Mexico Aluminum Alloys Market Size, Share, Trends and Forecast by Application and Region, 2025-2033

Mexico Aluminum Alloys Market Overview:

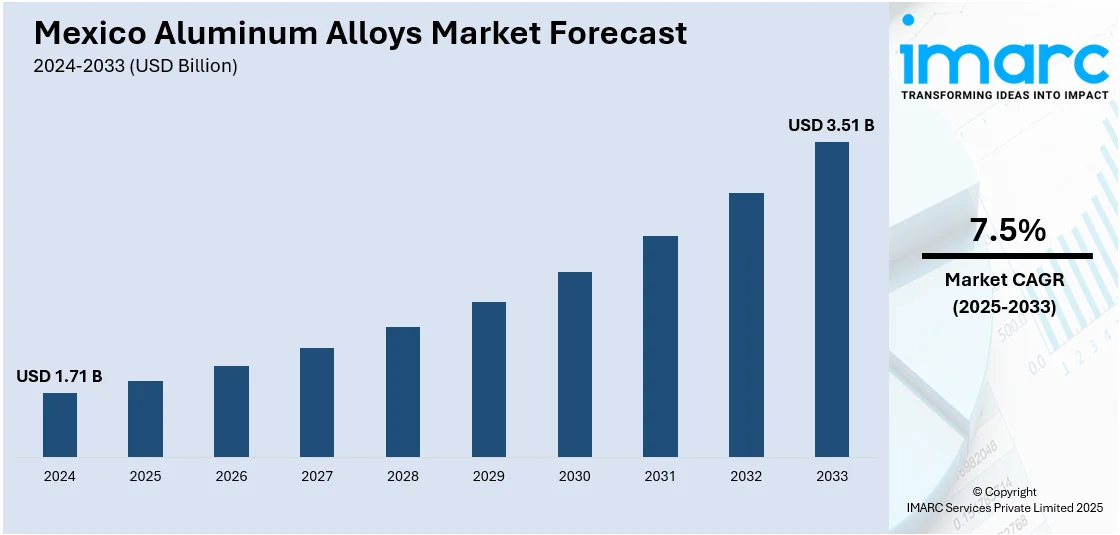

The Mexico aluminum alloys market size reached USD 1.71 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.51 Billion by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033. Growing demand from the automotive and aerospace industries, technological advancements in alloy production, increasing infrastructure development, and the rising need for lightweight, durable materials for energy-efficient applications are some of the factors contributing to Mexico aluminum alloys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.71 Billion |

| Market Forecast in 2033 | USD 3.51 Billion |

| Market Growth Rate 2025-2033 | 7.5% |

Mexico Aluminum Alloys Market Analysis:

- Major Market Trends: The major Mexico aluminum alloys market trends include increasing demand from the automotive, aerospace, and construction industries. Lightweight, corrosion-resistance alloys are being favored more and more. Innovation and sustainability are the priorities of manufacturers, and digitalization and new production methods are transforming supply chains, allowing quicker, cheaper production and keeping pace with changing industrial needs.

- Major Drivers: Major drivers for the market are increasing automobile and aerospace production, expansion in infrastructure, and the trend toward energy-efficient, light-weighting materials. Technologies improving with alloy processing increase strength and durability. Increasing industrial applications and environmental consciousness further accelerate Mexico aluminum alloys market demand, leading investments towards advanced manufacturing methods and high-performance alloy solutions across multiple industries.

- Market Opportunities: There are opportunities in creating new high-performance alloys and innovative production processes. Increased demand for energy-efficient, lightweight materials provides avenues for innovation. Increased activity in automotive, aerospace, and construction industries provides manufacturers opportunities to diversify products. Investment in research, sustainability, and specialty alloys can enhance market presence and address changing industrial requirements.

- Market Issues: According to the Mexico aluminum alloys market analysis, the major issues include dealing with complicated trade laws, finding quality raw materials, and controlling manufacturing expenses. Competition from substitute products and international suppliers tightens margins. Market volatility, environmental regulations, and keeping up with quickly changing industry norms demand strategic planning, streamlined operations, and innovation to stay competitive and achieve sustainable growth.

Mexico Aluminum Alloys Market Trends:

Manufacturing Expansion in the Aluminum Sector

The Mexico aluminum alloys industry is witnessing an enormous rise in investment, with much of it going toward expanding manufacturing capacities. This expansion is driven by the need for recycled aluminum and bespoke alloys, as well as the establishment of specialized workforce training and research facilities. The continuous investments are projected to create thousands of new jobs, benefiting the local economies. Furthermore, market participants are expanding their production capabilities, focusing on improving operational efficiency and gaining a competitive edge. This growth underlines Mexico's expanding presence in the global aluminum alloys market, with businesses trying to fulfill increased demand in a variety of industries, including automotive and manufacturing. These factors are intensifying the Mexico aluminum alloys market growth. For example, in October 2024, ARZYZ Metals, a leading Mexico-based aluminum and non-ferrous metals company, announced plans to invest USD 650 Million to expand its Nuevo Leon plant. The expansion aims to create 1,300 jobs and support workforce development, including a technical school and R&D center. ARZYZ, known for its recycled aluminum and customized alloys, has a 240,000mt/y capacity across two plants, enhancing its significant regional and international presence.

To get more information on this market, Request Sample

Growing Demand for Automotive Lightweight Components

The demand for aluminum alloy wheels in Mexico's automotive sector is expanding, driven by key contracts secured by local manufacturers. These agreements are set to generate significant sales, reflecting the growing need for lightweight components in vehicle production. This shift is in response to the automotive industry's push for fuel efficiency and improved performance. Manufacturers are focusing on increasing their production capabilities to meet this demand, positioning themselves to capture a larger share of the global automotive supply chain. Additionally, the adoption of advanced aluminum alloys supports automotive lightweighting initiatives, contributing to reduced vehicle weight and better fuel economy. This sector's growth highlights the increasing role of aluminum alloys in meeting evolving industry requirements. For instance, in October 2024, Lizhong Group's subsidiaries, i.e., Xintai Wheel, Mexico Lizhong, and Baoding Lizhong, secured aluminum alloy wheel contracts with two major customers. The projects are expected to generate sales of RMB 5.53 Billion over their lifecycles. The contracts reinforce Lizhong Group’s position as a global supplier of automotive lightweight components, enhancing its competitive edge and future business performance in the aluminum alloys market.

Mexico Aluminum Alloys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application.

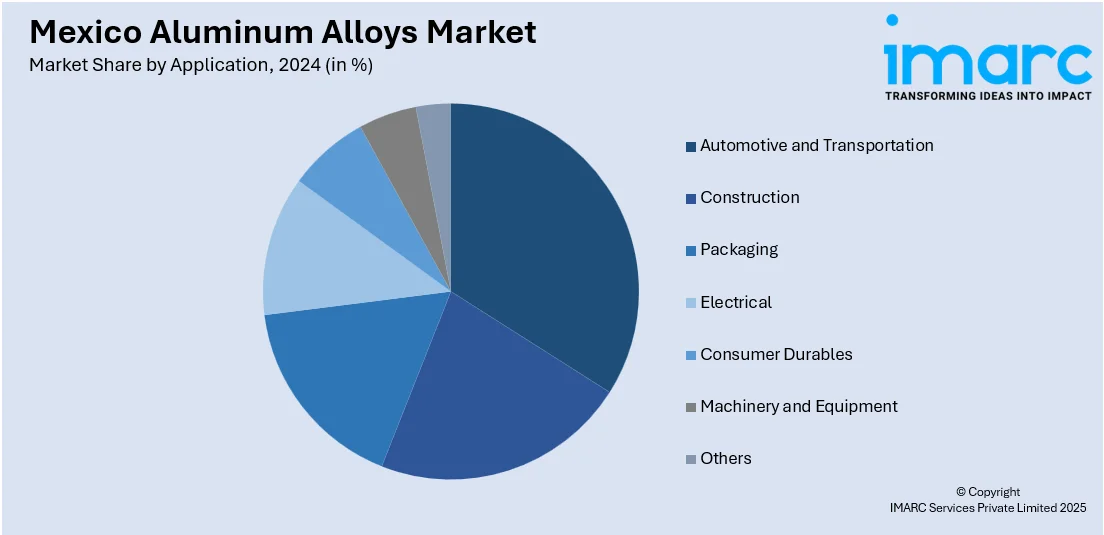

Application Insights:

- Automotive and Transportation

- Construction

- Packaging

- Electrical

- Consumer Durables

- Machinery and Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, construction, packaging, electrical, consumer durables, machinery and equipment, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In March 2025, Fastmarkets will launch three new aluminium import premiums for Mexico: the P1020A premium and 6063 extrusion billet premium on March 11, and a low-carbon P1020A differential on March 25, all CIF basis. These reflect Mexico’s growing aluminium market, the need for transparent pricing, and evolving low-carbon trends, amid potential U.S. import tariffs impacting regional dynamics. The premiums cover major ports, set quality standards, and will be published fortnightly.

- In June 2024, ARZYZ Metals has launched a domestic production initiative to supply Mexico’s flat-rolled aluminium products, aiming to produce 80,000 tonnes annually by mid-2026. The move reduces reliance on imports, mitigates tariff risks, and supports automotive, appliance, HVAC, and construction industries. Vertical integration ensures reliable supply, faster delivery, and improved competitiveness, addressing domestic demand gaps and responding to recent aluminium import tariffs.

Mexico Aluminum Alloys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive and Transportation, Construction, Packaging, Electrical, Consumer Durables, Machinery and Equipment, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aluminum alloys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aluminum alloys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aluminum alloys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aluminum alloys market in Mexico was valued at USD 1.71 Billion in 2024.

The Mexico aluminum alloys market is projected to exhibit a CAGR of 7.5% during 2025-2033, reaching a value of USD 3.51 Billion by 2033.

The Mexico aluminum alloys market is driven by demand from automotive, aerospace, construction, and packaging sectors. Aluminum’s lightweight, durable, and corrosion-resistant properties make it ideal for vehicles, infrastructure, and sustainable packaging. Advancements in alloy technology and recycling processes further improve performance, efficiency, and cost-effectiveness, supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)