Mexico Ammonia Market Size, Share, Trends and Forecast by Physical Form, Application, End Use Industry, and Region, 2025-2033

Mexico Ammonia Market Overview:

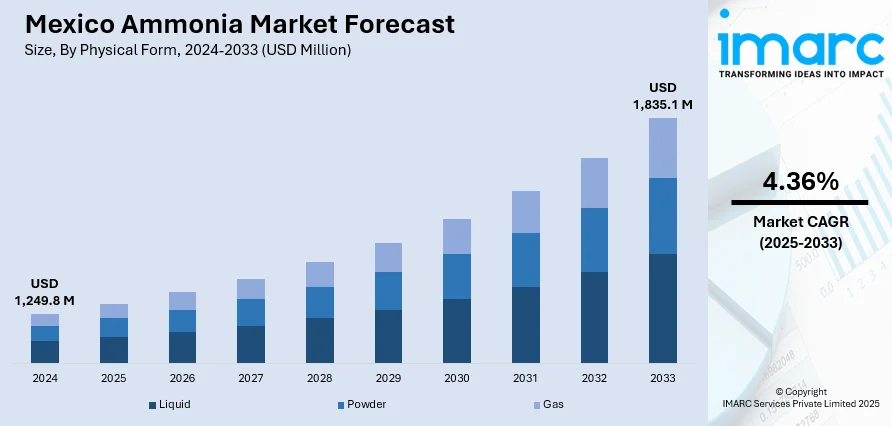

The Mexico ammonia market size reached USD 1,249.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,835.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.36% during 2025-2033. The market is growing due to rising fertilizer demand, clean energy goals, and large-scale investments in green production. Solar-powered and hydrogen-based projects, along with government-backed industrial upgrades, are shaping a shift toward low-emission, domestically produced ammonia for agriculture and exports.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,249.8 Million |

| Market Forecast in 2033 | USD 1,835.1 Million |

| Market Growth Rate 2025-2033 | 4.36% |

Mexico Ammonia Market Trends:

Rise in Renewable Ammonia Projects

Mexico is steadily emerging as a hub for renewable ammonia production, with a growing focus on leveraging its natural energy assets to drive cleaner industrial processes. The push toward low-carbon fertilizer solutions is gaining traction as both domestic policy and international demand align with sustainability goals. Solar and hydrogen-based ammonia production is particularly gaining interest due to the country’s vast solar potential and increasing need for fertilizer self-reliance. The trend is being driven by rising agricultural demand, export opportunities, and the need to replace conventional ammonia sourced from fossil fuels. In July 2024, Aslan Energy Capital acquired 35,000 hectares of land in Sonora to build a solar-powered ammonia plant. Positioned near the Gulf of California, the site benefits from excellent solar irradiance. Production is expected to reach 600,000 tons annually by 2028, with a second phase planned by 2030 to double capacity. This project represents a significant step forward in Mexico’s energy transition. It supports local fertilizer supply and allows surplus production to be shipped to the U.S., aided by established railway links. As new players like Aslan enter the market with renewable solutions, the shift toward solar-powered ammonia points to a long-term change in how fertilizer is produced and supplied within and beyond Mexico.

Industrial Demand Fuels Green Expansion

The ammonia market in Mexico is expanding beyond agriculture, driven by the rising demand for sustainable industrial inputs and clean marine fuels. Green ammonia, produced through renewable hydrogen and electrolysis, is now being prioritized due to its low emissions profile and growing relevance in global trade. The transition reflects increasing pressure on industries to reduce their carbon footprints and diversify away from fossil-derived ammonia. With government support and rising investor interest, Mexico is moving quickly to scale up green ammonia output and cater to wider energy, shipping, and industrial applications. In December 2024, Helax, backed by Copenhagen Infrastructure Partners, announced a USD 10 Billion investment in a green hydrogen and ammonia plant in Ciudad Ixtepec, located in the Isthmus of Tehuantepec. The project, part of Mexico’s broader regional development strategy, is scheduled to start operations by 2028 and aims to supply both industrial users and the marine fuel sector. The facility will serve as a cornerstone of Mexico’s industrial ammonia infrastructure, supported by collaboration across federal and state governments. Its location within the Interoceanic Corridor allows for efficient logistics and export potential. As large-scale projects like Helax-Istmo take shape, the market is evolving to meet new forms of demand while reinforcing Mexico’s position in the green energy supply chain.

Mexico Ammonia Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on physical form, application, and end use industry.

Physical Form Insights:

- Liquid

- Powder

- Gas

The report has provided a detailed breakup and analysis of the market based on the physical form. This includes liquid, powder, and gas.

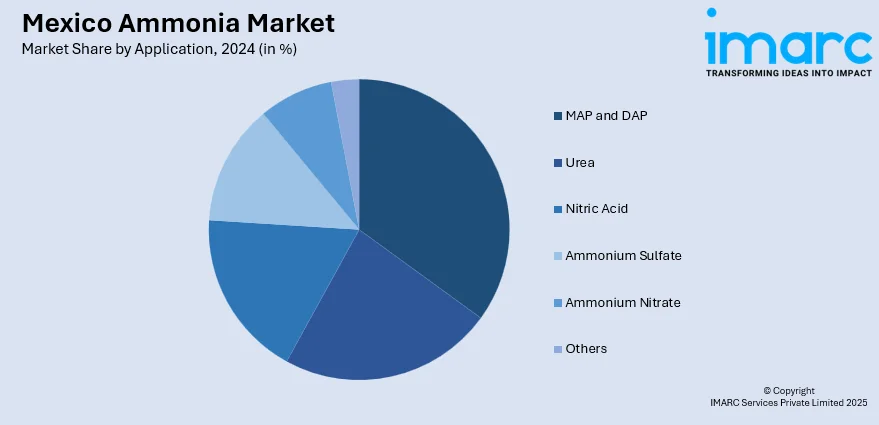

Application Insights:

- MAP and DAP

- Urea

- Nitric Acid

- Ammonium Sulfate

- Ammonium Nitrate

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes MAP and DAP, urea, nitric acid, ammonium sulfate, ammonium nitrate, and others.

End Use Industry Insights:

- Agrochemical

- Industrial Chemical

- Mining

- Pharmaceutical

- Textiles

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agrochemical, industrial chemical, mining, pharmaceutical, textiles, and others.

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Mexico Ammonia Market News:

- January 2025: Mexico announced plans for PEMEX to meet 80% of national fertilizer demand by upgrading four ammonia plants at Cosoleacaque. This move boosted domestic ammonia production, cut import reliance, and supported food security through expanded supply to small-scale farmers under the Fertilizers for Well-Being program.

- December 2024: Helax, backed by Copenhagen Infrastructure Partners, announced a USD 10 Billion green ammonia and hydrogen plant in Ciudad Ixtepec, Mexico. Set to begin operations by 2028, the project strengthened industrial ammonia prospects, boosting regional supply potential and supporting marine fuel and industrial applications.

Mexico Ammonia Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Physical Forms Covered | Liquid, Powder, Gas |

| Applications Covered | MAP and DAP, Urea, Nitric Acid, Ammonium Sulfate, Ammonium Nitrate, Others |

| End Use Industries Covered | Agrochemical, Industrial Chemical, Mining, Pharmaceutical, Textiles, Others |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Mexico ammonia market performed so far and how will it perform in the coming years?

- What is the breakup of the Mexico ammonia market on the basis of physical form?

- What is the breakup of the Mexico ammonia market on the basis of application?

- What is the breakup of the Mexico ammonia market on the basis of end use industry?

- What is the breakup of the Mexico ammonia market on the basis of region?

- What are the various stages in the value chain of the Mexico ammonia market?

- What are the key driving factors and challenges in the Mexico ammonia market?

- What is the structure of the Mexico ammonia market and who are the key players?

- What is the degree of competition in the Mexico ammonia market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico ammonia market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico ammonia market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)