Mexico Adhesive Tape Market Size, Share, Trends and Forecast by Material, Resin, Technology, Application, and Region, 2026-2034

Mexico Adhesive Tape Market Summary:

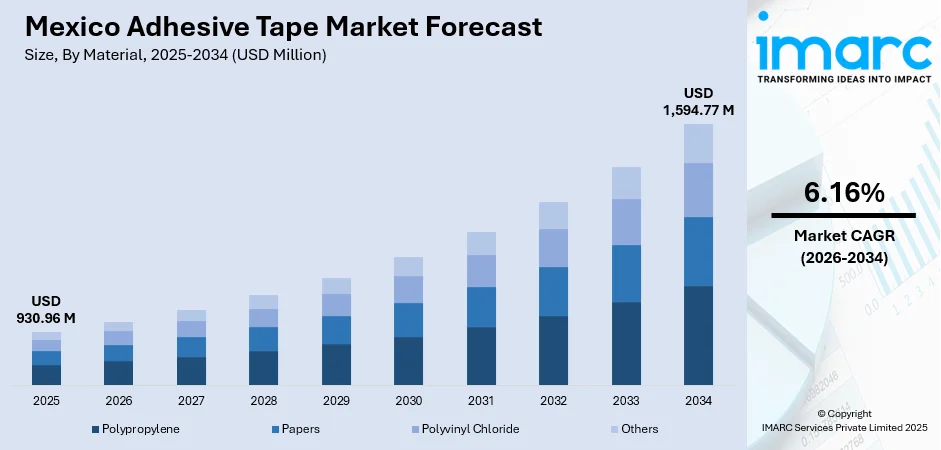

The Mexico adhesive tape market size was valued at USD 930.96 Million in 2025 and is projected to reach USD 1,594.77 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034.

The market experiences robust expansion driven by Mexico's strategic position as the fifth-largest global vehicle producer, with automotive manufacturing generating substantial demand for specialized bonding and assembly solutions. The country's automotive sector is producing massive quantities of autoparts, thereby supporting the market growth. Simultaneously, Mexico's e-commerce market is transforming packaging requirements, necessitating durable, tamper-evident adhesive solutions for secure transit. Major infrastructure initiatives, are driving consumption across construction applications for insulation, surface protection, and moisture barriers, collectively expanding the Mexico adhesive tape market share.

Key Takeaways and Insights:

-

By Material: Polypropylene dominates the market with a share of 53% in 2025, benefiting from superior tensile strength, flexibility, and chemical resistance properties that make it ideal for carton sealing, bundling, and palletizing applications across packaging operations, while offering cost advantages over alternatives like polyvinyl chloride and paper backing materials.

-

By Resin: Acrylic leads the market with a share of 46% in 2025, attributed to exceptional chemical resistance across oils and solvents, effective adhesion to diverse substrates including metal, glass, and plastics, and robust initial tack properties.

-

By Technology: Hot-melt-based adhesive tapes represent the largest segment with a market share of 42% in 2025, driven by fast-setting characteristics, strong initial bond strength, and temperature resistance properties.

-

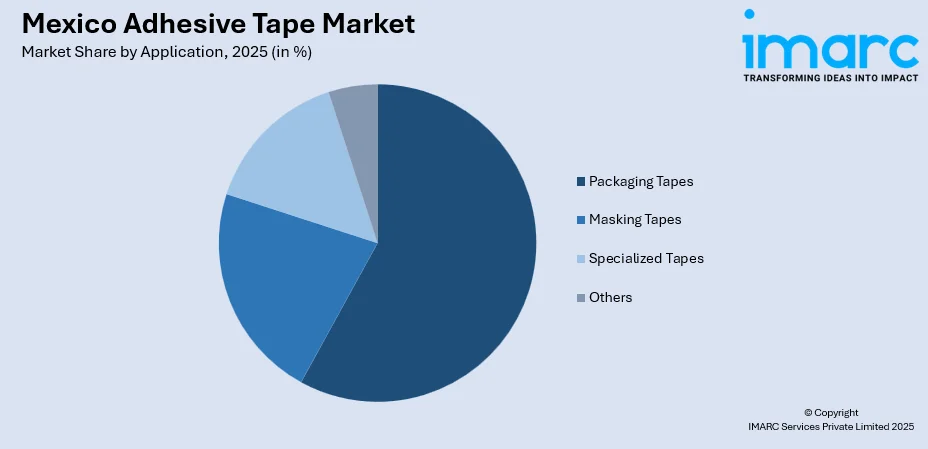

By Application: Packaging tape leads the market with a share of 58% in 2025, fueled by expanding e-commerce logistics networks, growing demand for corrugated box sealing, mailer reinforcement, and branded closure applications.

-

By Region: Northern Mexico represents the largest segment with a market share of 45% in 2025, anchored by concentrated automotive manufacturing operations in states like Coahuila.

-

Key Players: The Mexico adhesive tape market exhibits moderate competitive intensity, with multinational personal care and industrial materials corporations competing alongside regional manufacturers across price segments. Major global participants maintain strong market positions through extensive distribution networks, diversified product portfolios spanning commodity and specialty tapes, and continuous investments in sustainable adhesive formulations.

To get more information on this market Request Sample

Mexico's adhesive tape industry benefits from strategic geographic positioning that enables efficient integration into North American manufacturing value chains. The country's automotive cluster produces components for leading original equipment manufacturers. This manufacturing intensity creates sustained demand for specialized adhesive solutions across vehicle assembly, wire harness production, and interior component manufacturing. Beyond automotive and infrastructure, Mexico's packaging industry transformation driven by e-commerce growth demonstrates the Maya Train's broader economic impact, as improved connectivity enables distribution network expansion that increases packaging material requirements, including pressure-sensitive tapes for secure parcel sealing and branded closure applications throughout expanding logistics operations.

Mexico Adhesive Tape Market Trends:

E-Commerce Growth Driving Packaging Innovation

Mexico's digital commerce transformation is fundamentally reshaping adhesive tape demand patterns, with the e-commerce market projected to reach USD 175.8 Billion by 2034 as per IMARC Group’s predictions, as online retail platforms expand presence across urban and suburban areas. This expansion generates substantial increases in parcel shipping volumes and last-mile delivery operations, requiring stronger, more durable, and tamper-evident adhesive tape solutions to ensure product safety during transit. Companies are increasingly adopting premium-quality pressure-sensitive tapes for corrugated box sealing, mailer reinforcement, and flexible packaging applications, with specifications emphasizing tensile strength, adhesion consistency across temperature variations, and visual clarity for branded closure applications. Simultaneously, sustainable packaging trends are encouraging adoption of recyclable and biodegradable tape formulations, with packaging operations seeking solutions that maintain performance while meeting environmental compliance requirements and corporate sustainability commitments across growing logistics networks.

Automotive Electrification Accelerating Advanced Tape Adoption

The automotive industry's transition toward electric vehicle (EV) production is creating new opportunities for specialized adhesive tape applications across battery assembly, thermal management, and lightweight component bonding. Mexico achieved record vehicle production of 4 million light vehicles in 2024, establishing its position as the fifth-largest global producer, with manufacturers expanding electric vehicle manufacturing capabilities. These production operations require advanced adhesive solutions featuring high dielectric strength for battery module insulation, thermal conductivity for heat dissipation, and flame-retardant properties for safety compliance. Automotive manufacturers are increasingly replacing mechanical fasteners with structural adhesive tapes that reduce vehicle weight, minimize assembly time, and improve design flexibility across electric powertrains and interior components, driving innovation in high-performance tape formulations tailored to electromobility specifications.

Infrastructure Megaprojects Expanding Construction Tape Applications

Large-scale infrastructure initiatives are generating substantial adhesive tape consumption across construction and building applications throughout Mexico. In 2025, The Minister of Infrastructure, Communications and Transport and the Deputy Minister of Infrastructure for the Government of Mexico convened to review key projects that will aid communities and municipalities throughout the state. A prominent initiative is the “Tierra y Libertad” project, which in 2025 will feature the construction of the Jojutla Bridge, enhancements to the main circuit, and improvements to secondary roads. The initiative signifies an expenditure exceeding MX$170 million (US$9.12 million), comprising upwards of MX$50 million (US$2.68 million) from federal funds and MX$120 million (US$6.44 million) from the state administration. Mexico City's ongoing metro system expansions and urban development schemes supported by government investment further drive adhesive tape requirements for HVAC installations, electrical insulation, flooring protection, and window glazing applications. The construction sector's increasing focus on green building standards and energy efficiency is promoting specialist tape adoption for applications that enhance thermal insulation, minimize air leakage, and support sustainable construction practices across residential, commercial, and public infrastructure projects.

Market Outlook 2026-2034:

The market’s robust expansion trajectory reflects Mexico's strengthening position as a manufacturing powerhouse within North American supply chains, supported by automotive production growth, e-commerce logistics expansion, and infrastructure development initiatives. The market generated a revenue of USD 930.96 Million in 2025 and is projected to reach a revenue of USD 1,594.77 Million by 2034, growing at a compound annual growth rate of 6.16% from 2026-2034. The automotive sector's continued evolution toward EV platforms will drive increasing demand for specialty adhesive tapes featuring enhanced thermal management and dielectric properties, while packaging applications will benefit from sustained e-commerce growth requiring durable sealing solutions.

Mexico Adhesive Tape Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Material | Polypropylene | 53% |

| Resin | Acrylic | 46% |

| Technology | Hot-Melt-Based Adhesive Tapes | 42% |

| Application | Packaging Tapes | 58% |

| Region | Northern Mexico | 45% |

Material Insights:

- Polypropylene

- Paper

- Polyvinyl Chloride

- Others

Polypropylene dominates with a market share of 53% of the total Mexico adhesive tape market in 2025.

Polypropylene backing material commands the largest market segment, driven by its unique combination of high tensile strength, flexibility, and chemical resistance that makes it suitable for diverse applications across packaging, automotive, and construction industries. In packaging operations, polypropylene tapes deliver strong adhesion for carton sealing, bundling, and palletizing applications where durability under stress and temperature fluctuations is critical for maintaining package integrity during storage and transit. The automotive and construction sectors utilize polypropylene tapes extensively for masking, surface protection, and splicing applications, benefiting from the material's ability to withstand harsh environmental conditions, including exposure to moisture, chemicals, and temperature variations encountered across manufacturing processes.

Polypropylene's cost-effectiveness compared to alternatives like polyvinyl chloride and paper backing materials enhances its adoption across price-sensitive applications, particularly in high-volume commodity tape segments where material costs significantly impact total production economics. The material's processing characteristics facilitate efficient manufacturing at scale, with polypropylene films easily converted into tape backing through extrusion and coating processes that enable consistent quality across large production runs. This manufacturing efficiency supports competitive pricing that makes polypropylene-backed tapes accessible to small and medium enterprises alongside large industrial consumers across Mexico's diversified manufacturing landscape.

Resin Insights:

- Acrylic

- Rubber

- Silicone

- Others

Acrylic leads with a share of 46% of the total Mexico adhesive tape market in 2025.

Acrylic resin adhesives maintain market leadership through exceptional performance characteristics that address demanding industrial applications across automotive, electronics, and manufacturing sectors. These adhesives exhibit outstanding resistance to oils, solvents, and diverse chemical exposures encountered in harsh industrial environments, making them ideal for applications where conventional rubber-based adhesives would degrade or fail under chemical stress. The superior initial tack and bond strength of acrylic formulations enable effective adhesion to challenging substrates including metals, glass, plastics, and painted surfaces, supporting assembly operations across electronics manufacturing, automotive component production, and aerospace applications where reliable long-term bonding performance is non-negotiable.

The increasing emphasis on sustainable manufacturing practices strengthens acrylic adhesives' market position, as these formulations typically feature lower volatile organic compound emissions compared to solvent-based rubber adhesives, supporting compliance with environmental regulations while reducing workplace exposure concerns. Acrylic adhesive tapes demonstrate excellent aging resistance and ultraviolet stability, maintaining adhesion properties over extended periods without yellowing or adhesive migration that can compromise appearance or performance in visible applications. These characteristics make acrylic tapes particularly suitable for exterior automotive trim attachment, electronic device assembly, and construction glazing applications where long-term performance without maintenance is essential.

Technology Insights:

- Water-Based Adhesive Tapes

- Solvent-Based Adhesive Tapes

- Hot-Melt-Based Adhesive Tapes

Hot-melt-based adhesive tapes exhibits a clear dominance with a 42% share of the total Mexico adhesive tape market in 2025.

Hot-melt adhesive technology dominates packaging and industrial assembly applications through its fast-setting characteristics that enable immediate handling strength without curing delays, supporting high-speed production operations where rapid throughput is critical for operational efficiency. These adhesive systems achieve initial bond strength within seconds of application, allowing packaged goods to proceed directly to palletizing and shipping without staging delays required by water-based or solvent-based alternatives that need drying time before handling. The temperature resistance of hot-melt formulations ensures bond integrity across storage and transportation environments, maintaining package seals through temperature fluctuations encountered in uncontrolled warehouse conditions and extended transit cycles.

The technology's compatibility with high-speed automated tape application equipment makes it particularly suitable for large-scale packaging operations where rapid box sealing, case closing, and bundling applications demand consistent, immediate bond formation to maintain production flow. Hot-melt adhesive tapes demonstrate excellent adhesion to corrugated cardboard and paperboard substrates commonly used in shipping containers, providing secure closure that resists package opening during handling. In Mexico's expanding e-commerce logistics sector, hot-melt packaging tapes address requirements for tamper-evident seals, branded closure applications, and reinforced package security that protects goods throughout increasingly complex distribution chains connecting fulfillment centers to final delivery locations. IMARC Group predicts that the Mexico industrial packaging market is projected to reach USD 1,192.7 Million by 2033. This will further drive the need for efficient adhesives for securing packages.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Packaging Tapes

- Masking Tapes

- Specialized Tapes

- Others

Packaging tapes lead with a share of 58% of the total Mexico adhesive tape market in 2025.

Packaging tapes dominate market revenue through sustained demand from expanding e-commerce operations, retail distribution networks, and industrial shipping applications that require reliable, cost-effective sealing solutions for corrugated boxes, mailers, and flexible packaging formats. Mexico's e-commerce market generates substantial increases in parcel shipments requiring secure closure, with online retailers and logistics providers seeking adhesive tapes that deliver consistent bonding performance across diverse package types, weight loads, and handling conditions throughout last-mile delivery chains. The segment benefits from increasing packaging standards emphasizing tamper-evidence, brand visibility through printed closure tapes, and sustainable materials that align with corporate environmental commitments and consumer preferences for recyclable packaging solutions.

Packaging tape applications span diverse requirements from basic box sealing utilizing economy-grade tapes for non-critical shipments to premium pressure-sensitive solutions featuring reinforced backing materials and high-tack adhesives for heavy-duty industrial packaging where package integrity is critical for contents protection. The segment's growth is further supported by manufacturing operations requiring carton sealing for finished goods, component bundling throughout assembly processes, and pallet stabilization during warehousing and transportation. In 2024, Shurtape Technologies, LLC, a top manufacturer of adhesive tape and consumer products for home and office in the US, Mexico, and other countries, launched its Shurtape® Recycled Series Packaging Tapes. The latest line features three packaging tapes crafted from 90% Post-Consumer Recycled (PCR) Polyester, sourced from Polyethylene Terephthalate (PET) bottles and rigid containers, aimed at greatly lowering the reliance on virgin plastic in end-of-line packaging while maintaining the durability for which Shurtape’s packaging solutions are recognized.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 45% share of the total Mexico adhesive tape market in 2025.

Northern Mexico establishes regional market leadership through concentrated automotive manufacturing operations that generate substantial adhesive tape demand across vehicle assembly, component production, and electronics manufacturing supporting the automotive supply chain. The northern border states represent over half of Mexico's total autoparts production, with integrated manufacturing clusters serving original equipment manufacturers operating major assembly plants throughout the region. San Luis Potosí's automotive industry alone exports approximately USD 10 billion in manufactured goods annually, with production operations utilizing adhesive tapes extensively for wire harness assembly, interior trim attachment, body panel bonding, and temporary masking during painting processes. The region's proximity to United States border crossings facilitates just-in-time delivery systems that support integrated North American supply chains, with manufacturing operations maintaining high-volume adhesive tape consumption to support continuous production schedules serving major automakers.

Beyond automotive applications, northern Mexico's industrial base encompasses electronics assembly, aerospace component manufacturing, and heavy equipment production that collectively drive diverse adhesive tape requirements across specialized and commodity segments. The region benefits from established logistics infrastructure including major highway corridors, rail connections, and border crossing facilities that enable efficient material distribution supporting manufacturing operations. Industrial clusters in cities like Monterrey, Ciudad Juárez, and Hermosillo maintain sophisticated supplier networks providing adhesive tapes across multiple application categories, from basic packaging and bundling to advanced specialty tapes featuring specific performance characteristics for electronics assembly and precision manufacturing processes.

Market Dynamics:

Growth Drivers:

Why is the Mexico Adhesive Tape Market Growing?

Automotive Manufacturing Surge Driving Industrial Adhesive Demand

Mexico's transformation into a global automotive manufacturing powerhouse is fundamentally driving adhesive tape consumption across diverse vehicle assembly and component production applications. The country achieved record vehicle production of 3.99 million units in 2024, securing its position as the fifth-largest global producer and surpassing previous manufacturing peaks established in 2017. The northern border states, which represent a major portion of all autoparts production, maintain extensive manufacturing infrastructure supporting major original equipment manufacturers alongside hundreds of tier-one and tier-two suppliers producing components, subassemblies, and finished systems. San Luis Potosí's automotive sector alone exports approximately USD 10 billion in manufactured goods annually, generating 85,000 jobs across assembly plants and supplier operations utilizing adhesive tapes extensively throughout production processes. Vehicle electrification trends are creating additional opportunities for specialized adhesive solutions featuring enhanced thermal management, dielectric insulation, and flame-retardant properties required for battery module assembly and electric powertrain components, with manufacturers increasingly replacing mechanical fasteners with structural adhesive tapes that reduce vehicle weight while improving design flexibility.

E-Commerce Expansion Transforming Packaging Requirements

The explosive growth of digital commerce throughout Mexico is generating unprecedented demand for packaging adhesive tapes across fulfillment operations, logistics networks, and last-mile delivery services supporting booming online retail. In 2023, Mexico's online sales amounted to $74 billion, with projections estimating around $100 billion in 2024 and $176.8 billion by 2026, as per Center for Strategic and International Studies. This market expansion generates substantial increases in parcel shipping volumes requiring secure, tamper-evident closure solutions, with logistics providers and e-commerce platforms seeking pressure-sensitive tapes that deliver consistent bonding performance across diverse package formats including corrugated boxes, padded mailers, and flexible packaging materials.

Increasing Adoption in Electrical, Electronics, and Renewable Energy Installations

Adhesive tapes play a critical role in electrical insulation, wire harnessing, component protection, and thermal management, supporting demand from Mexico’s expanding electrical and electronics sectors. Growth in consumer electronics assembly, electrical appliance manufacturing, and industrial automation is increasing the use of PVC, polyester, and cloth electrical tapes. Moreover, the country is vigorousy investing in renewable energy projects. For instance, the Power Sector Development Plan 2025–2039 states that Mexico will incorporate 19,954 MW of renewable energy and 5,000 MW of energy storage by the year 2030. Solar PV will represent 58% of new renewable capacity, wind will contribute 22%, and battery storage will make up the final 20%. The state-owned utility CFE will be responsible for 69.2% of the overall development. In parallel, renewable energy projects, particularly solar installations, are creating new use cases for UV-resistant, weatherproof, and high-temperature tapes. These are used in cable management, module assembly, temporary fixation, and protection during installation.

Market Restraints:

What Challenges the Mexico Adhesive Tape Market is Facing?

Raw Material Price Volatility Pressuring Manufacturing Economics

The adhesive tape industry faces persistent challenges from fluctuating prices of key raw materials including polypropylene films, acrylic polymers, and petroleum-derived adhesive components, creating cost pressures that compress manufacturer margins and complicate long-term pricing strategies. Raw material costs represent significant portions of total production expenses, with price variations directly impacting profitability across commodity tape segments where competitive pressures limit ability to pass costs to customers without risking market share losses. Supply chain disruptions affecting petrochemical feedstocks and polymer production create periodic availability constraints that force manufacturers to absorb spot market premiums or risk production delays impacting customer relationships and delivery commitments.

Stringent Environmental Regulations Requiring Formulation Adaptations

Increasing environmental regulations governing volatile organic compound emissions, recyclability requirements, and sustainable material sourcing are compelling adhesive tape manufacturers to reformulate products and modify production processes, creating development costs and potential performance tradeoffs. Compliance with evolving environmental standards requires investments in research and development, testing, and certification processes that increase time-to-market for new products while existing formulations face potential restrictions limiting their continued use. The transition toward sustainable adhesive chemistries and recyclable backing materials must maintain performance characteristics customers expect while meeting cost targets necessary for competitive positioning across price-sensitive segments.

Supply Chain Disruptions Impacting Production Continuity

Global supply chain vulnerabilities affecting raw material availability, logistics capacity, and transportation reliability create operational challenges for adhesive tape manufacturers maintaining consistent production schedules and inventory levels. Periodic disruptions affecting key inputs or logistics networks force producers to retain higher safety stock levels, increasing working capital requirements while potentially facing stockout situations that disappoint customers and create competitive disadvantages. The geographic concentration of certain specialized raw material suppliers creates single-source vulnerabilities where production disruptions at key facilities cascade throughout the adhesive tape supply chain, impacting manufacturers' ability to fulfil customer commitments and maintain market relationships.

Competitive Landscape:

The Mexico adhesive tape market demonstrates moderate competitive intensity, characterized by both multinational corporations with global operations and regional manufacturers serving local market segments. Major international participants maintain strong market positions through extensive distribution networks, diversified product portfolios spanning commodity and specialty categories, and established relationships with large industrial customers across automotive, electronics, and packaging sectors. These global players leverage economies of scale in raw material procurement, manufacturing efficiency, and research and development capabilities to offer competitive pricing while continuously introducing innovative formulations addressing evolving customer requirements. Regional manufacturers compete effectively through localized customer service, responsive customization capabilities, and competitive pricing strategies that appeal to small and medium enterprises seeking reliable suppliers with flexible minimum order quantities and rapid turnaround times for specialized applications.

Mexico Adhesive Tape Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Polypropylene, Paper, Polyvinyl Chloride, Others |

| Resins Covered | Acrylic, Rubber, Silicone, Others |

| Technologies Covered | Water-Based Adhesive Tapes, Solvent-Based Adhesive Tapes, Hot-Melt-Based Adhesive Tapes |

| Applications Covered | Packaging Tapes, Masking Tapes, Specialized Tapes, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico adhesive tape market size was valued at USD 930.96 Million in 2025.

The Mexico adhesive tape market is expected to grow at a compound annual growth rate of 6.16% from 2026-2034 to reach USD 1,594.77 Million by 2034.

Polypropylene dominates the material segment with 53% share, driven by its superior combination of tensile strength, flexibility, and chemical resistance properties that make it ideal for packaging, automotive, and construction applications, while offering cost advantages over alternative backing materials like polyvinyl chloride and paper.

Key factors driving the Mexico adhesive tape market include automotive manufacturing expansion with Mexico achieving record production of 3.99 million vehicles in 2024 as the fifth-largest global producer, e-commerce growth driving packaging tape demand, and major infrastructure projects like the Maya Train generating construction adhesive requirements across insulation, surface protection, and joint sealing applications.

Major challenges include raw material price volatility affecting polypropylene films and acrylic polymers creating cost pressures on manufacturing economics, stringent environmental regulations requiring formulation adaptations and sustainable material sourcing that increase development costs, and supply chain disruptions impacting raw material availability and logistics capacity that threaten production continuity and inventory management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)