Mexico Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, End-Use Industry, and Region, 2025-2033

Mexico Aluminum Extrusion Market Overview:

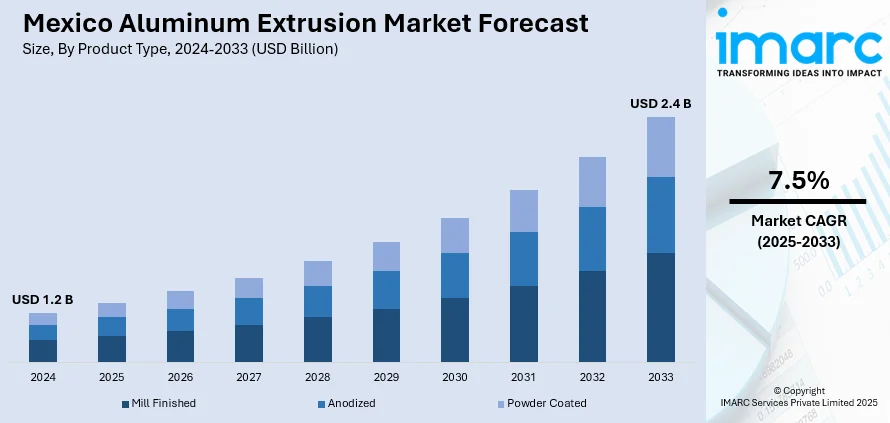

The Mexico aluminum extrusion market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.5% during 2025-2033. The market is growing due to rising construction projects, expanding automotive output, and increased demand for lightweight, corrosion-resistant materials. Technological upgrades and a focus on sustainable production are also shaping market movement in recent years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Market Growth Rate 2025-2033 | 7.5% |

Mexico Aluminum Extrusion Market Trends:

Rising Construction and Infrastructure Demand

Mexico’s aluminum extrusion market continues to benefit from sustained construction activity and infrastructure development. As public and private investments rise across housing, commercial complexes, and transport networks, demand for strong yet lightweight structural components remains steady. Extruded aluminum fits well into this space, offering durability and flexibility in design. Additionally, large-scale urbanization projects in northern and central regions have contributed to greater usage of window frames, curtain walls, and bridges. Increased adoption of aluminum profiles in prefabricated buildings and modular structures has also gained attention due to shorter construction timelines. Notably, developments like industrial park expansions and cross-border trade zones have created added interest in advanced aluminum framing systems. Local firms are expanding their extrusion capabilities to meet these evolving needs. Advanced surface treatments and tailored shapes are becoming more popular as clients seek both performance and aesthetic consistency. These shifts are prompting extrusion facilities in states like Nuevo León and Coahuila to ramp up output and invest in smarter equipment. The shift toward modern architecture and efficient building systems continues to support consistent market movement in the country.

Automotive Sector Driving Material Demand

Mexico’s growing role as a regional auto manufacturing hub is pushing the aluminum extrusion sector forward. Carmakers and auto parts suppliers increasingly prefer extruded aluminum for structural and functional components due to weight savings and improved crash performance. The shift toward fuel efficiency and electric mobility is making lightweight metal solutions even more relevant. OEMs and Tier-1 suppliers are requesting custom extrusions for body-in-white assemblies, heat exchangers, and battery housings. In recent months, manufacturers have added new production lines to serve EV platforms that require tailored shapes and thermal management solutions. Strong supplier linkages with U.S.-based auto companies have also driven consistency in cross-border extrusion demand. Factories in states like Puebla and Guanajuato are working closely with downstream partners to design optimized aluminum parts that reduce overall vehicle mass without compromising strength. The use of multi-cavity dies, and tighter tolerances have become more common as performance expectations rise. These adjustments are not only strengthening domestic production but also boosting Mexico’s role in the North American aluminum supply chain. As lightweighting continues to gain traction, aluminum extrusion is expected to maintain its central position in vehicle design and assembly.

Mexico Aluminum Extrusion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, alloy type, and end-use industry.

Product Type Insights:

- Mill Finished

- Anodized

- Powder Coated

The report has provided a detailed breakup and analysis of the market based on the product type. This includes mill finished, anodized, and powder coated.

Alloy Type Insights:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

A detailed breakup and analysis of the market based on the alloy type have also been provided in the report. This includes 1000 series aluminum alloy, 2000 series aluminum alloy, 3000 series aluminum alloy, 5000 series aluminum alloy, 6000 series aluminum alloy, and 7000 series aluminum alloy.

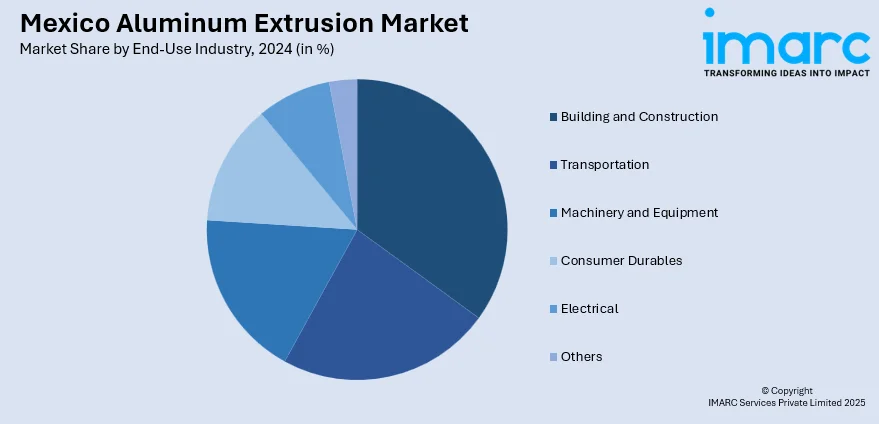

End-Use Industry Insights:

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes building and construction, transportation, machinery and equipment, consumer durables, electrical, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Aluminum Extrusion Market News:

- June 2024: ARZYZ Metals launched a domestic production initiative targeting 80,000 Tons of aluminum flat-rolled products annually in Mexico. This move reduced reliance on imports, addressed tariff pressures, and strengthened supply chains, supporting the aluminum extrusion market’s growth in automotive, construction, and appliance sectors.

- October 2024: Samuel opened a 125,000-square-foot railcar manufacturing plant in Monclova, Mexico, in partnership with IMMSA. The facility, which began operations and produced parts for railcars, contributed to the growth of the aluminum extrusion market by meeting regional demand and creating new manufacturing jobs.

Mexico Aluminum Extrusion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico aluminum extrusion market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico aluminum extrusion market on the basis of product type?

- What is the breakup of the Mexico aluminum extrusion market on the basis of alloy type?

- What is the breakup of the Mexico aluminum extrusion market on the basis of end-use industry?

- What is the breakup of the Mexico aluminum extrusion market on the basis of region?

- What are the various stages in the value chain of the Mexico aluminum extrusion market?

- What are the key driving factors and challenges in the Mexico aluminum extrusion market?

- What is the structure of the Mexico aluminum extrusion market and who are the key players?

- What is the degree of competition in the Mexico aluminum extrusion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico aluminum extrusion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico aluminum extrusion market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico aluminum extrusion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)