Mexico Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Mexico Agricultural Equipment Market Overview:

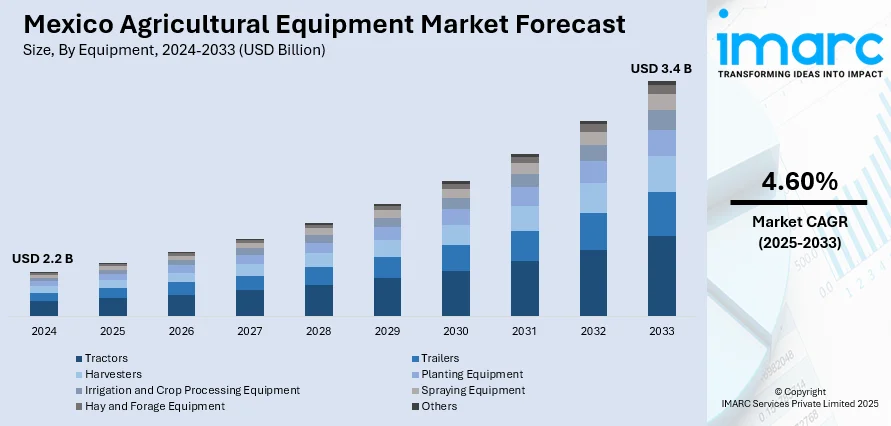

The Mexico agricultural equipment market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The market is driven by increasing mechanization, government support programs, and a rising demand for food due to population growth. Technological advancements and precision farming practices are also encouraging farmers to adopt modern equipment for improved productivity and efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 4.60% |

Mexico Agricultural Equipment Market Trends:

Adoption of Precision Agriculture Technologies

With the rising Mexico agricultural equipment market share the precision agriculture is picking up pace as farmers adopt tools such as global positioning system (GPS)-guided machinery, drones, and sensors to improve farm management. This brings about increased resource utilization with reduced wastage and higher crop yields. Farmers can now focus on specific areas of the field using precision tools, deploying water, fertilizers, and pesticides only where necessary. Artificial intelligence (AI) and data analysis complement decision-making for the best output. Such technologies also encourage sustainability through reduced environmental footprints. As more and more farmers go for precision farming, the market for associated machinery keeps growing, changing the agricultural landscape in Mexico towards more efficient and intelligent practice.

Expansion of Mechanization in Small-Scale and Urban Farming

Mexico's agriculture sector is experiencing an increase in mechanization, not only for large farms but also for small-scale and urban farmers. Small, affordable equipment is assisting smaller farmers in increasing productivity and saving on labor. This change is especially significant in urban settings where access to heavy equipment has been restricted. Small-scale farmers are now able to utilize specialized equipment that addresses their specific needs, improving efficiency and yields. Government support plays a critical role, with nearly 75% of Mexico’s agricultural budget in 2025 allocated to social assistance programs for small-scale farmers. This also includes mechanization subsidies and fertilizer subsidy programs. Training programs are assisting these farmers in procuring modern equipment, thus strengthening the Mexico agricultural equipment market growth. These initiatives are propelling innovation and changing the face of Mexican agriculture, promoting more sustainable and efficient methods of farming.

Shift Towards Sustainable and Energy-Efficient Equipment

Sustainability is a major point of emphasis within Mexico's farm equipment market outlook. Increasing demand for energy-saving equipment, particularly electric and hybrid tractors, is driven by farmers who want to save energy and reduce their carbon footprint. Environmental concern is driving farmers to incorporate climate-wise solutions like drip irrigation systems that help save water and increase crop output. The shift to energy-efficient machinery is in line with national and international sustainability objectives. Government programs and incentives to promote green practices are also helping drive the use of these technologies. This movement is transforming the agricultural industry, pushing it toward a more sustainable and environmentally conscious future.

Mexico Agricultural Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others.

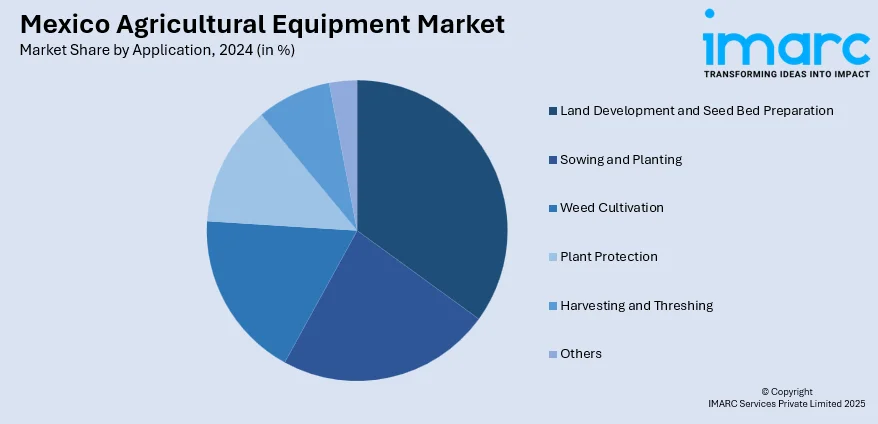

Application Insights:

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Central, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Agricultural Equipment Market News:

- In October 2024, TAFE, a leading global tractor manufacturer, is expanding its reach by opening a subsidiary in Mexico in January 2025 to better serve its growing customer base. Known for its quality and cost-effective products, TAFE offers a range of tractors from 20-110 HP. With a strong global presence, TAFE aims to enhance its market growth, following its successful launch in Europe and its diverse business interests in farm machinery, diesel engines, and more.

- In February 2024, Biotor Labs launched two new biopesticides, Trichomax and Klamic, in Mexico. Trichomax, a biofungicide, and Klamic, a bionematicide, are designed to control soilborne diseases and nematodes in various crops. Both products are certified as Low Risk by COFEPRIS, ensuring their safety for human health and the environment. The products feature innovative formulations and have undergone extensive scientific research, demonstrating high efficacy in field trials.

Mexico Agricultural Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment’s Covered | Tractors, Trailers, Harvesters, Planting Equipment, Irrigation and Crop Processing Equipment, Spraying Equipment, Hay and Forage Equipment, Others |

| Applications Covered | Land Development and Seed Bed Preparation, Sowing and Planting, Weed Cultivation, Plant Protection, Harvesting and Threshing, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico agricultural equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico agricultural equipment market on the basis of equipment?

- What is the breakup of the Mexico agricultural equipment market on the basis of application?

- What is the breakup of the Mexico agricultural equipment market on the basis of region?

- What are the various stages in the value chain of the Mexico agricultural equipment market?

- What are the key driving factors and challenges in the Mexico agricultural equipment market?

- What is the structure of the Mexico agricultural equipment market and who are the key players?

- What is the degree of competition in the Mexico agricultural equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico agricultural equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico agricultural equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico agricultural equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)