Mexico Agribusiness Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Mexico Agribusiness Market Overview:

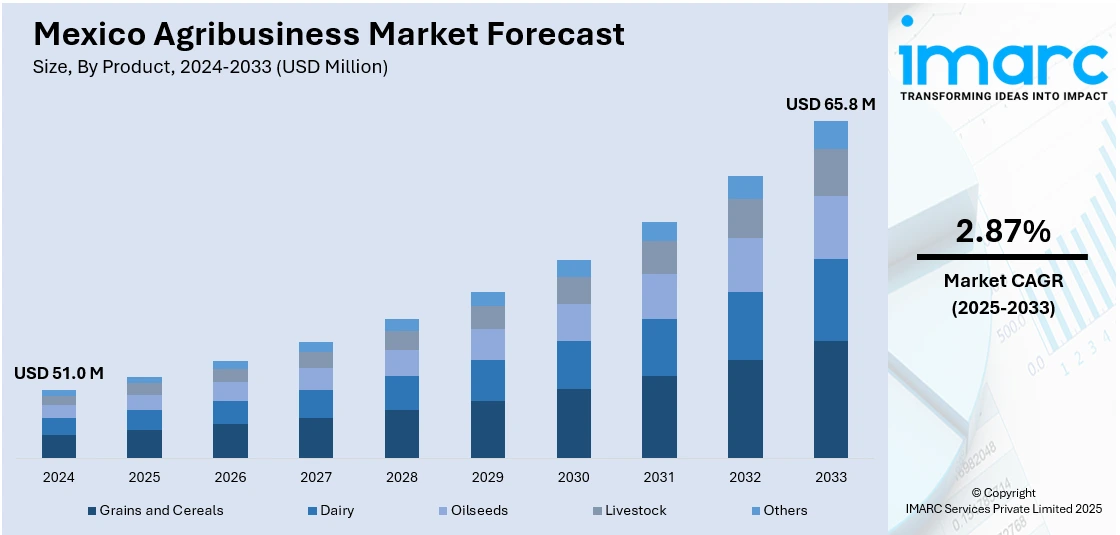

The Mexico agribusiness market size reached USD 51.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 65.8 Million by 2033, exhibiting a growth rate (CAGR) of 2.87% during 2025-2033. The market is witnessing significant growth driven by strong domestic demand, export opportunities, and diverse crop production. Key sectors include fruits, vegetables, grains, and livestock. Government support, trade agreements, and technological adoption continue to shape growth and improve productivity across the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.0 Million |

| Market Forecast in 2033 | USD 65.8 Million |

| Market Growth Rate 2025-2033 | 2.87% |

Mexico Agribusiness Market Trends:

Growing Export Demand

Mexico's agribusiness sector is experiencing significant expansion driven by increasing exports of fresh produce such as avocados, berries and tomatoes. The Mexico agribusiness market growth is fueled by rising global demand, trade agreements and advancements in agricultural technology. The strong demand from the United States which remains Mexico’s largest trading partner along with growing interest from European and Asian markets is accelerating exports. Regulatory developments and trade policies continue to shape Mexico’s agricultural exports ensuring compliance with international standards and market access. For instance, in June 2024, Mexico and the U.S. established a security model for phytosanitary inspections allowing the resumption of avocado exports from Michoacan. Officials emphasize collaboration on security, environmental and labor issues under the USMCA agreement. Favorable trade policies including the USMCA and Mexico’s competitive agricultural labor costs have further strengthened its export position. Additionally, investments in greenhouse farming and advanced irrigation techniques have improved productivity and product quality making Mexican produce more attractive globally. Government incentives and private sector investments in modernizing farming practices are also playing a key role. With increasing global food demand a positive Mexico agribusiness market outlook is expected reinforcing the country's position in the global food supply chain.

Technological Advancements

Technological advancements are transforming Mexico’s agribusiness sector enhancing productivity and optimizing resource efficiency. The adoption of precision agriculture, automation and IoT-based solutions is helping farmers monitor soil conditions, weather patterns and crop health in real-time leading to improved yields and reduced input costs. Smart irrigation systems and drone technology are further optimizing water usage and pest control addressing sustainability concerns. The increasing integration of AI-driven analytics and blockchain in supply chain management is also enhancing traceability and reducing post-harvest losses. Strategic collaborations and technological investments are further accelerating the digital transformation of Mexico’s agribusiness sector. For instance, in September 2024, Hydrosat expanded its presence in Latin America by signing four new commercial agreements with partners in Mexico and Guatemala. Utilizing its IrriWatch platform the company aims to enhance water use efficiency and crop yields through satellite-based thermal imagery, empowering farmers with data-driven tools for sustainable agriculture. Government initiatives and private sector investments are accelerating the adoption of these advanced technologies, making agriculture more efficient and competitive in global markets. As farmers and agribusinesses continue to embrace innovation, the sector is poised for sustained growth, strengthening its position in global food production and increasing Mexico agribusiness market share.

Mexico Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Grains and Cereals

- Dairy

- Oilseeds

- Livestock

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains and cereals, dairy, oilseeds, livestock, and others.

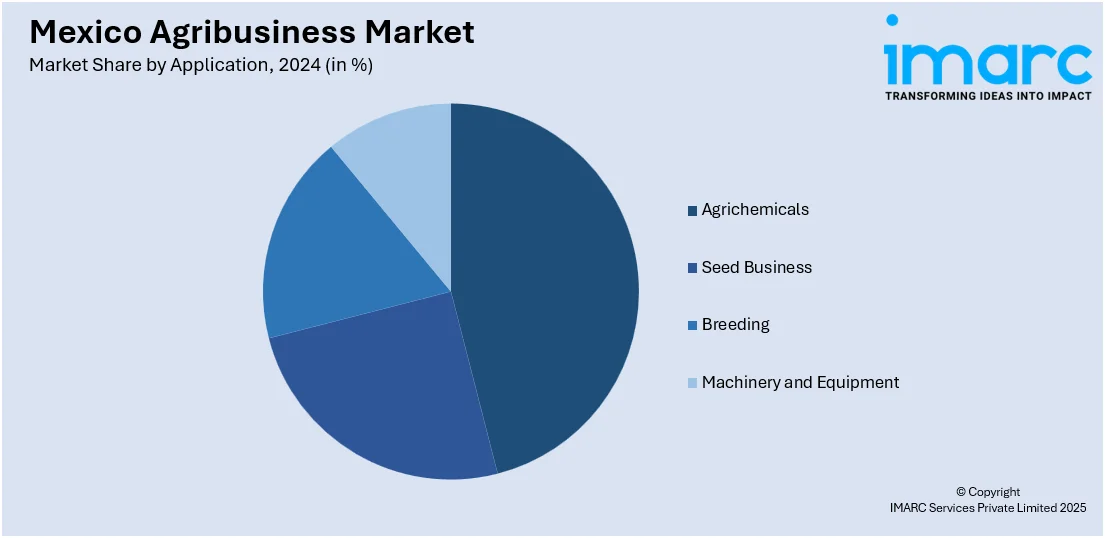

Application Insights:

- Agrichemicals

- Seed Business

- Breeding

- Machinery and Equipment

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agrichemicals, seed business, breeding, and machinery and equipment.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Agribusiness Market News:

- In December 2024, Bayer announced the launch of its digital agriculture platform, FieldView, in Mexico to enhance farming efficiency and sustainability. Available in 27 countries, this tool allows farmers to collect and analyze real-time data, optimizing crop management and resource use, thus promoting informed decision-making throughout the agricultural cycle.

- In February 2024, Biotor Labs announced the launch of two biopesticides, Trichomax and Klamic, in Mexico to combat soilborne diseases and nematodes. Classified as Low Risk by COFEPRIS, these products feature innovative, chemical-free formulations. They are expected to be registered for wider distribution in Mexico by early 2025, enhancing sustainability in agriculture.

Mexico Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Grains and Cereals, Dairy, Oilseeds, Livestock, Others |

| Applications Covered | Agrichemicals, Seed Business, Breeding, Machinery and Equipment |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico agribusiness market on the basis of product?

- What is the breakup of the Mexico agribusiness market on the basis of application?

- What is the breakup of the Mexico agribusiness market on the basis of region?

- What are the various stages in the value chain of the Mexico agribusiness market?

- What are the key driving factors and challenges in the Mexico agribusiness market?

- What is the structure of the Mexico agribusiness market and who are the key players?

- What is the degree of competition in the Mexico agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)