Mexico Agrochemicals Market Size, Share, Trends and Forecast by Fertilizer Type, Pesticide Type, Crop Type, and Region, 2025-2033

Mexico Agrochemicals Market Overview:

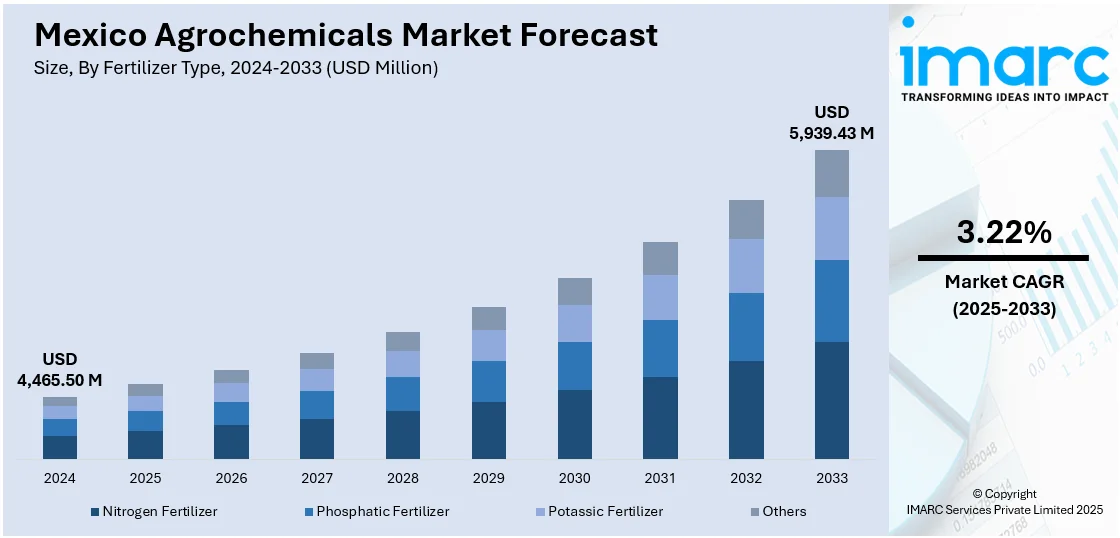

The Mexico agrochemicals market size reached USD 4,465.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,939.43 Million by 2033, exhibiting a growth rate (CAGR) of 3.22% during 2025-2033. The market is driven by rising food demand, expanding agricultural exports, climate change pressures, and government support for productivity. Increasing dependence of farmers on agrochemicals to boost yields, meet export standards, and manage pests and weather-related stress, along with innovation in agrochemical usage nationwide are collectively fueling the Mexico agrochemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,465.50 Million |

| Market Forecast in 2033 | USD 5,939.43 Million |

| Market Growth Rate 2025-2033 | 3.22% |

Mexico Agrochemicals Market Trends:

Rising Food Demand and Population Growth

As Mexico’s population continues to grow, the demand for food increases accordingly. To meet this rising need, farmers must maximize agricultural output without expanding land use. Agrochemicals, such as fertilizers, herbicides, and pesticides, are essential tools to enhance crop productivity, prevent pest-related losses, and ensure consistent yields. These inputs help farmers manage soil fertility and protect crops from diseases and insects, directly contributing to food security. Urbanization and dietary pattern changes have developed significant pressure on agricultural systems, which require more efficient and sustainable farming practices. As a result, the adoption of agrochemical solutions becomes crucial for farmers aiming to balance growing demand with resource constraints, especially in high-consumption crops like maize, beans, and vegetables.

Expansion of Agricultural Export Markets

Mexico is one of the world’s leading exporters of fruits, vegetables, and other agricultural products. According to the Ministry of Agriculture and Rural Development (Sader), as reported by Municipios Puebla, Mexico established itself as a significant exporter of chilies, broccoli, cauliflower, lemon, and cucumber in 2024 due to the rising demand and ongoing efforts of those involved in these production chains. To maintain international competitiveness and meet strict export standards, farmers must produce high-quality crops with minimal defects. Agrochemicals play a vital role in achieving this by protecting crops against pests and diseases and enhancing their appearance and shelf life. Export crops like avocados, tomatoes, and berries require intensive crop management, where precise application of agrochemicals ensures quality and yield. Trade agreements such as the USMCA further incentivize agricultural exports, prompting farmers to invest in better crop protection methods. As demand for Mexican produce grows globally, especially in North America and Europe, so does the need for effective and efficient agrochemical solutions.

Climate Change and Environmental Pressures

Mexico faces increasing climate variability, including droughts, irregular rainfall, and rising temperatures, which drives the Mexico agrochemicals market growth. These environmental challenges make crops more vulnerable to pests, diseases, and reduced productivity. Agrochemicals become essential in mitigating these effects by helping crops withstand biotic and abiotic stress. For example, pesticides can reduce pest outbreaks linked to warmer climates, while fertilizers can restore nutrient-depleted soils after extreme weather. Climate change also accelerates the spread of invasive species, requiring farmers to use more targeted agrochemical strategies. Additionally, the unpredictability of seasons has led to a more intensive use of chemical inputs to stabilize production cycles. This growing need for resilience in farming systems is a significant driver of agrochemical use in the Mexican agriculture sector.

Mexico Agrochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on fertilizer type, pesticide type, and crop type.

Fertilizer Type Insights:

- Nitrogen Fertilizer

- Phosphatic Fertilizer

- Potassic Fertilizer

- Others

The report has provided a detailed breakup and analysis of the market based on the fertilizer type. This includes nitrogen fertilizer, phosphatic fertilizer, potassic fertilizer, and others.

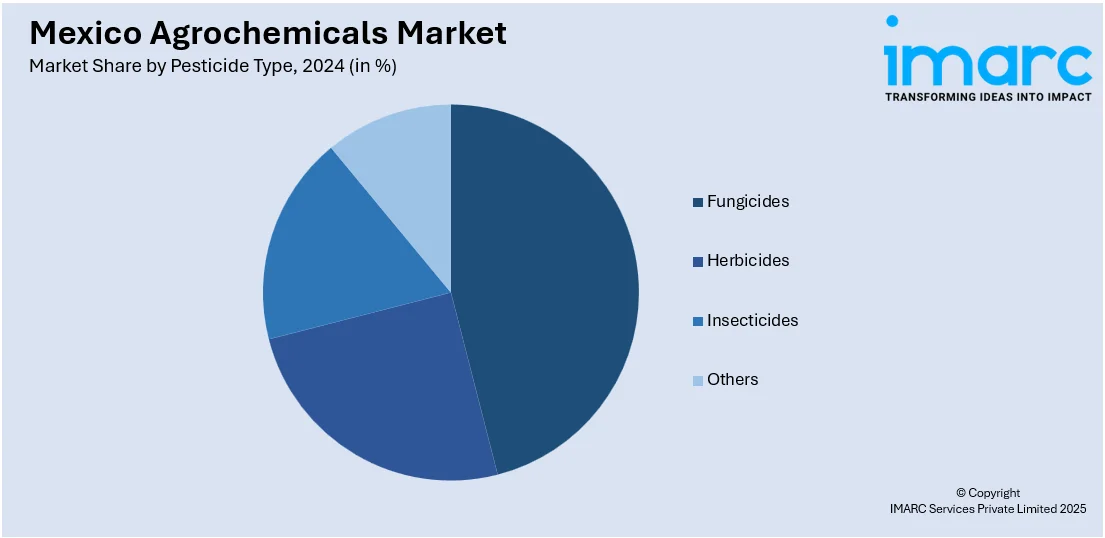

Pesticide Type Insights:

- Fungicides

- Herbicides

- Insecticides

- Others

A detailed breakup and analysis of the market based on the pesticide type have also been provided in the report. This includes fungicides, herbicides, insecticides, and others.

Crop Type Insights:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes cereals and grains, oilseeds and pulses, fruits and vegetables, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Agrochemicals Market News:

- In February 2024, Trichomax and Klamic were introduced in Mexico by Biotor Labs, a Nicaraguan business that specializes in the creation, formulation, and production of bioinsecticides, biofungicides, and bionematicides. These two novel biological products regulate nematodes and soilborne illnesses in a variety of crops.

Mexico Agrochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fertilizer Types Covered | Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, Others |

| Pesticide Types Covered | Fungicides, Herbicides, Insecticides, Others |

| Crop Types Covered | Cereals And Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico agrochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico agrochemicals market on the basis of fertilizer type?

- What is the breakup of the Mexico agrochemicals market on the basis of pesticide type?

- What is the breakup of the Mexico agrochemicals market on the basis of crop type?

- What is the breakup of the Mexico agrochemicals market on the basis of region?

- What are the various stages in the value chain of the Mexico agrochemicals market?

- What are the key driving factors and challenges in the Mexico agrochemicals?

- What is the structure of the Mexico agrochemicals market and who are the key players?

- What is the degree of competition in the Mexico agrochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico agrochemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico agrochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico agrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)