Mexico Adhesives Market Size, Share, Trends and Forecast by Technology, Resin, End User Industry, and Region, 2026-2034

Mexico Adhesives Market Summary:

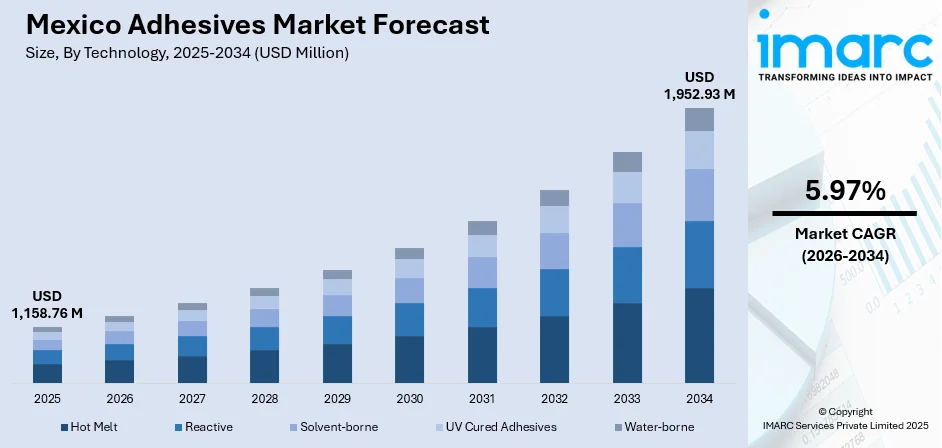

The Mexico adhesives market size was valued at USD 1,158.76 Million in 2025 and is projected to reach USD 1,952.93 Million by 2034, growing at a compound annual growth rate of 5.97% from 2026-2034.

The Mexico adhesives market is experiencing robust expansion, driven by the country's dynamic manufacturing ecosystem. Industrial activities across automotive assembly plants, packaging facilities, and construction projects are generating sustained demand for high-performance bonding solutions. The market benefits from Mexico's extensive network of free trade agreements with multiple countries, attracting foreign investment in manufacturing operations that require advanced adhesive technologies. Rising urbanization and infrastructure development initiatives by federal and state governments are creating substantial opportunities for adhesives across residential and commercial construction applications.

Key Takeaways and Insights:

- By Technology: Water-borne dominates the market with a share of 38% in 2025, owing to its eco-friendly formulation, low volatile organic compound (VOC) emissions, and cost-effectiveness across packaging and construction applications. Regulatory compliance requirements and sustainability initiatives are accelerating adoption.

- By Resin: Acrylic leads the market with a share of 27% in 2025, driven by its versatility, excellent adhesion properties, and resistance to environmental factors, including ultraviolet (UV) exposure and temperature fluctuations across the automotive, construction, and packaging sectors.

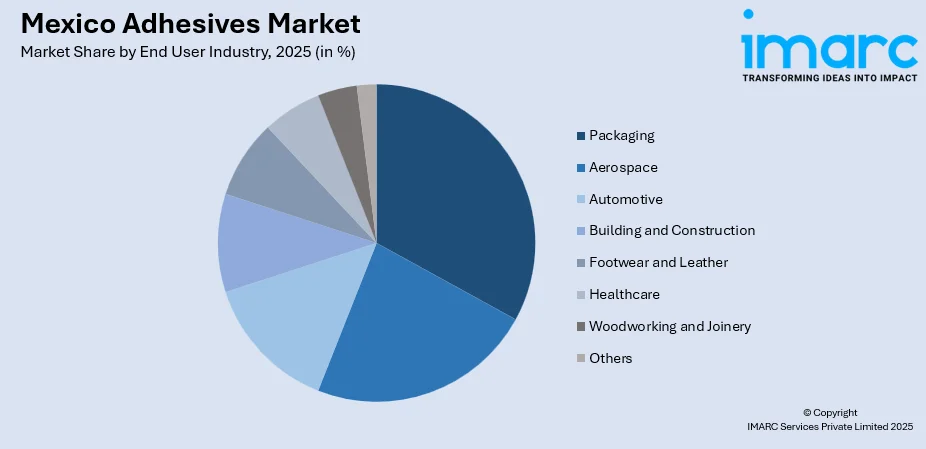

- By End User Industry: Packaging represents the largest segment with a market share of 32% in 2025, reflecting the expanding e-commerce sector, food and beverage (F&B) industry growth, and increasing demand for sustainable packaging solutions requiring high-performance adhesive applications.

- By Region: Central Mexico comprises the largest region with 42% share in 2025, driven by the concentration of manufacturing facilities, population centers, and industrial hubs around Mexico City, Puebla, and surrounding metropolitan zones that support logistics and production operations.

- Key Players: Key players drive the Mexico adhesives market by investing in production capacity expansion, developing sustainable product formulations, and establishing localized manufacturing operations. Their focus on technological innovations, strategic acquisitions, and partnerships with automotive and packaging manufacturers strengthens distribution networks and market penetration.

To get more information on this market Request Sample

The Mexico adhesives market is characterized by continuous technological advancements and increasing emphasis on environmental sustainability. Manufacturers are responding to stringent regulatory requirements by developing low-VOC and bio-based adhesive formulations that meet international environmental standards while maintaining superior bonding performance. The thriving automotive sector is creating the demand for specialized adhesives capable of handling thermal management and battery assembly requirements. According to the Mexican Automotive Industry Association (AMIA), light-vehicle manufacturing hit nearly 3.9 Million units in 2024, representing significant year-over-year growth that directly correlates with adhesive consumption. Additionally, the packaging industry's evolution towards flexible and sustainable solutions continues to drive innovations in water-borne and hot-melt adhesive technologies, positioning Mexico as a key manufacturing hub for adhesives serving North American markets.

Mexico Adhesives Market Trends:

Rising Adoption of Sustainable and Eco-Friendly Adhesive Formulations

Environmental consciousness is transforming adhesive preferences across Mexican industries, as manufacturers increasingly prioritize low-VOC and water-based solutions. The shift towards sustainable formulations aligns with international environmental regulations and corporate sustainability commitments driving procurement decisions. Government agencies are implementing guidelines to promote reduced emissions in industrial applications, encouraging adhesive manufacturers to develop greener alternatives. In July 2023, Mexico's Ministry of Environment and Natural Resources adopted a proactive approach by presenting a draft technical standard intended to regulate the emissions of VOCs during production processes and ancillary services.

Integration of Advanced Dispensing Technologies and Automation

Manufacturing operations throughout Mexico are embracing automated adhesive dispensing systems to enhance production efficiency and ensure consistent application quality. Precision dispensing equipment enables optimized adhesive usage, reducing material waste while improving bond reliability across high-volume manufacturing processes. The automotive and electronics sectors particularly benefit from robotic adhesive application systems that deliver repeatable results across complex assembly operations. Integration of Industry 4.0 principles, including real-time monitoring and predictive maintenance capabilities, is elevating adhesive application processes within modern manufacturing facilities across the country. As per IMARC Group, the Mexico Industry 4.0 market is set to attain USD 8,330.45 Million by 2033, exhibiting a growth rate (CAGR) of 14.46% during 2025-2033.

Development of High-Performance Specialty Adhesive Solutions

Technological innovations continue to drive the development of specialty adhesives engineered for demanding applications in automotive, aerospace, and electronics manufacturing. Advanced reactive adhesives offering superior thermal resistance and structural bonding capabilities are gaining traction among manufacturers requiring high-performance solutions. The electronics miniaturization trend is increasing demand for precision adhesives that provide reliable bonding in compact designs while managing heat dissipation requirements. Manufacturers are teaming up with research institutions and technology partners to create customized adhesive formulations addressing specific industrial challenges within Mexican manufacturing operations.

Market Outlook 2026-2034:

The Mexico adhesives market demonstrates strong growth potential, supported by continued expansion across key end-use sectors and strategic investments in manufacturing capabilities. Industrial development initiatives and nearshoring trends are attracting foreign direct investment (FDI) in manufacturing operations that will sustain adhesive demand throughout the forecast period. The market generated a revenue of USD 1,158.76 Million in 2025 and is projected to reach a revenue of USD 1,952.93 Million by 2034, growing at a compound annual growth rate of 5.97% from 2026-2034. Automotive electrification, sustainable packaging requirements, and infrastructure modernization initiatives will create sustained demand for advanced adhesive technologies, while manufacturers continue to expand production capabilities to serve growing regional markets.

Mexico Adhesives Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Water-borne | 38% |

| Resin | Acrylic | 27% |

| End User Industry | Packaging | 32% |

| Region | Central Mexico | 42% |

Technology Insights:

- Hot Melt

- Reactive

- Solvent-borne

- UV Cured Adhesives

- Water-borne

Water-borne dominates with a market share of 38% of the total Mexico adhesives market in 2025.

Water-borne adhesives have established market leadership through their environmentally favorable characteristics, including low VOC content and compliance with increasingly stringent environmental regulations. These formulations utilize water as the primary carrier medium instead of organic solvents, making them safer for workers and reducing harmful emissions during application processes. The packaging industry represents a primary consumer of water-borne adhesives due to their excellent bonding performance on paper, cardboard, and flexible packaging substrates while meeting food safety requirements.

Mexican manufacturers increasingly prefer water-borne technologies for applications requiring cost-effective solutions without compromising bond quality. Construction sector expansion has created substantial demand for water-borne adhesives in flooring, tile setting, and wallcovering installations where low odor and environmental safety are prioritized. As per DENUE 2025, the construction sector recorded 20,828 economic units in Mexico. The technology segment benefits from ongoing formulation improvements that enhance performance characteristics while maintaining environmental compliance, positioning water-borne adhesives for continued growth throughout the forecast period.

Resin Insights:

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE/EVA

- Others

Acrylic leads with a share of 27% of the total Mexico adhesives market in 2025.

Acrylic resins command the largest market share due to their exceptional versatility and performance across diverse industrial applications. These adhesives provide strong adhesion to multiple substrates, including metals, plastics, glass, and ceramics while demonstrating excellent resistance to moisture, temperature variations, and UV exposure. The automotive sector relies heavily on acrylic-based pressure-sensitive adhesives for interior trim components, labels, and mounting applications requiring long-term durability under varying environmental conditions.

The construction industry utilizes acrylic adhesives extensively for panel bonding, insulation attachment, and facade applications where weather resistance and structural integrity are essential requirements. Acrylic formulations available in water-based configurations support sustainability objectives while delivering performance characteristics comparable to solvent-based alternatives. Continued research and development (R&D) investments by major manufacturers focus on enhancing acrylic adhesive performance for emerging applications in electronics assembly and renewable energy installations.

End User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Aerospace

- Automotive

- Building and Construction

- Footwear and Leather

- Healthcare

- Packaging

- Woodworking and Joinery

- Others

Packaging exhibits a clear dominance with a 32% share of the total Mexico adhesives market in 2025.

The packaging industry's leadership position reflects the essential role of adhesives in carton sealing, labeling, flexible packaging lamination, and case assembly operations supporting Mexico's expanding consumer goods and e-commerce sectors. Mexico's e-commerce industry demonstrates substantial growth, driving the demand for robust packaging solutions that ensure product protection during shipping and handling. As per IMARC Group, the Mexico e-commerce market size reached USD 54.4 Billion in 2025. F&B manufacturers require adhesives meeting stringent safety standards for direct and indirect food contact applications.

The segment benefits from increasing consumer preference for sustainable packaging options, prompting the development of recyclable and bio-based adhesive solutions. Flexible packaging growth continues to accelerate, as brands are transitioning from rigid containers to lightweight alternatives requiring specialized laminating adhesives capable of bonding multiple substrate layers.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico represents the leading segment with a 42% share of the total Mexico adhesives market in 2025.

Central Mexico's market dominance stems from the concentration of manufacturing facilities, population centers, and logistics infrastructure surrounding the Mexico City metropolitan area and extending through Puebla, Querétaro, and neighboring states. As per World Population Review, Mexico City increased by 247,100 in 2024, amounting to a 1.1% yearly change, creating substantial demand for consumer goods and construction materials requiring adhesive applications. Mexico City serves as the primary logistics hub, with significant e-commerce market potential concentrated in the corridor driving packaging adhesive consumption.

The automotive sector maintains strong presence in Central Mexico through luxury vehicle firms’ supply chains centered around Puebla, employing thousands of workers and generating consistent adhesive demand. Construction activities remain robust across residential and commercial development projects, supported by urban expansion and infrastructure modernization initiatives. The region's strategic location facilitates efficient distribution to domestic and international markets, attracting adhesive manufacturers seeking proximity to major customer operations.

Market Dynamics:

Growth Drivers:

Why is the Mexico Adhesives Market Growing?

Expanding Automotive Manufacturing and EV Production

Mexico's position as a major automotive manufacturing hub within North America continues to strengthen through substantial investments by domestic and international automakers expanding production capabilities. The country's strategic location, skilled workforce, and favorable trade agreements attract automotive investments requiring advanced adhesive technologies for vehicle assembly operations. Lightweight material adoption in vehicle construction increases reliance on structural adhesives that replace traditional mechanical fasteners while improving fuel efficiency and reducing emissions. EV production growth creates demand for specialized adhesives capable of thermal management and battery pack assembly, with manufacturers developing formulations addressing unique EV requirements. In 2024, Mexico's uptake of EVs hit 124,000 units, representing a 67% rise compared to 2023. The automotive sector's expansion directly correlates with adhesive consumption as modern vehicles incorporate increasing amounts of bonding materials throughout assembly processes.

Construction Sector Growth and Infrastructure Development Initiatives

Residential and commercial construction activities throughout Mexico generate substantial adhesive demand across flooring installation, tile setting, insulation attachment, and structural bonding applications. In February 2024, Ayesa expanded its real estate project portfolio in Mexico by offering construction oversight services for the high-rise structure Puerta Bosques Torre Renta. Comprising 455 rental units across 46 stories, the initiative was executed by the property developer and manager Greystar and was included in a significant 42.13 Million euro residential and commercial project. Government infrastructure development programs focusing on transportation networks, housing, and public facilities create ongoing opportunities for construction adhesive consumption. Urbanization trends drive expansion of metropolitan areas requiring new residential and commercial developments utilizing adhesives for efficient assembly and finishing operations. The construction industry's recovery and growth trajectory support adhesive manufacturers developing specialized formulations addressing regional climate conditions and building code requirements. Green building initiatives promote demand for low-VOC adhesives meeting environmental certification standards increasingly required for commercial and government construction projects.

E-Commerce Expansion and Packaging Industry Evolution

Digital commerce growth across Mexico accelerates packaging adhesive consumption, as online retailers and logistics providers require robust sealing solutions ensuring product integrity during shipping and handling operations. The F&B industry's expansion creates sustained demand for packaging adhesives meeting safety regulations for direct and indirect food contact applications. Consumer preference transition towards sustainable packaging options drives innovations in recyclable and bio-based adhesive formulations supporting circular economy objectives. Flexible packaging adoption continues to expand, as brands shift from rigid containers to lightweight alternatives requiring specialized laminating adhesives capable of multi-layer substrate bonding. Packaging automation investments by manufacturers and converters increase demand for adhesives compatible with high-speed production equipment delivering consistent application performance.

Market Restraints:

What Challenges is the Mexico Adhesives Market Facing?

Raw Material Price Volatility and Supply Chain Disruptions

Fluctuations in petrochemical-derived raw material prices impact adhesive production costs and profit margins across the industry. Supply chain vulnerabilities expose manufacturers to availability challenges affecting key input materials required for adhesive formulations. Global economic uncertainties and geopolitical factors contribute to pricing instability, affecting business planning and customer pricing strategies.

Competition from Low-Cost Imports and Alternative Fastening Methods

Import competition from lower-cost adhesive products manufactured in regions with reduced production expenses challenges domestic manufacturers maintaining market share. Alternative fastening technologies, including mechanical fasteners and welding processes, compete with adhesive solutions in certain applications. Price-sensitive market segments face pressure from imported products offering acceptable performance at reduced price points.

Stringent Environmental Regulations and Compliance Requirements

Increasingly stringent VOC emission regulations require manufacturers to reformulate products meeting environmental compliance standards. Investment requirements for developing low-emission adhesive technologies burden smaller manufacturers with limited research capabilities. Regulatory complexity across different industries and applications creates challenges for adhesive suppliers navigating compliance requirements. Additionally, frequent updates to environmental standards increase compliance costs and slow product commercialization, creating uncertainty in long-term planning for adhesive manufacturers.

Competitive Landscape:

The Mexico adhesives market demonstrates moderate fragmentation with global companies and local producers competing through various application segments. Major international players maintain substantial market positions through established distribution networks, manufacturing facilities, and technical service capabilities. Competition intensifies, as companies are investing in production capacity expansion, sustainable product development, and strategic acquisitions strengthening market positioning. Manufacturers are differentiating through technical expertise, customized formulation services, and responsive customer support addressing specific application requirements across the automotive, packaging, and construction sectors in the country.

Recent Developments:

- In June 2025, Hernon Manufacturing, Inc., a top global innovator in adhesives, sealants, and precise dispensing solutions, unveiled the inauguration of its new office in Querétaro, Mexico. The launch event represented a significant achievement in Hernon's continuous global growth and dedication to local assistance throughout Latin America.

Mexico Adhesives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Hot Melt, Reactive, Solvent-borne, UV Cured Adhesives, Water-borne |

| Resins Covered | Acrylic, Cyanoacrylate, Epoxy, Polyurethane, Silicone, VAE/EVA, Others |

| End User Industries Covered | Aerospace, Automotive, Building and Construction, Footwear and Leather, Healthcare, Packaging, Woodworking and Joinery, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico adhesives market size was valued at USD 1,158.76 Million in 2025.

The Mexico adhesives market is expected to grow at a compound annual growth rate of 5.97% from 2026-2034 to reach USD 1,952.93 Million by 2034.

Water-borne dominated the market with a share of 38%, driven by eco-friendly formulation characteristics, regulatory compliance advantages, and widespread applications across the packaging, construction, and woodworking sectors requiring sustainable adhesive solutions.

Key factors driving the Mexico adhesives market include expanding automotive manufacturing operations and EV production, construction sector growth supported by infrastructure development initiatives, e-commerce expansion, and increasing adoption of sustainable adhesive formulations meeting environmental regulations.

Major challenges include raw material price volatility affecting production costs, competition from low-cost adhesive imports impacting domestic manufacturers, stringent environmental regulations requiring product reformulation, supply chain disruptions affecting material availability, and pressure from alternative fastening technologies in certain applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)