Mexico Adhesives and Sealants Market Size, Share, Trends and Forecast by Adhesive Type, Sealant Type, Technology, Application, and Region, 2026-2034

Mexico Adhesives and Sealants Market Summary:

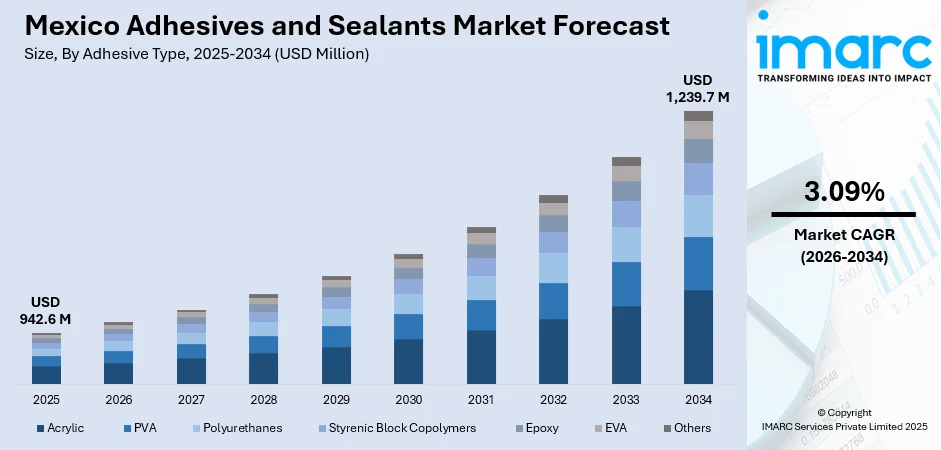

The Mexico adhesives and sealants market size was valued at USD 942.6 Million in 2025 and is projected to reach USD 1,239.7 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034.

The Mexico adhesives and sealants market is experiencing robust growth driven by the expanding automotive manufacturing sector, increasing packaging demand, and rising construction activities across the country. The market benefits from Mexico's strategic position as a manufacturing hub for North America, supported by favorable trade agreements including USMCA. Growing emphasis on sustainability and eco-friendly bonding solutions is reshaping product development priorities, with water-based and bio-based adhesive technologies gaining significant traction across industrial applications.

Key Takeaways and Insights:

-

By Adhesive Type: PVA dominates the market with a share of 28% in 2025, driven by its cost-effectiveness, versatility in bonding porous materials, and widespread use in packaging, woodworking, and paper applications across Mexican industries.

-

By Sealant Type: Silicone leads the market with a share of 40% in 2025, owing to its superior temperature resistance, flexibility, and excellent weather durability required in construction and automotive applications throughout Mexico's diverse climate zones.

-

By Technology: Water-based represents the largest segment with a market share of 46% in 2025, attributed to stringent environmental regulations, low VOC emissions, and increasing adoption of eco-friendly formulations across packaging and consumer goods sectors.

-

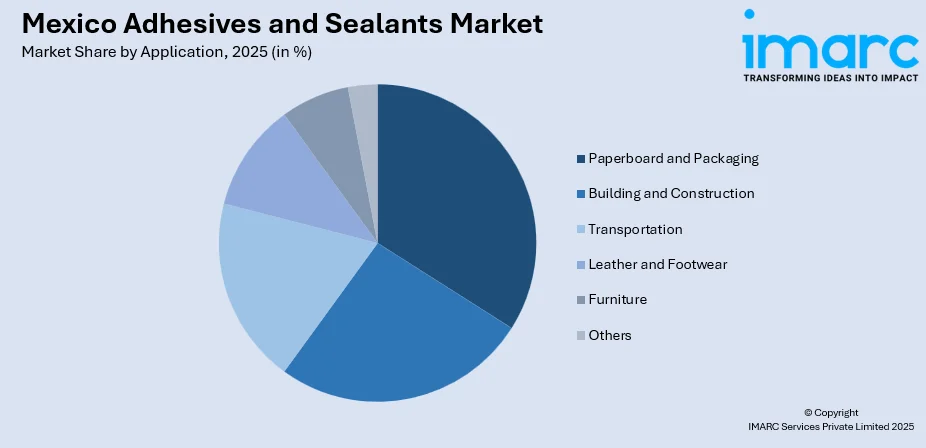

By Application: Paperboard and packaging dominate with a market share of 32% in 2025, fueled by Mexico's thriving e-commerce sector, expanding food and beverage packaging requirements, and increasing demand for flexible packaging solutions.

-

By Region: Northern Mexico represents the largest revenue share of 44% in 2025, driven by the concentration of automotive manufacturing facilities, industrial parks, and proximity to the United States border, facilitating export-oriented production.

-

Key Players: The Mexico adhesives and sealants market demonstrates moderate competitive intensity, with established international companies competing alongside regional manufacturers. Competition is driven by continuous product innovation, adoption of sustainable solutions, and strategic expansion efforts to strengthen market presence and meet growing regional demand.

To get more information on this market Request Sample

The Mexico adhesives and sealants market is benefiting from the country's position as the fifth-largest global vehicle producer, with automotive manufacturing reaching record levels of 4.2 million units in 2024. The automotive sector's shift toward electric vehicles and lightweight materials is creating substantial demand for high-performance structural adhesives. Major Manufacturers are increasingly expanding production capacities within Mexico to strengthen local supply chains and improve regional distribution capabilities. New, technologically advanced facilities are being developed to support growing domestic demand while also serving export markets across the broader region, enhancing manufacturing efficiency and responsiveness. The transformation of the packaging industry, supported by rapid e-commerce expansion, is driving increased adoption of specialized adhesives for flexible packaging, carton sealing, and labeling applications. At the same time, ongoing construction activity, spanning infrastructure development, industrial parks, and residential and commercial projects, is sustaining strong demand for construction sealants and structural bonding solutions across multiple end-use segments.

Mexico Adhesives and Sealants Market Trends:

Sustainable and Bio-Based Formulation Development

The Mexico adhesives and sealants market is increasingly shifting toward sustainable and bio-based formulations as manufacturers address environmental concerns and rising demand for eco-friendly solutions. Companies are developing adhesives with lower carbon footprints and incorporating renewable, plant-derived materials. The industry is also embracing water-based and solvent-free technologies, particularly for packaging applications where safety and recyclability are critical. High-performance and low-temperature adhesives are gaining traction, meeting the requirements of diverse industrial uses while supporting sustainability goals and more responsible production practices across the sector. For instance, in November 2025, Biobond, a leading innovator in sustainable material technologies, has commenced operations in Mexico, unveiling a sophisticated three-layer antimicrobial coating system aimed at safeguarding and enhancing commercial, residential, industrial, and governmental buildings. This launch aligns with a significant period of nationwide infrastructure growth, encompassing new industrial zones, hospitals, airports, and housing developments, supporting Mexico’s broader construction initiatives ahead of major international events.

Automotive Lightweighting and Electric Vehicle Integration

The transformation of Mexico's automotive manufacturing sector toward electric vehicles and lightweight construction is driving demand for advanced structural adhesives and specialty bonding solutions. The Mexico electric vehicle aftermarket size reached USD 1.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6.6 Million by 2033, exhibiting a growth rate (CAGR) of 20.59% during 2025-2033. This fuels the need for specialized adhesives in vehicle production, repairs, and aftermarket modifications. As automakers prioritize weight reduction to improve fuel efficiency and extend EV battery range, adhesive bonding is increasingly replacing traditional mechanical fastening methods in vehicle assembly. The shift toward all-electric manufacturing processes reflects the broader automotive industry’s move toward sustainable production practices that demand compatible adhesive technologies. Advanced formulations for battery assembly, composite bonding, and multi-material joining are seeing rapid adoption as manufacturers prioritize lightweight construction and efficiency in electric vehicle production.

Smart Packaging and E-Commerce Fulfillment Solutions

The explosive growth of e-commerce and digital retail channels is reshaping adhesive requirements for packaging applications throughout Mexico. The Mexico e-commerce logistics market size reached USD 9.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 44.3 Billion by 2033, exhibiting a growth rate (CAGR) of 17.7% during 2025-2033. Online retail penetration exceeding fifteen percent of total sales is driving demand for packaging solutions optimized for shipping durability, tamper evidence, and consumer unboxing experiences. Hot melt adhesives designed for high-speed automated packaging lines are gaining traction as fulfillment centers invest in efficiency improvements. The food delivery sector's substantial growth is creating opportunities for specialty adhesives meeting food-contact safety requirements while enabling innovative packaging formats for temperature-sensitive products.

Market Outlook 2026-2034:

The Mexico adhesives and sealants market outlook remains positive through the forecast period, supported by sustained industrial expansion, nearshoring momentum, and infrastructure development initiatives. The construction sector's projected growth, driven by residential demand in major urban centers and industrial facility construction for manufacturing relocations, will maintain steady sealant consumption. Packaging applications will benefit from the food and beverage industry's continued expansion and evolving consumer preferences for convenience-oriented packaging formats. The market generated a revenue of USD 942.6 Million in 2025 and is projected to reach a revenue of USD 1,239.7 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034.

Mexico Adhesives and Sealants Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Adhesive Type | PVA | 28% |

| Sealant Type | Silicone | 40% |

| Technology | Water-Based | 46% |

| Application | Paperboard and Packaging | 32% |

| Region | Northern Mexico | 44% |

Adhesive Type Insights:

- Acrylic

- PVA

- Polyurethanes

- Styrenic Block Copolymers

- Epoxy

- EVA

- Others

The PVA dominates with a market share of 28% of the total Mexico adhesives and sealants market in 2025.

Polyvinyl acetate adhesives maintain market leadership through their exceptional versatility and cost-effectiveness across multiple industrial applications. These adhesives demonstrate excellent bonding performance on porous substrates, including paper, cardboard, wood, and textiles, making them indispensable for Mexico's packaging and furniture manufacturing sectors. The woodworking industry particularly relies on PVA formulations for furniture assembly, cabinetry, and joinery applications where strong bonds and easy cleanup are essential requirements.

The segment benefits from PVA's environmental advantages, as water-based formulations produce minimal volatile organic compound emissions during application and curing. Manufacturing facilities across Mexico's industrial corridors utilize PVA adhesives for bookbinding, packaging assembly, and textile lamination applications. The availability of modified PVA variants offering enhanced water resistance and faster setting times continues expanding application possibilities in demanding industrial environments requiring improved performance characteristics.

Sealant Type Insights:

- Acrylic

- Silicone

- Polyurethane

- Butyl

- Others

The silicone leads with a share of 40% of the total Mexico adhesives and sealants market in 2025.

Silicone sealants dominate the Mexican market through their superior performance characteristics, including exceptional temperature resistance, weather durability, and long-term flexibility retention. The construction industry extensively utilizes silicone sealants for glazing applications, expansion joint sealing, and weatherproofing in both residential and commercial buildings. Mexico's diverse climate conditions, ranging from desert environments in the north to humid tropical zones in the south, require sealant solutions capable of maintaining performance across extreme temperature variations.

The automotive sector represents another significant consumption area for silicone sealants, with applications in engine compartment sealing, windshield bonding, and interior assembly operations. Room temperature vulcanizing silicones constitute most of the market consumption, favored for their ease of application and reliable curing characteristics. High-temperature silicone formulations serve specialized industrial applications in manufacturing facilities where thermal resistance requirements exceed the capabilities of alternative sealant chemistries.

Technology Insights:

- Water-Based

- Solvent-Based

- Hot Melt

- Reactive

- Others

The water-based exhibits clear dominance with a 46% share of the total Mexico adhesives and sealants market in 2025.

Water-based adhesive technologies command market leadership driven by increasingly stringent environmental regulations and workplace safety requirements across Mexican manufacturing facilities. These formulations offer significant advantages including low volatile organic compound emissions, reduced flammability risks, and easier cleanup compared to solvent-based alternatives. The packaging industry particularly favors water-based adhesives for food and beverage applications where direct or indirect food contact necessitates compliance with safety standards.

The segment's growth is accelerating as manufacturers respond to sustainability mandates and consumer preferences for environmentally responsible products. Water-based formulations are gaining adoption in label application, carton sealing, and flexible packaging lamination, where performance requirements can be met without solvent-based alternatives. Continuous technological improvements in water-based adhesive chemistries are addressing historical limitations regarding setting speed and water resistance, expanding viable application ranges across industrial sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Paperboard and Packaging

- Building and Construction

- Transportation

- Leather and Footwear

- Furniture

- Others

The paperboard and packaging dominates with a 32% share of the total Mexico adhesives and sealants market in 2025.

The packaging sector's market leadership reflects Mexico's position as a major manufacturing and export hub requiring extensive packaging solutions for diverse product categories. The food and beverage industry represents the largest consumer segment, utilizing adhesives for carton assembly, label application, and flexible packaging lamination across domestic and export-oriented production facilities. E-commerce expansion, with online retail projected to exceed significant growth milestones, is creating sustained demand for shipping cartons, mailers, and protective packaging requiring reliable adhesive performance.

Hot melt adhesives dominate high-speed packaging line applications where rapid setting and strong initial bonds are essential for production efficiency. The segment benefits from ongoing investments in packaging automation as Mexican manufacturers upgrade facilities to improve throughput and reduce labor costs. Sustainability trends are influencing adhesive selection toward formulations compatible with recycling processes, supporting circular economy initiatives gaining traction among major consumer goods companies operating in Mexico.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico represents the largest revenue share of 44% of the total Mexico adhesives and sealants market in 2025.

Northern Mexico's market dominance stems from the region's concentration of automotive manufacturing facilities, maquiladora operations, and export-oriented industrial parks clustered along the United States border corridor. States including Nuevo León, Chihuahua, and Baja California host major automotive assembly plants and tier-one supplier facilities requiring substantial adhesives and sealants consumption for vehicle production and component manufacturing. The region's logistical advantages, including proximity to the United States market and established transportation infrastructure, attract continued industrial investment supporting market growth.

Nearshoring trends are accelerating industrial development across Northern Mexico as manufacturers relocate production from Asia to capitalize on supply chain proximity to North American markets. Industrial park development and manufacturing facility construction are driving construction sealant demand, while expanding manufacturing operations increase adhesives consumption across packaging, assembly, and maintenance applications. The region's established adhesives manufacturing presence, exemplified by Henkel's hot melt production facility in Nuevo León, ensures local supply availability supporting regional industrial growth.

Market Dynamics:

Growth Drivers:

Why is the Mexico Adhesives and Sealants Market Growing?

Expanding Automotive Manufacturing and Export Production

Mexico’s automotive sector continues to generate significant demand for adhesives and sealants, driven by ongoing vehicle production and assembly activities. The industry requires a wide range of adhesive solutions for body assembly, interior trim, component bonding, and other manufacturing processes. As vehicle designs evolve toward electric mobility and lightweight construction, specialty adhesives for battery pack assembly and multi-material joining are increasingly essential. The growing focus on sustainability and efficiency in vehicle production further reinforces the need for advanced bonding technologies, positioning the adhesives and sealants market for sustained expansion alongside automotive sector transformation.

Nearshoring-Driven Industrial Development

The restructuring of global supply chains and the shift toward nearshoring strategies are fueling industrial expansion across Mexico, generating consistent demand for adhesives and sealants. New industrial facilities, manufacturing plants, and expanded operations require construction sealants for building development, alongside adhesives for manufacturing processes, assembly operations, and ongoing maintenance. This industrial growth encourages the adoption of durable and high-performance bonding solutions, while the need for operational efficiency drives innovation in adhesive technologies. As industrial clusters expand and production activity intensifies, adhesives and sealants remain critical to supporting facility development, equipment assembly, and ongoing operational requirements.

Packaging Industry Growth and E-Commerce Expansion

Mexico’s packaging sector is experiencing strong growth, supported by increasing manufacturing activity and the rising prominence of e-commerce channels. Adhesives are essential across a variety of packaging applications, including carton assembly, label attachment, flexible packaging production, and protective shipping materials. The evolution toward sustainable and recyclable packaging formats is influencing the selection of bio-based and environmentally friendly adhesive solutions. Expanding online retail distribution and export-oriented production further amplify demand for reliable, high-performance bonding solutions. Innovation in adhesive technologies is increasingly driven by the need to balance performance, sustainability, and compatibility with diverse packaging materials across industrial and consumer applications.

Market Restraints:

What Challenges the Mexico Adhesives and Sealants Market is Facing?

Raw Material Price Volatility

Adhesive and sealant manufacturers face persistent challenges from fluctuating petrochemical and specialty chemical input costs that impact production economics and pricing stability. Raw material price volatility creates uncertainty in procurement planning and contract pricing, particularly for manufacturers serving customers with fixed-price agreements. Currency fluctuations compound raw material cost pressures as peso depreciation increases import costs for specialty chemicals sourced from international suppliers.

Stringent Environmental Compliance Requirements

Increasingly rigorous environmental regulations governing volatile organic compound emissions and hazardous material handling impose compliance costs on adhesive manufacturers and end users. Transitioning from solvent-based to water-based or reactive formulations requires capital investment in reformulation research, production equipment modifications, and application technology upgrades. Regulatory compliance timelines create pressure for rapid product development and market introduction, potentially straining technical resources and increasing development costs.

Trade Policy Uncertainty

Evolving trade relationships and tariff policies create uncertainty affecting both adhesive manufacturers and their industrial customers across export-oriented sectors. Potential changes to USMCA provisions and import tariff structures could impact raw material costs, finished goods trade flows, and competitive positioning of Mexican manufacturing operations. Market participants must navigate policy uncertainty while making long-term investment decisions regarding production capacity and market development.

Competitive Landscape:

The Mexico adhesives and sealants market demonstrates moderate competitive intensity, with a mix of established multinational corporations and regional manufacturers operating across diverse application segments. Leading participants maintain strong positions through broad product portfolios, technical support services, and well-developed distribution networks catering to industrial and commercial customers. Competition is driven by continuous innovation, sustainability-focused product development, and strategic expansion of local manufacturing capabilities to meet growing regional demand. Regional manufacturers compete effectively in targeted applications by offering cost-efficient solutions, ensuring proximity to customers, and providing specialized products tailored to local requirements, reinforcing their relevance in niche market segments.

Recent Developments:

-

December 2024: Arkema completed the USD 250 million acquisition of Dow's flexible packaging laminating adhesives business, strengthening Bostik's portfolio in industrial, medical, and food packaging markets across North America and Mexico.

Mexico Adhesives and Sealants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Adhesive Types Covered | Acrylic, PVA, Polyurethanes, Styrenic Block Copolymers, Epoxy, EVA, Others |

| Sealant Types Covered | Acrylic, Silicone, Polyurethane, Butyl, Others |

| Technologies Covered | Water-Based, Solvent-Based, Hot Melt, Reactive, Others |

| Applications Covered | Paperboard and Packaging, Building and Construction, Transportation, Leather and Footwear, Furniture, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico adhesives and sealants market size was valued at USD 942.6 Million in 2025.

The Mexico adhesives and sealants market is expected to grow at a compound annual growth rate of 3.09% from 2026-2034 to reach USD 1,239.7 Million by 2034.

PVA dominates the adhesive type segment with a 28% market share in 2025, driven by its cost-effectiveness, versatility in bonding applications, and widespread use across packaging, woodworking, and paper industries in Mexico.

Key factors driving the Mexico adhesives and sealants market include expanding automotive manufacturing production, nearshoring-driven industrial development, growing packaging demand fueled by e-commerce expansion, and increasing construction activities across residential, commercial, and industrial segments.

Major challenges include raw material price volatility affecting production costs, stringent environmental compliance requirements necessitating formulation transitions, trade policy uncertainties impacting cross-border supply chains, and currency fluctuations affecting import costs for specialty chemical inputs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)