Mexico Air Fryer Market Size, Share, Trends and Forecast by Product Type, Technology, Sales Channel, End Use, and Region, 2025-2033

Mexico Air Fryer Market Overview:

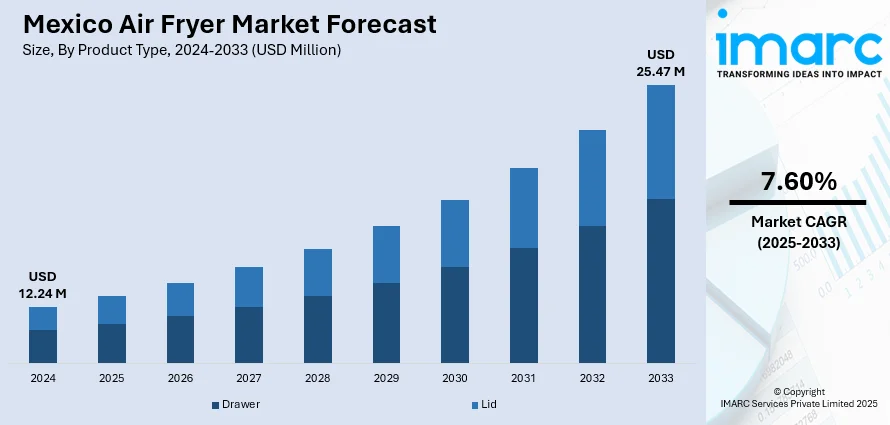

The Mexico air fryer market size reached USD 12.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25.47 Million by 2033, exhibiting a growth rate (CAGR) of 7.60% during 2025-2033. The market is driven by consumers who are opting for air fryers as a healthier option compared to conventional deep-frying, reflecting the growing awareness regarding the need to cut down on oil usage. The functionality of air fryers allowing people to prepare a variety of foods and innovation in smart air fryers, which incorporate digital controls and app connectivity, also adds to the comfort of users, increasing the Mexico air fryer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.24 Million |

| Market Forecast in 2033 | USD 25.47 Million |

| Market Growth Rate 2025-2033 | 7.60% |

Mexico Air Fryer Market Trends:

Rise in Health-Conscious Cooking

In Mexico, an increasing focus on health and wellness is impacting appliance shopping decisions, resulting in the increased popularity of air fryers. According to the IMARC Group, the Mexico health and wellness market size reached USD 52.3 Billion in 2024, and is further expected to reach USD 80.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.58% during 2025-2033. Hence, consumers are increasingly using appliances like air fryers to cook meals with little oil, which is consistent with the global shift toward reduced-fat content in cooking. This allows them to create crispy foods without deep frying and compliments dietary efforts at minimizing calorie consumption. This shift is witnessed in most Mexican homes, where air fryers are now a household favorite among individuals who want healthier food options. Hence, air fryers are a preferred choice among health-oriented consumers nationwide, owing to the ease of use and the added health benefits that come with it, which further accelerates the Mexico air fryer market growth.

Technological Improvements in User Experience

The application of new technologies in air fryers is changing the way Mexicans cook. New air fryers are equipped with digital controls, pre-programmed cooking cycles, and enhanced safety features, making them more convenient and effective. Some units even come with smart features, enabling users to operate the device remotely through mobile apps. These features appeal to the technology-friendly Mexican consumer market, where ease of use and functionality are considered important. Moreover, the ongoing technological advancement of air fryer equipment ensures the devices cater to changing demands and desires of Mexican consumers, enhancing their adoption rates across households nationwide.

Adoption of Space-Saving Designs

Among Mexican urban populations, where kitchens often are smaller in size, the space-efficient and compact sizes of new-generation air fryers prove particularly popular. Manufacturers are reacting to this demand by producing streamlined, compact versions that blend perfectly into tighter kitchens without sacrificing performance. These space-saving designs make air fryers the perfect option for apartment dwellers and those with minimal counter space. The blending of functionality and small size ensures that Mexican consumers can appreciate the advantages of air frying without taking up large kitchen space, thus making these devices a convenient addition to city homes.

Mexico Air Fryer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, technology, sales channel, and end use.

Product Type Insights:

- Drawer

- Lid

The report has provided a detailed breakup and analysis of the market based on the product type. This includes drawer and lid.

Technology Insights:

- Digital

- Manual

A detailed breakup and analysis of the market based on technology has also been provided in the report. This includes digital and manual.

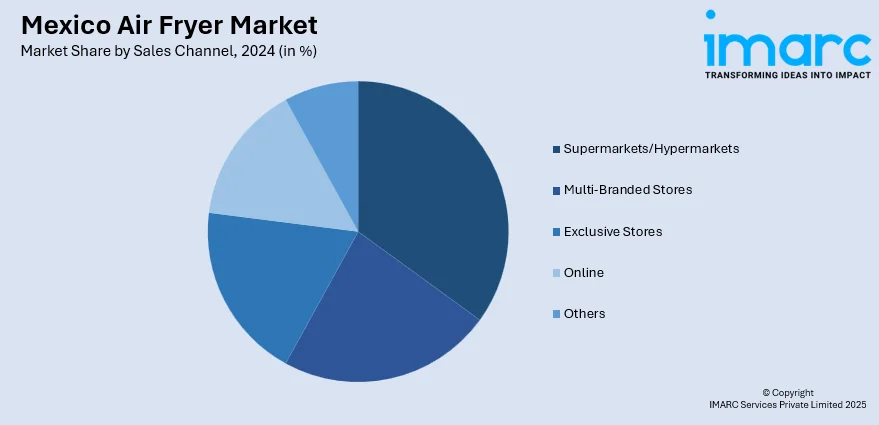

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Multi-Branded Stores

- Exclusive Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel has also been provided in the report. This includes supermarkets/hypermarkets, multi-branded stores, exclusive stores, online, and others.

End Use Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end use. This includes residential and commercial.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Air Fryer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Drawer, Lid |

| Technologies Covered | Digital, Manual |

| Sales Channels Covered | Supermarkets/Hypermarkets, Multi-Branded Stores, Exclusive Stores, Online, Others |

| End Uses Covered | Residential, Commercial |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico air fryer market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico air fryer market on the basis of product type?

- What is the breakup of the Mexico air fryer market on the basis of technology?

- What is the breakup of the Mexico air fryer market on the basis of sales channel?

- What is the breakup of the Mexico air fryer market on the basis of end use?

- What is the breakup of the Mexico air fryer market on the basis of region?

- What are the various stages in the value chain of the Mexico air fryer market?

- What are the key driving factors and challenges in the Mexico air fryer market?

- What is the structure of the Mexico air fryer market and who are the key players?

- What is the degree of competition in the Mexico air fryer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico air fryer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico air fryer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico air fryer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)