Global Metal Stamping Market Set to Reach USD 281.5. Billion by 2033, Asia Pacific Led with 57.7% Market Share in 2024 - IMARC Group

Global Metal Stamping Market Statistics, Outlook and Regional Analysis 2025-2033

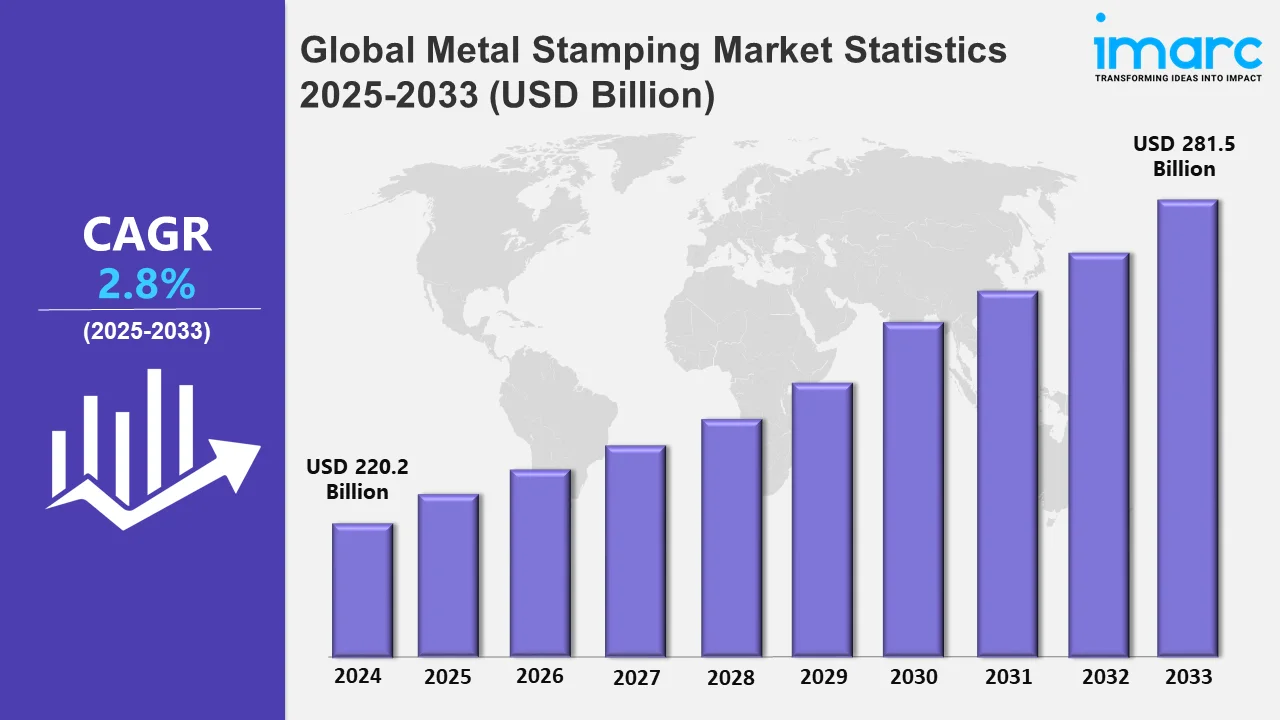

The global metal stamping market size was valued at USD 220.2 Billion in 2024, and it is expected to reach USD 281.5 Billion by 2033, exhibiting a growth rate (CAGR) of 2.8% from 2025 to 2033.

To get more information on this market, Request Sample

The global market is primarily driven by the increasing demand for lightweight and durable components in the automotive sector as manufacturers seek to enhance fuel efficiency and meet stringent environmental regulations. Additionally, strategic partnership between companies is enhancing the market appeal. For example, on August 8, 2024, Lutco announced the acquisition of an 800-ton Minster E2-800 Heavy Stamper, enhancing its manufacturing capabilities and reinforcing its industry leadership in the Northeast. This advanced press accommodates larger and more complex components, enabling Lutco to undertake projects requiring bigger, thicker, and more varied materials. The acquisition reflects Lutco's commitment to innovation and excellence in the metal stamping industry. Apart from these, the growing construction industry demands for structural components and machinery parts also serve as an important factor that facilitates market expansion.

Furthermore, growing investments in research and development (R&D) activities to improve material utilization and minimize waste also contribute to the growth of the market. Also, the increasing adoption of metal stamping in the medical field for the fabrication of surgical instruments and medical devices has expanded its application scope. The paradigm shift toward renewable energy has raised the demand for stamped parts in wind turbines and solar panel assemblies. In addition, the integration of sustainable practices, including the use of recyclable materials, aligns the market with global environmental goals, strengthening its long-term prospects. On September 24, 2024, AutoForm Engineering launched Forming R12, enhancing metal stamping processes with improved feasibility analysis and process validation tools. The software introduces advanced mesh refinement, elastic tool deflection compensation, and enhanced solver capabilities, allowing for efficient design and production. These updates aim to optimize quality and reduce manufacturing inefficiencies.

Global Metal Stamping Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of expanding automotive and electronics industries, cost-efficient production processes, and the adoption of advanced stamping technologies.

Asia-Pacific Metal Stamping Market Trends:

The Asia Pacific region dominates the metal stamping market with a market share of 57.7%, driven by large-scale manufacturing and low-cost production processes. Emerging countries are at the forefront due to rapid industrialization and expansion of end-user industries like automobiles, electronics, and construction. The region is one of the world's leading producers of electronics, where precision metal stamping is crucial for manufacturing components such as connectors, terminals, and heat sinks. A robust automotive industry in the region contributes greatly to the demand for lightweight and durable stamped parts. High-speed stamping and progressive die technologies are rapidly being adopted in the region. For instance, on October 6, 2024, UV Graphic Technologies will showcase high-speed stamping advancements at Labelexpo 2024, including the Pony Hot Foil FB, a flatbed hot foil stamping, embossing, and die-cutting machine achieving speeds of 20,000 IPH or 250 MPM, with integrated waste rewind and 100% inspection. The Pony FS offers high-speed roll-to-roll flatbed silk screen printing with digital foil embellishment. Local manufacturers are increasingly integrating automation and robotics to enhance efficiency and reduce production errors.

North America Metal Stamping Market Trends:

North America plays an important role in the metal stamping market with a developed manufacturing base and the ability to use advanced technologies. It is a major hub for several largest automotive, aerospace, and electronics companies. All these sectors heavily rely on metal stamping techniques to produce high-quality parts. With skilled labor and investments in automation and precision tools, the region is witnessing industry development. Additionally, a focus on innovations such as the inclusion of progressive stamping and advanced die technologies allows metal stamping in North America to cater to the high demand for lighter and more durable pieces.

Europe Metal Stamping Market Trends:

Europe plays a significant role in the market with its cutting-edge manufacturing infrastructure and rising emphasis on innovation. The region is known for the high-level production of complex, high-grade components, which are characterized by advanced materials and detailed designs. The focus on accuracy and quality has made Europe a niche leader in most applications. Sustainability initiatives throughout Europe have an effective influence on the metal stamping market, as manufacturers are increasingly adopting energy-efficient processes with lighter, recyclable material content to comply with rigorous environmental regulations. The well-organized suppliers' network in Europe, coupled with efficient logistics, add to the growth of the market in the region.

Latin America Metal Stamping Market Trends:

Latin America is also gaining importance in the metal stamping market due to its increasing industrial base and development of the automobile and electronics sectors. Countries such as Mexico and Brazil are more prominent due to their strategic locations and rising foreign investments. Latin America offers low-cost manufacturing solutions that attract global companies looking to optimize production. The region's skilled yet affordable labor pool further enhances its appeal, enabling efficient production of stamped components for both domestic and export markets. The availability of raw materials such as steel and aluminum help Latin American manufacturers keep their prices competitive while at the same time minimizing import reliance, which also supports the market growth in the region.

Middle East and Africa Metal Stamping Market Trends:

The Middle East and Africa are a developing region in the market with increasing industrialization, and infrastructure projects. The rise in construction, oil and gas, and transportation in this region results in the need for metal stamping. As governments heavily invest in urbanization and infrastructure development, the demand for precision-engineered metal components is growing, thus positioning this region as a potential growth area for stamping technologies. The availability of natural resources such as iron ore in the region supports localized production and diminishes import dependency. Diversification of economies, primarily in the Middle East region, is encouraging growth within the manufacturing sectors, specifically metal stamping.

Top Companies Leading in the Metal Stamping Industry

Some of the leading metal stamping market companies include Acro Metal Stamping, American Industrial Co., Caparo, CIE Automotive, Clow Stamping Company, D&H Industries, Inc, Goshen Stamping Company, Kenmode, Inc., Klesk Metal Stamping Co., Manor Tool & Manufacturing Company, and Tempco Manufacturing Company, Inc., among others. Notably, Acro Metal Stamping was recognized as the top new supplier by one of the biggest engine manufacturers in North America on June 27, 2024. This accolade highlights Acro's commitment to excellence in providing high-quality metal stamping solutions. The recognition reflects the company's dedication to meeting and exceeding industry standards.

Global Metal Stamping Market Segmentation Coverage

- On the basis of the material, the market has been categorized into steel, aluminum, copper, and others, wherein steel represents the leading segment with a market share of 64.1%. This dominance can be attributed to the material’s high strength, versatility, and durability. Steel offers structural integrity in various stamped parts. The resistance to corrosion and its capacity to support heavy loads render it highly appropriate for the automotive, aerospace, and construction industries. The significance of steel in the metal stamping market is also exhibited through its role in supporting high-volume production. Steel is ideal for producing intricate designs with precision, which makes it suitable for parts such as brackets, panels, and fasteners.

- Based on the press type, the market is classified into mechanical press, hydraulic press, and servo press, amongst which mechanical press dominates the market with a market share of 48.9%. Mechanical presses provide accuracy and efficiency in producing high-quality stamped parts. These presses utilize a flywheel-driven mechanism to generate force, which makes them ideal for high-speed stamping operations. The applications for mechanical presses include manufacturing in the automotive and electronics industries, which require constant force and precise control. The mechanical press is quite efficient and inexpensive, so it is widely used in an industry with mass production. Their simple yet reliable design allows for quick setup and long-term durability, making them an essential tool in large-scale production.

- On the basis of the process, the market has been divided into blanking, embossing, bending, coining, deep drawing, flanging, and others. Among these, blanking accounts for the majority of the market share, with 23.7%. Blanking is a key procedure for cutting flat, accurate forms from a bigger sheet of metal. This process takes a punch through the material to form a clean, uniform piece called a "blank," which is further processed into finished parts. It is widely used within industries such as automobiles, aircraft, and electronic manufacturing. The ability to produce high volumes of blanks quickly and accurately makes blanking a critical process in the manufacturing supply chain. The significance of blanking is that it offers cheap and efficient production solutions.

- Based on the application, the market is segregated into automotive, industrial machinery, consumer electronics, aerospace, electrical and electronics, healthcare, defense, telecommunications, and others, wherein automotive represents the leading segment with a market share of 32.9%. The automotive industry widely uses metal stamping, thereby contributing to the market growth. Metal stamping is used to produce a wide range of automotive components, including body panels, brackets, and structural components. The ability to manufacture parts quickly and efficiently while maintaining high levels of precision makes metal stamping an essential process for automotive production. It enables manufacturers to generate complex forms and fine features, ensuring the structural and aesthetic needs of automotive products are fulfilled. With the further development in the automotive industry towards electric-powered vehicles, metal stamping remains significant in producing lightweight, relatively inexpensive, yet durable products.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 220.2 Billion |

| Market Forecast in 2033 | USD 281.5 Billion |

| Market Growth Rate 2025-2033 | 2.8% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Steel, Aluminum, Copper, Others |

| Press Types Covered | Mechanical Press, Hydraulic Press, Servo Press |

| Processes Covered | Blanking, Embossing, Bending, Coining, Deep Drawing, Flanging, Others |

| Applications Covered | Automotive, Industrial Machinery, Consumer Electronics, Aerospace, Electrical and Electronics, Healthcare, Defense, Telecommunications, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acro Metal Stamping, American Industrial Co., Caparo, CIE Automotive, Clow Stamping Company, D&H Industries, Inc, Goshen Stamping Company, Kenmode, Inc., Klesk Metal Stamping Co., Manor Tool & Manufacturing Company, Tempco Manufacturing Company, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Metal Stamping Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)