Mexico Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Mexico Advertising Market Overview:

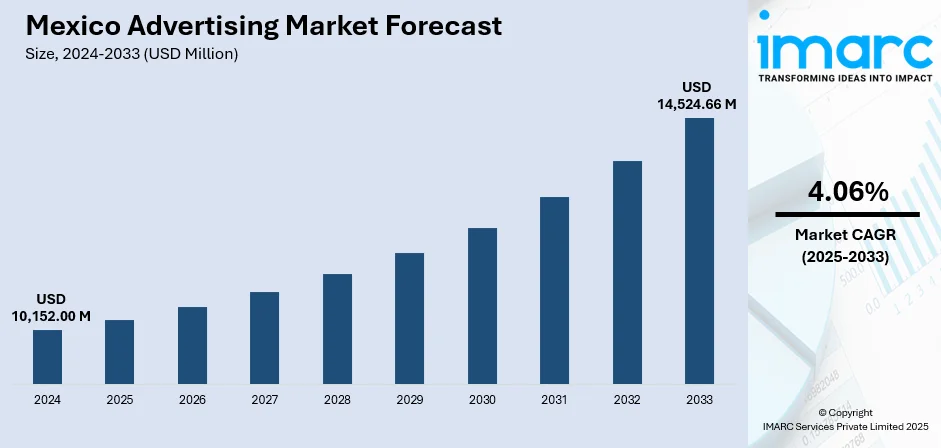

The Mexico advertising market size reached USD 10,152.00 Million in 2024. The market is projected to reach USD 14,524.66 Million by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033. The market is experiencing a dynamic transformation, driven by rapid digital adoption and evolving consumer behaviors. Digital media, particularly programmatic video and mobile, are taking center stage, with offline media remaining resilient. Social media and influencer marketing are shaking up brand-consumer relationships. Regional variation reflects varying levels of digital uptake and infrastructure maturity across different markets. This changing scenario offers opportunities for advertisers to employ new-age tactics to efficiently target heterogenous groups of people nationwide, influencing the Mexico advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,152.00 Million |

| Market Forecast in 2033 | USD 14,524.66 Million |

| Market Growth Rate 2025-2033 | 4.06% |

Mexico Advertising Market Trends:

Regulatory Changes Impact Advertising Industry

In April 2025, Mexico introduced proposed reforms to the Federal Telecommunications and Broadcasting Law that could impose fines up to 5% of broadcasters’ revenues for airing foreign government propaganda, excluding cultural or tourism content. This move comes after a U.S. anti-immigration ad aired on Mexican TV, sparking concerns about external influence on local audiences. The reforms plan to transfer regulatory authority from the Federal Telecommunications Institute (IFT) to the new Agency for Digital Transformation (ATD), while giving the Ministry of the Interior (SEGOB) more control over content oversight. These changes aim to protect the integrity of Mexico’s advertising market and guard public opinion from potentially manipulative messaging. As the legislation progresses through the Senate and Chamber of Deputies, it signals a growing focus on regulatory frameworks that can shape advertising practices across both traditional and digital platforms. This shift reflects evolving Mexico advertising market trends, emphasizing a more controlled and transparent environment for advertisers and broadcasters alike. The new rules could significantly affect content strategies and compliance requirements going forward.

To get more information on this market, Request Sample

Digital Advertising's Expanding Influence

Mexico's digital advertising market reached approximately several billion pesos in 2024, indicative of the rapid shift toward digital platforms as the primary medium for brand communication. Google alone controls more than 36% of the digital advertising market share, marking its high level of influence in search and display advertisements. This expansion is fueled by increased internet usage, with more than 80% of the population being covered, and widespread smartphone adoption that enables constant access to digital content. Advertisers are spending more on targeted, data-based campaigns on social media, search engines, and streaming media to reach audiences more powerfully and observe their influence with accuracy. This trend indicates the decline of traditional media usage to digital platforms, which are more dynamic and optimize in real-time. As brands continue to spend more on digital advertising, it strongly boosts the forecast for Mexico advertising market growth, which means sustained growth and development in the industry. The changing digital landscape is revolutionizing how brands reach consumers, rendering digital advertising a fundamental pillar of marketing strategies for Mexico.

Government Moves to Restrict Foreign Political Messaging

Mexico's president in April 2025 called for a U.S. government advertisement to be taken off the air during a big soccer game, calling it discriminatory and inappropriate for national viewing. The ad cautioned migrants against entering the U.S. and faced widespread criticism for its political content and belligerent tone. As a response, the president directed plans to introduce legislation that would ban foreign governments from broadcasting political or ideological matter on national media, except for limited purposes of culture or tourism. This is an indication of increased concern over foreign narratives gaining traction in local advertising zones. Broadcasters called on greater restraint in the advertisements they host, particularly those containing potential political influence or sway over public opinion. The move came shortly after the ad was broadcast, underscoring how swiftly the government is moving to define the limits of appropriate media content. As regulatory discussions persist, advertisers and media outlets are being forced to navigate increased scrutiny and evolving restrictions on content delivery.

Mexico Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

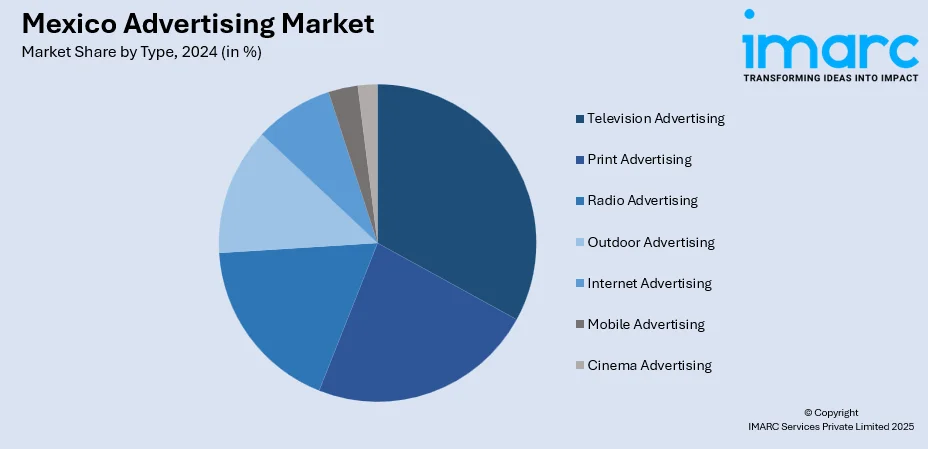

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Advertising Market News:

- December 2024: Mexico News Daily has announced it will go completely ad‑free, eliminating all external advertisements from its digital platform to improve reader experience. Headquartered in Mexico, the online publication aims to remove intrusive pop‑ups and misleading ad formats through Google Ad Manager. This strategic shift underscores the company’s commitment to maintaining editorial integrity and a clean interface. Although revenue will now rely entirely on subscriptions, the move reinforces its mission to provide trusted, unbiased coverage of Mexico and its evolving media landscape.

Mexico Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico advertising market on the basis of type?

- What is the breakup of the Mexico advertising market on the basis of region?

- What are the various stages in the value chain of the Mexico advertising market?

- What are the key driving factors and challenges in the Mexico advertising market?

- What is the structure of the Mexico advertising market and who are the key players?

- What is the degree of competition in the Mexico advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)