Mexico Air Cargo Market Size, Share, Trends and Forecast by Type, Service, Destination, End User, and Region, 2026-2034

Mexico Air Cargo Market Summary:

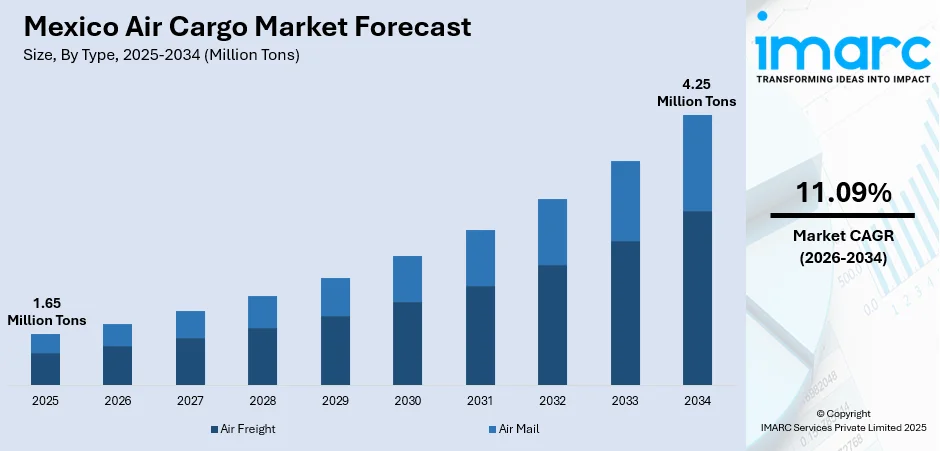

The Mexico air cargo market size reached 1.65 Million Tons in 2025 and is projected to reach 4.25 Million Tons by 2034, growing at a compound annual growth rate of 11.09% from 2026-2034.

The market growth is propelled by accelerating nearshoring initiatives that have positioned Mexico as the United States' largest trading partner since 2023, coupled with surging e-commerce activity and deepening integration within the United States-Mexico-Canada Agreement framework. Strategic airport infrastructure investments, alongside growing demand for time-sensitive freight across automotive, aerospace, pharmaceutical, and electronics manufacturing sectors, continue to strengthen Mexico's role as a critical logistics gateway between North American markets and global supply chains, thereby expanding the Mexico air cargo market share.

Key Takeaways and Insights:

-

By Type: Air freight dominates the market with a share of 86% in 2025, driven by its superior speed and reliability for high-value manufacturing components, just-in-time automotive assemblies, and temperature-sensitive pharmaceutical shipments where delivery precision outweighs cost considerations in nearshored supply chains.

-

By Service: Express leads the market with a share of 62% in 2025, propelled by expanding e-commerce operations requiring guaranteed delivery windows, premium pharmaceutical distribution networks demanding GDP-certified handling, and cross-border component flows in manufacturing that necessitate expedited clearance and time-definite transit commitments.

-

By Destination: International represents the largest segment with a market share of 72% in 2025, reflecting Mexico's export-oriented manufacturing base where 83.3% of shipments flow to the United States, supplemented by growing Asian trade corridors for electronics components and European connections for aerospace assemblies requiring transcontinental speed.

-

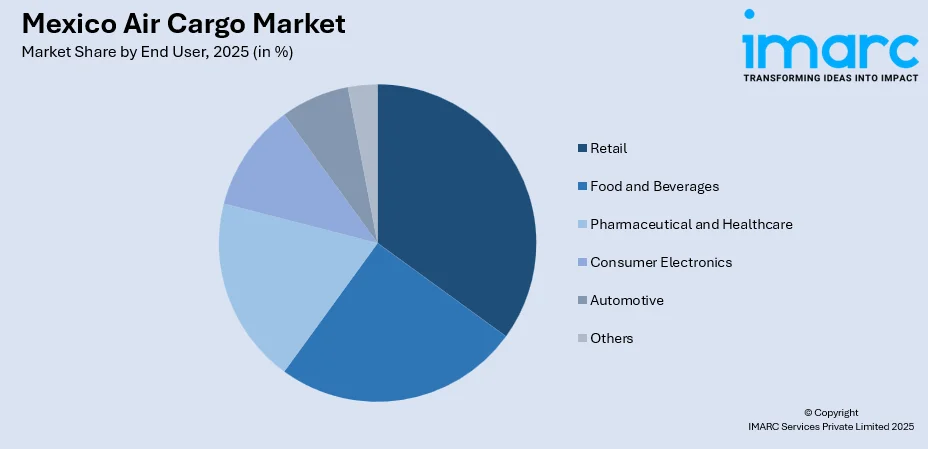

By End User: Retail leads the market with a share of 24% in 2025, supported by digital shopping adoption that pushed e-commerce demand, fueled by fashion platforms, consumer electronics marketplaces, and cross-border fulfillment operations centered in logistics hubs.

-

By Region: Central Mexico represents the largest segment with a market share of 45% in 2025, concentrating operations across Mexico City's dual airport system, collectively processing a major portion of national air freight through proximity to industrial clusters and strategic connectivity to North American trade corridors.

-

Key Players: The Mexico air cargo market exhibits moderate competitive intensity, with multinational integrators commanding freighter operations alongside regional carriers including competing across express delivery, specialized logistics, and belly cargo segments while navigating infrastructure transitions and bilateral aviation policy dynamics.

To get more information on this market Request Sample

Mexico's air cargo sector operates at a pivotal inflection point where structural advantages collide with transitional challenges. The market draws strength from manufacturing nearshoring momentum, with Mexico absorbing production capacity migrating from Asia while leveraging USMCA preferential treatment and geographical proximity to the United States. Total goods trade reaching $839 billion in 2024 underscores aviation's indispensable role in connecting time-sensitive industrial supply chains across automotive assembly corridors in the Bajío region, aerospace clusters in Querétaro and Nuevo León, and electronics manufacturing expanding throughout northern states. Infrastructure modernization efforts, exemplified by Felipe Ángeles International Airport's capacity expansion to accommodate nine simultaneous freighter operations by 2026, signal governmental commitment to scaling throughput capacity. In October 2025, Mexico’s air cargo industry processed 113,642t, reflecting a 1.4% Year-over-Year rise, according to the Federal Civil Aviation Agency (AFAC). Felipe Ángeles International Airport (AIFA) continued to be the largest cargo airport in the country by volume, processing 37,273t in October, which represents 32.6% of the total national air cargo.

Mexico Air Cargo Market Trends:

Acceleration of Digital Transformation and Smart Cargo Infrastructure

Mexican air cargo facilities are transitioning toward intelligent, automated operations as airports implement next-generation logistics technologies to enhance throughput efficiency and supply chain visibility. Felipe Ángeles International Airport's 2025-2030 development plan, announced in October 2025, exemplifies this shift by integrating AI-driven predictive maintenance systems, IoT sensor networks for real-time cargo tracking, and robotic handling equipment. Felipe Ángeles International Airport (AIFA) corridor serves as a central point for data center development. This effort aims to leverage current infrastructure to draw approximately US$9.2 billion in investment within the coming five years, establishing Mexico as a central hub in the regional digital economy. The modernization initiative aligns with IATA's Vision for the Future of Air Cargo Facilities 2025, which identifies intelligent analytics, robotics, and digital process automation as critical pillars for competitive advantage. This technological convergence reduces manual intervention, accelerates customs clearance, minimizes cargo dwell times, and provides shippers with unprecedented shipment transparency, positioning digitally advanced facilities to capture market share in increasingly time-sensitive and compliance-intensive global supply chains.

E-commerce Expansion Reshaping Air Freight Demand Patterns

Digital retail proliferation is fundamentally altering cargo composition and service requirements across Mexican aviation infrastructure, with e-commerce platforms driving express air freight adoption and reshaping airport traffic patterns. The e-commerce surge elevated demand for small-parcel express services, with the courier, express, and parcel segment generating 36.44% of total market demand in 2024, predominantly driven by fashion, electronics, and household goods categories. Express services are projected to advance, outpacing traditional freight growth rates. Despite short-term regulatory headwinds, structural e-commerce demand continues propelling investments in temperature-controlled facilities, last-mile integration, and specialized handling capabilities essential for serving digital retail's evolving requirements. IMARC Group predicts that the Mexico e-commerce market is predicted to reach USD 175.8 Billion by 2034.

Nearshoring Momentum Driving Manufacturing-Related Air Freight Growth

Global supply chain reconfiguration is channeling manufacturing activity toward Mexico, generating sustained air freight demand for components, assemblies, and finished goods across automotive, aerospace, electronics, and medical device sectors. Mexico surpassed China as the United States' largest trading partner in 2023, a watershed transition reflecting geopolitical tensions and supply chain resilience strategies that favor proximate production locations. Bilateral goods trade increased, with manufacturing goods accounting for a major portion of Mexico's exports in the first half of 2025. This manufacturing concentration generates substantial air cargo flows for time-sensitive components requiring just-in-time delivery protocols, particularly in automotive supply chains spanning the Bajío region and aerospace clusters in Querétaro producing parts for North American and European assembly lines. The air-cargo market in Mexico is expected to experience double-digit growth in the next ten years, fueled by near-shoring and e-commerce.

Market Outlook 2026-2034:

The Mexico air cargo market is positioned for substantial expansion as nearshoring initiatives, e-commerce proliferation, and strategic infrastructure investments converge to reshape the country's logistics landscape. The market size was estimated at 1.65 Million Tons in 2025 and is expected to reach 4.25 Million Tons by 2034, reflecting a compound annual growth rate of 11.09% over the forecast period 2026-2034. Regional airports including Guadalajara, Querétaro, and Monterrey continue strengthening their positions as manufacturing and e-commerce logistics gateways, collectively processing increasing proportions of national freight. The market growth reflects structural advantages in geographical proximity, trade agreement frameworks, and manufacturing competitiveness, positioning Mexico as an essential air cargo gateway connecting North American markets with global supply chains throughout the forecast period.

Mexico Air Cargo Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Air Freight | 86% |

| Service | Express | 62% |

| Destination | International | 72% |

| End User | Retail | 24% |

| Region | Central Mexico | 45% |

Type Insights:

- Air Freight

- Air Mail

Air freight dominates with a market share of 86% of the total Mexico air cargo market in 2025.

The air freight segment commands overwhelming market dominance, propelled by Mexico's manufacturing-intensive export economy where production timelines demand rapid component delivery and finished goods distribution. Freighter operations, dominated by multinational integrators, provide dedicated maindeck capacity essential for automotive just-in-time assemblies, aerospace precision components, pharmaceutical cold-chain shipments, and electronics requiring controlled handling environments. More than two-thirds of transborder tonnage between the United States and Mexico moves via maindeck freighters, reflecting the segment's critical role in supporting manufacturing supply chains where delivery speed justifies premium pricing over surface alternatives.

Felipe Ángeles International Airport's expansion to accommodate nine simultaneous freighter operations by 2026, including heavy models like the Boeing 747-8F, demonstrates infrastructure investments targeting this segment's capacity requirements. Manufacturing nearshoring momentum, which elevated Mexico to the United States' largest trading partner, generates sustained demand for dedicated freight capacity connecting industrial corridors in Querétaro, Guadalajara, and Monterrey with North American distribution networks. The segment benefits from growing cargo charter activity, particularly supporting automotive manufacturing operations, alongside scheduled freighter services that provide predictable capacity for shippers managing complex multi-node supply chains requiring precise transit timing.

Service Insights:

- Express

- Regular

Express leads with a share of 62% of the total Mexico air cargo market in 2025.

Express services dominate the Mexico air cargo landscape, capturing market leadership through specialized capabilities addressing time-critical shipments that justify premium pricing for guaranteed delivery windows and enhanced tracking visibility. The segment's growth trajectory, significantly outpaces regular freight expansion, reflecting structural demand shifts toward faster fulfillment requirements. E-commerce proliferation drives substantial express volumes, with digital retail constituting a major portion of courier, express, and parcel market demand in 2024, as fashion platforms, electronics marketplaces, and cross-border fulfilment operations centered in logistics hubs like Querétaro require next-day and two-day delivery guarantees.

Manufacturing supply chains generate additional express demand through cross-border component flows requiring guaranteed transit times to maintain just-in-time assembly schedules, particularly in automotive and aerospace sectors where production delays impose substantial financial penalties. The segment benefits from integrator network investments in Mexican hub facilities, which expand capacity and enhance connectivity to support rising cross-border demand driven by nearshoring and digital commerce trends. In 2025, Lufthansa Cargo's time-critical logistics firm time:matters is broadening its global network by launching courier terminals at Mexico City International Airport (MEX) and Felipe Ángeles International Airport (NLU). In collaboration with Lufthansa Cargo Servicios Logísticos de México (LCSLM), the newly established facilities will focus on sectors like automotive, semiconductors, and life sciences, managing spare and service parts, medical devices, high-value items, and hazardous substances.

Destination Insights:

- Domestic

- International

International exhibits a clear dominance with a 72% share of the total Mexico air cargo market in 2025.

The international segment dominates Mexico's air cargo market, occupying a major part the country's manufacturing-intensive export economy generates substantial cross-border freight flows connecting industrial production with North American distribution networks and global supply chains. Mexico's ascension to the United States' largest trading partner in 2023, handling in bilateral goods trade during 2024, underscores aviation's critical role in facilitating time-sensitive international commerce across automotive assemblies, aerospace components, pharmaceutical products, and electronics requiring rapid transcontinental transit. The segment exhibited robust activity with international cargo increasing, despite experiencing year-to-date pressures from regulatory adjustments and capacity reallocations.

Regional airports like Guadalajara recorded exceptional performance, reinforcing their strategic importance as manufacturing and logistics gateways. Asian trade corridors handle electronics components and consumer goods flows, with a significant portion of southbound US-Mexico air cargo originating from Asian origins like China before transiting through US gateways including Anchorage, Los Angeles, and Chicago. Aeroméxico Cargo's 2025 partnership with Uzbekistan-based My Freighter, extending cargo connections between Mexico and Central Asia through hubs like Tashkent, exemplifies network expansion strategies capturing emerging international routes. The segment benefits from USMCA preferential frameworks facilitating cross-border trade, alongside expanding pharmaceutical exports requiring cold-chain handling and aerospace shipments demanding specialized packaging for high-value precision components.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Food and Beverages

- Pharmaceutical and Healthcare

- Consumer Electronics

- Automotive

- Others

Retail leads with a share of 24% of the total Mexico air cargo market in 2025.

The Retail segment captures significant market share, propelled by digital commerce proliferation and evolving consumer expectations for rapid product delivery across fashion, electronics, home goods, and specialty categories. E-commerce constituted a major part of Mexico's courier, express, and parcel market demand in 2024, with fashion and gadgets driving high-frequency shipments requiring guaranteed delivery windows to maintain competitive positioning in crowded digital marketplaces. Mexico's e-commerce sector is innovating with platforms announcing investment plans targeting further expansion throughout 2025.

This growth concentrated activity at strategic logistics nodes, particularly Querétaro, which emerged as the domestic hub, recording an increase in domestic air cargo during early 2025 as fulfilment centers leveraged aviation connectivity to serve national markets with next-day and two-day delivery guarantees. Cross-border e-commerce flows generate substantial international air cargo demand, particularly serving Mexican consumers purchasing from United States and Asian retailers requiring customs clearance and last-mile delivery coordination. Social commerce platforms experienced accelerated adoption, with over half of shoppers in Mexico, Brazil, and Colombia utilizing social media-integrated purchasing channels by 2025, creating additional demand for small-parcel express air services.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico exhibits a clear dominance with a 45% share of the total Mexico air cargo market in 2025.

Central Mexico commands market leadership, leveraging strategic geographic positioning, dense manufacturing concentration, and superior aviation infrastructure to process approximately 90% of national air freight through its interconnected airport network. Mexico City's dual airport system comprising Mexico City International Airport (AICM) and Felipe Ángeles International Airport (AIFA) forms the region's cargo backbone. AICM exhibited recovery momentum, handling 22,606 tons in October 2025 with 3.0% year-over-year growth and 4.8% gains during the first ten months, as the facility's proximity to metropolitan distribution networks and established ground handling infrastructure offset operational constraints from slot restrictions.

Guadalajara International Airport demonstrated exceptional performance, recording a year-over-year international freight expansion reinforcing its role as a high-value manufacturing and logistics gateway serving electronics, aerospace, and automotive industries concentrated in Jalisco. Querétaro emerged as the domestic cargo leader, leveraging its position as the aerospace logistics nexus and e-commerce fulfillment hub for Amazon and Mercado Libre operations. The region benefits from manufacturing clusters spanning the Bajío industrial corridor, proximity to metropolitan consumer markets generating e-commerce demand, and strategic connectivity to North American trade routes essential for supporting cross-border component flows and finished goods distribution.

Market Dynamics:

Growth Drivers:

Why is the Mexico Air Cargo Market Growing?

Strengthening Air Cargo Infrastructure and Airport Capacity

Mexico has been investing in airport upgrades and cargo handling facilities to support rising freight volumes. Dedicated cargo terminals, improved warehousing, and better cold chain capabilities at airports like Mexico City, Guadalajara, Monterrey, and Querétaro are improving operational efficiency. The opening of Felipe Ángeles International Airport has added cargo focused capacity, easing congestion at older hubs. These improvements reduce dwell time, support larger freighter aircraft, and attract global cargo carriers. Better infrastructure enables Mexico to handle higher throughput, support specialized cargo, and position itself as a regional logistics hub linking North America, Latin America, and transpacific trade lanes. Several state governments in Mexico, along with Aeropuertos y Servicios Auxiliares (ASA), are allowing for the construction of five new airport terminals, which will benefit the movement of citizens more efficiently through these routes. The construction project plans to build five new air terminals, distributed across Guanajuato, Jalisco, Baja California, and Quintana Roo. As per the statements of ASA CEO, two of these terminals will be located in the San Miguel de Allende and Ensenada areas.

Growth in Aerospace and High-Value Industrial Exports

Mexico’s aerospace sector is expanding rapidly, with clusters in Querétaro, Baja California, and Chihuahua supplying components to global aircraft manufacturers. Aerospace parts are high value, time critical, and often customized, making air cargo essential. Similar demand comes from advanced electronics, precision machinery, and automotive components where delays can disrupt production schedules. These sectors require secure handling, traceability, and rapid transport across borders. As Mexico moves up the value chain from basic assembly to advanced manufacturing, the share of exports suited to air freight continues to rise, supporting steady growth in air cargo volumes. The national aerospace sector is anticipated to rise from US$2.65 billion in 2023 to US$3 billion by 2030, representing a 14.7% growth compared to 2025 estimates, based on predictions from the Mexican-German Chamber of Commerce and Industry (CAMEXA).

Rising Trade Integration with the US and Latin America

Mexico’s trade agreements and geographic position support growing air cargo flows within the Americas. Strong economic ties with the US drive frequent cross border shipments, particularly for industrial inputs and finished goods. At the same time, Mexico is increasing air trade links with Central and South America for pharmaceuticals, consumer goods, and industrial supplies. Air cargo offers speed and reliability across these routes, especially where ground or sea transport is slower or less predictable. Increased regional connectivity, combined with expanding freighter services and belly cargo capacity, continues to strengthen Mexico’s role in regional air logistics networks. In 2025, Tamaulipas Gov. Américo Villarreal Anaya inaugurated operations at the Puerto del Norte in Matamoros. The port was non-operational for 24 years and is the first major port to open in Mexico in two decades. The opening of new ports is further strengthening trade operations in the country.

Market Restraints:

What Challenges the Mexico Air Cargo Market is Facing?

Infrastructure Constraints and Airport Capacity Limitations

Mexican air cargo expansion confronts persistent infrastructure bottlenecks as airport facilities, ground handling capabilities, and multimodal connectivity struggle to match surging demand driven by nearshoring and e-commerce growth. The forced relocation of dedicated freighter operations from Mexico City International Airport to Felipe Ángeles International Airport, located 35 kilometers north of the capital, created operational disruptions as carriers adapted to the newer facility's less mature ground handling infrastructure and customs processing systems. Adoption remained slow through early 2025 due to slot allocation complexities, customs operations maturity gaps, and ground-handling infrastructure deficiencies. Access challenges compounded adoption barriers, as the government suspended a shuttle service connecting AICM and AIFA in February 2025 after struggling with low ridership and operational costs, leaving shippers and forwarders dependent on private transportation alternatives adding time and expense to cargo movements.

Regulatory Disruptions and Trade Policy Uncertainties

Air cargo operations face mounting regulatory headwinds as policy adjustments regarding de minimis exemptions, customs requirements, and bilateral aviation agreements introduce volatility into operational planning and commercial viability assessments. Mexico's termination of its de minimis import exemption in 2025 fundamentally altered cross-border e-commerce economics, requiring comprehensive customs documentation for previously exempted low-value shipments and making business models employed by fast-fashion platforms. Tariff concerns contributed to airfreight volume declines, with shippers front-loading goods to avoid anticipated cost increases, creating temporary demand surges followed by ordering slowdowns as inventory positions normalized.

Bilateral Aviation Disputes and Diplomatic Tensions

Escalating aviation policy disagreements between Mexican and United States authorities threaten established cargo operations and future route development, introducing diplomatic risks that compound commercial uncertainties facing air cargo operators. The United States Department of Transportation suspended 13 current and planned routes to Felipe Ángeles International Airport in October 2025. This suspension directly impacts both passenger and cargo services, preventing route expansions planned by carriers. These diplomatic disputes create operational uncertainties as carriers postpone Mexican capacity expansion pending dispute resolution, while existing operations face potential disruptions if bilateral negotiations fail to produce mutually acceptable compromises addressing United States concerns regarding competitive access and operational transparency while accommodating Mexican infrastructure development objectives at AIFA.

Competitive Landscape:

The Mexico air cargo market exhibits moderate competitive intensity characterized by a bifurcated structure where multinational integrators command freighter operations and premium express services while regional carriers leverage established networks and government relationships to maintain market presence. International operators including FedEx, UPS, and DHL dominate dedicated freighter activities through extensive aircraft fleets, sophisticated ground handling networks, and comprehensive customs brokerage capabilities enabling time-definite delivery guarantees across North American and global routes. These integrators benefit from economies of scale, advanced information technology platforms providing real-time shipment tracking, and established customer relationships with multinational manufacturers requiring integrated logistics solutions. Regional carriers compete through belly-hold capacity on passenger routes, specialized handling capabilities for regional manufacturing clusters, and established relationships with Mexican shippers preferring domestically-owned logistics providers.

Recent Developments:

-

In June 2025, AeroUnion, a Mexican airline owned by Avianca Cargo, has revealed a new brand, Avianca Cargo Mexico, aimed at linking Mexico and the US West Coast to international airfreight centers. The new brand seeks to enhance AeroUnion and Avianca Cargo's route network and cater to essential sectors, such as technology, automotive, pharmaceuticals, medical devices, personal care, and perishables. Two Airbus A330-300 passenger-to-freighter (P2F) aircraft operated by AeroUnion will provide capacity, with the second one arriving in Mexico on June 20. This freighter, with a capacity exceeding 60 tons, will facilitate the transport of large and temperature-sensitive cargo.

-

In May 2025, Revenue Technology Services (RTS), a provider of consulting and software solutions aimed at profit optimization for the travel and transportation sector, announced that Aeromexico Cargo, the national flag carrier of Mexico, has partnered with RTS to adopt best practices in Revenue Management. RTS assisted Aeromexico Cargo in creating a strategy for implementing revenue management (RM) systems and processes following a comprehensive readiness evaluation. RTS professionals and subject matter specialists carried out this study in 2024, involving onsite meetings, demonstrations of key RM methods, data analysis, training, and hands-on activities related to RM concepts.

Mexico Air Cargo Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Freight, Air Mail |

| Services Covered | Express, Mail |

| Destinations Covered | Domestic, International |

| End Users Covered | Retail, Food and Beverages, Pharmaceutical and Healthcare, Consumer Electronics, Automotive, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico air cargo market size reached 1.65 Million Tons in 2025.

The Mexico air cargo market is expected to grow at a compound annual growth rate of 11.09% from 2026-2034 to reach 4.25 Million Tons by 2034.

Air freight dominated with 86% market share, driven by its unmatched speed and reliability for transporting high-value, time-sensitive cargo across Mexico's export-oriented manufacturing base. Express services lead the service segment, propelled by expanding e-commerce operations and premium pharmaceutical distribution requirements. The international destination segment represents robust market activity, reflecting Mexico's export-oriented manufacturing economy.

Key factors driving the Mexico air cargo market include nearshoring and manufacturing relocation that positioned Mexico as the United States' largest trading partner handling bilateral goods trade during 2024, e-commerce expansion with digital retail creating express delivery demand, and strategic location combined with USMCA trade agreement advantages providing preferential market access and proximity enabling overnight delivery to major US metropolitan areas.

Major challenges include infrastructure constraints as the forced relocation of freighter operations from AICM to AIFA created adoption barriers with the newer facility recording a cargo volume collapse in early 2025, regulatory disruptions from Mexico's May 2025 termination of de minimis import exemptions precipitating a cargo capacity drop alongside the US suspension causing an collapse in postal traffic, and bilateral aviation disputes with the US suspending 13 routes to AIFA in October 2025 while threatening to terminate the Delta-Aeroméxico joint venture potentially impacting economic activity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)