Mexico Advanced Wound Care Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2026-2034

Mexico Advanced Wound Care Market Summary:

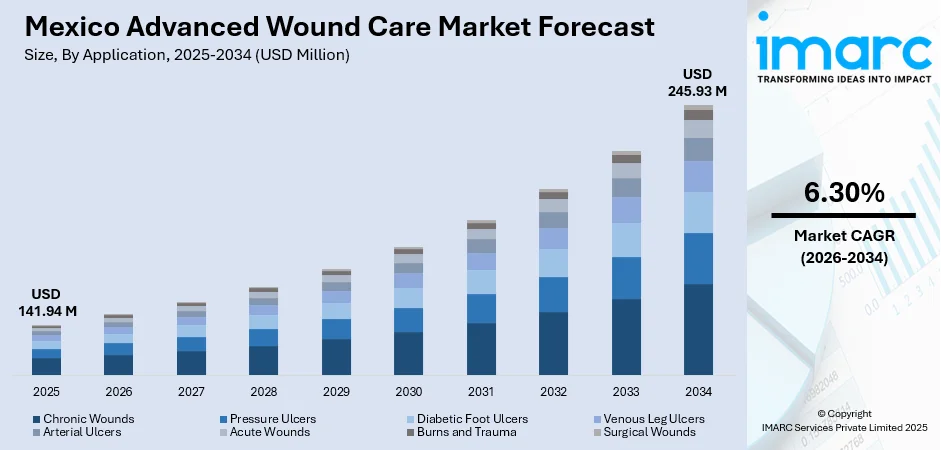

The Mexico advanced wound care market size was valued at USD 141.94 Million in 2025 and is projected to reach USD 245.93 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034.

The Mexico advanced wound care market is driven by the rising prevalence of chronic conditions such as diabetes and pressure ulcers, coupled with an expanding geriatric population requiring specialized wound management solutions. Healthcare modernization initiatives and growing investment in hospital infrastructure are accelerating the adoption of sophisticated wound care products, including advanced dressings, negative pressure wound therapy devices, and bioengineered skin substitutes. Increasing awareness among healthcare professionals about evidence-based wound management practices and the benefits of faster healing outcomes continues to propel market expansion across the country.

Key Takeaways and Insights:

-

By Product: Exudate management dominates the market with a share of 28% in 2025, driven by widespread clinical adoption of foam dressings and hydrocolloids for effective fluid absorption and moisture balance in wound healing protocols.

-

By Application: Chronic wounds lead the market with a share of 64% in 2025, reflecting Mexico's substantial diabetic population and the growing incidence of pressure ulcers among elderly patients requiring long-term wound management.

-

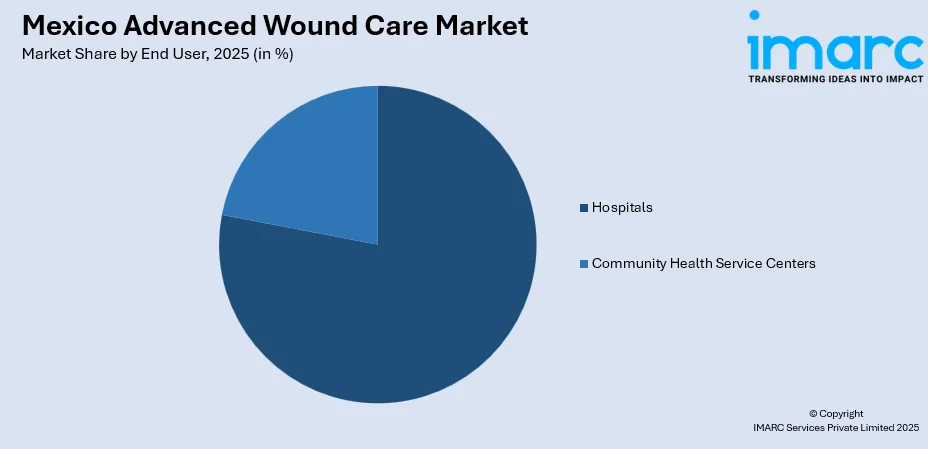

By End User: Hospitals represent the largest segment with a market share of 78% in 2025, attributed to comprehensive wound care capabilities, specialized clinical staff, and established treatment protocols available in institutional healthcare settings.

-

By Region: Northern Mexico leads the market with approximately 38% revenue share in 2025, supported by advanced healthcare infrastructure in industrial cities and proximity to cross-border medical technology trade corridors.

-

Key Players: The Mexico advanced wound care market exhibits a moderately competitive landscape characterized by the presence of established multinational medical device corporations competing alongside regional distributors and emerging local manufacturers across therapeutic segments.

To get more information on this market Request Sample

The Mexico advanced wound care market represents a critical segment of the country's evolving healthcare ecosystem, driven by epidemiological factors including one of the world's highest diabetes prevalence rates. With approximately 14.1 million adults living with diabetes in Mexico, diabetic foot ulcers have emerged as a leading cause of hospitalization and amputation, creating sustained demand for advanced therapeutic interventions. The Mexican Institute of Social Security (IMSS) and other public health institutions have increasingly prioritized wound care protocols as part of broader chronic disease management strategies. For instance, community health initiatives in regions like Veracruz have focused on educating elderly populations about proper wound care and infection prevention practices, demonstrating growing awareness at grassroots levels. Healthcare infrastructure modernization across major metropolitan areas continues to expand access to sophisticated wound care technologies, while telemedicine integration enables remote wound assessment and treatment monitoring in underserved regions.

Mexico Advanced Wound Care Market Trends:

Growing Adoption of Antimicrobial and Bioactive Dressings

Healthcare facilities across Mexico are increasingly transitioning from traditional wound care approaches to antimicrobial dressings and bioactive wound care products that offer enhanced infection prevention capabilities. The shift toward silver-impregnated dressings, collagen-based matrices, and hydrogel formulations reflects evidence-based clinical practices aimed at reducing bacterial colonization and promoting optimal healing environments. Advanced catalytic gels and novel wound treatment technologies have begun entering the Mexican market, addressing the urgent need for effective chronic wound solutions, particularly among diabetic patients in underserved communities where traditional therapies have shown limited efficacy.

Expansion of Home Healthcare and Outpatient Wound Management

The Mexican healthcare system is witnessing significant growth in home-based wound care services as patients and providers seek cost-effective alternatives to prolonged hospital stays. Portable negative pressure wound therapy devices and user-friendly dressing systems designed for outpatient settings are gaining traction, enabling patients to continue treatment in comfortable home environments while reducing healthcare facility burden. This trend aligns with broader healthcare decentralization efforts and reflects changing patient preferences for convenient, accessible wound management solutions that maintain treatment continuity without requiring frequent clinical visits.

Integration of Digital Health Technologies in Wound Assessment

Digital wound imaging, telemedicine consultations, and electronic health record integration are transforming wound care delivery models across Mexico's healthcare landscape. The Mexico digital health devices market size reached USD 1,390.51 Million in 2025. The market is projected to reach USD 4,147.97 Million by 2034, growing at a CAGR of 12.91% during 2026-2034. Remote monitoring capabilities enable wound care specialists to assess healing progress, adjust treatment protocols, and provide expert consultations for complex cases without requiring patient travel to specialized centers. Rural healthcare innovation programs, including collaborative initiatives in remote areas like Xicotepec in Puebla, are demonstrating how technology-enabled wound care can extend specialized services to underserved populations and improve treatment outcomes in geographically challenging regions.

Market Outlook 2026-2034:

The Mexico advanced wound care market outlook remains positive as healthcare infrastructure investments, rising chronic disease prevalence, and growing clinical awareness converge to drive sustained market expansion. Government health programs focusing on diabetes management and elderly care are expected to increase institutional adoption of advanced wound care technologies, while private sector growth in ambulatory surgical centers and specialized wound care clinics will expand access beyond traditional hospital settings. Innovation in portable therapy devices, bioengineered skin substitutes, and combination treatment approaches will continue to reshape the competitive landscape. The market generated a revenue of USD 141.94 Million in 2025 and is projected to reach a revenue of USD 245.93 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034.

Mexico Advanced Wound Care Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Exudate Management |

28% |

|

Application |

Chronic Wounds |

64% |

|

End User |

Hospitals |

78% |

|

Region |

Northern Mexico |

38% |

Product Insights:

- Infection Management

- Silver Wound Dressings

- Non-silver Dressings

- Collagen Dressings

- Exudate Management

- Hydrocolloids Dressings

- Foam Dressings

- Alginate Dressings

- Hydrogel Dressings

- Active Wound Care

- Skin Substitutes

- Growth Factors

- Therapy Devices

- Negative Pressure Wound Therapy (NPWT)

- Oxygen and Hyperbaric Oxygen Equipment

- Electromagnetic Therapy Devices

- Others

The exudate management dominates with a market share of 28% of the total Mexico advanced wound care market in 2025.

Exudate management products, including foam dressings, hydrocolloids, alginates, and hydrogels, represent the cornerstone of contemporary wound care protocols in Mexican healthcare facilities. These advanced dressings address the critical need for optimal moisture balance in wound beds, absorbing excess fluid while maintaining the moist environment essential for tissue regeneration. Clinical adoption has accelerated as healthcare professionals recognize the superior outcomes achieved through modern exudate management compared to traditional gauze-based approaches, particularly in managing highly exudative chronic wounds prevalent among diabetic patients.

The segment's leadership reflects practical clinical considerations, including ease of application, extended wear times, reducing dressing change frequency, and compatibility with various wound types encountered in Mexican hospital and outpatient settings. Foam dressings have gained prominence due to their conformability, cushioning properties, and effectiveness across wound depths, while hydrocolloid formulations continue serving as reliable options for moderate exudate management in acute and chronic wound scenarios throughout the healthcare system.

Application Insights:

- Chronic Wounds

- Pressure Ulcers

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Arterial Ulcers

- Acute Wounds

- Burns and Trauma

- Surgical Wounds

The chronic wounds lead with a share of 64% of the total Mexico advanced wound care market in 2025.

Chronic wounds represent the largest segment of Mexico’s advanced wound care market, driven by widespread diabetes-related complications and the growing incidence of age-related impairments in wound healing. Diabetic foot ulcers are a particularly critical concern, often requiring specialized and long-term wound management solutions. Public healthcare institutions increasingly recognize the clinical and economic impact of diabetes-associated lower-limb complications, encouraging greater emphasis on early intervention, preventive wound care strategies, and the adoption of advanced therapeutic products to improve healing outcomes and reduce complications.

Pressure ulcers among hospitalized patients and elderly individuals receiving home care form a significant share of chronic wound care needs, with demand rising as the population continues to age. A growing elderly demographic is expanding the number of patients requiring long-term wound management. In response, healthcare providers are strengthening wound care protocols, investing in specialized clinical training, and increasing adoption of advanced treatment solutions suited for prolonged healing cycles typically associated with chronic wounds.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Community Health Service Centers

The hospitals exhibit a clear dominance with a 78% share of the total Mexico advanced wound care market in 2025.

Hospitals maintain overwhelming market leadership as the primary treatment setting for advanced wound care in Mexico, leveraging comprehensive clinical capabilities, specialized medical staff, and established procurement channels for sophisticated wound management products. Major public healthcare institutions, including those under IMSS, ISSSTE, and the Ministry of Health networks, operate dedicated wound care programs with access to the full spectrum of therapeutic modalities from basic dressings to negative pressure wound therapy devices and bioengineered skin substitutes. The concentration of complex cases requiring multidisciplinary care naturally channels advanced wound care product utilization toward hospital settings.

Private hospitals and specialized clinics in metropolitan areas have invested significantly in advanced wound care technologies as differentiating services, catering to patients seeking expedited healing and reduced complication rates. The segment's dominance reflects both clinical necessity and healthcare system structure, though growing interest in ambulatory and home-based care models suggests potential for gradual diversification of treatment settings as portable wound care technologies mature and patient preferences evolve toward community-based healthcare delivery models.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico leads the market with approximately 38% revenue share of the total Mexico advanced wound care market in 2025.

Northern Mexico's market leadership stems from the region's advanced healthcare infrastructure concentrated in major industrial cities, including Monterrey, Tijuana, Ciudad Juárez, and border communities benefiting from proximity to the United States medical supply chains. The region's economic development has supported the establishment of modern hospital networks, private healthcare facilities, and specialized medical centers with the capacity to adopt sophisticated wound care technologies. Industrial employment patterns have also contributed to employer-sponsored healthcare coverage, enabling access to advanced medical treatments beyond basic public health services.

Cross-border healthcare dynamics play a notable role in Northern Mexico's advanced wound care market, with medical tourism flows and trade relationships facilitating technology transfer and product availability. Healthcare providers in the region often benchmark against international standards, accelerating the adoption of evidence-based wound care protocols and innovative therapeutic products. The concentration of pharmaceutical and medical device distribution infrastructure further supports market development, creating efficient supply chains for advanced wound care products serving both institutional and outpatient care settings throughout the northern states.

Market Dynamics:

Growth Drivers:

Why is the Mexico Advanced Wound Care Market Growing?

Rising Prevalence of Diabetes and Associated Complications

Mexico faces one of the world's highest diabetes prevalence rates, with the condition affecting a substantial proportion of the adult population and emerging as a leading cause of mortality and disability. Mexico’s national mortality rate stood at 630 deaths per 100,000 people, with heart disease, diabetes, and malignant tumors ranking as the top three causes of death. Together, these conditions were responsible for over 400,000 fatalities, with heart disease leading at 192,518 deaths, followed by diabetes, which accounted for 112,577 deaths. Diabetic foot ulcers represent a particularly devastating complication, frequently leading to hospitalization, extended treatment requirements, and, in severe cases, lower extremity amputation. The progressive nature of diabetes-related wound healing impairment creates sustained demand for advanced therapeutic interventions capable of addressing the complex pathophysiology underlying chronic diabetic wounds. Healthcare systems across Mexico have increasingly recognized diabetic wound care as a priority area requiring investment in specialized products, clinical training, and multidisciplinary treatment protocols to reduce the devastating human and economic toll of diabetes-related amputations.

Expanding Geriatric Population and Age-Related Wound Care Needs

Mexico's demographic transition toward an aging population structure is fundamentally reshaping healthcare demands, including wound care requirements. The population of Mexicans aged 65 and above requiring care is projected to increase threefold, reaching about 7.3 million by 2050. The elderly population faces elevated risk for multiple wound types, including pressure ulcers from reduced mobility, venous leg ulcers from circulatory compromise, and delayed healing from age-related physiological changes. Projections indicating dramatic growth in the population aged sixty and above over the coming decades underscore the expanding patient population requiring advanced wound management. Healthcare facilities are adapting care models to address geriatric wound care needs, incorporating pressure redistribution strategies, nutritional optimization, and advanced dressing technologies capable of managing the complex wound healing challenges characteristic of elderly patients with multiple comorbidities.

Healthcare Infrastructure Modernization and Clinical Awareness

Ongoing investment in healthcare infrastructure across Mexico is expanding access to advanced wound care technologies beyond major metropolitan centers. Hospital modernization programs, the establishment of specialized wound care clinics, and healthcare professional training initiatives are collectively elevating treatment standards and clinical capabilities throughout the healthcare system. The Mexico healthcare asset management market size reached USD 214.80 Million in 2024. Looking forward, the market is expected to reach USD 513.19 Million by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. Growing awareness among physicians, nurses, and allied health professionals regarding evidence-based wound management practices is driving the adoption of advanced products demonstrating superior outcomes compared to traditional approaches. Educational programs, professional conferences, and clinical guideline development are disseminating wound care knowledge, while telemedicine platforms are extending specialist consultation capabilities to underserved regions where local wound care expertise may be limited.

Market Restraints:

What Challenges the Mexico Advanced Wound Care Market is Facing?

High Product Costs and Healthcare Budget Constraints

Advanced wound care products are priced significantly higher than conventional dressings, posing procurement challenges for healthcare facilities with limited budgets. Public hospitals and clinics may prioritize essential supplies over costly therapeutic products, restricting patient access to optimal wound care, especially in underserved or resource-constrained regions where budget constraints directly impact treatment quality and availability.

Limited Clinical Training and Specialized Expertise

Effective use of advanced wound care products requires specialized training for proper selection, application, and monitoring. Inadequate clinical expertise, particularly in rural or underserved areas, can lead to incorrect usage, reduced therapeutic effectiveness, and inconsistent adherence to treatment protocols, which may discourage healthcare providers from fully adopting these advanced solutions.

Fragmented Healthcare System and Reimbursement Inconsistencies

Mexico’s healthcare landscape includes multiple public and private providers with varying policies on advanced wound care products. Inconsistent reimbursement frameworks and complex administrative procedures create uncertainty for providers, potentially delaying procurement and treatment initiation. These disparities may limit patient access to specialized wound care therapies and complicate adoption across the healthcare system.

Competitive Landscape:

The Mexico advanced wound care market exhibits a moderately consolidated competitive structure characterized by the presence of established multinational medical device corporations operating alongside regional distributors and emerging domestic suppliers. Market participants compete across multiple dimensions, including product portfolio breadth, clinical evidence supporting therapeutic efficacy, distribution network reach, and healthcare professional education and support services. Innovation in product formulations, therapy delivery systems, and integrated wound care solutions drives differentiation among leading competitors, while strategic partnerships with healthcare institutions and professional associations strengthen market positioning. The evolving regulatory environment and healthcare procurement practices continue shaping competitive dynamics as companies navigate market access requirements while expanding their presence across hospital, ambulatory, and emerging home care segments.

Recent Developments:

-

In September 2025, DEBx Medical confirmed that DEBRICHEM® obtained regulatory clearance from Mexico’s Federal Commission for the Protection against Sanitary Risk (COFEPRIS). Collaborating with Biotechlives SAPI, the company is introducing this innovative therapy to the Mexican market, offering a specialized solution aimed at promoting healing in chronic wounds.

Mexico Advanced Wound Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered |

|

| End Users Covered | Hospitals, Community Health Service Centers |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico advanced wound care market size was valued at USD 141.94 Million in 2025.

The Mexico advanced wound care market is expected to grow at a compound annual growth rate of 6.30% from 2026-2034 to reach USD 245.93 Million by 2034.

The exudate management segment dominated the product category with approximately 28% market share in 2025, driven by widespread clinical adoption of foam dressings and hydrocolloids for effective moisture management in wound healing protocols.

Key factors driving the Mexico advanced wound care market include rising diabetes prevalence and associated complications, expanding geriatric population with increased wound care needs, healthcare infrastructure modernization, and growing clinical awareness of evidence-based wound management practices.

Major challenges include high product costs limiting accessibility in resource-constrained settings, insufficient specialized clinical training particularly in rural areas, fragmented healthcare system reimbursement policies, and infrastructure limitations restricting advanced therapy adoption in underserved regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)