Mexico Alcohol Free Perfumes Market Size, Share, Trends and Forecast by Product Type, Gender, Price Range, Distribution Channel, End User, and Region, 2026-2034

Mexico Alcohol Free Perfumes Market Summary:

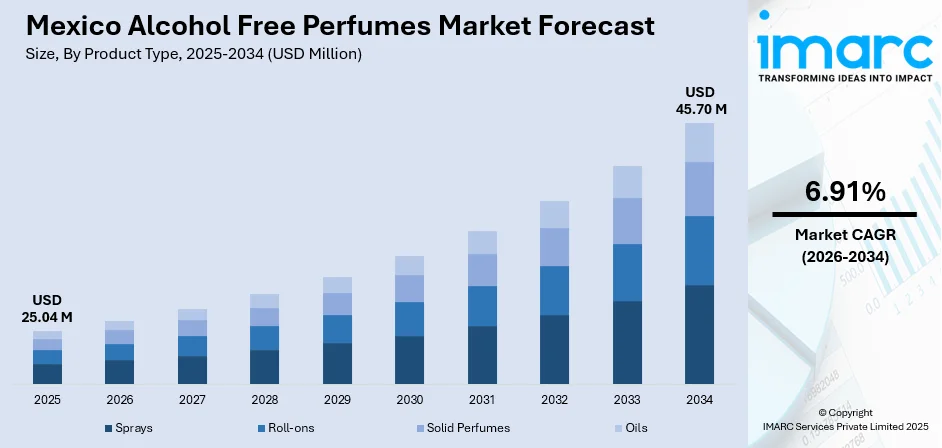

The Mexico alcohol free perfumes market size was valued at USD 25.04 Million in 2025 and is projected to reach USD 45.70 Million by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034.

The Mexico alcohol free perfumes market is experiencing steady expansion driven by heightened consumer awareness regarding skin sensitivities and the growing preference for gentle, hypoallergenic fragrance formulations. Increasing urbanization and rising disposable incomes among the middle-class population are fueling the demand for premium personal care products that prioritize health-conscious ingredients. The cultural emphasis on personal grooming and self-expression continues to strengthen, with consumers seeking fragrance options that align with evolving lifestyle preferences and wellness-oriented choices in the Mexico alcohol free perfumes market share.

Key Takeaways and Insights:

-

By Product Type: Sprays dominate the market with a share of 56% in 2025, owing to their convenient application, even fragrance distribution, and widespread consumer preference for portable formats that deliver consistent scent intensity throughout daily activities.

-

By Gender: Women lead the market with a share of 48% in 2025, reflecting strong cultural associations between fragrance and feminine self-expression, coupled with expanding product portfolios featuring floral, fruity, and botanical scent profiles tailored to female preferences.

-

By Price Range: Mid-range exhibits a clear dominance in the market with 43% share in 2025, driven by consumers seeking quality formulations at accessible price points that balance premium ingredients with affordability across diverse socioeconomic segments.

-

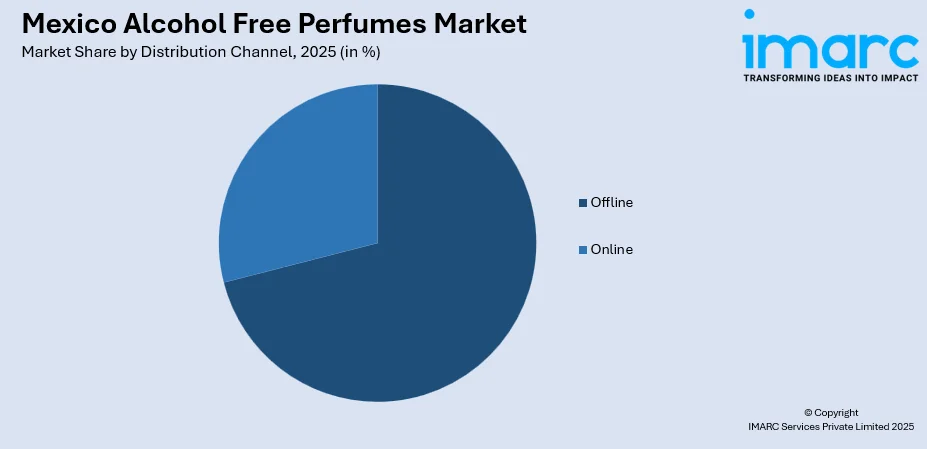

By Distribution Channel: Offline represents the biggest segment with a market share of 71% in 2025, reflecting Mexican consumers' preference for in-store fragrance testing and personalized consultations at department stores, specialty retailers, and pharmacies.

-

By End User: Personal use dominates the market with a share of 75% in 2025, underscoring the integral role of fragrance in daily grooming routines and personal identity expression among Mexican consumers prioritizing self-care rituals.

-

By Region: Central Mexico is the largest region with 40% share in 2025, driven by the concentration of affluent consumers in Mexico City metropolitan area, extensive retail infrastructure, and higher purchasing power enabling premium product adoption.

-

Key Players: Key players drive the Mexico alcohol free perfumes market by expanding natural ingredient portfolios, investing in dermatologically tested formulations, and strengthening distribution partnerships with specialty retailers and pharmacies to enhance product accessibility and consumer trust.

To get more information on this market Request Sample

The Mexico alcohol free perfumes market is witnessing transformative growth as consumers increasingly prioritize skin-friendly fragrance alternatives that eliminate potential irritants associated with ethanol-based formulations. The market expansion is supported by the country's robust beauty and personal care sector, with rising female workforce participation indicating enhanced purchasing power and demand for convenient personal care solutions. Market players are strategically incorporating indigenous Mexican botanicals and natural extracts to create distinctive scent profiles that resonate with culturally conscious consumers. Moreover, digital transformation reshapes distribution channels, with internet penetration reaching 83.2% and e-commerce adoption growing rapidly among younger demographics. Additionally, heightened awareness of dermatological sensitivities and clean beauty principles continues driving preference shifts toward alcohol-free alternatives that offer gentle, long-lasting fragrance experiences without compromising on scent intensity or longevity throughout daily activities.

Mexico Alcohol Free Perfumes Market Trends:

Rising Consumer Preference for Natural and Botanical Formulations

Mexican consumers are demonstrating increasing affinity for fragrances incorporating natural botanicals and plant-derived ingredients that align with clean beauty principles. This shift reflects broader wellness consciousness driving demand for products free from synthetic compounds and potential skin irritants. Manufacturers are responding by formulating perfumes featuring indigenous ingredients such as agave extracts, native florals, and aromatic herbs that celebrate Mexico's rich botanical heritage while delivering gentle, skin-compatible scent experiences for sensitive consumers.

Integration of Cultural Heritage in Fragrance Development

The market is currently experiencing a renaissance of culturally inspired fragrance creations that honor Mexico's artisanal traditions and olfactory heritage. Brands operating in the industry are incorporating ancestral ingredients like copal, vanilla, and tuberose into contemporary alcohol-free formulations that resonate with consumers seeking authentic sensorial experiences. This trend toward heritage-driven perfumery is attracting both domestic customers and international visitors who appreciate the storytelling dimension and cultural authenticity embedded within these distinctive fragrance offerings.

Expansion of Specialized Retail and Experiential Shopping

The retail landscape for alcohol-free perfumes is evolving with enhanced in-store experiences and dedicated fragrance consultation services. Department stores and specialty retailers are expanding beauty sections with trained consultants offering personalized scent matching and skin compatibility assessments. This experiential approach addresses consumer needs for tactile product evaluation and professional guidance when selecting alcohol-free alternatives, fostering deeper brand engagement and informed purchasing decisions throughout the customer journey. Retailers are also creating dedicated sampling stations that allow consumers to test multiple formulations before committing to purchases.

Market Outlook 2026-2034:

The Mexico alcohol free perfumes market outlook remains positive, supported by sustained consumer demand for skin-friendly fragrance alternatives and expanding retail infrastructure. The market generated a revenue of USD 25.04 Million in 2025 and is projected to reach a revenue of USD 45.70 Million by 2034, growing at a compound annual growth rate of 6.91% from 2026-2034. Continued investments in natural ingredient sourcing, expanding distribution networks, and growing consumer education regarding alcohol-free benefits position the market for sustained expansion throughout the forecast period. Rising interest in dermatologically tested formulations and culturally inspired scent profiles further reinforces positive growth trajectories.

Mexico Alcohol Free Perfumes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Sprays | 56% |

| Gender | Women | 48% |

| Price Range | Mid-Range | 43% |

| Distribution Channel | Offline | 71% |

| End User | Personal Use | 75% |

| Region | Central Mexico | 40% |

Product Type Insights:

- Sprays

- Roll-ons

- Solid Perfumes

- Oils

Sprays dominate with a market share of 56% of the total Mexico alcohol free perfumes market in 2025.

The spray format continues to hold a strong leadership position in the market due to its ease of use, controlled application, and ability to deliver a uniform fragrance experience. Consumers increasingly favor sprays because they fit seamlessly into fast-paced routines, allowing quick refreshes without effort or waste. Alcohol-free spray formulations rely on refined dispersion systems that spread fragrance evenly across the skin, avoiding the dryness and irritation often linked with ethanol-based products. This feature has gained particular traction among Mexican consumers who value skin comfort alongside scent performance.

Portability also plays a major role in driving demand. Compact spray bottles support frequent use during long workdays, commuting, and social engagements, while still offering reliable fragrance retention. In response, manufacturers are investing in improved atomizers designed specifically for alcohol-free bases, helping enhance projection and address earlier concerns around weaker scent presence. Product ranges are expanding to include a broad mix of floral, fresh, oriental, and woody profiles, signaling close attention to shifting taste patterns. Brands are also highlighting dermatological testing and gentle formulations, reinforcing sprays as premium, skin-friendly options within Mexico’s growing alcohol-free perfume segment.

Gender Insights:

- Men

- Women

- Unisex

Women lead with a share of 48% of the total Mexico alcohol free perfumes market in 2025.

The women's segment dominates the market reflecting the deep cultural connection between femininity and fragrance expression in Mexican society. Female consumers demonstrate sophisticated fragrance preferences spanning floral, fruity, and oriental scent profiles that complement diverse occasions from professional settings to social celebrations. The emphasis on personal grooming and self-care rituals among Mexican women drives consistent demand for high-quality alcohol-free options that prioritize skin compatibility and gentle formulation approaches. Women particularly value products offering long-lasting scent projection without the drying effects associated with traditional alcohol-based alternatives, making skin-friendly formulations increasingly attractive across age demographics.

Brands targeting female consumers are expanding portfolios with dermatologically gentle formulations featuring natural botanicals such as rose, jasmine, and tuberose that resonate with traditional fragrance preferences. The growing female workforce in Mexico is creating demand for versatile fragrances suitable for extended daily wear without skin irritation or sensitivity concerns. Manufacturers are developing layered product systems combining alcohol-free perfumes with complementary body care items that enable personalized scent experiences throughout the day, addressing evolving consumer expectations for cohesive fragrance wardrobes.

Price Range Insights:

- Premium

- Mid-Range

- Economy

Mid-range exhibits a clear dominance with a 43% share of the total Mexico alcohol free perfumes market in 2025.

The mid-range price segment captures the largest market share by effectively balancing premium ingredient quality with accessible pricing that appeals to Mexico's expanding middle class. Consumers in this segment prioritize value-driven purchases that deliver noticeable quality improvements over economy alternatives without commanding luxury-tier investment. The mid-range positioning enables broader market penetration across diverse socioeconomic demographics seeking reliable alcohol-free fragrance options that satisfy both performance expectations and budgetary considerations. This segment attracts consumers who have graduated from entry-level products and seek elevated experiences without transitioning to prestige categories.

Brands competing in this segment emphasize transparent ingredient sourcing and dermatological testing certifications that justify moderate price premiums while building consumer trust and brand loyalty. The proliferation of mid-range offerings featuring natural botanical extracts and hypoallergenic formulations addresses growing demand for clean beauty products at attainable price points. Manufacturers are leveraging efficient distribution partnerships with pharmacy chains and department stores to maintain competitive pricing while ensuring product quality and consistent availability across urban and suburban retail environments throughout Mexico.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline represents the leading segment with a 71% share of the total Mexico alcohol free perfumes market in 2025.

Offline retail channels maintain dominant market position as Mexican consumers demonstrate strong preference for in-person fragrance evaluation before purchase commitment. Department stores such as El Palacio de Hierro and Liverpool serve as primary destinations where consumers access trained beauty consultants offering personalized scent recommendations and skin compatibility assessments tailored to individual needs. The tactile shopping experience enables comprehensive product testing that addresses concerns regarding fragrance intensity, silage characteristics, and longevity performance specific to alcohol-free formulations requiring direct sensory evaluation.

Pharmacies and specialty beauty retailers are expanding alcohol-free perfume selections to meet growing demand for dermatologically sensitive products among health-conscious consumers. Physical retail environments facilitate trust-building through direct product interaction and professional guidance that digital channels cannot fully replicate, particularly for fragrance categories where scent perception varies significantly between individuals. Major retailers are enhancing beauty departments with dedicated fragrance consultation spaces featuring comfortable seating areas and private testing stations that elevate shopping experiences while educating consumers about alcohol-free alternatives and their skin-friendly benefits compared to conventional formulations.

End User Insights:

- Personal Use

- Gifting

Personal use dominates with a market share of 75% of the total Mexico alcohol free perfumes market in 2025.

Personal use applications drive the majority of market demand as fragrance remains integral to daily grooming rituals and self-expression among Mexican consumers seeking distinctive olfactory identities. The emphasis on maintaining pleasant personal scent throughout professional and social interactions motivates consistent repurchase behavior for alcohol-free alternatives that deliver reliable performance without compromising skin health. Individual consumers increasingly seek fragrance products addressing specific skin sensitivities while fulfilling aesthetic preferences for distinctive scent identities that reflect personal style and complement individual lifestyle patterns.

The personal use segment benefits from growing awareness regarding ingredient transparency and clean beauty principles guiding contemporary purchase decisions across demographic groups. Consumers are transitioning from traditional alcohol-based perfumes to gentle formulations that align with holistic wellness approaches encompassing integrated skincare and personal care routines focused on overall wellbeing. Brands are developing loyalty programs and subscription models that cultivate repeat purchasing patterns among dedicated personal use customers seeking consistent access to preferred alcohol-free fragrances while enjoying exclusive member benefits and early access to new product launches throughout the year.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Central Mexico dominates with a market share of 40% of the total Mexico alcohol free perfumes market in 2025.

Central Mexico commands clear market leadership driven by the concentration of affluent consumers in Mexico City and surrounding metropolitan areas with sophisticated fragrance preferences and elevated personal care expectations. The region hosts the country's premier luxury retail destinations including flagship department stores and specialty beauty boutiques featuring extensive alcohol-free perfume selections carefully curated for discerning clientele. Higher disposable incomes enable premium product adoption while dense urban populations create substantial addressable markets for fragrance brands targeting health-conscious consumers seeking gentle formulations suitable for extended daily wear.

The region's cosmopolitan character attracts international fragrance houses establishing presence alongside domestic artisanal brands celebrating Mexican botanical heritage. Robust retail infrastructure encompassing department stores, pharmacies, and specialty beauty retailers facilitates comprehensive market coverage and consumer accessibility. Cultural events, tourism attractions, and vibrant social scenes stimulate fragrance consumption patterns while positioning Central Mexico as the nation's trendsetting market for innovative alcohol-free perfume introductions. Furthermore, with 87.9% of Mexico's total population living in urban areas, Central Mexico's metropolitan concentration creates natural demand density for personal care products including alcohol free perfumes.

Market Dynamics:

Growth Drivers:

Why is the Mexico Alcohol Free Perfumes Market Growing?

Rising Consumer Awareness of Skin Sensitivities and Clean Beauty

Mexican consumers are demonstrating heightened awareness regarding potential skin sensitivities triggered by alcohol-based fragrance formulations, driving substantial demand shifts toward gentler alternatives. The clean beauty movement has gained significant momentum as consumers scrutinize ingredient labels and seek products free from synthetic compounds and potential irritants. Health-conscious purchasing behaviors are particularly pronounced among younger demographics who prioritize ingredient transparency and dermatological safety in personal care selections. Brands responding with dermatologically tested alcohol-free formulations are capturing market share from traditional perfume categories.

Expanding Middle Class and Increasing Disposable Incomes

Mexico's expanding middle class with growing purchasing power is fueling demand for premium personal care products that deliver enhanced quality and specialized benefits. Rising disposable incomes enable consumers to invest in alcohol-free perfume alternatives that command moderate price premiums for superior skin compatibility and ingredient quality. Urbanization trends are concentrating purchasing power in metropolitan areas where retail infrastructure supports diverse fragrance product availability. The beauty and personal care market in Mexico was valued at USD 11.17 Billion in 2025, reflecting substantial consumer spending capacity. Economic advancement is enabling previously underserved consumer segments to access quality fragrance products aligned with evolving lifestyle aspirations.

Cultural Emphasis on Personal Grooming and Fragrance Expression

Mexican culture maintains deep-rooted appreciation for personal fragrance as essential to social presentation and individual identity expression. Fragrance wearing extends beyond special occasions into daily routines where pleasant personal scent conveys professionalism, confidence, and social awareness. The cultural significance of smelling good in interpersonal interactions drives consistent demand for quality fragrance products across demographic segments. Traditional appreciation for bold, long-lasting scents is evolving to accommodate skin-friendly formulations that maintain desired intensity without alcohol-related irritation. This cultural foundation combined with modernizing consumer preferences creates sustained demand trajectory for alcohol-free perfume innovations.

Market Restraints:

What Challenges the Mexico Alcohol Free Perfumes Market is Facing?

Higher Product Costs Compared to Conventional Alternatives

Alcohol-free perfume formulations typically command price premiums reflecting specialized ingredient sourcing and advanced delivery technologies. Cost-sensitive consumers may hesitate to transition from familiar alcohol-based products when price differentials appear substantial. Manufacturing complexity associated with maintaining fragrance intensity without alcohol carriers is contributing to elevated production costs that impact retail pricing strategies.

Limited Consumer Awareness and Education

Many Mexican consumers remain unfamiliar with alcohol-free perfume benefits and consequently may question performance characteristics as compared to traditional formulations. Insufficient consumer education regarding skin compatibility advantages and ingredient differences creates adoption barriers. Marketing investments required to build category awareness and communicate value propositions add competitive challenges for emerging brands.

Competition from Established Alcohol-Based Fragrance Brands

Dominant market players with established brand equity in traditional perfume categories possess significant competitive advantages, such as distribution networks and consumer loyalty. Transitioning consumer preferences from familiar alcohol-based fragrances requires overcoming ingrained purchasing habits. Premium alcohol-based brands investing in marketing and product innovation maintain strong competitive positioning against alcohol-free alternatives.

Competitive Landscape:

The Mexico alcohol free perfumes market features a mix of international personal care conglomerates and domestic artisanal brands competing across diverse price segments. Market leaders differentiate through ingredient innovation, emphasizing natural botanical sourcing and dermatological testing certifications that resonate with health-conscious consumers. Distribution partnerships with major department store chains and pharmacy networks remain critical for achieving market visibility and consumer accessibility. Players are investing in cultural marketing strategies that celebrate Mexican heritage while positioning alcohol-free formulations as premium alternatives to traditional perfumes. Emerging local brands are gaining traction through authentic storytelling and immersive retail experiences that foster consumer connections.

Mexico Alcohol Free Perfumes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-ons, Solid Perfumes, Oils |

| Genders Covered | Men, Women, Unisex |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Use, Gifting |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Mexico alcohol free perfumes market size was valued at USD 25.04 Million in 2025.

The Mexico alcohol free perfumes market is expected to grow at a compound annual growth rate of 6.91% from 2026-2034 to reach USD 45.70 Million by 2034.

Sprays dominated the market with a share of 56%, driven by consumer preference for convenient application formats delivering consistent fragrance dispersion and portable usage.

Key factors driving the Mexico alcohol free perfumes market include rising consumer awareness of skin sensitivities, expanding middle-class purchasing power, cultural emphasis on personal grooming, and growing preference for clean beauty products.

Major challenges include higher product costs compared to conventional alternatives, limited consumer awareness and education regarding alcohol-free benefits, competition from established alcohol-based fragrance brands, and distribution access limitations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)