Mexico Aluminum Cans Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Mexico Aluminum Cans Market Overview:

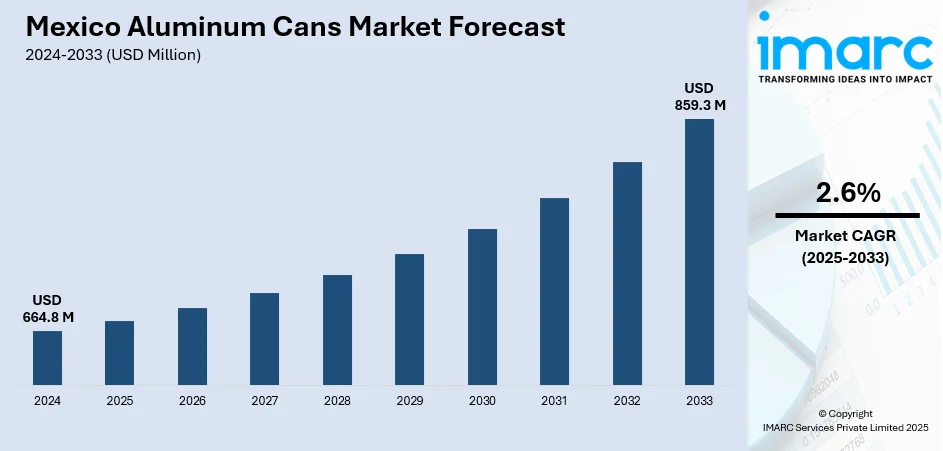

The Mexico aluminum cans market size reached USD 664.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 859.3 Million by 2033, exhibiting a growth rate (CAGR) of 2.6% during 2025-2033. The market share is expanding, driven by the growing need for convenience, along with the rising government awareness campaigns and support for recycling infrastructure, which aid in reinforcing the benefits of aluminum over plastic.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 664.8 Million |

| Market Forecast in 2033 | USD 859.3 Million |

| Market Growth Rate 2025-2033 | 2.6% |

Mexico Aluminum Cans Market Trends:

Growing need for convenience

The rising need for convenience is fueling the Mexico aluminum cans market growth. Aluminum cans are widely preferred because they are simple to open, easy to carry, and perfect for on-the-go usage. With a high working population in Mexico, people look for quick food and beverage (B&V) options that fit into their busy daily schedules. As per the DataMexico, in the third quarter of 2024, the active working force in México stood at 61.4 Million individuals. The labor force totaled 59.5 Million individuals (40.8% female and 59.2% male) with an average monthly wage of USD 6.26k MX. Aluminum cans offer ready-to-drink (RTD) and single-serve solutions across a wide assortment of beverages, inculcating sparkling water, soft drinks, and energy drinks. These cans are also easy to store and chill quickly, which adds to their practical value in everyday life. Many companies in the F&B industry employ aluminum cans to improve customer satisfaction and expand their reach, especially among urban users. Moreover, aluminum cans are durable and safe, reducing the risk of breakage while maintaining the freshness of the contents. As convenience is becoming more of a priority for people across all age groups, the demand for aluminum cans keeps growing in the country’s packaging market.

Increasing implementation of government initiatives

The rising execution of government initiatives aimed at reducing plastic usage is offering a favorable Mexico aluminum cans market outlook. As plastic pollution is becoming a major environmental concern, government agencies are implementing policies that limit single-use plastics, encouraging both manufacturers and users to shift towards recyclable materials like aluminum. In March 2024, WWF, in collaboration with the Ellen MacArthur Foundation and WRAP, initiated a National Plastic Pact to address plastic pollution in Mexico. The project focused on creating a list of problematic and unnecessary plastic items, along with identifying strategies and solutions to eliminate or lessen them. Aluminum cans emerge as a strong alternative because they are lightweight, durable, and infinitely recyclable without losing quality. These cans also align with circular economy goals, making them attractive for industries looking to comply with new regulations while maintaining efficiency in packaging. Beverage companies, in particular, respond quickly to these changes by adopting aluminum cans for soft drinks, beer, and energy drinks. The growing demand from environmentally conscious people is also encouraging this shift, as people prefer products that reflect their values. In addition, government awareness campaigns and support for recycling infrastructure help to reinforce the benefits of aluminum over plastic. Businesses receive incentives to adopt sustainable packaging, creating more opportunities for local aluminum can producers. Consequently, the market is experiencing increasing investments and innovations in can manufacturing technologies.

Mexico Aluminum Cans Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on application.

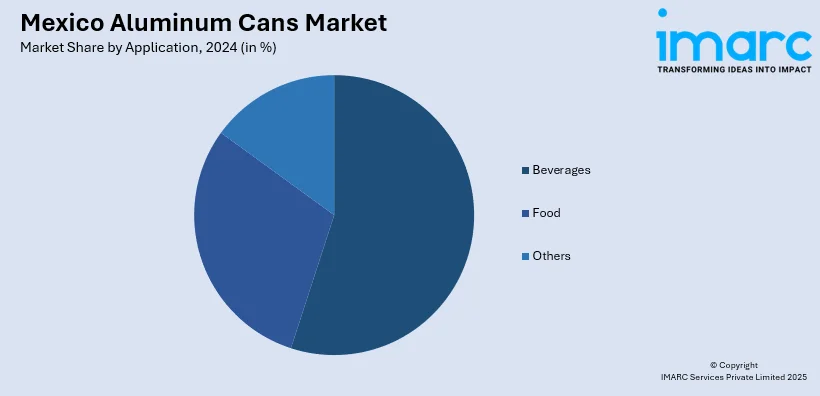

Application Insights:

- Beverages

- Food

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, food, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Aluminum Cans Market News:

- In March 2024, the Aluminum Stewardship Initiative chose Crown Holdings for the sustainable production of beverage cans in its Mexican facilities by awarding the Chain of Custody Standard V2 (2022) Certification. This highlighted Crown's dedication to responsible sourcing methods and ethical standards throughout its supply chain.

Mexico Aluminum Cans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Beverages, Food, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico aluminum cans market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico aluminum cans market on the basis of application?

- What is the breakup of the Mexico aluminum cans market on the basis of region?

- What are the various stages in the value chain of the Mexico aluminum cans market?

- What are the key driving factors and challenges in the Mexico aluminum cans market?

- What is the structure of the Mexico aluminum cans market and who are the key players?

- What is the degree of competition in the Mexico aluminum cans market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aluminum cans market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aluminum cans market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aluminum cans industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)