Mexico Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2026-2034

Mexico Alternative Data Market Overview:

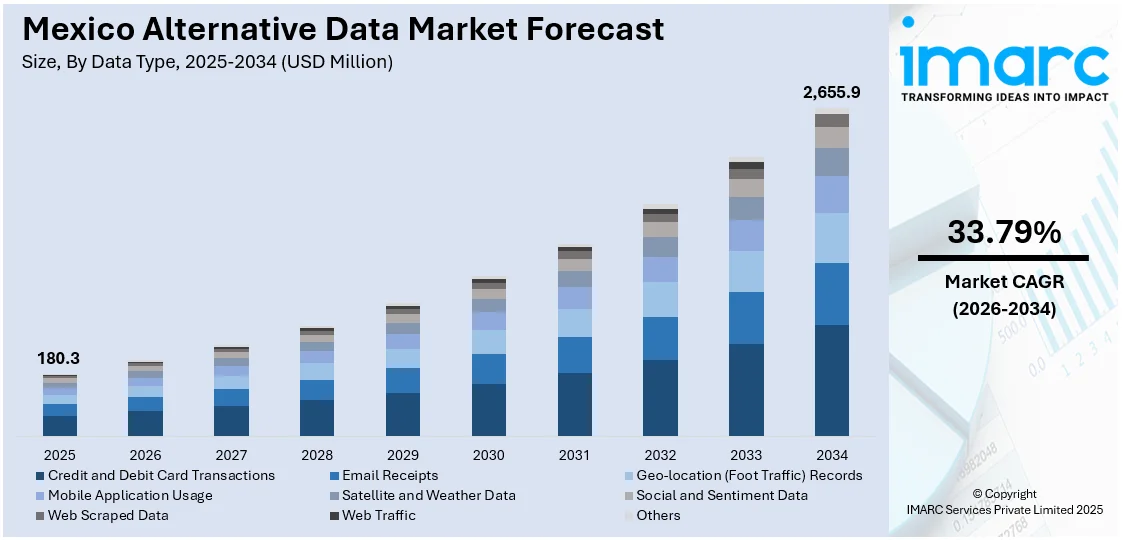

The Mexico alternative data market size reached USD 180.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,655.9 Million by 2034, exhibiting a growth rate (CAGR) of 33.79% during 2026-2034. Increased deployment of digital infrastructure, greater usage of the internet and smartphones, and the development of fintech and e-commerce are some of the main drivers of the demand for the market. They provide huge volumes of non-traditional data that allow businesses to make informed inferences about the behavior of their customers, enhance decision-making processes, and accelerate innovation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 180.3 Million |

| Market Forecast in 2034 | USD 2,655.9 Million |

| Market Growth Rate 2026-2034 | 33.79% |

Mexico Alternative Data Market Trends:

Expansion of Digital Infrastructure

The main driver of the alternative data sector in Mexico is the country's growing digital infrastructure. Increased mobile usage, improved broadband capabilities, and wider internet coverage have created abundant new data sources. As a result of this expansion, businesses may now get valuable data from social media, mobile interactions, and internet usage. Businesses are able to gather and examine non-traditional forms of data, like browser history, geolocation, and online user behavior, owing to the ongoing advancements in digital tools and technologies. By tapping into this information, companies gain greater insight into consumer trends, preferences, and market activity, ultimately giving them a competitive edge in decision-making and enabling businesses to better understand their target markets and respond to market changes more effectively.

To get more information on this market Request Sample

Government Initiatives for Data Accessibility

Mexico's government is prioritizing data accessibility through its National Digital Strategy, aiming to enhance transparency and innovation. In January 2025, a new digital strategy was announced to digitalize 80% of government procedures and cut waiting times by 50%, reducing bureaucracy and corruption. This initiative facilitates public access to data, enabling businesses to leverage alternative data for economic analysis, public service improvement, and decision-making. The increased availability of structured datasets fuels advancements in healthcare, finance, and urban development, where data-driven solutions optimize efficiency and outcomes. By fostering collaboration between the public and private sectors, these efforts enhance business insights and support policy development, positioning Mexico as a leader in digital transformation and open data governance.

Growth of Fintech and E-Commerce Sectors

The fast expansion of fintech and e-commerce in Mexico is fueling the need for alternative data. With more consumers making online financial transactions and shopping, companies have access to a treasure trove of transaction data. This data offers rich insights into consumer spending habits, payment patterns, and creditworthiness, which can be utilized to create targeted products and services. The fintech sector, in particular, is using alternative data to improve risk assessments, and it is becoming easier for financial institutions to provide tailored financial products. Additionally, alternative data use is promoting financial inclusion in Mexico by allowing more individuals, including those who do not have conventional credit histories, to access financial services and credit.

Mexico Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics and others.

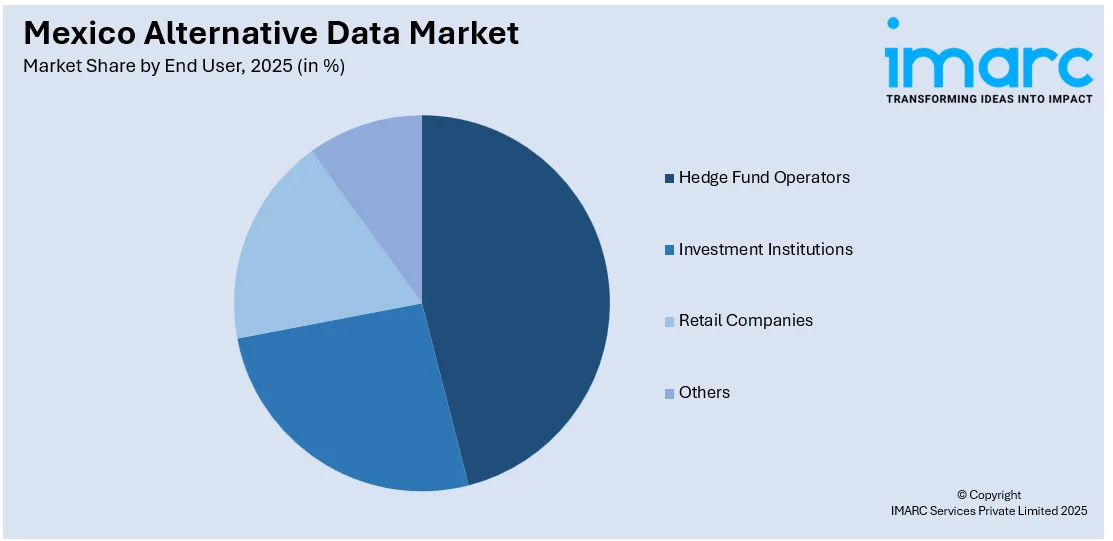

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Alternative Data Market News:

- In February 2025, Openbank, Grupo Santander's fully digital bank, launched in Mexico, offering a complete range of financial products. After receiving 30,000 sign-up requests, it welcomes its first customers, enabling quick registration in five minutes. The bank’s services include a 10% yield Débito Open account with no fees, free SPEI transfers, and cash withdrawals at Santander ATMs. It also offers a credit card with 3% cash back and interest-free purchase deferrals.

- In July 2024, Blu Financiero, a FinTech company targeting Mexico's underbanked population, launched a credit card with a 99% approval rate, requiring no formal credit history. The launch followed a waiting list of over 50,000 people, highlighting the demand for accessible financial products. Blu uses big data and AI to underwrite these consumers, addressing the lack of credit access in Mexico, where only 14% of people have a credit card.

Mexico alternative data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico alternative data market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico alternative data market on the basis of data type?

- What is the breakup of the Mexico alternative data market on the basis of industry?

- What is the breakup of the Mexico alternative data market on the basis of end user?

- What is the breakup of the Mexico alternative data market on the basis of region?

- What are the various stages in the value chain of the Mexico alternative data market?

- What are the key driving factors and challenges in the Mexico alternative data market?

- What is the structure of the Mexico alternative data market and who are the key players?

- What is the degree of competition in the Mexico alternative data market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico alternative data market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)