Mexico Advanced Packaging Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Mexico Advanced Packaging Market Overview:

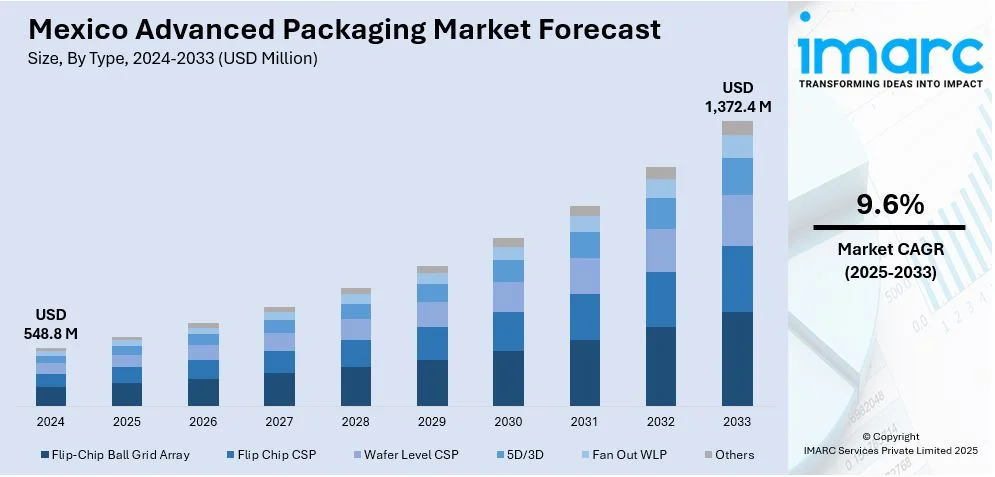

The Mexico advanced packaging market size reached USD 548.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,372.4 Million by 2033, exhibiting a growth rate (CAGR) of 9.6% during 2025-2033. The growing demand for miniaturized, high-performance electronic devices, expanding semiconductor manufacturing, rising investments in 5G infrastructure, increasing adoption of internet of things (IoT) and artificial intelligence (AI) technologies, and government initiatives to boost local electronics production are some of the major factors driving market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 548.8 Million |

| Market Forecast in 2033 | USD 1,372.4 Million |

| Market Growth Rate 2025-2033 | 9.6% |

Mexico Advanced Packaging Market Trends:

Increased Local Semiconductor Fabrication Initiatives

Mexico is witnessing a notable increase in semiconductor fabrication efforts, driven by strategic policies aimed at reducing dependency on Asian imports and building domestic resilience. Additionally, government-supported programs are incentivizing global semiconductor firms to establish advanced packaging and assembly units within the country, which is providing an impetus to Mexico advanced packaging market growth. For example, on February 12, 2025, the President formally announced the creation of the National Kutsari Semiconductor Design Center as part of the Plan Mexico strategy. This initiative is designed to boost technological innovation, expand domestic design capabilities, and enhance industrial competitiveness. Strategically located across Puebla, Jalisco, and Sonora, the Kutsari Center will operate in collaboration with leading academic and research institutions to advance semiconductor design, simplify intellectual property procedures, and promote commercialization that meets international standards. The center’s roadmap includes finalizing a national semiconductor manufacturing framework by 2026 and launching a domestic fabrication facility by 2029. These developments are closely aligned with the broader objectives of the USMCA, which promotes nearshoring and regional integration. Consequently, global foundries and OSAT firms are actively engaging with Mexican industrial hubs to capitalize on these government-driven opportunities, thereby fueling sustained demand for advanced packaging capabilities across the country. In addition to economic and geopolitical drivers, the availability of skilled technical labor in cities such as Guadalajara and Monterrey further strengthen the feasibility of establishing local packaging infrastructure. The shift toward domestic production directly correlates with the growing demand for advanced packaging technologies, including fan-out wafer-level packaging and system-in-package configurations.

Adoption of Advanced Packaging for Automotive Electronics

The growth of electric and autonomous vehicles is significantly influencing demand for advanced packaging solutions, which is positively impacting Mexico advanced packaging market outlook. According to an industry report, Mexico manufactured nearly 4 million light vehicles in 2024, and export value reached a record of a record 3,479,086 units. As a major hub for automotive manufacturing, Mexico plays a pivotal role in the supply chains of global automakers, particularly for control units, power modules, and sensors. These components require robust, thermally efficient, and miniaturized packaging to meet the high-performance and safety standards of modern vehicles. In addition to this, technologies such as flip-chip packaging, embedded die, and multi-chip modules are increasingly integrated to support the functionality of LiDAR systems, ADAS processors, and battery management units. The need for high reliability under extreme temperature and vibration conditions is also accelerating innovation in thermal interface materials and substrate technologies. Moreover, strategic collaboration between automotive OEMs and semiconductor firms is intensifying in regions like Puebla and San Luis Potosí, where tier-one suppliers are co-developing next-generation chipsets and integrating advanced packaging into vehicle architecture. These factors are collectively augmenting the Mexico advanced packaging market share.

Mexico Advanced Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Flip-Chip Ball Grid Array

- Flip Chip CSP

- Wafer Level CSP

- 5D/3D

- Fan Out WLP

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes flip-chip ball grid array, flip chip CSP, wafer level CSP, 5D/3D, fan out WLP, and others.

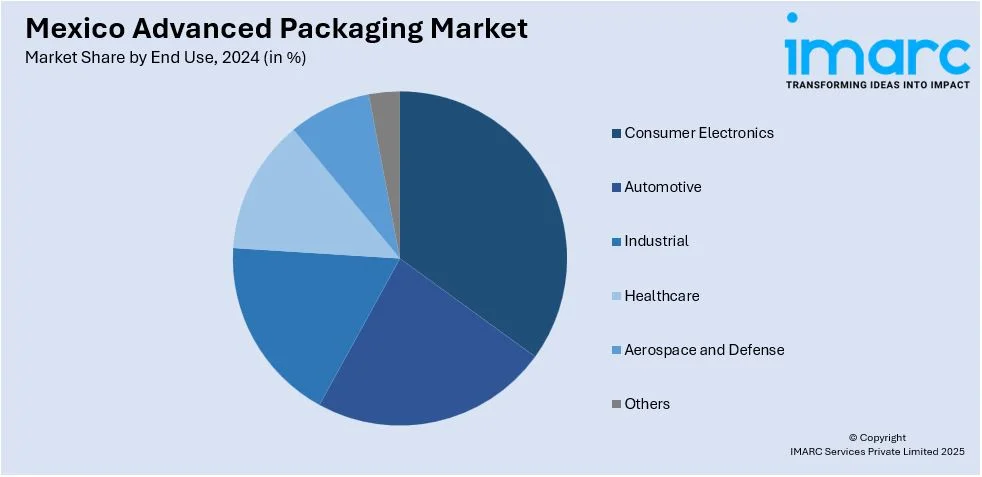

End Use Insights:

- Consumer Electronics

- Automotive

- Industrial

- Healthcare

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes consumer electronics, automotive, industrial, healthcare, aerospace and defense, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Advanced Packaging Market News:

- On June 26, 2024, ASE Technology Holding announced plans to construct new semiconductor packaging and testing facilities in the United States and Mexico, aiming to strengthen its presence in North America. This strategic expansion seeks to meet growing regional demand and enhance supply chain resilience amid global semiconductor shortages. The initiative aligns with ASE's commitment to supporting clients with advanced packaging solutions closer to their manufacturing bases.

Mexico Advanced Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flip-Chip Ball Grid Array, Flip Chip CSP, Wafer Level CSP, 5D/3D, Fan Out WLP, Others |

| End Uses Covered | Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace and Defense, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico advanced packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico advanced packaging market on the basis of type?

- What is the breakup of the Mexico advanced packaging market on the basis of end use?

- What is the breakup of the Mexico advanced packaging market on the basis of region?

- What are the various stages in the value chain of the Mexico advanced packaging market?

- What are the key driving factors and challenges in the Mexico advanced packaging market?

- What is the structure of the Mexico advanced packaging market and who are the key players?

- What is the degree of competition in the Mexico advanced packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico advanced packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico advanced packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico advanced packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)