Mexico Advanced Ceramics Market Size, Share, Trends and Forecast by Material Type, Class Type, End Use Industry, and Region, 2025-2033

Mexico Advanced Ceramics Market Overview:

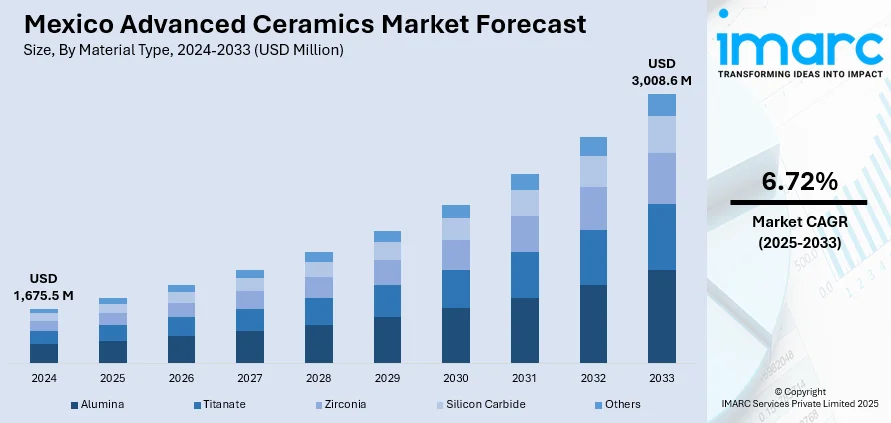

The Mexico advanced ceramics market size reached USD 1,675.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,008.6 Million by 2033, exhibiting a growth rate (CAGR) of 6.72% during 2025-2033. Rising demand in automotive, electronics, and renewable energy sectors, miniaturization in electronics, renewable energy investments, growth in aerospace manufacturing, growing product adoption in medical implant, industrial automation, environmental compliance, semiconductor innovation, and increasing Foreign Direct Investment (FDI) in high-tech manufacturing clusters are factors accelerating the Mexico advanced ceramics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,675.5 Million |

| Market Forecast in 2033 | USD 3,008.6 Million |

| Market Growth Rate 2025-2033 | 6.72% |

Mexico Advanced Ceramics Market Trends:

Automotive Industry Expansion

The expanding automotive sector, which remains a cornerstone of the country’s manufacturing landscape, is one of the key factors driving the Mexico advanced ceramics market growth. The nation hosts production facilities for global original equipment manufacturers (OEMs) such as General Motors, Ford, and Volkswagen, all of which are progressively incorporating advanced materials into vehicle systems to improve fuel efficiency and durability. Advanced ceramics are being integrated into components like exhaust systems, oxygen sensors, and engine parts due to their high-temperature resistance, corrosion protection, and mechanical strength. These materials extend product life cycles and enhance vehicle performance, particularly in hybrid and electric vehicles where thermal management is crucial. As Mexico continues to attract foreign investment in auto manufacturing, suppliers of ceramic components are scaling up operations, making the sector a consistent driver of advanced ceramic adoption across production facilities and supply chains.

To get more information of this market, Request Sample

Electronics and Semiconductor Growth

The electronics and semiconductor sector in Mexico is creating new opportunities for the advanced ceramics market, particularly as the country strengthens its role in the North American tech supply chain. Advanced ceramics are valued for their exceptional electrical insulation, high dielectric strength, and ability to perform in extreme temperatures, characteristics critical for use in semiconductors, capacitors, substrates, and circuit board assemblies. With manufacturing hubs in states like Jalisco and Baja California, demand for reliable materials that can support miniaturization and improve thermal regulation has increased. Global electronics manufacturers are turning to Mexico to localize production for North America, especially with supply chain diversification efforts underway. As this reshoring trend accelerates, there is greater interest in materials that can meet the strict quality and thermal tolerance demands of modern electronics.

Renewable Energy Investments

Mexico’s rising investments in renewable energy infrastructure are supporting the growth of the advanced ceramics market, particularly in solar and wind applications. In 2025, The Mexican government has revised its renewable energy capacity targets, aiming to add approximately 93,924 MW over the next 15 years, with a notable increase in wind energy projects. Additionally, a $22.3 billion electricity expansion plan has been announced, focusing on enhancing the national grid and supporting renewable energy infrastructure. Advanced ceramics are essential for their ability to withstand harsh environmental conditions, resist corrosion, and provide thermal insulation in renewable energy systems. In solar power installations, ceramic coatings are applied to modules to enhance efficiency and durability under constant ultraviolet (UV) exposure and temperature fluctuations. In wind turbines, ceramics are used in bearing systems, electrical insulators, and brake components where mechanical stress and reliability are key. The government’s commitment to diversify energy sources and increase the share of renewables in the national grid is drawing both domestic and international investment.

Mexico Advanced Ceramics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, class type, and end use industry.

Material Type Insights:

- Alumina

- Titanate

- Zirconia

- Silicon Carbide

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes alumina, titanate, zirconia, silicon carbide, and others.

Class Type Insights:

- Monolithic Ceramics

- Ceramic Coatings

- Ceramic Matrix Composites

- Others

A detailed breakup and analysis of the market based on the class type have also been provided in the report. This includes monolithic ceramics, ceramic coatings, ceramic matrix composites, and others.

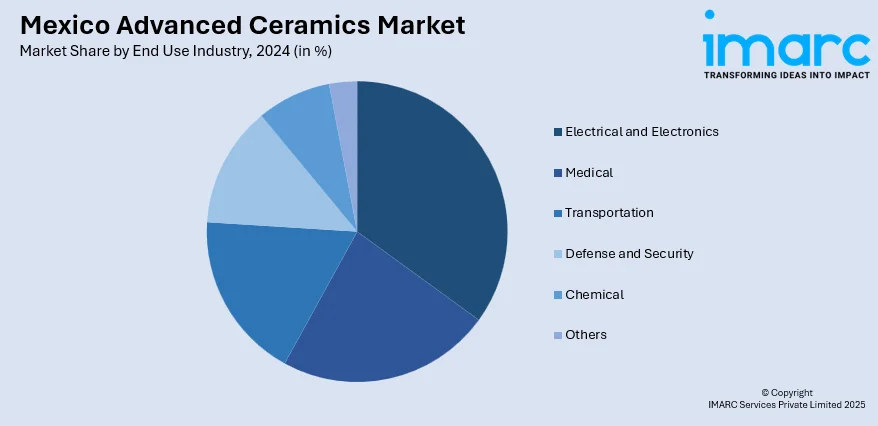

End Use Industry Insights:

- Electrical and Electronics

- Medical

- Transportation

- Defense and Security

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes electrical and electronics, medical, transportation, defense and security, chemical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Advanced Ceramics Market News:

- In 2024, the Czech Republic launched the Tech Mission 2024 in Mexico to strengthen economic and academic ties, focusing on new technologies such as nanotechnology and advanced materials. This initiative aims to enhance collaboration between the two countries in developing innovative solutions, including eco-friendly ceramic technologies. Representatives from Czech research institutions and companies participated in this mission, highlighting the importance of international cooperation in advancing sustainable materials.

Mexico Advanced Ceramics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Alumina, Titanate, Zirconia, Silicon Carbide, Others |

| Class Types Covered | Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites, Others |

| End Use Industries Covered | Electrical and Electronics, Medical, Transportation, Defense and Security, Chemical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico advanced ceramics market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico advanced ceramics market on the basis of material type?

- What is the breakup of the Mexico advanced ceramics market on the basis of class type?

- What is the breakup of the Mexico advanced ceramics market on the basis of end use industry?

- What is the breakup of the Mexico advanced ceramics market on the basis of region?

- What are the various stages in the value chain of the Mexico advanced ceramics market?

- What are the key driving factors and challenges in the Mexico advanced ceramics market?

- What is the structure of the Mexico advanced ceramics market and who are the key players?

- What is the degree of competition in the Mexico advanced ceramics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico advanced ceramics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico advanced ceramics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico advanced ceramics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)