Mexico Active Pharmaceutical Ingredients Market Size, Share, Trends and Forecast by Drug Type, Manufacturer Type, Synthesis Type, Therapeutic Application, and Region, 2026-2034

Mexico Active Pharmaceutical Ingredients Market Summary:

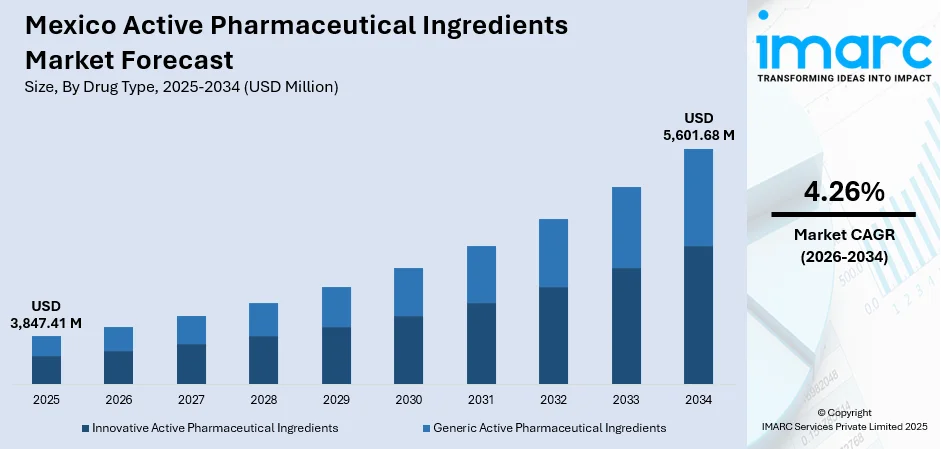

The Mexico active pharmaceutical ingredients market size was valued at USD 3,847.41 Million in 2025 and is projected to reach USD 5,601.68 Million by 2034, growing at a compound annual growth rate of 4.26% from 2026-2034.

The Mexico active pharmaceutical ingredients market is experiencing significant expansion driven by the country's strategic position as a nearshoring hub for North American pharmaceutical supply chains. Growing domestic healthcare demands, particularly for treatments addressing prevalent chronic conditions, are stimulating API production. Government initiatives promoting pharmaceutical self-sufficiency and regulatory modernization aligned with international standards are accelerating market development across therapeutic segments.

Key Takeaways and Insights:

-

By Drug Type: Generic active pharmaceutical ingredients dominate the market with a share of 64% in 2025, driven by healthcare system prioritization of affordable medications and expanding public procurement of generic medicines.

-

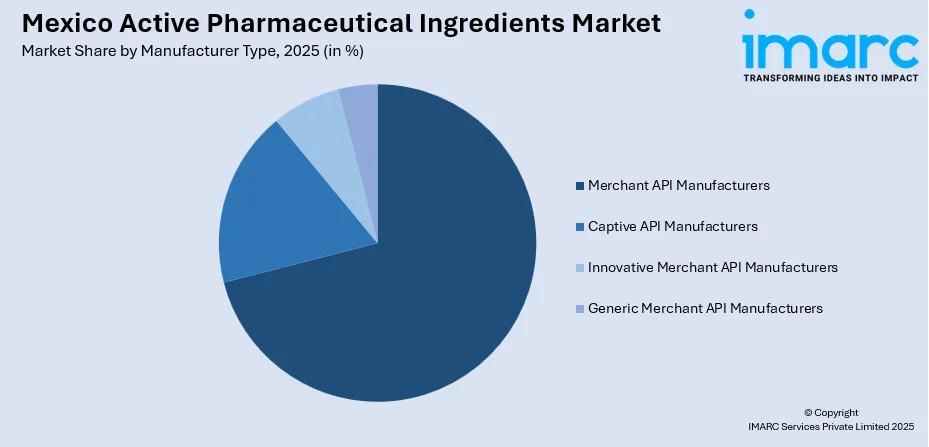

By Manufacturer Type: Merchant API manufacturers lead the market with a share of 71% in 2025, reflecting growing demand from pharmaceutical companies seeking reliable third-party API suppliers for diverse therapeutic portfolios.

-

By Synthesis Type: Synthetic active pharmaceutical ingredients represent the largest segment with a market share of 84% in 2025, supported by established chemical synthesis infrastructure and cost advantages over biotechnology-derived alternatives.

-

By Therapeutic Application: Cardiovascular and respiratory leads with a share of 30% in 2025, driven by the high prevalence of hypertension and diabetes-related cardiovascular complications in the Mexican population.

-

By Region: Central Mexico dominates with a market share of 46% in 2025, benefiting from pharmaceutical headquarters concentration, research facilities, and proximity to major healthcare institutions.

-

Key Players: The Mexico active pharmaceutical ingredients market exhibits moderate competitive intensity with established multinational pharmaceutical corporations competing alongside domestic manufacturers across price segments, investing in advanced manufacturing facilities and quality certifications.

To get more information on this market Request Sample

The Mexican pharmaceutical industry is undergoing a significant transformation as the country positions itself as a strategic manufacturing hub for North American markets. Government policies promoting pharmaceutical sovereignty have catalyzed substantial investments from both domestic and international players. The Ministry of Health's commitment to procuring essential medicines has provided confidence to manufacturers expanding API production capabilities. The country's favorable trade arrangements, combined with competitive manufacturing costs and a skilled workforce, are attracting pharmaceutical companies seeking to diversify supply chains away from traditional Asian suppliers. Mexico's extensive installed capacity includes manufacturing plants certified by COFEPRIS and aligned with international regulatory standards, enabling production of diverse pharmaceuticals from cost-effective generics to specialized biologics. Recent investment announcements demonstrate strong industry confidence in the market's growth trajectory, with major pharmaceutical groups committing substantial capital toward expanding production capacity and developing biosimilar capabilities.

Mexico Active Pharmaceutical Ingredients Market Trends:

Nearshoring-Driven Manufacturing Expansion

The pharmaceutical nearshoring trend is reshaping Mexico's API landscape as global companies seek to reduce supply chain vulnerabilities exposed during recent global disruptions. Multinational corporations are establishing and expanding manufacturing operations in Mexico to serve North American markets with shorter lead times and improved supply security. The country's extensive installed capacity and manufacturing plants certified to international standards enable the production of diverse pharmaceuticals. Recent investments in tablet production facilities exemplify this strategic manufacturing shift toward regional production capabilities. For instance, Neolsym plans to allocate 500 million pesos to expand its API production facilities in Ecatepec, aiming to increase manufacturing capacity and strengthen its presence in the active pharmaceutical ingredient sector.

Regulatory Modernization and International Alignment

Mexico is modernizing its regulatory framework to meet global pharmaceutical standards. Updated Good Manufacturing Practice (GMP) guidelines now align with international inspection schemes and trade agreement requirements, enabling smoother cross-border collaborations. The acceptance of foreign GMP certifications minimizes duplicate inspections, while the digitization of regulatory processes improves efficiency and reduces administrative burdens. Extended validity periods for GMP certifications provide stability for manufacturers, supporting long-term planning and infrastructure development, and fostering a more predictable and streamlined environment for pharmaceutical production and compliance across the country.

Biotechnology and Biosimilar Development Initiatives

The biotechnology API segment is experiencing accelerated development as manufacturers invest in biologics and biosimilar production capabilities. Infrastructure expansion for biopharmaceutical production from microbial cells, biotechnological product filling, and vaccine manufacturing is underway across manufacturing clusters. Central Mexico has emerged as a focal point for biotech API development, hosting clinical trials, research facilities, and innovation-driven manufacturing operations. For instance, in May 2025, Innocan Pharma Corporation, a leader in the pharmaceutical and biotechnology sectors, announced that the Mexican patent office granted a notice of allowance for its patent application, protecting the company’s innovative proprietary topical pain-relief technology. Government support through national pharmaceutical policy initiatives is encouraging collaboration between academic institutions and pharmaceutical manufacturers.

Market Outlook 2026-2034:

The Mexico active pharmaceutical ingredients market outlook remains highly positive as structural healthcare needs converge with evolving pharmaceutical manufacturing capabilities and supportive government policies. The combination of domestic healthcare expansion, nearshoring-driven investment influx, and growing biotech capabilities is positioning Mexico as a strategic powerhouse in regional drug manufacturing. Investment commitments from pharmaceutical companies demonstrate strong confidence in the market's potential. The market generated a revenue of USD 3,847.41 Million in 2025 and is projected to reach a revenue of USD 5,601.68 Million by 2034, growing at a compound annual growth rate of 4.26% from 2026-2034.

Mexico Active Pharmaceutical Ingredients Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Drug Type | Generic Active Pharmaceutical Ingredients | 64% |

| Manufacturer Type | Merchant API Manufacturers | 71% |

| Synthesis Type | Synthetic Active Pharmaceutical Ingredients | 84% . |

| Therapeutic Application | Cardiovascular and Respiratory | 30% |

| Region | Central Mexico | 46% |

Drug Type Insights:

- Innovative Active Pharmaceutical Ingredients

- Generic Active Pharmaceutical Ingredients

The generic active pharmaceutical ingredients dominate with a market share of 64% of the total Mexico active pharmaceutical ingredients market in 2025.

Mexico's healthcare system demonstrates strong reliance on generic medicines to ensure treatment affordability and accessibility for its population. Public healthcare organizations have increasingly prioritized generics in procurement processes, aligning with government initiatives aimed at reducing healthcare expenditure while expanding national drug coverage. This policy direction directly stimulates domestic API consumption as pharmaceutical manufacturers scale production of active ingredients used in commonly prescribed treatments.

The generic API segment benefits significantly from Mexico's position as a cost-effective manufacturing center serving both domestic and export markets. Patent expirations for key branded drugs continue creating new generic market opportunities, prompting pharmaceutical producers to expand their API requirements for treatments addressing chronic conditions endemic to the Mexican population, including diabetes and cardiovascular disorders.

Manufacturer Type Insights:

Access the comprehensive market breakdown Request Sample

- Captive API Manufacturers

- Merchant API Manufacturers

- Innovative Merchant API Manufacturers

- Generic Merchant API Manufacturers

The merchant API manufacturers lead with a share of 71% of the total Mexico active pharmaceutical ingredients market in 2025.

Merchant API manufacturers have established a dominant market position by serving diverse pharmaceutical companies requiring reliable third-party API supplies for their formulation operations. These manufacturers cater to both domestic pharmaceutical producers and multinational corporations seeking qualified suppliers in Mexico's nearshoring-friendly environment. Contract manufacturing arrangements with global pharmaceutical firms have strengthened Mexico's merchant API segment significantly.

The growth trajectory of merchant API manufacturers reflects broader industry trends toward outsourcing specialized manufacturing operations. Pharmaceutical companies increasingly prefer partnering with established merchant manufacturers possessing necessary regulatory certifications, quality management systems, and production expertise rather than investing in dedicated captive facilities requiring substantial capital expenditure.

Synthesis Type Insights:

- Synthetic Active Pharmaceutical Ingredients

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech Active Pharmaceutical Ingredients

- Drug Type

- Innovative Biotech APIs

- Biosimilars

- Product Type

- Monoclonal Antibodies

- Vaccines

- Cytokines

- Others

- Expression System Type

- Mammalian Expression System

- Microbial Expression System

- Yeast Expression System

- Others

The synthetic active pharmaceutical ingredients exhibit clear dominance with an 84% share of the total Mexico active pharmaceutical ingredients market in 2025.

Synthetic APIs maintain overwhelming market dominance due to established chemical synthesis infrastructure developed over decades of pharmaceutical manufacturing history in Mexico. The country possesses well-developed capabilities for producing chemically synthesized active ingredients through proven manufacturing processes that deliver consistent quality at competitive costs across diverse therapeutic categories.

The cost advantages of synthetic API production compared to biotechnology-derived alternatives contribute to sustained segment leadership. Manufacturing infrastructure for chemical synthesis is well-established across Mexico's pharmaceutical manufacturing clusters, with facilities certified to international quality standards enabling both domestic supply and export operations to neighboring markets.

Therapeutic Application Insights:

- Oncology

- Cardiovascular and Respiratory

- Diabetes

- Central Nervous System Disorders

- Neurological Disorders

- Others

The cardiovascular and respiratory dominates with a share of 30% of the total Mexico active pharmaceutical ingredients market in 2025.

Cardiovascular and respiratory APIs lead therapeutic applications reflecting the significant burden of these conditions in Mexico's population. The prevalence of hypertension among Mexican adults has increased substantially in recent years, driving consistent demand for antihypertensive active ingredients. Cardiovascular diseases represent the leading cause of mortality in Mexico, requiring sustained pharmaceutical interventions.

Respiratory conditions including chronic obstructive pulmonary disease and asthma contribute to the segment's prominence, particularly given environmental factors affecting urban populations in major Mexican cities. The interrelationship between diabetes and cardiovascular conditions further amplifies demand as a significant proportion of diabetic patients develop cardiovascular complications requiring concurrent treatments.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 46% of the total Mexico active pharmaceutical ingredients market in 2025.

The Mexico active pharmaceutical ingredients (API) market is being driven by rising demand for pharmaceuticals, particularly generic medicines, as healthcare access expands and treatment needs increase across the country. Pharmaceutical manufacturers are focusing on securing reliable API supplies to support consistent drug production and cost efficiency. Supportive regulatory frameworks, efforts to strengthen domestic manufacturing, and initiatives to reduce reliance on imported raw materials are further encouraging investment in local API capabilities. Additionally, growing emphasis on quality standards and compliance is pushing manufacturers to modernize production processes and scale operations.

Central Mexico plays a pivotal role in this growth due to its well-developed industrial ecosystem and strategic advantages. The region hosts a high concentration of pharmaceutical manufacturers, research centers, and skilled technical talent, enabling efficient API production and innovation. Strong transportation networks and proximity to major consumption and export markets enhance supply chain efficiency. Furthermore, the presence of academic institutions and contract research organizations supports formulation development and process optimization, reinforcing Central Mexico’s position as a key hub for API manufacturing and distribution.

Market Dynamics:

Growth Drivers:

Why is the Mexico Active Pharmaceutical Ingredients Market Growing?

Rising Prevalence of Chronic Diseases Driving Healthcare Demand

Mexico faces a significant and growing burden of chronic non-communicable diseases that directly stimulates pharmaceutical demand and API consumption. The prevalence of diabetes and hypertension has increased substantially among Mexican adults, with cardiovascular diseases now representing the leading cause of death in the country. Heart disease accounts for the highest mortality figures, followed closely by diabetes-related deaths. Even with increased statin use and better cholesterol management, the risk of cardiovascular disease in Mexico increased from 2016 to 2023. This finding, presented at ACC Latin America 2025, relied on region-specific assessment tools to provide a more precise estimation of the local disease burden. The interrelationship between these conditions creates compounded pharmaceutical needs, as diabetic patients frequently require concurrent cardiovascular medications. Lifestyle factors including physical inactivity, dietary changes, and urbanization, continue driving disease prevalence increases, expanding the addressable market for API manufacturers.

Strategic Nearshoring and Supply Chain Diversification

Global pharmaceutical supply chain reconfiguration is positioning Mexico as a preferred manufacturing destination for companies seeking to reduce dependence on Asian suppliers. The nearshoring trend accelerated following supply chain disruptions that exposed vulnerabilities in concentrated pharmaceutical manufacturing networks. Mexico's geographic proximity to the United States, favorable trade arrangements, and manufacturing cost advantages make it an attractive alternative for pharmaceutical production serving North American markets. Multinational pharmaceutical corporations are expanding operations in Mexico to benefit from shorter supply chain distances, improved delivery reliability, and regulatory harmonization with key export markets, driving substantial capital investments.

Government Initiatives Promoting Pharmaceutical Self-Sufficiency

The Mexican government has implemented comprehensive policies supporting domestic pharmaceutical manufacturing development and reducing import dependence. Health sovereignty has become a national priority, with authorities committing to expanded procurement of locally manufactured medicines. The Ministry of Health has guaranteed purchases of basic medicines and medical supplies, providing market certainty for manufacturers investing in production capacity expansion. Regulatory modernization efforts have streamlined approval processes while maintaining quality standards aligned with international requirements. Government incentives, including tax benefits, infrastructure support, and public procurement prioritization, are encouraging both domestic and multinational corporations to expand API manufacturing operations.

Market Restraints:

What Challenges the Mexico Active Pharmaceutical Ingredients Market is Facing?

Continued Import Dependence on Foreign API Sources

Although domestic pharmaceutical production is expanding, Mexico still relies heavily on imported active pharmaceutical ingredients (APIs). This dependence makes the supply chain vulnerable to external disruptions such as price volatility, shipping delays, and geopolitical uncertainties. Developing a fully self-reliant API manufacturing ecosystem demands significant capital investment, advanced technological capabilities, and specialized workforce training to ensure consistent, high-quality production within the country.

Infrastructure and Technical Capacity Limitations

To emerge as a leading pharmaceutical manufacturing hub, Mexico requires sustained investment in critical infrastructure, including reliable water, energy, and transportation networks. Certain regions currently lack the facilities needed for large-scale API production. Establishing advanced manufacturing capabilities for complex pharmaceutical compounds also demands focused workforce training programs, adoption of cutting-edge technologies, and knowledge transfer initiatives to build technical expertise.

Competitive Pressure from Other Nearshoring Destinations

Mexico faces growing competition from other nearshoring destinations aiming to attract pharmaceutical manufacturing investments. Rival countries often offer favorable regulatory environments, advanced infrastructure, and incentive schemes to lure investors. To remain competitive, Mexico must continuously enhance regulatory efficiency, upgrade infrastructure, incentivize investments, and strengthen manufacturing capabilities, ensuring it can attract and retain pharmaceutical production while meeting global quality and compliance standards.

Competitive Landscape:

The Mexico active pharmaceutical ingredients market exhibits a moderately competitive landscape characterized by the presence of established domestic manufacturers alongside multinational pharmaceutical corporations expanding their Mexican operations. Market participants are differentiated by manufacturing capabilities spanning synthetic chemistry and emerging biotechnology production, regulatory certifications enabling domestic and export market access, and therapeutic specialization across cardiovascular, diabetes, oncology, and other therapeutic areas. Competition is intensifying as nearshoring trends attract new investments, while existing players expand capacity to capture growing demand. Companies are increasingly investing in quality certifications, advanced manufacturing technologies, and backward integration strategies to strengthen competitive positioning.

Recent Developments:

-

In August 2025, multiple pharmaceutical companies, Boehringer Ingelheim, Laboratorios Carnot, Bayer, and AstraZeneca announced investments exceeding MXN 12 billion for expanding clinical research, manufacturing capacity, and technological capabilities in Mexico, demonstrating strong industry confidence in the market.

-

In July 2025, the Mexican government unveiled a fresh investment of MX$10.48 billion (US$524 million) aimed at enhancing the nation’s pharmaceutical manufacturing capacity. Implemented under the “Plan México” framework, this initiative intends to strengthen domestic drug production, lessen dependence on global supply chains, and boost the country’s self-reliance in pharmaceutical manufacturing.

Mexico Active Pharmaceutical Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Types Covered | Active Pharmaceutical Ingredients, Generic Active Pharmaceutical Ingredients |

| Manufacturer Types Covered | Captive API Manufacturers, Merchant API Manufacturers |

| Synthesis Types Covered |

|

| Therapeutic Applications Covered | Oncology, Cardiovascular and Respiratory, Diabetes, Central Nervous System Disorders, Neurological Disorders, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico active pharmaceutical ingredients market size was valued at USD 3,847.41 Million in 2025.

The Mexico active pharmaceutical ingredients market is expected to grow at a compound annual growth rate of 4.26% from 2026-2034 to reach USD 5,601.68 Million by 2034.

Generic active pharmaceutical ingredients dominated the market with a share of 64% in 2025, driven by healthcare system prioritization of affordable generic medications and expanding public procurement programs.

Key factors driving the Mexico active pharmaceutical ingredients market include rising prevalence of chronic diseases, strategic nearshoring and supply chain diversification by pharmaceutical companies, and government initiatives promoting pharmaceutical self-sufficiency.

Major challenges include continued import dependence on foreign API sources, infrastructure and technical capacity limitations in certain regions, and competitive pressure from other nearshoring destinations seeking pharmaceutical manufacturing investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)