Mexico Adult Diaper Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Mexico Adult Diaper Market Overview:

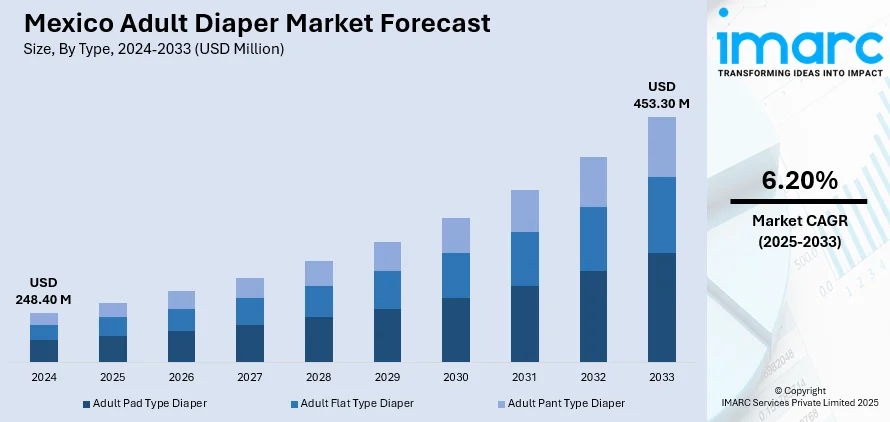

The Mexico adult diaper market size reached USD 248.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 453.30 Million by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The market is being driven by a rapidly aging population, rising awareness about incontinence care, increasing acceptance of adult hygiene products, improved healthcare infrastructures, and elevating demand for discreet, comfortable, and eco-friendly solutions that enhance quality of life for both elderly individuals and patients with mobility or health conditions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 248.40 Million |

| Market Forecast in 2033 | USD 453.30 Million |

| Market Growth Rate 2025-2033 | 6.20% |

Mexico Adult Diaper Market Trends:

Aging Population and Rising Life Expectancy

One of the key factors driving the demand for adult diapers in Mexico is the growing population of elderly people, as well as the rise in life expectancy. Official estimates predict that Mexico's population aged 65 or older will triple to 20.2% by 2050, reflecting a swift change in demography. As people age, they are more prone to chronic conditions, including urinary incontinence, mobility impairments, and weakening of pelvic floor muscles due to advancing age—all these requiring the need for adult diapers. The improved life expectancy rate, currently at an average of 75 years, has also helped to promote an extended requirement for eldercare solutions. Most elderly people desire to stay active and socially connected, which increases the need for high-quality, unobtrusive adult incontinence products so that they can stay mobile. Families and caregivers are also looking for convenient and hygienic solutions to help aging loved ones, which makes adult diapers a necessary part of home care. In addition to this, government policies concerning health that are aimed at elder welfare and the increasing population of retirement communities have indirectly driven the uptake of adult diapers. Such facilities tend to purchase incontinence products in bulk, contributing to the general market size expansion.

Changing Social Attitudes and Awareness Toward Incontinence

Another key driver of the adult diaper business in Mexico is the changing cultural view and rising public consciousness about incontinence and hygiene care. Traditionally, incontinence was considered an off-color topic in Mexican society: a topic that typically instilled shame and social disrepute. It resulted in keeping many people from using adult diapers, even in cases of necessity dictated by their medical condition. But in recent years, surge in health literacy, improved media portrayal, and public health campaigns have all contributed significantly to transforming this picture. Pharmaceutical corporations, health NGOs, and diaper brands for adults are extensively getting involved in education campaigns that popularize the use of incontinence products. These campaigns aim at quality of life, autonomy, and self-esteem—reaching both caregivers and consumers. Greater visibility in retail outlets, websites, and even mass-market advertising has served to further desensitize the use of such products. Concurrently, urbanization and lifestyle modernization have diminished the intergenerational stigma that previously surrounded adult hygiene products. Younger caregivers are more receptive and responsive to the health concerns of their older parents, and even middle-aged adults are more proactive in bladder health management.

Mexico Adult Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Adult Pad Type Diaper

- Adult Flat Type Diaper

- Adult Pant Type Diaper

The report has provided a detailed breakup and analysis of the market based on the type. This includes adult pad type diaper, adult flat type diaper, and adult pant type diaper.

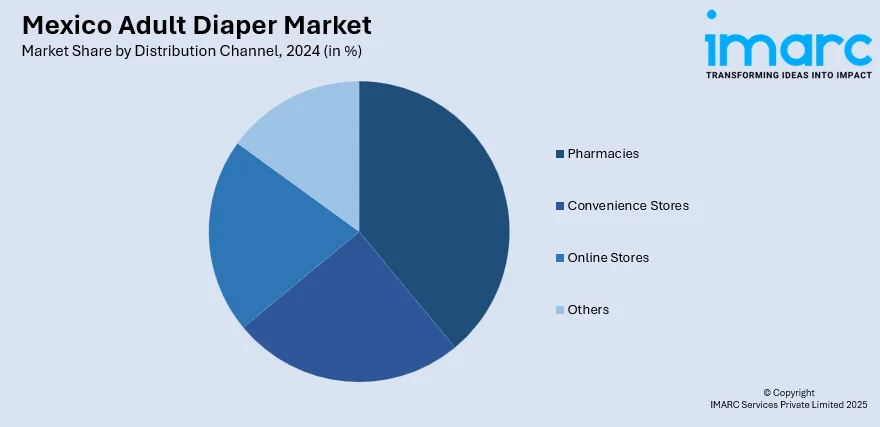

Distribution Channel Insights:

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Adult Diaper Market News:

- July 2023: Delicawash Care Corp., known for its tree-free Soft N Dry diapers, expanded into Mexico by establishing operations in Zapopan, Jalisco. This move included launching a Spanish-language website and partnering with influencer marketing firm StarNgage to enhance brand visibility.

- May 2023: Belgian personal care company Ontex completed the sale of its Mexican operations to Chilean firm Softys for approximately EUR 265 million. The acquisition included Ontex's Puebla facility and brands such as BBTips, Chicolastic, Kiddies, BioBaby, Affective, and Fiore, encompassing adult diapers and incontinence products.

Mexico Adult Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Adult Pad Type Diaper, Adult Flat Type Diaper, Adult Pant Type Diaper |

| Distribution Channels Covered | Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico adult diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico adult diaper market on the basis of type?

- What is the breakup of the Mexico adult diaper market on the basis of distribution channel?

- What are the various stages in the value chain of the Mexico adult diaper market?

- What are the key driving factors and challenges in the Mexico adult diaper?

- What is the structure of the Mexico adult diaper market and who are the key players?

- What is the degree of competition in the Mexico adult diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico adult diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico adult diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico adult diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)