Mexico Abrasives Market Size, Share, Trends and Forecast by Product Type, Material Type, End-Use, and Region, 2025-2033

Mexico Abrasives Market Overview:

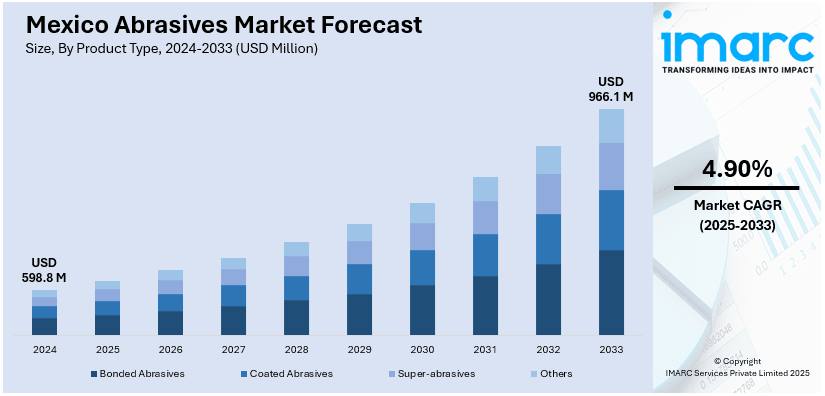

The Mexico abrasives market size reached USD 598.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 966.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. Growing construction and automotive sectors, rising demand for precision tools, and expansion in metal fabrication drive the market. Increasing infrastructure projects and industrialization, coupled with the shift toward automated manufacturing processes, further boost demand for coated, bonded, and super abrasives across industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 598.8 Million |

| Market Forecast in 2033 | USD 966.1 Million |

| Market Growth Rate 2025-2033 | 4.90% |

Mexico Abrasives Market Trends:

Rising Demand from Expanding Metal Fabrication Industry

The rapid expansion of metalworking and fabrication activities is fueling consistent demand for abrasives in Mexico. As global investment in fabrication equipment grows, Mexico is witnessing increased adoption of surface finishing, grinding, and cutting tools to support automotive, machinery, and infrastructure sectors. The rise in precision engineering and automated manufacturing has further accelerated the consumption of coated and bonded abrasives. In particular, the push toward lightweight metal structures and complex component production has heightened the need for high-performance abrasives that offer durability and speed. This shift is also supported by growing industrial capacity and the relocation of manufacturing bases to Mexico, which has created a robust downstream demand for reliable abrasive solutions. With fabrication processes becoming more specialized and volume-driven, abrasives are gaining critical importance in ensuring quality, consistency, and productivity across a range of metalworking applications, reinforcing their market presence in the country. For example, the global metal fabrication equipment market size reached USD 73.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 105.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.89% during 2025-2033.

Faster Fulfillment Driving Product Demand

Shortening delivery timelines for specialized abrasive products is reshaping supply expectations in Mexico’s industrial and automotive sectors. With growing reliance on just-in-time manufacturing and tight production cycles, faster access to gear grinding wheels and other precision abrasives has become a competitive advantage. Manufacturers increasingly seek partners that can offer reduced lead times without compromising on performance or customization. Enhanced service models and local support capabilities are enabling a more agile supply chain, especially for high-demand applications in gear and engine component finishing. This shift is strengthening the role of premium abrasives in industrial workflows as users prioritize availability, speed, and quality to meet escalating output demands. The ability to deliver quickly is not just a logistical improvement, it directly impacts operational efficiency and production continuity across Mexican industries. For instance, in August 2024, Weiler Abrasives introduced its Precision Express service, aimed at reducing delivery time for gear grinding wheels from months to days. This launch supports Mexico's automotive and industrial sectors by addressing lead time issues and ensuring consistent supply through advanced in-house profiling and proprietary V59 bond technology.

Mexico Abrasives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material type, and end-use.

Product Type Insights:

- Bonded Abrasives

- Coated Abrasives

- Super-abrasives

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bonded abrasives, coated abrasives, super-abrasives, and others.

Material Type Insights:

- Natural Abrasives

- Synthetic Abrasives

The report has provided a detailed breakup and analysis of the market based on the material type. This includes natural abrasives and synthetic abrasives.

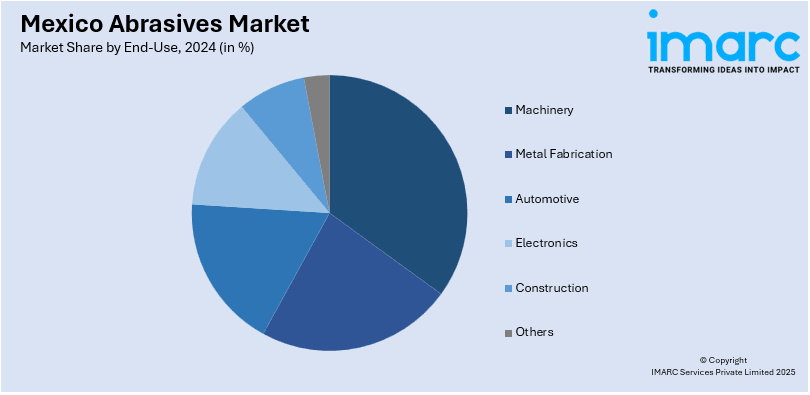

End-Use Insights:

- Machinery

- Metal Fabrication

- Automotive

- Electronics

- Construction

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes machinery, metal fabrication, automotive, electronics, construction, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Abrasives Market News:

- In September 2024, PPG’s SEM Products launched a new performance abrasives line, expanding its automotive refinishing solutions. With sanding sheets, discs, and blocks designed for durability and fast cutting, the product targets markets across North America, including Mexico, reinforcing PPG’s position in the professional-grade abrasives segment.

Mexico Abrasives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bonded Abrasives, Coated Abrasives, Super-abrasives, Others |

| Material Types Covered | Natural Abrasives, Synthetic Abrasives |

| End-Uses Covered | Machinery, Metal Fabrication, Automotive, Electronics, Construction, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico abrasives market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico abrasives market on the basis of product type?

- What is the breakup of the Mexico abrasives market on the basis of material type?

- What is the breakup of the Mexico abrasives market on the basis of end-use?

- What are the various stages in the value chain of the Mexico abrasives market?

- What are the key driving factors and challenges in the Mexico abrasives market?

- What is the structure of the Mexico abrasives market and who are the key players?

- What is the degree of competition in the Mexico abrasives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico abrasives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico abrasives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico abrasives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)