Mexico Air Conditioning Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Mexico Air Conditioning Market Summary:

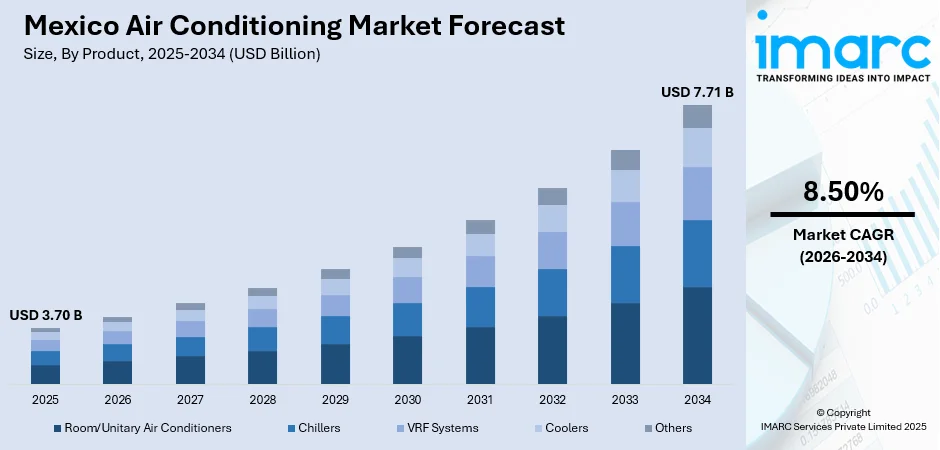

The Mexico air conditioning market size was valued at USD 3.70 Billion in 2025 and is projected to reach USD 7.71 Billion by 2034, growing at a compound annual growth rate of 8.50% from 2026-2034.

The Mexico air conditioning market is experiencing robust expansion driven by escalating temperatures, rapid urbanization, and growing middle-class purchasing power. Rising demand for energy-efficient and smart heating, ventilation, and air conditioning (HVAC) solutions is reshaping consumer preferences across residential and commercial segments. Government initiatives aimed at promoting energy efficiency standards and sustainable cooling technologies are accelerating market transformation. Technological innovations, including Internet of Things (IoT) integration, inverter technology, and variable refrigerant flow systems, are enhancing product capabilities and driving Mexico air conditioning market share growth across diverse application sectors.

Key Takeaways and Insights:

-

By Product: Room/unitary air conditioners dominate the market with a share of 48% in 2025, owing to their affordability, ease of installation, and widespread applicability in residential settings. Rising household incomes and expanding urban housing developments continue to propel demand for these accessible cooling solutions.

-

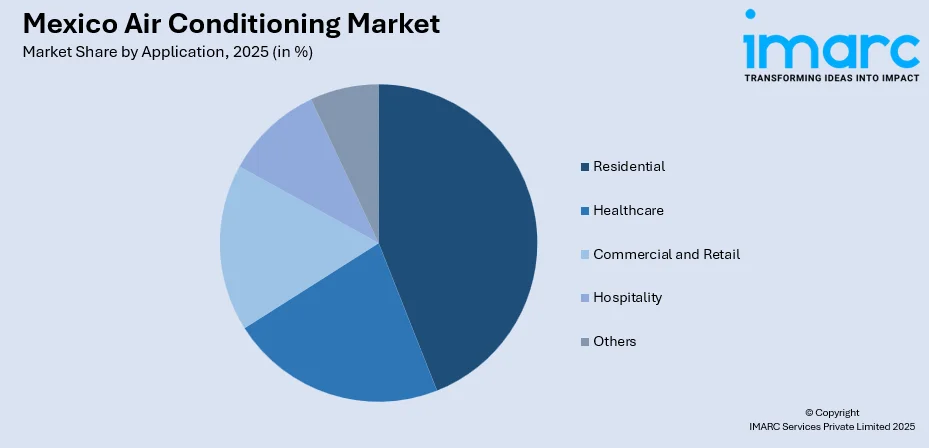

By Application: Residential leads the market with a share of 44% in 2025, This dominance is driven by increasing homeownership rates, rising temperatures across Mexican regions, and growing consumer awareness about energy-efficient cooling options for household comfort enhancement.

-

By Region: Northern Mexico comprises the largest region with 39% share in 2025, driven by extreme climatic conditions, industrial concentration in Monterrey and Tijuana, and expanding commercial infrastructure requiring robust climate control solutions.

-

Key Players: Major players drive the Mexico air conditioning market by expanding manufacturing capabilities, investing in energy-efficient technologies, enhancing distribution networks, and creating alliances to strengthen market visibility and advance sustainable cooling solutions across residential and commercial sectors.

To get more information on this market Request Sample

The Mexico air conditioning market is advancing, as manufacturers expand local production capabilities and consumers increasingly prioritize energy-efficient cooling solutions. The market is characterized by intensifying competition among global manufacturers establishing regional manufacturing hubs to address growing demand. Additionally, rising temperatures due to climate change are creating urgent demand for cooling solutions. In June 2024, Mexico experienced its highest temperature on record during a heatwave that resulted in at least 125 fatalities during the year. Besides this, smart home integration and IoT-enabled climate control systems are gaining traction, as Mexican consumers embrace digital technologies for enhanced comfort and energy management, supporting sustained market growth. Furthermore, government initiatives promoting energy-efficient appliances and stringent efficiency standards are encouraging faster replacement of older air conditioning units. Growing urbanization and residential construction activities are also expanding the installed base of cooling systems across both housing and commercial segments.

Mexico Air Conditioning Market Trends:

Integration of Smart and IoT-Connected Air Conditioning Systems

Smart and connected air conditioning systems are transforming climate control across Mexican homes and commercial establishments. Consumers are increasingly installing systems that integrate with smartphones, smart speakers, and home automation platforms for remote temperature control, usage monitoring, and energy-saving automation. In June 2025, Samsung's Mexico City showroom featured artificial intelligence (AI)-driven, energy-saving air conditioners with SmartThings integration, offering up to 30% energy savings while redefining comfort and sustainability standards in the Mexican market.

Rising Adoption of Energy-Efficient Inverter Technology

Inverter technology adoption is accelerating across residential and commercial segments, as consumers seek solutions that reduce electricity consumption and operational costs. Unlike conventional fixed-speed compressors, inverter systems adjust motor speeds dynamically to maintain desired temperatures with significantly lower energy usage. Mexico's National Commission for the Efficient Use of Energy announced new draft standard in September 2024, establishing minimum seasonal energy efficiency ratios (SEER) for variable refrigerant flow air conditioners, reinforcing the regulatory push towards energy-saving technologies.

Expansion of Variable Refrigerant Flow Systems in Commercial Applications

Variable refrigerant flow systems are gaining significant traction in commercial and large-scale applications due to their superior zoning capabilities, energy efficiency, and installation flexibility. These systems enable independent climate control across multiple zones from a single outdoor unit, making them ideal for office complexes, hotels, hospitals, and retail establishments. Growing commercial real estate activities across major Mexican cities, including mixed-use developments and hospitality projects, are driving increased adoption of variable refrigerant flow (VRF) technology as building owners prioritize operational efficiency and occupant comfort. As per IMARC Group, the Mexico commercial real estate market is set to attain USD 8.51 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033.

Market Outlook 2026-2034:

The Mexico air conditioning market outlook remains highly positive as economic growth, urbanization trends, and climate factors converge to sustain strong demand trajectories. Ongoing investments in manufacturing infrastructure by global players are strengthening local supply chains and improving product accessibility. The market generated a revenue of USD 3.70 Billion in 2025 and is projected to reach a revenue of USD 7.71 Billion by 2034, growing at a compound annual growth rate of 8.50% from 2026-2034. Rising consumer preferences for eco-friendly refrigerants, smart connectivity features, and premium comfort solutions will continue to shape product development priorities across the forecast period.

Mexico Air Conditioning Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Room/Unitary Air Conditioners |

48% |

|

Application |

Residential |

44% |

|

Region |

Northern Mexico |

39% |

Product Insights:

- Room/Unitary Air Conditioners

- Chillers

- VRF Systems

- Coolers

- Others

Room/unitary air conditioners dominate with a market share of 48% of the total Mexico air conditioning market in 2025.

Room/unitary air conditioning systems maintain dominant market positioning due to their accessibility, straightforward installation requirements, and suitability for diverse residential and small commercial applications. These units offer consumers cost-effective cooling solutions without requiring extensive infrastructure modifications, making them particularly attractive for existing buildings and retrofit applications.

Rising household formation rates and expanding middle-class homeownership across Mexican urban centers continue driving sustained demand for these versatile cooling products. In April 2025, the federal government revealed plans to construct 1.1 Million new homes throughout Mexico over this six-year government term (2024-30), raising its target by 100,000 residences. Technological advancements are enhancing product capabilities across the room and unitary segment, with manufacturers integrating energy-efficient inverter compressors, smart connectivity features, and improved refrigerants.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Healthcare

- Commercial and Retail

- Hospitality

- Others

Residential leads with a share of 44% of the total Mexico air conditioning market in 2025.

The residential segment commands substantial market share, as Mexican households increasingly prioritize indoor comfort amid rising temperatures and improving economic conditions. Expanding urban housing developments, increasing household incomes, and growing awareness about air quality benefits are driving installation rates across single-family homes, apartments, and condominiums. INEGI reported that in Mexico, the average monthly income per household in 2024 was MXD 25,955, reflecting a 10.6% real rise from 2022. The proliferation of affordable financing options and government programs supporting energy-efficient appliances further facilitates residential adoption across diverse income segments.

Smart home integration is gaining momentum within the residential segment, as homeowners embrace IoT-enabled systems offering remote control, automated scheduling, and energy monitoring capabilities. These features allow users to optimize cooling usage, reduce electricity bills, and enhance overall convenience. Frequent heatwaves and prolonged warm seasons increase the need for reliable home cooling solutions. Replacement demand from aging air conditioning units also supports steady sales. Additionally, preference for compact, easy-to-install systems makes residential applications more widespread than commercial or industrial use, strengthening their market dominance.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Northern Mexico exhibits a clear dominance with a 39% share of the total Mexico air conditioning market in 2025.

Northern Mexico's commanding market position reflects the convergence of extreme climatic conditions, industrial concentration, and commercial infrastructure expansion across states, including Nuevo León, Baja California, and Chihuahua. The region experiences consistently high temperatures, creating essential demand for reliable cooling solutions across residential, commercial, and industrial applications. Manufacturing hub development, particularly driven by nearshoring trends, continues to attract significant investments requiring sophisticated climate control infrastructure.

High population concentration in cities supports widespread adoption of split and window air conditioners. The region also benefits from better access to retail channels, aftersales services, and trained installers. Greater awareness about environment-friendly and energy-efficient cooling solutions further accelerates purchases, reinforcing Northern Mexico’s leading position in the national air conditioning market. In January 2024, LG Electronics inaugurated a new scroll compressor production line at its factory in Monterrey, Mexico. The facility produced Gen 3 Scroll Compressors utilizing low GWP refrigerants with GWPs less than 700, strengthening LG's ability to service the market with eco-conscious HVAC solutions.

Market Dynamics:

Growth Drivers:

Why is the Mexico Air Conditioning Market Growing?

Expansion of Distribution Networks and After-Sales Services

The expansion of distribution channels and after-sales service networks is another important factor driving the Mexico air conditioning market. Strong presence of multi-brand retail stores, e-commerce platforms, and regional dealers improves product availability nationwide. As per IMACR Group, the Mexico e-commerce market size reached USD 54.4 Billion in 2025. Efficient logistics ensure timely delivery even in semi-urban areas. Equally important is the growth of installation, repair, and maintenance services, which reduces operational concerns for buyers. Reliable after-sales support enhances customer trust and encourages repeat purchases. Availability of spare parts and trained technicians increases product lifespan and satisfaction. As brands invest in stronger distribution and service infrastructure, consumers experience smoother ownership cycles. This improved market ecosystem supports higher adoption rates and long-term growth of the air conditioning market in Mexico.

Rising Temperatures and Climate Variability

Increasing temperatures and changing climate patterns are major drivers of the Mexico air conditioning market. Longer summers and frequent heatwaves are encouraging households and businesses to adopt reliable cooling solutions for thermal comfort and health protection. Higher nighttime temperatures also increase continuous air conditioner usage rather than seasonal operation. Vulnerable populations, including children and the elderly, rely heavily on indoor cooling to avoid heat-related illnesses. As temperature extremes become more common, air conditioning is shifting from a luxury to a basic necessity in many regions. This trend boosts both first-time installations and replacement demand for higher-capacity systems. Additionally, prolonged heat exposure accelerates wear and tear on existing units, increasing aftermarket sales. The growing need for consistent indoor temperature control across homes, offices, and service establishments continues to strengthen air conditioner penetration nationwide. Climate-driven demand remains one of the most powerful and sustained growth factors for the Mexico air conditioning market.

Technological Advancements and Energy-Efficient Systems

Technological improvements are strongly driving growth in the Mexico air conditioning market. Manufacturers are introducing energy-efficient models that reduce electricity consumption while maintaining high cooling performance. Inverter technology, improved compressors, and advanced heat exchangers enhance efficiency and durability. Smart features, such as programmable settings, remote operation, and performance monitoring, increase consumer interest. Energy-efficient systems help users manage rising electricity costs, encouraging upgrades from older units. Improved refrigerants and better insulation technologies also support compliance with evolving efficiency expectations. These advancements make air conditioning more accessible and cost-effective over the product lifecycle. As awareness about operational savings increases, consumers and businesses increasingly favor modern systems. Continuous innovation improves performance reliability and user convenience, making technological advancement a key catalyst for sustained growth of the market.

Market Restraints:

What Challenges the Mexico Air Conditioning Market is Facing?

High Initial Installation and Equipment Costs

The upfront costs associated with purchasing and installing air conditioning systems remain significant barriers for many Mexican consumers, particularly those in lower-income segments across the country. Premium energy-efficient systems, while offering long-term operational savings, require substantial initial investments that exceed household budgets without adequate financing options or government incentive programs.

Shortage of Qualified Technical Personnel

In Mexico, the air conditioning industry faces persistent challenges in recruiting and retaining qualified technicians capable of properly installing and maintaining sophisticated modern systems. Advanced technologies, including VRF systems, smart connectivity features, and low global warming potential (GWP) refrigerants, require specialized training that existing workforce development programs insufficiently address, creating service quality inconsistencies across markets.

Electrical Grid Infrastructure Limitations

In Mexico, the electrical infrastructure is facing capacity constraints during peak demand periods, particularly during extreme heat events when air conditioning loads surge simultaneously. Grid limitations can result in voltage fluctuations, outages, and service interruptions that compromise cooling system performance and reliability, discouraging adoption in areas with unstable electrical supply.

Competitive Landscape:

The Mexico air conditioning market demonstrates intensifying competition, as global manufacturers expand regional presence through manufacturing investments, distribution network enhancement, and strategic partnerships. Companies are focusing on diversifying product portfolios, improving energy efficiency ratings, and integrating smart connectivity features to differentiate offerings and capture market share. Local manufacturing investments by major players are strengthening supply chain resilience while enabling faster response to regional demand patterns. Competition is increasingly driven by technological innovations, sustainability credentials, and comprehensive service offerings encompassing installation, maintenance, and after-sales support across residential and commercial customer segments.

Recent Developments:

-

In August 2025, Webasto Americas, a worldwide frontrunner in cutting-edge thermal management solutions, appointed PLC Marine World S.A. as its sole Master Distributor for marine air conditioning and sunroof systems across Mexico. This strategic partnership greatly extended Webasto's presence in one of the fastest-growing marine sectors in the Americas, providing improved support, quicker logistics, and direct local access to cutting-edge marine climate technologies.

Mexico Air Conditioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Room/Unitary Air Conditioners, Chillers, VRF Systems, Coolers, Others |

| Applications Covered | Residential, Healthcare, Commercial and Retail, Hospitality, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico air conditioning market size was valued at USD 3.70 Billion in 2025.

The Mexico air conditioning market is expected to grow at a compound annual growth rate of 8.50% from 2026-2034 to reach USD 7.71 Billion by 2034.

Room/unitary air conditioners dominated the market with a share of 48%, driven by their affordability, ease of installation, and widespread applicability across residential and small commercial applications throughout Mexico.

Key factors driving the Mexico air conditioning market include climate change and intensifying extreme heat events, rapid urbanization and middle-class expansion, government energy efficiency standards, rising consumer demand for smart and connected HVAC solutions, and growing commercial construction activities.

Major challenges include high initial equipment and installation costs, shortage of qualified technical personnel, electrical grid infrastructure limitations, regulatory compliance complexity, and economic uncertainties affecting consumer purchasing decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)