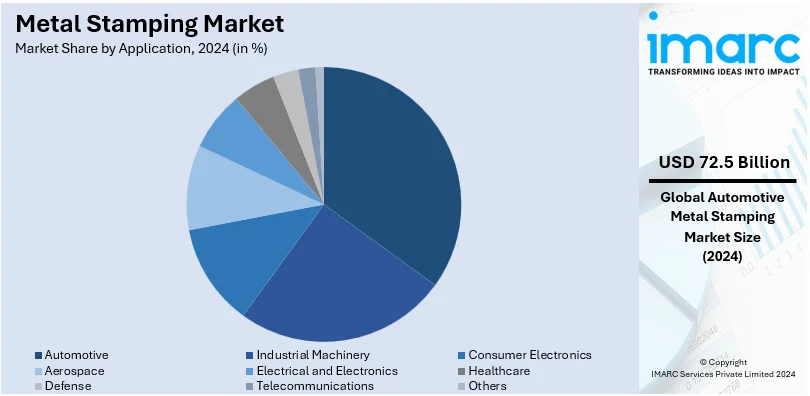

Analysis by Application:

- Automotive

- Industrial Machinery

- Consumer Electronics

- Aerospace

- Electrical and Electronics

- Healthcare

- Defense

- Telecommunications

- Others

Automotive held the largest market share in 2024. Automotive manufacturers rely heavily on metal stamping to produce components, including body panels, chassis parts, brackets, and engine components. The automotive industry's demand for lightweight yet durable materials has increased the adoption of metal-stamped parts, especially using materials like aluminum and advanced high-strength steel. Metal stamping's ability to produce precise and consistent components at high volumes aligns perfectly with the automotive sector's mass production requirements. Additionally, as the automotive industry shifts towards electric and hybrid vehicles, there is a growing need for specialized metal components for battery enclosures, powertrain components, and charging infrastructure. As the automotive industry continues to evolve and expand globally, the demand for metal-stamped components will remain robust, thereby expanding the metal stamping industry. Moreover, the rising collaboration between key players is also driving the market growth. For instance, in January 2024, GSC Steel Stamping, LLC, a family-owned firm that manufactures automobile parts, acquired Dixien LLC's assets to allow GSC Steel Stamping to continue its 43-year tradition in automobile parts stamping.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share. According to the metal stamping market statistics, the Asia Pacific region is witnessing rapid industrialization, infrastructure development, and economic growth, creating a high demand for metal-stamped components in various industries. The automotive sector is one of the largest consumers of metal stamped parts, fueled by the region's burgeoning automotive manufacturing industry. Additionally, the electronics and consumer goods industries are driving the demand for precision metal components, further boosting the market. Moreover, the region's focus on renewable energy projects, construction, and advancements in telecommunications infrastructure creates additional opportunities for metal stamping applications. The Asia Pacific's lower manufacturing costs and the availability of skilled labor and technological advancements attract investments from global players, contributing to the market expansion. As Asia Pacific continues to be a manufacturing hub and a crucial contributor to various industries' growth, the need for these components will remain strong, thus catalyzing the metal stamping market demand in the region. Apart from this, various manufacturers in the region are using business methods to cater to the metal stamping market offerings. For example, at the Auto Expo 2023-Components in January 2023, Gestamp launched its fourth hot stamping production line in India. This new expansion complements the current hot stamping plants in Pune, India. The business adds that this decision is consistent with its overall strategy for India and globally. It strives to increase consumer proximity and collaboration on solutions near manufacturers.

Key Regional Takeaways:

North America Metal Stamping Market Analysis

The metal stamping market in North America is experiencing robust growth, driven by advancements in the automotive, electronics, and renewable energy sectors. The increasing demand for electric vehicles has fueled the need for lightweight and precision-engineered metal components, positioning metal stamping as a critical manufacturing process. Additionally, the electronics industry, with rising demand for smartphones and 5G infrastructure, heavily relies on stamped metal parts for connectors and frames. Renewable energy initiatives, particularly in solar and wind energy, further amplify the market's expansion, with stamped components essential for energy-efficient equipment. North America’s adoption of advanced technologies like computer-aided manufacturing (CAM) and servo presses ensures higher precision and efficiency, keeping the region at the forefront of metal stamping innovations.

United States Metal Stamping Market Analysis

The U.S. metal stamping market is growing because of its high defense budget and industrial demand. The total exports of goods and services in 2023 were USD 3,053.5 Billion, according to the U.S. Bureau of Economic Analysis (BEA), with industrial supplies and materials making up a share of this amount. Civilian demand is stable because of a steady market in manufacturing and infrastructure. It also continues to find fuel from the significant demand for automobile and aerospace component production. New technologies that include the trend of automation as well as advance materials are found to augment the market's growth momentum. Some companies like Illinois Tool Works and Johnson Controls are quite prominent in this market. Increasing drives for reshoring manufacturing coupled with reducing the reliance on import is strengthening domestic markets. Federal policies and increasing awareness regarding sustainability also spur innovation in the metal stamping industry. U.S.-based manufacturers are expanding their reach, tapping into export opportunities, and reinforcing the country's position in the global market.

Europe Metal Stamping Market Analysis

Europe's metal stamping industry is dominated by its automobiles and green energy transition. According to ACEA, Europe manufactured more than 18.1 million new passenger vehicles in 2023, which provided the industry with a steady demand for precise-stamped components. The renewable energy sector, primarily wind turbines and solar panels, is the main driver for specialized stamped parts. As per Eurostat, in 2023, more than 44% of electricity generated in Europe was produced from renewable sources, pushing green manufacturing initiatives. Key players include Gestamp and Schuler AG, who focus on sustainable practices and align their operations with EU directives. Government-backed R&D initiatives in lightweight materials and precision tooling help them stay at the competitive edge while still being environmentally compliant. Europe is setting itself up as a global powerhouse for advanced metal stamping solutions through technology integration and cross-border partnerships.

Asia Pacific Metal Stamping Market Analysis

Asia Pacific leads the global metal stamping market, due to high growth in manufacturing and infrastructure development. The China Association of Automobile Manufacturers has reportedly produced 30.16 million vehicles in 2023, accounting for nearly 32% of the total global output. According to industrial reports, during 2023-24, automotive exports in India rose by 16% year-on-year, with the country allotting a defense budget of USD 72.6 Billion to promote local manufacturing. Electronics manufacturing is also driving demand, with South Korea and Japan being major producers of semiconductors. Regional emphasis on cost-effective stamping processes is pushing the boundaries of innovation in multi-slide and progressive die techniques. Government programs, such as "Make in India" and "Made in China 2025," promote technological advancement and capacity building. Key players such as Aida Engineering and Hitachi Metals benefit from regional growth by investing in automation and precision stamping. Asia Pacific's strategic focus on high quality and scalability will therefore make it a global player in the industry.

Latin America Metal Stamping Market Analysis

Latin America's metal stamping market is growing in response to industrial development and infrastructure projects. Brazil is the largest economy in the region, which is witnessing an increase in automotive production. As per industry reports, the automotive sales were up by 11.3% in 2023, reaching 2.18 million units. This increased production is driving the demand for precision stamped components used in making vehicles. Mexico and Colombia are also investing in the manufacturing capacity. Mexico now stands as a hub of automotive production in Latin America. Infrastructure development and renewable energy projects are the areas that region is concentrating on more; hence, stamped parts in construction and energy sectors face an increasing demand. Nemak and Metalsa are at the forefront in Latin America, investing in advanced stamping techniques and lightweight materials. The developing manufacturing capacity and increased governmental support for Latin America in this sector place it as a significant player in the global market of metal stamping.

Middle East and Africa Metal Stamping Market Analysis

Industrial development and infrastructure development in the Middle East and Africa drive the growth of the metal stamping market. The OECD reports that in the 2022, Saudi Arabia budgeted USD 642.7 Million to social infrastructure and services while it accounted for 9.9% gross bilateral official development assistance (ODA). Automotive exports of South Africa stood at USD 14.5 Billion in 2023, which creates growth in precision metal stamping. Renewable energy projects such as the installation of solar in UAE and Morocco are gaining. Advanced stamping techniques companies use are Oman Cables and Denel in meeting the requirements. Governments' plans through Saudi Vision 2030 boost their manufacturing capability rather than depending on imports. Partnerships with multinationals help in facilitating technology transfer and enhance the competitiveness of local manufacturers, positioning this region as a key player in this evolving metal stamping industry.

Competitive Landscape:

As per the emerging metal stamping market trends, top companies are catalyzing the market through their expertise, innovation, and customer-centric approach. These companies leverage their extensive experience and skilled workforce to provide high-quality metal-stamped components that meet the diverse needs of various industries. By investing in advanced technology and automation, they enhance production efficiency and precision, ensuring the timely delivery of products. Their commitment to research and development enables the development of new materials, processes, and designs, catering to evolving industry demands. Moreover, metal stamping industry companies prioritize customer satisfaction, offering customized solutions and excellent customer service. This fosters long-term partnerships and attracts new clients, driving market expansion through positive word-of-mouth and referrals. As market leaders, these companies set high industry standards and best practices, inspiring other players to innovate and elevate the overall quality of metal stamping products. Their continuous efforts to optimize manufacturing processes and expand capabilities contribute significantly to the overall growth and advancement of the market.

The report provides a comprehensive analysis of the competitive landscape in the metal stamping market with detailed profiles of all major companies, including:

- Acro Metal Stamping

- American Industrial Co.

- Caparo

- CIE Automotive

- Clow Stamping Company

- D&H Industries, Inc

- Goshen Stamping Company

- Kenmode, Inc.

- Klesk Metal Stamping Co.

- Manor Tool & Manufacturing Company

- Tempco Manufacturing Company, Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- June 2024: Tenral, a metal stamping components manufacturer in China, announced to offer cost-effective and high-quality precision metal stamping services.

- June 2024: BMW Manufacturing opened a press shop in Spartanburg, South Carolina, that can stamp up to 10,000 steel metal parts daily.

- January 2024: GSC Steel Stamping, LLC, a family-owned firm that manufactures automobile parts, acquired Dixien, LLC's assets to allow GSC Steel Stamping to continue its 43-year tradition in automobile parts stamping.

Metal Stamping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Steel, Aluminum, Copper, Others |

| Press Types Covered | Mechanical Press, Hydraulic Press, Servo Press |

| Processes Covered | Blanking, Embossing, Bending, Coining, Deep Drawing, Flanging, Others |

| Applications Covered | Automotive, Industrial Machinery, Consumer Electronics, Aerospace, Electrical and Electronics, Healthcare, Defense, Telecommunications, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acro Metal Stamping, American Industrial Co., Caparo, CIE Automotive, Clow Stamping Company, D&H Industries, Inc, Goshen Stamping Company, Kenmode, Inc., Klesk Metal Stamping Co., Manor Tool & Manufacturing Company, Tempco Manufacturing Company, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the metal stamping market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global metal stamping market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the metal stamping industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal stamping market was valued at USD 220.2 Billion in 2024.

IMARC estimates the Metal Stamping market to exhibit a CAGR of 2.8% during 2025-2033.

The global metal stamping market is driven by rising demand from the automotive industry for lightweight and durable components, expanding electronics production, advancements in renewable energy infrastructure, and growth in medical device manufacturing.

There are three types of metal stamping, namely, mechanical press, hydraulic press, and servo press.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the Metal Stamping market include Acro Metal Stamping, American Industrial Co., Caparo, CIE Automotive, Clow Stamping Company, D&H Industries, Inc, Goshen Stamping Company, Kenmode, Inc., Klesk Metal Stamping Co., Manor Tool & Manufacturing Company, Tempco Manufacturing Company, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)