Mexico Airborne ISR Market Size, Share, Trends and Forecast by Platform, System, Type, Fuel Type, Application, and Region, 2025-2033

Mexico Airborne ISR Market Overview:

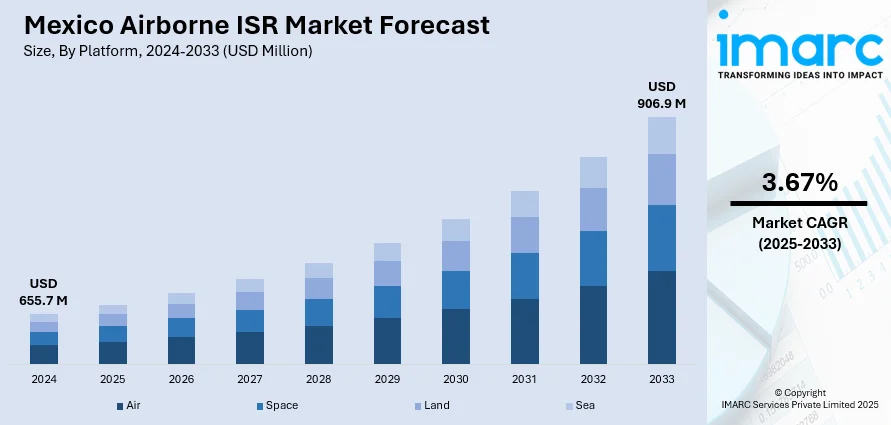

The Mexico airborne ISR market size reached USD 655.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 906.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033. Rising drug trafficking surveillance, growing defense modernization, increasing cross-border security concerns, demand for real-time intelligence, enhanced situational awareness needs, and government investments in UAVs and manned aircraft systems for intelligence, surveillance, and reconnaissance operations are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 655.7 Million |

| Market Forecast in 2033 | USD 906.9 Million |

| Market Growth Rate 2025-2033 | 3.67% |

Mexico Airborne ISR Market Trends:

Enhanced Multispectral Imaging for Airborne ISR Operations

Mexico is experiencing substantial growth as a result of the implementation of modern multi-spectral imaging systems, which considerably improve aerial intelligence, surveillance, and reconnaissance (ISR) missions. These systems, which provide high-resolution photography across many spectrums, are proving critical for a variety of operations, including search and rescue, marine patrol, and border security. These technologies, which can work well in both day and night circumstances, provide improved situational awareness and mission efficacy. As more governments and organizations incorporate these systems into their military and surveillance operations, their role in bolstering security efforts and monitoring large regions, such as borders and coasts, becomes more important. The utilization of these sophisticated imaging systems is helping to improve ISR capabilities throughout the world. For example, in November 2024, Teledyne FLIR Defense announced the first international sale of its UltraFORCE 380X-HDc multi-spectral imaging systems to NL EASP AIR, with the technology to be used on its Dornier DO328-110 aircraft. The system’s advanced imaging capabilities are expected to support search and rescue, maritime patrol, and ISR missions, potentially benefiting Mexico's defense and maritime operations.

Increased Airborne ISR Usage for Border Control

The growing requirement for stronger border security has resulted in a considerable increase in the use of aerial ISR devices. With rising worries about drug cartels and illegal migration, military operations are relying more on ISR equipment to monitor and control the border. This trend is being driven by increased troop deployment and the strategic necessity of aerial surveillance in discovering illegal activity. As these activities grow, conversations are underway to improve collaboration with local governments and ensure effective and transparent surveillance methods. The integration of modern ISR capabilities is expected to play a critical role in border security, reflecting a larger focus on high-tech solutions for national security. For instance, in February 2025, the U.S. military intensified surveillance along the Mexico border, with around 5,000 soldiers deployed. Airborne ISR is a key component of the operation, targeting drug cartels and illegal migration. These efforts, which may expand further, align with the U.S. president's push for increased border control. The U.S. military's presence also aims to monitor cartel activities, with discussions about further coordination and transparency with the Mexican government.

Mexico Airborne ISR Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on platform, system, type, fuel type, and application.

Platform Insights:

- Air

- Space

- Land

- Sea

The report has provided a detailed breakup and analysis of the market based on the platform. This includes air, space, land, and sea.

System Insights:

- Maritime Patrol

- Electronic Warfare

- Airborne Early Warning and Control (AEWC)

- Airborne Ground Surveillance (AGS)

- Signals Intelligence (SIGINT)

A detailed breakup and analysis of the market based on the system have also been provided in the report. This includes maritime patrol, electronic warfare, airborne early warning and control (AEWC), airborne ground surveillance (AGS), and signals intelligence (SIGINT).

Type Insights:

- Surveillance

- Reconnaissance

- Intelligence

The report has provided a detailed breakup and analysis of the market based on the type. This includes surveillance, reconnaissance, and intelligence.

Fuel Type Insights:

- Hydrogen Fuel-Cells

- Solar Powered

- Alternate Fuel

- Battery Operated

- Gas-Electric Hybrids

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes hydrogen fuel-cells, solar powered, alternate fuel, battery operated, and gas-electric hybrids.

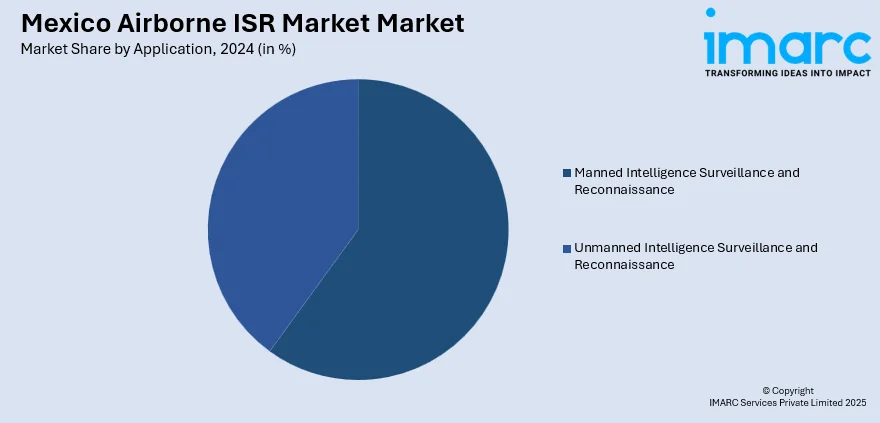

Application Insights:

- Manned Intelligence Surveillance and Reconnaissance

- Unmanned Intelligence Surveillance and Reconnaissance

The report has provided a detailed breakup and analysis of the market based on the application. This includes manned intelligence surveillance and reconnaissance and unmanned intelligence surveillance and reconnaissance.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Airborne ISR Market News:

- In February 2025, the U.S. military increased airborne surveillance over Mexico to combat drug cartels. This effort focuses on using airborne ISR to track cartel activities and illegal migration. Mexico expressed interest in the operation but seeks more transparency and coordination with the U.S. government. This initiative is part of broader efforts to enhance border security.

Mexico Airborne ISR Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Air, Space, Land, Sea |

| Systems Covered | Maritime Patrol, Electronic Warfare, Airborne Early Warning and Control (AEWC), Airborne Ground Surveillance (AGS), Signals Intelligence (SIGINT) |

| Types Covered | Surveillance, Reconnaissance, Intelligence |

| Fuel Types Covered | Hydrogen Fuel-Cells, Solar Powered, Alternate Fuel, Battery Operated, Gas-Electric Hybrids |

| Applications Covered | Manned Intelligence Surveillance and Reconnaissance, Unmanned Intelligence Surveillance and Reconnaissance |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico airborne ISR market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico airborne ISR market on the basis of platform?

- What is the breakup of the Mexico airborne ISR market on the basis of system?

- What is the breakup of the Mexico airborne ISR market on the basis of type?

- What is the breakup of the Mexico airborne ISR market on the basis of fuel type?

- What is the breakup of the Mexico airborne ISR market on the basis of application?

- What are the various stages in the value chain of the Mexico airborne ISR market?

- What are the key driving factors and challenges in the Mexico airborne ISR market?

- What is the structure of the Mexico airborne ISR market and who are the key players?

- What is the degree of competition in the Mexico airborne ISR market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico airborne ISR market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico airborne ISR market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico airborne ISR industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)